Plooto Review 2025

Plooto Accounting Software Plans & Pricing

Plooto Comparison

Expert Review

Pros

Cons

Plooto Accounting Software's Offerings

Managing accounts payable (AP) and accounts receivable (AR) has always felt like a tedious, time-consuming task—until I started using Plooto. This cloud-based platform completely transformed how I handle payments, offering automation, efficiency, and peace of mind. If you’re looking to streamline your financial workflows, Plooto might be exactly what you need.

Customer Support

Plooto has a few customer support options for users to contact for help. Live chat is a great way to get in touch with an agent from the company, and they also offer a phone number and email address for contacting support.

Phone Support

Plooto’s phone support number is (844) 475-6686, and they are available Monday through Friday from 9 am to 8 pm EST. Contacting phone support is very easy. It only took about 4 minutes to get through the short automatic responses and connect to an agent. The agent I spoke to was very helpful in answering my questions and giving me additional information about the software offerings. She also mentioned setting up a demo of the software for a better understanding of how everything works. Overall, phone support is a very useful option.

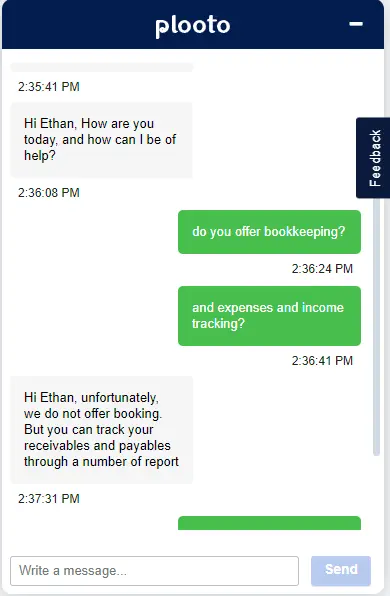

Live Chat

Plooto’s Live chat option is an excellent way for users to get a quick response and questions answered. Unfortunately, you only have the live chat option when you’re a user of Plooto software. However, you can use it during the free trial. I was connected to a live agent within 4 minutes, and she answered all of my questions very quickly and to the point.

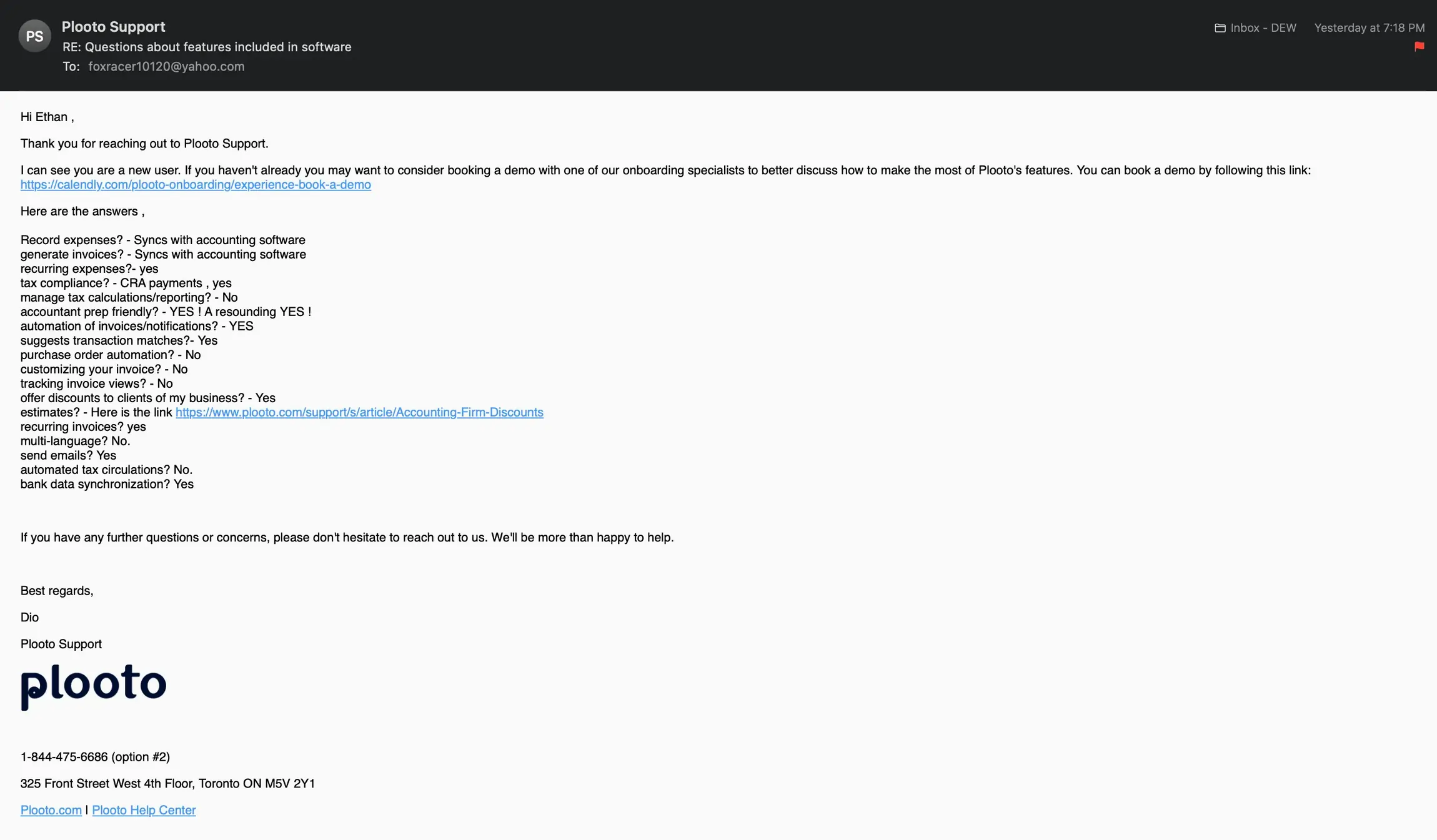

Email Support

Anyone can email support@plooto.com to ask questions or get more information about the software. Responses were pretty quick, as they responded to my email by the morning of the next business day. The agent who emailed me back answered all of my questions as well as offered to help me set up a demo of the software.

Features & Functionality

General Features

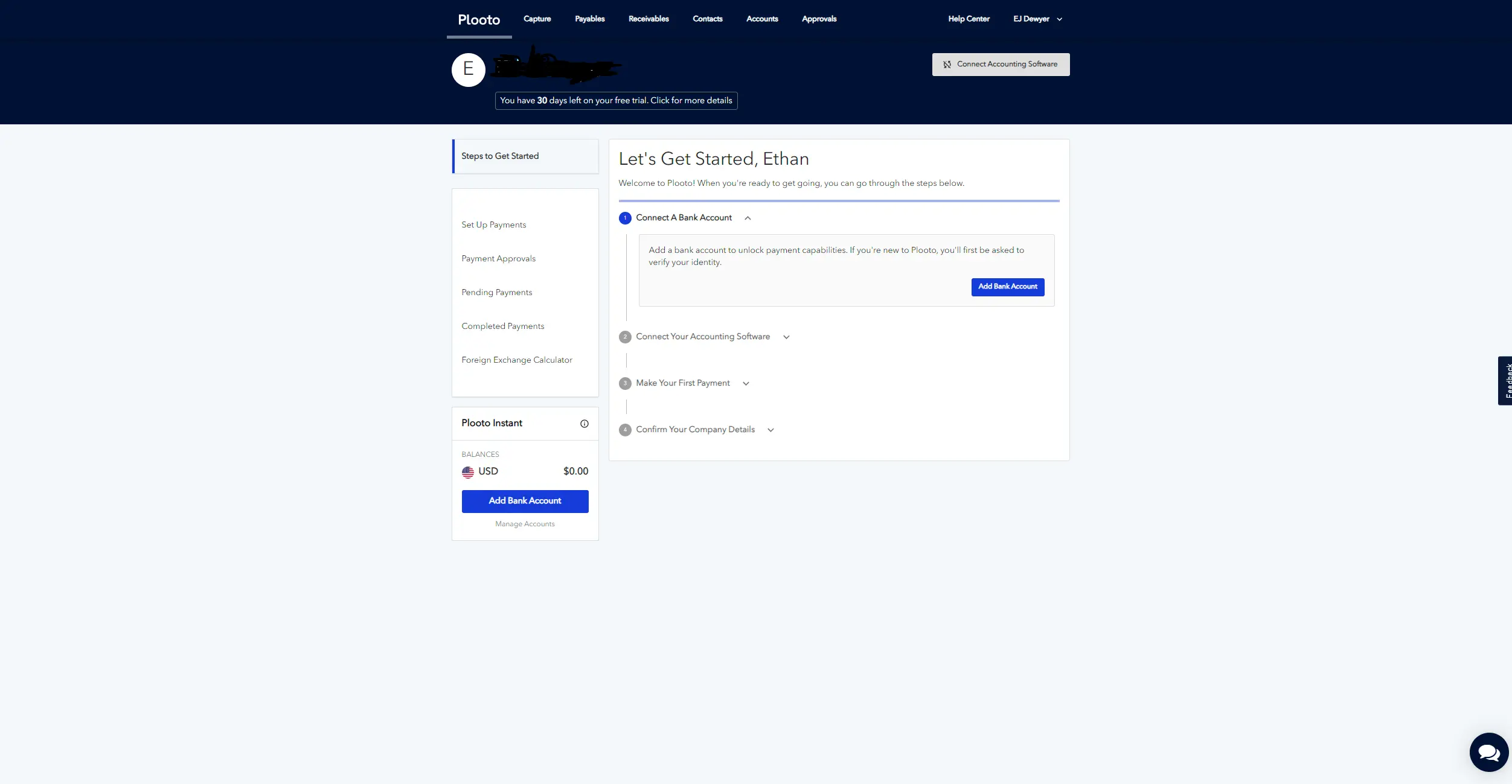

Account Dashboard

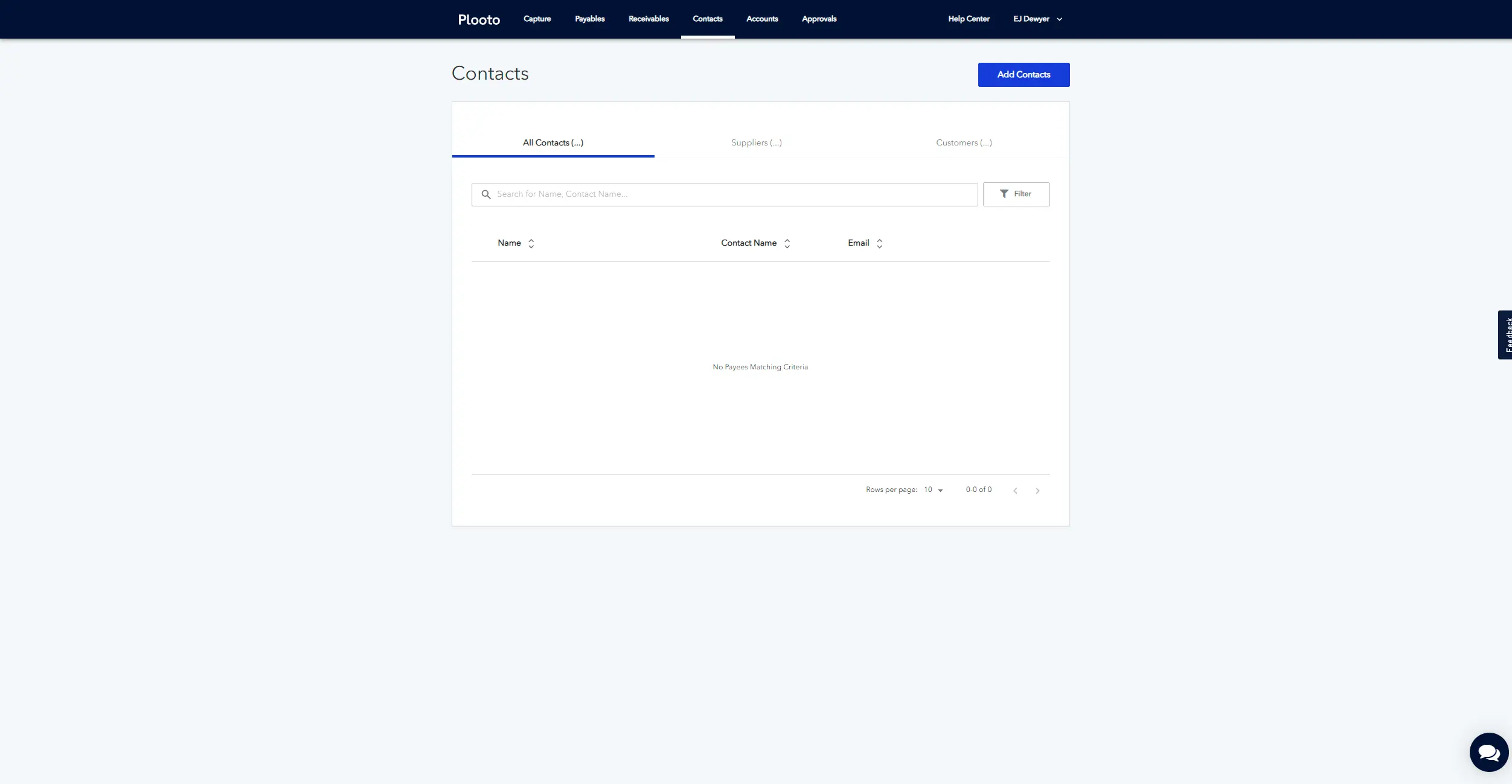

The Plooto account dashboard is simple and fairly easy to navigate. Users get access to the dashboard and software features with the free trial so they can test it before making the commitment. The main features include paying vendors, processing payments, and saving contacts.

Integrations

Plooto integrates seamlessly with Xero and Intuit Quickbooks, two of the top-rated accounting and invoicing software platforms. Businesses on the Pro plan (the highest tier) also get integration with Netsuite Oracle.

Payment Features

Plooto allows payments via online check, credit card, debit card, and ACH payments. With Plooto Instant, you can process payments faster. You can pre-fund your Plooto account so you are ready to make payments to vendors with Plooto’s vast network of 120,000 payees.

Time-Saving Automations

Plooto allows users to set up automatic ACH payments from their clients and customers. Plooto makes it easy to set up and receive payments automatically.

Multiple Payment Methods

Plooto allows you to make and receive payments by using credit/debit cards, online checks, and ACH payments.

Some other fees to note:

- Cross-border payments: $10

- Paper checks: $2

- ACH Payments: 50 cents

- Credit card payment processing: 2.9% + 30 cents

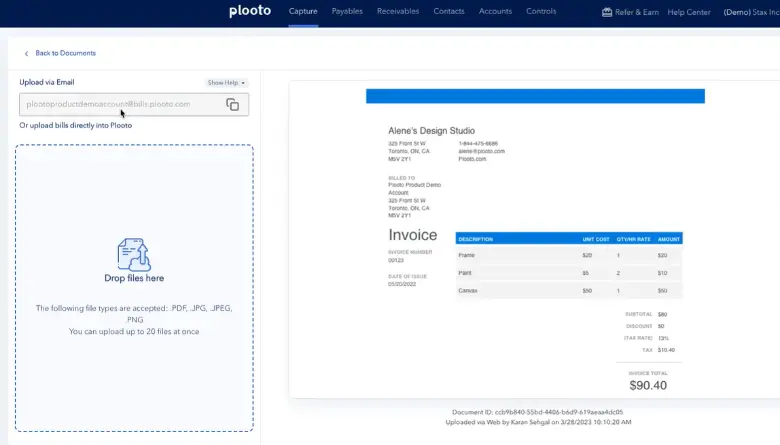

Invoice Importing

Document capture is a user-friendly feature that will be a major time saver for businesses. Uploading invoices is easy with Plooto. The software allows you to upload invoices right from your account dashboard and will pull information from the uploaded invoice for your business.

Reports & Analytics Features

Plooto offers simple reporting for software users. They auto-track expenses/payments made to vendors and received from customers. Plooto tracks all payments made to and from your business and provides monthly reports.

Track Expenses

Monitor and categorize expenses for accurate financial tracking.

Tax Preparation

Streamline tax compliance with automated preparation tools.

Time-Saving Automations

1. Effortless Automation for AP and AR

The first thing I noticed about Plooto was how much time it saved me. Instead of manually processing invoices and payments, everything is automated. From invoice approval to payment scheduling, Plooto takes care of the heavy lifting. The system tracks everything, so I’m always in control without getting bogged down by repetitive tasks.

2. Seamless Integration with My Accounting Software

One of Plooto’s standout features is how smoothly it integrates with popular accounting tools like QuickBooks and Xero. For me, this meant no more manual data entry—everything syncs automatically. It keeps my records accurate and saves me hours every month.

3. Tailored Approval Workflows

I really appreciate Plooto’s custom approval workflows. I can set up rules so that payments over a certain amount need extra authorization, giving me confidence that every transaction is secure and properly reviewed. It’s great for maintaining financial control without micromanaging every step.

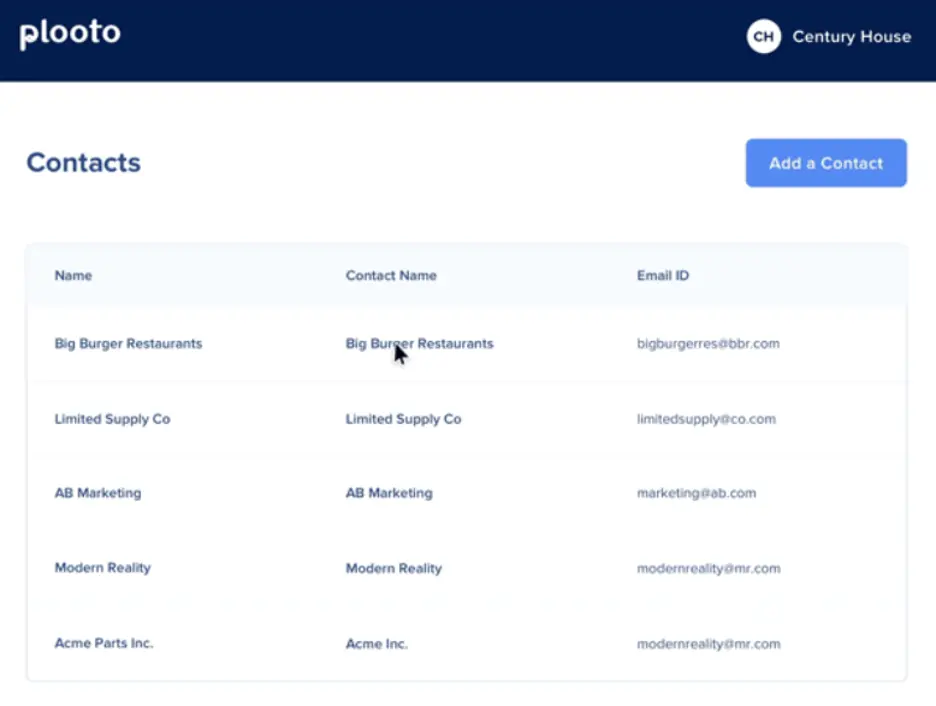

4. Vendor and Supplier Management Made Easy

Plooto simplifies vendor payments by connecting me to its extensive network of over 150,000 vendors. I can pay suppliers quickly, track transactions effortlessly, and keep all my records in one place. It’s a big stress reliever, especially when juggling multiple vendors.

5. Handles International Payments

One thing I find especially useful is how Plooto supports both domestic and international payments. While international fees can be a bit higher, having the ability to send payments across borders is invaluable for global operations.

Why Plooto Works for Me

- User-Friendly Interface: I love how intuitive the platform is. Even if you’re not a financial expert, Plooto makes it easy to navigate and manage your payments.

- Time-Saving Features: The automation has been a game-changer. Tasks that used to take hours now happen in minutes, letting me focus on growing my business instead of getting buried in admin work.

- Accurate Reconciliation: With Plooto’s automated bank reconciliation, I never have to worry about errors. The system ensures that every transaction is accounted for.

Add-Ons

Expand software functionality with customizable add-ons.

Supported Devices

Access accounting tools seamlessly across various devices.

Performance:

If you’re a small to mid-sized business owner looking to automate your payments, reduce manual errors, and save time, Plooto is a fantastic choice. It’s easy to use, integrates seamlessly with popular accounting tools, and gives you better visibility into your cash flow.

Plooto has been more than just a tool—it’s been a reliable partner in keeping my finances organized and stress-free. If you’re ready to take the hassle out of AP and AR, I can’t recommend it enough!

Ease Of Use:

Plooto is user-friendly, and signing up for a free trial is a breeze. Just answer 2-3 questions about your business, and you’re sent to the dashboard using the software in no time. Email authorization is required when setting up an account. Plooto’s integrations with Intuit Quickbooks and Xero make managing accounting for your business easy.

Plooto Account Setup

It was extremely easy to set up an account with Plooto. I was signed in and utilizing the software’s free trial within 60 seconds.

Uniqueness:

Since adopting Plooto, I’ve noticed a big difference in how smoothly my financial operations run. Tasks that used to feel overwhelming are now streamlined, and I have more confidence in my financial management. The automation and integrations with my existing tools have freed up time I can now spend on strategy and growth.

While Plooto has been amazing for my payment workflows, there are a couple of things worth mentioning:

- Focus on Payments: Plooto specializes in AP and AR, so if you need full-service accounting features, you might need additional tools.

- International Fees: If you’re handling frequent cross-border payments, the fees can add up, so it’s something to factor into your decision.

Verdict:

Overall, I think Plooto is great for businesses looking to streamline their financial process with end-to-end accounts payable and accounts receivable functions. They have an above-and-beyond customer service department. While many companies employ automated customer service systems, Plooto maintains live agent support. Plooto is also an excellent choice for any business using Quickbooks or Xero. The company’s growth plan has many features for an affordable price point.

User Review

- Ever since Plooto, I have a considerable less amount of errors and inaccuracies in my books and payments.

- The only small downfall I found was that you may experience issues when working with foreign banks.

- Their per payment pricing was a factor in choosing them and they do not have them anymore. We hope they bring it back.

- The international payment feature has been a great asset to growing my business.

- Would like to see the amount of payment options increase.

- The vendor management feature keeps my payables and receivables organized and easy to track.