Sage Review 2025

Sage Payroll Services Plans & Pricing

Sage Comparison

Expert Review

Pros

Cons

Sage Payroll Services's Offerings

Sage 50 offers bundled solutions that integrate accounting with payroll services, designed to simplify small business finances. The available plans include Pro Accounting with Payroll, which supports payroll for a set number of employees, and Premium Accounting with Payroll, which offers additional user access and payroll options. There is also an option to integrate HR and Payroll with Sage 50 Accounting, providing businesses with a more comprehensive financial and workforce management solution. These bundles aim to streamline payroll processing while maintaining robust accounting features.

Customer Support

Sage customer support is available 7:30 AM- 7:00 PM EST; Monday – Friday.

There is no chatbot or email contact option for non-users on the Sage People Payroll page. All support requests drive the user back to a live phone conversation. I requested a price quote through the online form and received a reply via phone.

Live Phone Conversation

My phone consultation with the Sage support team was helpful. There were, however, several upsell attempts.

Online Resources

Sage has extensive online resources for all sized businesses and levels of experience. Some of these include:

Sage Advice: Members of the Sage community get automatic access to exclusive benefits, including talks, articles, and expert advice.

Sage University

With training courses help the user get a head start, improve productivity, and minimize compliance risks.

Overall Experience

My overall experience with customer support was acceptable for a platform of this size. The lack of pricing transparency and the need to talk to a representative before getting anywhere was time-consuming.

Features & Functionality

Payroll Features

Employees can choose between direct deposit, a convenient Pay Card or they can pick up their paychecks from your workplace. Paychecks delivered to your workplace would be ready for distribution-signed and inserted into individual envelopes— according to your specified schedule. Sage also handles your company’s year-end requirements, including direct reporting to the proper tax authorities and statements of deposits and filings made on your behalf.

Mobile Use

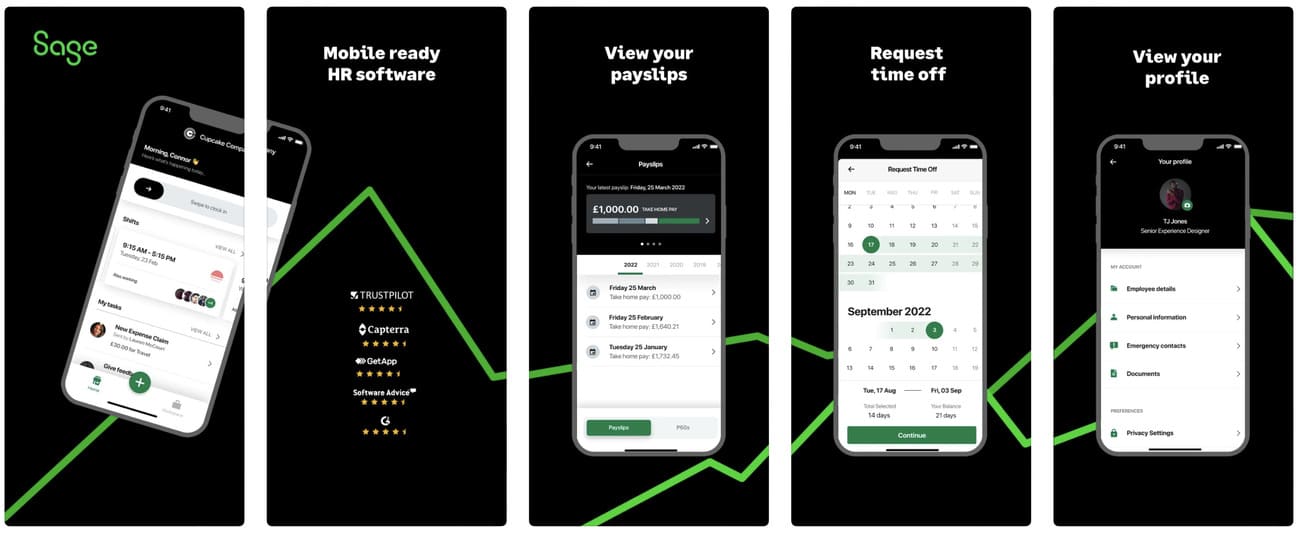

Sage has a new mobile app that is currently only available on iPhone.

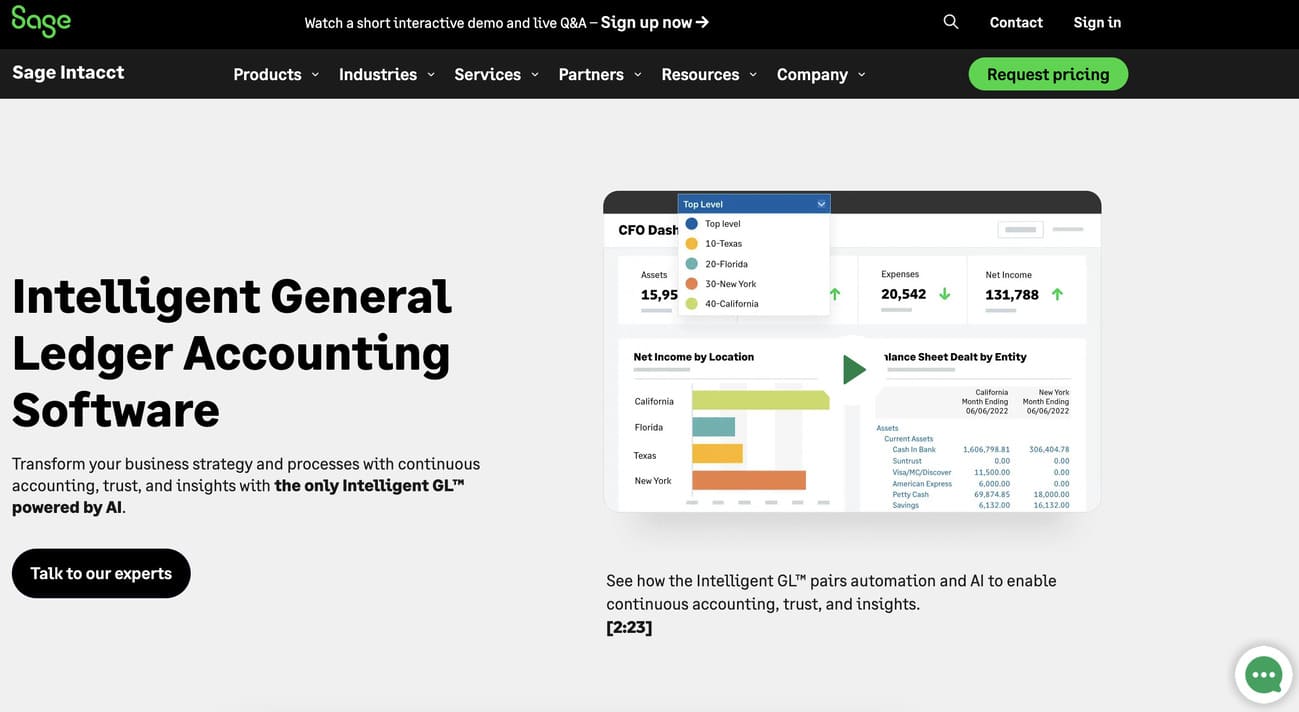

General Ledger

The general ledger interface to creates an import-ready file that brings all your payroll journal entries into your software package. Avoid manual journal entries and the expense of developing custom interfaces to connect your payroll and general ledger. Easily transmit the file to your Sage Intacct Accounting & ERP Software.

Automation Features

Automate repetitive payroll tasks to save time.

HR Features

Integrated HR tools for comprehensive employee management.

Tax Features

Tax Administration & Filing

Sage People Payroll prepares, files, and deposits federal, state, and local taxes, while also issuing the required monthly reporting to relevant tax authorities. The software also responds to associated inquiries from any tax agency.

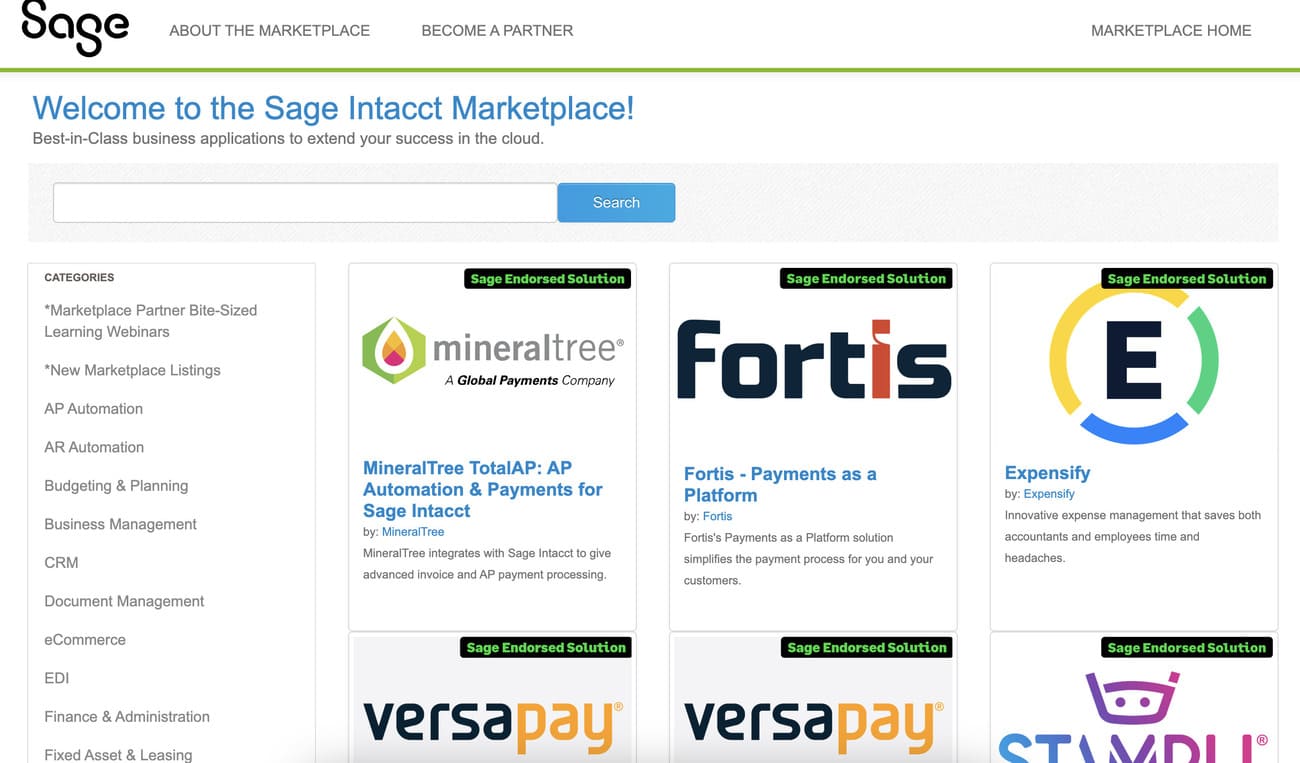

Integrations

Through the Sage Intacct Marketplace, users can find and activate their favorite Sage and 3rd party platforms.

Ease Of Use:

My first attempt at connecting with Sage led me to their previous website, and I was not redirected to the new Sage People Payroll page for some time. Once on their new site, I found the interface to be busy and confusing to navigate at times. This is partially due to their enormous amount of features.

Although I didn’t have direct access to the platform, my impressions through available demos and peer reviews reflected an easy-to-use interface for running payroll.

Sign-Up

The following business information is required to create an account:

●Business Tax ID/EIN – This will be verified by Sage

●Business Banking Information – This will be verified by Sage

●Business Mailing Address

To run Payroll, employee/contractor address, SSN, and banking information is also needed. *Only address and SSN are needed if payment will be via paper check.

Click the video for a walk-through of the website and navigation:

Verdict:

Sage Payroll is geared toward small and medium-sized businesses that are looking for a human resources management system. It is also recently integrated with ADP, which is another powerful payroll and HR platform. I found the initial navigation and setup to be frustrating, but this could be due to the roll-out of their new partnership and site. I would recommend requesting a consultation to see if Sage People Payroll is the right fit for your business.

Click the video to see my closing thoughts:

User Review

- I frequently ran into unique problems that could not be resolved and customer support was lacking

- I really like Sage's ability to do things in multiple ways

- Sage took forever to learn and it's not user friendly in the least