5 Reasons Why Small Business Owners Should Use QuickBooks Payroll

As a small business owner, managing your payroll can be a time-consuming and complex task. Between staying up-to-date with various tax regulations, managing all employee hours, calculating salaries, and ensuring timely payments, these tasks can be overwhelming and mistakes can lead to penalties, unhappy employees, and even legal issues.

Thankfully, technology has made it easier for small businesses to manage their payroll efficiently and with a lot less effort. QuickBooks Payroll is an online payroll software, by Intuit QuickBooks, designed specifically for small businesses. With QuickBooks Payroll, small business owners can automate their payroll processing, reducing errors and saving time.

In this article, we will look into five reasons why business owners should consider using QuickBooks Payroll to manage their payroll operations, and how QuickBooks can help automate payroll processing, manage employee time and schedules, ensure tax compliance, and provide same-day direct deposit, all at very affordable prices.

Reason 1: Automated Payroll Processing

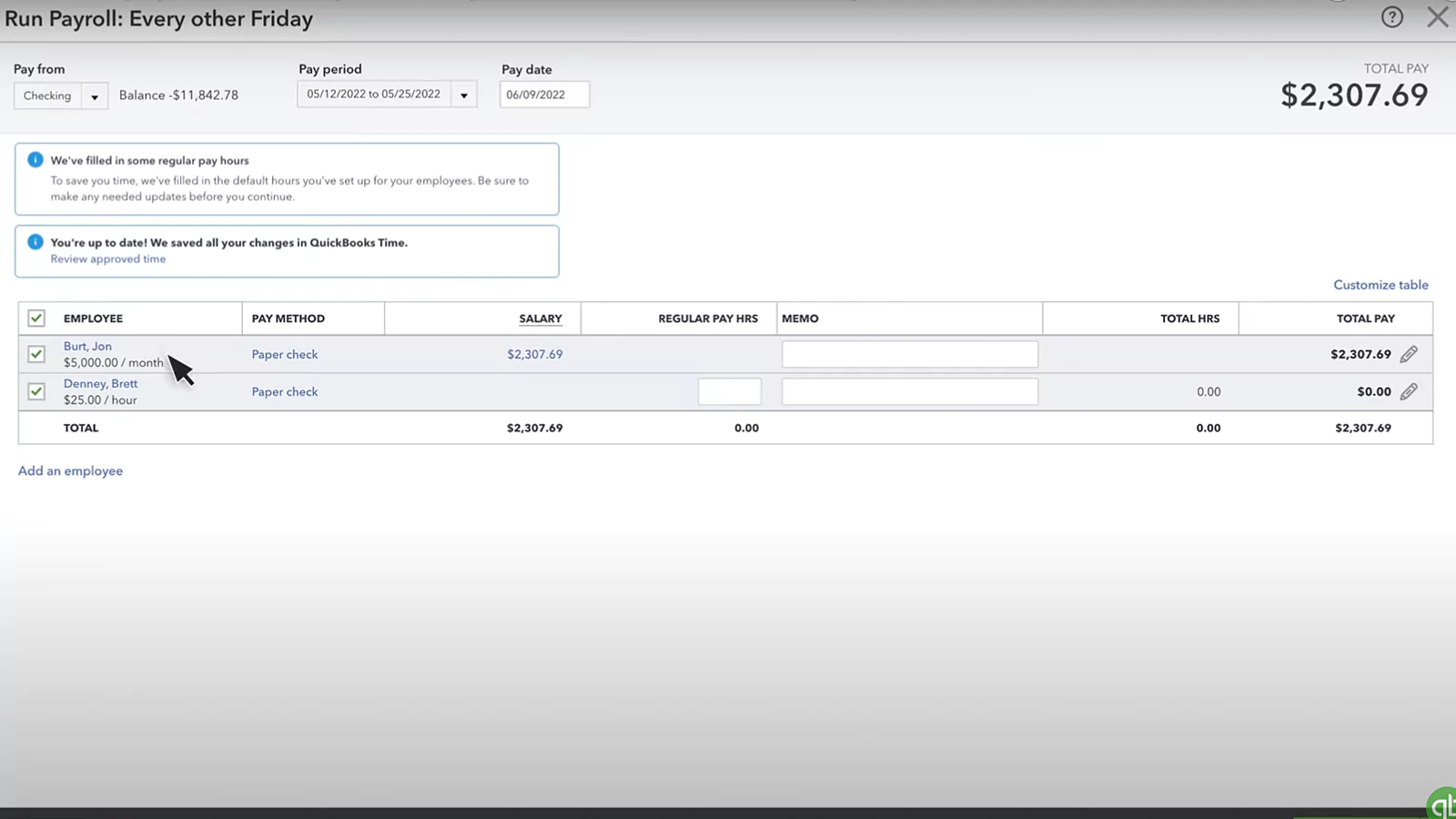

QuickBooks Payroll offers automated payroll processing, from start to finish, which can save business owners a lot of time and effort, all the while significantly reducing risk of errors. The software can calculate employee salaries, taxes, and benefits, automatically, based on the data entered by the user. Once the initial data is entered, QuickBooks Payroll users can set up the software to run payroll automatically.

QuickBooks’ automated payroll processing can handle all of the tasks involved in the process. This includes accurately calculating individual employee salaries, before and after taxes. Users can also customize the software to accommodate different payment frequencies, pay rates, and benefit plans. This ensures that employees are always paid the correct amount, on time.

Automated payroll processing can save small business owners loads of time by reducing the need for manual tasks like data entry, employee schedule management, and generating pay stubs. Hours of time taken by manually adding or changing information every time an employee changes his marital status, address, or tax bracket, is instantly reduced.

Also, the risk of a manual data-entry error is greatly reduced when calculations are being done automatically, by a computer. This can also help businesses stay compliant with tax regulations and avoid penalties.

Reason 2: Time Tracking and Scheduling Features

QuickBooks Payroll’s time tracking and scheduling features can help businesses owners manage their employees’ hours and shifts much more efficiently. These features ensure that employees are working the hours they are supposed to and that they are getting paid accurately for their time.

![]()

Without an effective system in place, business owners may struggle to keep track of their employees’ hours, which can lead to confusion among workers, as well as errors and inaccuracies in payroll processing.

QuickBooks Payroll offers a variety of time tracking and scheduling features to help small business owners manage their employees’ time more effectively. Some of the features include:

- Time tracking: Employees can clock in and out using their mobile device or computer. Employers can also set up different pay rates for different types of work, such as regular time, overtime, or double-time. This also eliminates the need for paper timesheets.

- Scheduling: Employers can create and manage employee schedules in one central location. They can also view and approve employee time off requests, and send schedule updates to their employees. This helps to ensure that everyone is on the same page and reduces the likelihood of miscommunication.

- Mobile access: Employees can easily view their schedules, request time off, and clock in and out, all from their mobile devices.

With QuickBooks Payroll, small business owners can completely streamline their time tracking and scheduling processes. By having accurate and up-to-date information, business owners can make better decisions about employee hours, payroll processing, and staffing needs.

Additionally, this can lead to increased employee satisfaction, as they will be paid accurately and have a better understanding of their schedules. With the convenience of mobile access, both employers and employees can stay connected and on top of their schedules from anywhere. Overall, QuickBooks Payroll’s time tracking and scheduling features provide small business owners with the tools they need to manage their workforce effectively.

Reason 3: Tax Penalty Protection

All business owners are responsible for ensuring that they comply with federal and state tax laws. Failing to do so can result in costly penalties, fines, even punishable, criminal offense.

![]()

QuickBooks Payroll’s tax penalty protection feature can help small business owners stay compliant and avoid costly mistakes by providing guaranteed accurate tax calculations. With QuickBooks Payroll, users can enjoy:

- Accurate Payroll Tax Calculations: QuickBooks Payroll software calculates all payroll taxes and deductions accurately, reducing the risk of errors that could result in fines and penalties from the IRS or state tax agencies.

- Timely Tax Filing: The software automatically files and pays all payroll taxes on time, helping businesses avoid late fees and penalties.

- Compliance with Tax Regulations: QuickBooks Payroll constantly keeps up with changes in tax laws and regulations, ensuring that businesses are always in compliance with the latest requirements.

- W-2 and 1099 Preparation: The software automatically generates W-2 and 1099 forms at the end of the year, making it easy for businesses to file their annual tax returns.

- Detailed Tax Reports: QuickBooks Payroll provides businesses with detailed tax reports, which can be used to reconcile payroll taxes and prepare for tax audits.

With tax penalty protection we’ll pay up to $25,000 if you receive a penalty.**

Source: QuickBooks

By using QuickBooks Payroll, small businesses can avoid the headaches and risks associated with payroll tax compliance. The software takes care of all payroll-related tax obligations, so business owners can focus on growing their businesses, without worrying about tax penalties or compliance issues.

Reason 4: Same-Day Direct Deposit

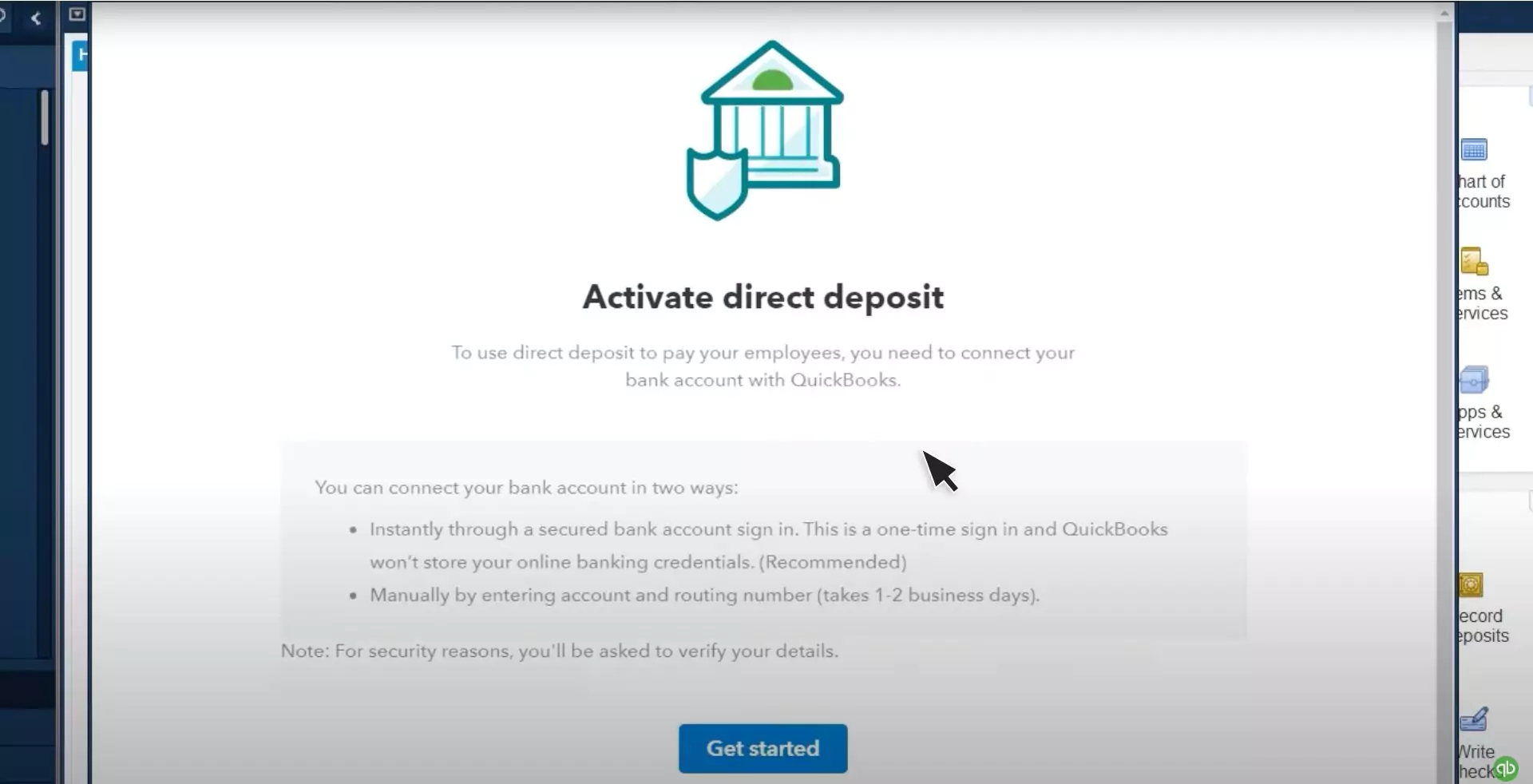

One of the most helpful benefits of using QuickBooks Payroll is its same-day direct deposit feature. This feature lets businesses pay their employees on the same day that they run payroll, which can help with cash flow management and improve employee satisfaction – a happy employee is one who gets paid on-time.

The software allows businesses to set up direct deposits for all of their employees, quickly and easily, without the need for paper checks or other payment methods.

Same-day direct deposit benefits both businesses owners and their employees. For businesses, it can help with cash flow management by reducing the time between running payroll and paying employees. For example, if a business experiences a cash flow crunch and needs to delay payroll processing, they can still pay their employees on time using QuickBooks’ same-day direct deposit feature. It also eliminates the need for paper checks, which can be costly and difficult to track.

For employees, same-day direct deposit offers the convenience of receiving their pay on the same day they work. It also eliminates a trip to the bank to deposit a paper check.

Reason 5: Affordable Pricing Plans

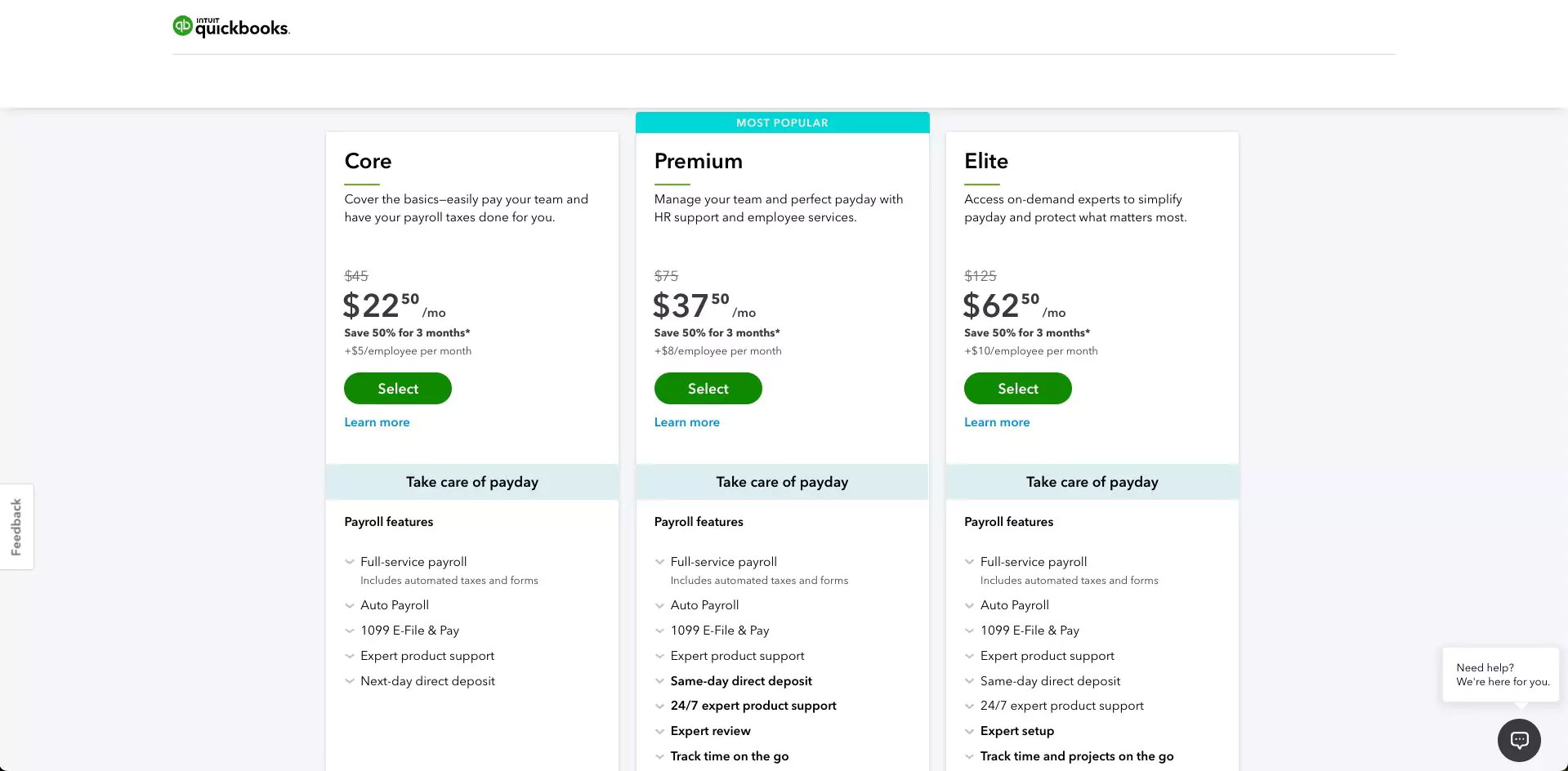

QuickBooks Payroll offers very affordable pricing plans that are designed to meet the needs of small businesses. The software offers a 3-tier pricing plan, including a Core plan, a Premium plan, and an Elite plan, with prices starting at just $45 per month.

The Core plan is designed for businesses that want to run payroll themselves, and offers basic features like automated taxes and forms, next-day direct deposit, and 401(k) plans. The Premium plan starts at $75 per month, and offers additional features like same-day direct deposit, 24/7 product support, and mobile time-tracking. The Elite plan starts at $125 per month, and offers deluxe features like expert setup, tax penalty protection, and a personal HR advisor.

When compared to other payroll software providers, QuickBooks Payroll is very competitively priced. While other providers do offer some similar features and services, they are typically costlier to the user.

By offering affordable pricing plans, QuickBooks Payroll can help small businesses save money and budget more effectively. The software eliminates the need for expensive payroll processing services, which can save businesses thousands of dollars each year. It also helps businesses avoid costly payroll errors and tax penalties, which can save them even more money in the long run.

Conclusion

QuickBooks Payroll is an essential tool for small business owners looking to streamline their payroll process and increase their working efficiency. With its automated payroll processing, time tracking and scheduling features, tax penalty protection, same-day direct deposit, and affordable pricing plans, QuickBooks Payroll offers an all-in-one solution that simplifies the entire payroll process and helps small businesses save time and money.

For small-medium sized business owners who are currently managing their payroll manually or using another, costlier payroll software, QuickBooks is an excellent option. With all the features needed to manage payroll effectively, it is designed to fit the needs and budgets of businesses of different sizes.

QuickBooks Payroll is a smart investment that can help small businesses save time, avoid errors, and stay compliant with regulations, all year-round. If you’re looking to simplify your payroll process and increase efficiency, give QuickBooks Payroll a try.

Don’t let the complexities of payroll management overwhelm you. With QuickBooks Payroll, managing payroll is simple, efficient, and stress-free. Sign up today and take advantage of its powerful features to streamline your payroll process and focus on growing your business.