Form 941 Explained: A Step-by-Step Guide for Businesses

Running a business means juggling many responsibilities, from managing day-to-day operations to ensuring compliance with tax laws. Staying on top of payroll taxes is critical to maintaining financial health and meeting your obligations as an employer.

Understanding key tax forms is essential for businesses of all sizes. One of the most important is Form 941, a federal tax return that tracks payroll activities. This guide will provide a clear overview of Form 941, including its purpose, who needs to file it, and a foolproof, step-by-step approach to completing it—with helpful visuals along the way.

What is Form 941?

Form 941, officially known as the Employer’s Quarterly Federal Tax Return, is a tax form required by the IRS to report payroll taxes. It serves as a detailed record of the wages you’ve paid to employees, the federal income taxes withheld from their paychecks, and your contributions to Social Security and Medicare taxes.

This form is filed quarterly and is essential for ensuring compliance with federal tax laws. In addition to reporting tax withholdings, it provides space to account for adjustments, such as overpayments or unreported tips, and any tax credits your business may be eligible for, like the Employee Retention Credit.

Why is Form 941 Important?

The 941 IRS form is essential for maintaining compliance with federal payroll tax laws. By filing this form, businesses report taxes withheld from employees’ wages, including federal income taxes, Social Security taxes, and Medicare taxes. This ensures the IRS receives accurate and timely information about your payroll activities.

For small businesses, filing payroll tax form 941 on time demonstrates financial responsibility and helps avoid penalties that could strain your financial resources. Beyond compliance, staying on top of quarterly tax reports like the 941 report shows your commitment to operating legally and ethically. Filing Form 941 on time can indirectly benefit your business in several ways:

- Improves loan eligibility: Lenders often view timely tax compliance as a sign of stability, increasing your chances of loan approval and potentially leading to better rates.

- Builds credibility with stakeholders: Consistent compliance enhances your reputation with investors, partners, and other stakeholders, showcasing your commitment to proper financial management.

- Minimizes IRS scrutiny: Filing accurately and on time reduces the likelihood of penalties, audits, or additional reviews by the IRS, ensuring smoother operations.

- Supports employee trust: Proper payroll tax filings ensure employees’ contributions to Social Security and Medicare are accurate, building confidence and trust in your business.

While not directly linked to credit scores, timely filings contribute to your overall financial health, stability, and credibility.

Who Needs to File Form 941?

Most employers who pay wages and withhold taxes need to file Form 941 quarterly. This includes small businesses, corporations, nonprofits, and certain government entities. However, seasonal businesses may not need to file for quarters with no wages, and some businesses with no employees may be exempt.

If you’re unsure about your filing requirements, consult the IRS guidelines or a trusted tax professional to ensure compliance.

Form 941 Filing Deadlines

To stay compliant, you must file Form 941 quarterly. Here are the deadlines:

|

Quarter |

Reporting Period |

Deadline |

|

Q1 (January–March) |

January 1 – March 31 |

April 30 |

|

Q2 (April–June) |

April 1 – June 30 |

July 31 |

|

Q3 (July–September) |

July 1 – September 30 |

October 31 |

|

Q4 (October–December) |

October 1 – December 31 |

January 31 |

If the deadline falls on a weekend or holiday, the due date shifts to the next business day. Staying on top of these dates ensures timely filing and prevents penalties.

To avoid errors or missed deadlines, consider organizing your payroll records well before the filing dates. Staying proactive ensures your 941 IRS form is accurate and submitted on time.

Recommended Payroll Services

Gusto – Cloud-based full-service payroll & HR

Onpay – Payroll & taxes for businesses of all sizes

Paychex – In-house compliance team to stay ahead of the curve

Key Sections of Tax Form 941

Understanding the structure of Form 941 is the first step to completing it accurately. Here’s a breakdown of the key sections you’ll encounter when filling out the form:

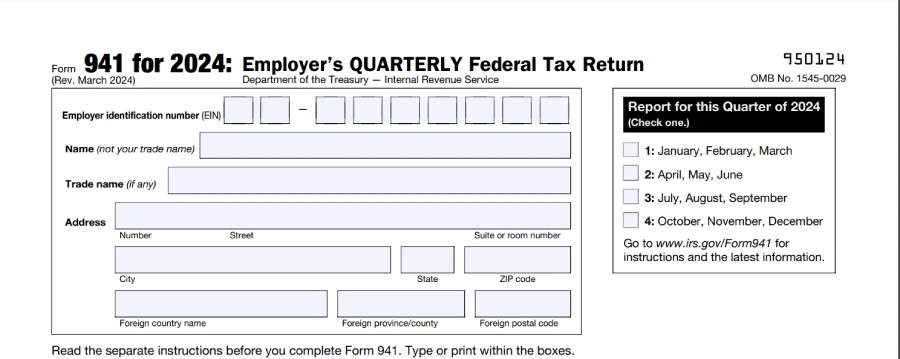

Part 1: Employer information

- This section collects basic details about your business, such as your Employer Identification Number (EIN), business name, and address. You’ll also need to specify the quarter you’re filing for.

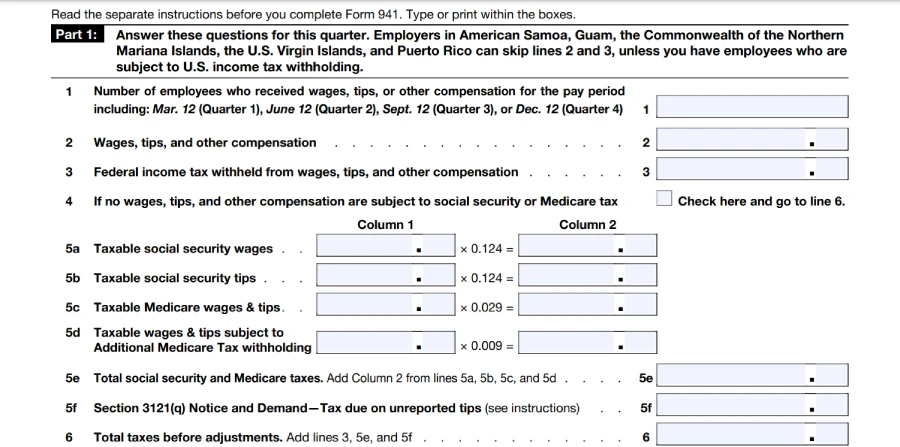

Part 2: Reporting wages and taxes

- Here, you’ll report the total wages paid, the federal income tax withheld, and the Social Security and Medicare taxes owed. This section is the heart of the 941 report and requires precise calculations.

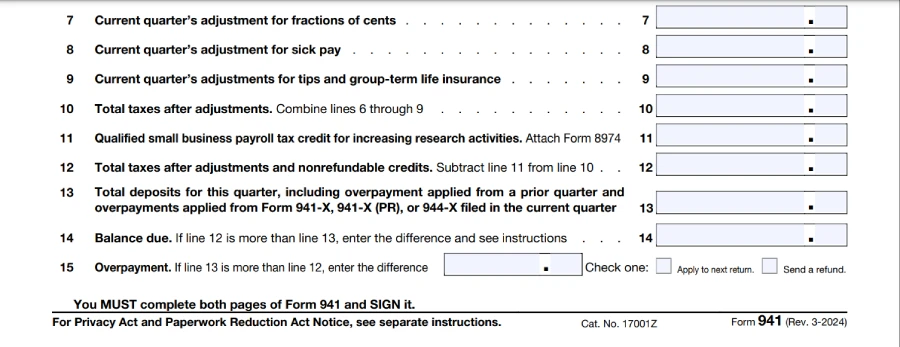

Part 3: Adjustments

- If you’ve over- or under-reported taxes in previous quarters, this section allows you to make the necessary corrections.

Part 4: Payment information

- This part applies if you owe additional taxes. You’ll indicate how the payment will be made, such as through the Electronic Federal Tax Payment System (EFTPS).

Part 5: Certification

- The final section requires an authorized person’s signature to confirm the form’s accuracy.

Each part of the 941 IRS form serves a specific purpose, so it’s essential to review everything carefully before filing. The next section will provide a detailed, step-by-step guide to simplify the process.

Step-by-Step How to Complete Form 941

Filling out Form 941 can feel intimidating, but trust me when I say it’s straightforward; just follow these steps:

1. Enter employer information

Fill in your Employer Identification Number (EIN), business name, and address. Check the appropriate box for the quarter.

2. Report wages and taxes

This is the heart of Form 941, where you’ll report your quarterly payroll details. You’ll need to calculate and input the following:

- Total wages paid: Enter the total wages paid to employees during the quarter. This includes salaries, hourly wages, bonuses, commissions, and taxable fringe benefits.

- Federal income tax withheld: Report the total amount of federal income tax withheld from your employees’ paychecks.

- Social Security and Medicare taxes: Calculate employee and employer shares of these taxes. Remember, you’re responsible for matching the amounts withheld from employees for these taxes.

Note: If your employees receive tips as part of their income, include reported tips in this section. Failure to report tips accurately can lead to discrepancies and penalties.

3. Adjustments

The adjustments section is where you can make corrections to prior reporting errors or account for special circumstances during the quarter. Here’s what to focus on:

- Previous quarter corrections: If you over- or under-reported wages or taxes in a previous quarter, this is where you rectify those discrepancies. For example, if you withheld too much or too little federal income tax, note the adjustment here.

- Sick pay adjustments: If employees received third-party sick pay, such as through an insurance provider, these payments should be adjusted and reported in this section.

- Tips and fringe benefits: Adjustments may also be needed for unreported tips or taxable fringe benefits that were initially omitted.

Note: Keep detailed records of your payroll adjustments. This documentation can help resolve discrepancies quickly if the IRS raises questions about your filing.

4. Tax liability and payment

After reporting wages and adjustments, you’ll calculate your total tax liability for the quarter. Follow these steps:

- Calculate total taxes owed: Add the federal income tax withheld, the employee and employer portions of Social Security, and the Medicare tax.

- Subtract deposits made: If you’ve already made tax deposits for the quarter via EFTPS, subtract those amounts from your total liability.

- Determine payment method: If you owe additional taxes after deposits, indicate your payment method. The IRS prefers electronic payments through the Electronic Federal Tax Payment System (EFTPS) but accepts checks or money orders.

Note: Double-check your calculations to ensure the payment amount aligns with your liability. Errors here can result in penalties or processing delays.

5. Designate a third-party designee (Optional)

If you’d like someone else, such as your accountant, payroll provider, or another trusted individual, to discuss your Form 941 with the IRS, you can designate them as a third-party designee. Here’s what to do:

- Provide designee information: Include the person’s name, phone number, and a five-digit personal identification number (PIN).

- Authorization scope: By naming a designee, you authorize them to discuss any questions the IRS may have about your filing. However, they cannot sign the form on your behalf or receive refunds.

- Timeframe: The authorization is only valid for the current filing period and does not grant access to your account for future filings.

Note: Ensure your designee is familiar with your payroll and tax details, as they may need to provide additional clarification to the IRS.

6. Certification:

Sign and date the form to certify its accuracy.

7. Submit the form:

File electronically via the IRS’s e-file system or mail it to the appropriate IRS address.

Warning Signs and Red Flags

Filing Form 941 accurately is essential, but even small errors can trigger red flags or costly penalties. Here are some common warning signs to watch out for when filling out your form:

1. Mismatch between reported wages and deposits

Ensure that the wages and taxes reported on the form align with the amounts you’ve deposited through the IRS’s Electronic Federal Tax Payment System (EFTPS). Discrepancies can lead to audits or delays in processing.

2. Missing deadlines

Filing late is one of the easiest ways to incur penalties. Keep track of the quarterly deadlines for filing Form 941 and submit on time to avoid unnecessary fines.

3. Incorrect employee information

Double-check employee Social Security numbers and reported wages. Errors here can delay processing or result in notices from the IRS.

4. Failure to report adjustments

If there are corrections or adjustments to be made for prior quarters, be sure to include them in Part 3. Ignoring these adjustments could cause inaccuracies in your records.

5. Leaving sections incomplete

Every applicable field on the form must be completed. Omitting required information may result in the form being returned or rejected.

Penalties and Compliance

Failing to file Form 941 accurately and on time can lead to penalties that impact your business’s bottom line. Here’s what you need to know about staying compliant and avoiding costly mistakes.

1. Late filing penalties

If you miss the deadline for filing Form 941, the IRS imposes a penalty of 5% of the unpaid tax for each month the return is late, up to a maximum of 25%. These penalties can quickly add up for small businesses, making timely submission crucial.

2. Failure to pay taxes

Not paying the taxes reported on your 941 IRS form can result in a separate penalty. The IRS typically charges 0.5% of the unpaid amount each month, capped at 25%. Interest also accrues on unpaid balances, further increasing the financial burden.

3. Filing incorrect information

Submitting inaccurate or incomplete information on the 941 report may result in fines. Errors in employee wages or tax calculations can trigger additional scrutiny and possible penalties.

4. Compliance tips

To stay compliant, organize your records, double-check all calculations, and submit your payroll tax form 941 before the deadline. If you anticipate challenges meeting your tax obligations, consider contacting the IRS to arrange a payment plan.

Understanding these penalties and compliance requirements will help you avoid unnecessary fines and keep your business on track. By completing and filing your f-941 accurately, you demonstrate your commitment to responsible business practices.

Simplify with Payroll Software

Payroll software can automate filing Form 941, making the process faster, more accurate, and stress-free. These tools handle complex tax calculations, generate pre-filled forms, and even file electronically with the IRS.

Beyond tax filing, payroll software offers a range of features to streamline business operations. Many solutions include employee management tools, such as tracking hours, managing benefits, and generating pay stubs. They also provide automatic compliance updates to help businesses stay current with changing tax laws. By automating repetitive payroll tasks, these tools save valuable time, allowing business owners to focus on growth and strategic goals.

As your business scales, payroll software can adapt to handle larger teams and more complex payroll needs, ensuring you stay efficient at every stage.

Here are some recommended payroll software:

- Paychex: an all-in-one HR and payroll solution designed for small and medium-sized businesses, offering integration with other HR tools.

- Paycor: comprehensive payroll software that automates the entire process and provides in-depth reporting features.

- BamboorHR: versatile tool that simplifies payroll while offering HR functionalities like applicant tracking and employee onboarding.

Explore these tools and more to find one that fits your business needs.

Final Thoughts

Managing payroll taxes may seem challenging, but with the right knowledge and tools, filing Form 941 becomes effortless. By understanding its purpose, following a step-by-step process, and utilizing payroll software, you can ensure compliance while saving time and effort.

FAQ

Q. What is Form 941?

A. Form 941, also known as the Employer’s Quarterly Federal Tax Return, is a tax form used to report employee wages, withheld federal income taxes, and Social Security and Medicare contributions to the IRS.

Q. Who needs to file Form 941?

A. Most businesses with employees who pay wages and withhold taxes must file the 941 IRS form. Exceptions include seasonal employers during inactive quarters or businesses with no employees.

Q. When is Form 941 due?

A. The 941 report is due quarterly:

- Q1 (January–March): Due April 30

- Q2 (April–June): Due July 31

- Q3 (July–September): Due October 31

- Q4 (October–December): Due January 31

The form is due the next business day if the deadline falls on a weekend or holiday.

Q. Can I file Form 941 electronically?

A. Yes, the IRS allows you to e-file Form 941 through its authorized e-file providers or payroll software, which streamlines the process and helps avoid errors.

Q. What happens if I file Form 941 late?

A. Late filings can result in a penalty of 5% of the unpaid tax for each month the return is late, up to 25%. Additionally, interest may accrue on any unpaid taxes.