Square Review 2025

Square Merchant Services Plans & Pricing

Square Comparison

Expert Review

Pros

Cons

Square Merchant Services's Offerings

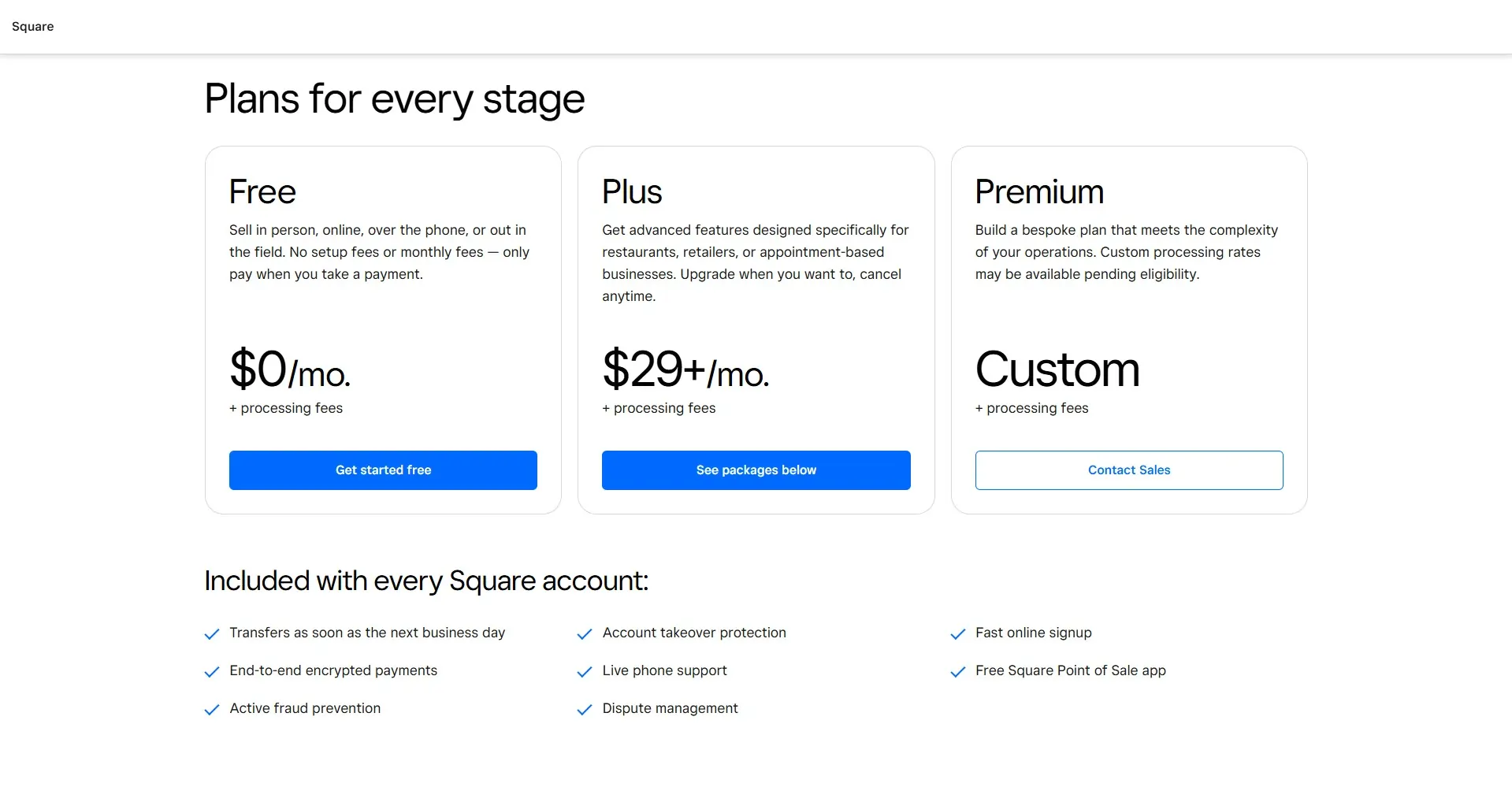

Square doesn’t charge one-time or monthly fees — you merely pay per transaction. Thus, you don’t have to be as cautious about signing up for Square. If you don’t like it, you can cancel their services without paying anything. Square has a few different fee structures depending on the way you take payments. Each one is pretty inexpensive, making Square suitable for smaller, low-volume businesses.

Customer Support

Square offers nearly every standard support option, from customer service agents (accessible through several avenues) to self-help resources like blog posts and tutorials.

Features & Functionality

General Features

Square merchant service provider offers a huge array of features and business optimizing solutions to improve your payment processing functions and business workflows. Here are some of the tools on offer:

- Point-of-sale (POS) systems for various business types

- Multiple ways to get paid

- Recurring invoices

- Payment reminders

- Online payment solutions for e-commerce

- Marketing and customer loyalty programs

- Payroll services for businesses

- Employee management and scheduling tools

- Square Banking with savings and checking options

- Hardware solutions like Square Terminal, Register, and Stand

- Payment processing for in-person, online, and mobile transactions

- Buy Now, Pay Later integration for customers

- Customer directory and database management

- Gift card solutions for businesses

- Advanced analytics and reporting tools

- Industry-specific tools for food & beverage, retail, beauty, etc

- Support for large enterprises and franchises

Point-of-Sale (POS) Systems for Various Business Types

Square offers versatile POS systems designed to cater to diverse industries, including retail, food, and beauty. The solutions integrate seamlessly with their Merchant Services software, providing real-time transaction data and advanced features like inventory management, sales tracking, and receipt customization. Whether through Square Register, Terminal, or Stand, businesses benefit from streamlined in-person payment processing via swipe, chip, tap, or manual inputs, enhancing operational efficiency.

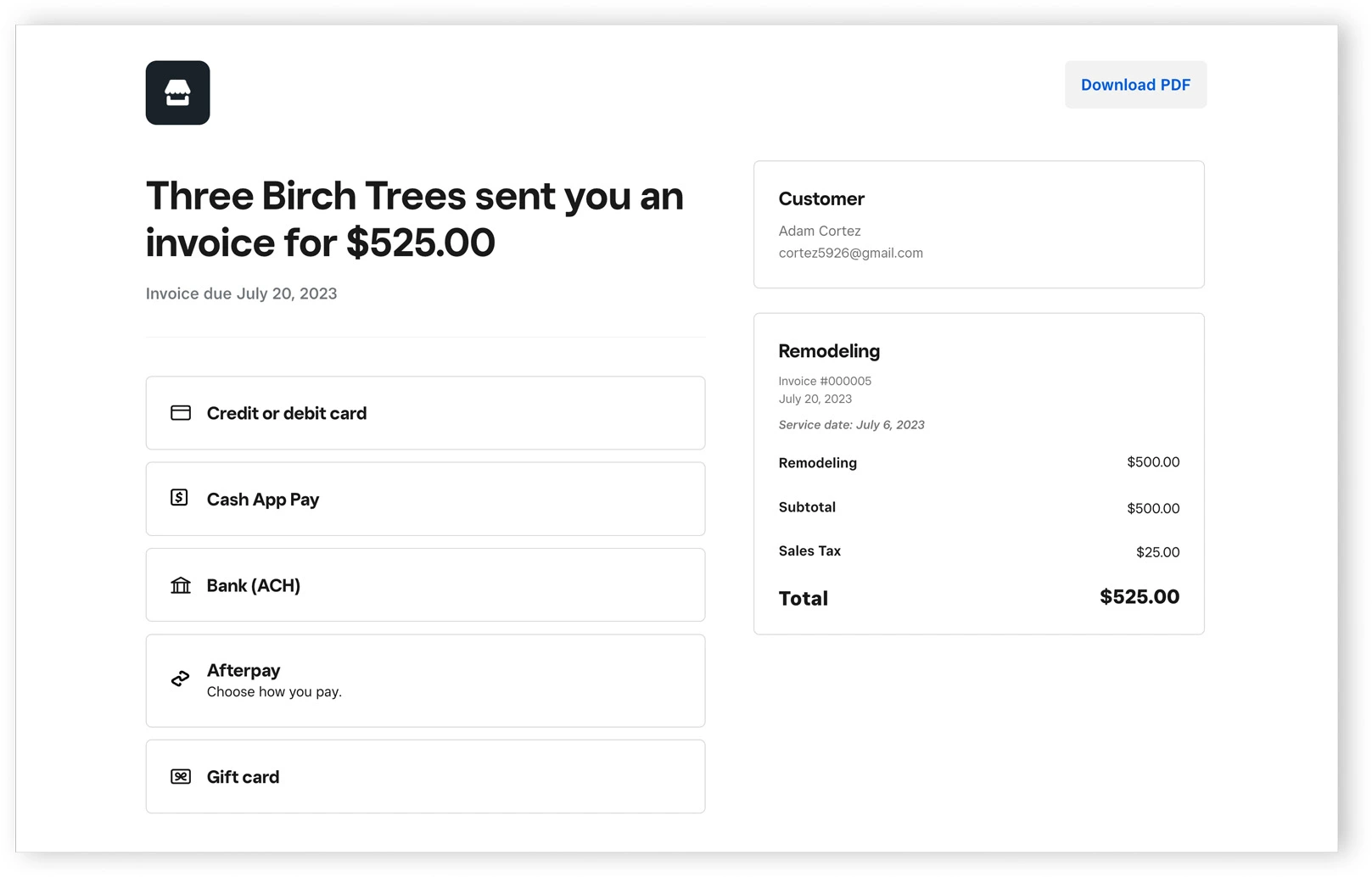

Multiple Ways to Get Paid

Square offers a ton of ways to get paid. You can get some hardware from Square for in-person swipe, chip, tap, or manual payments. You can accept payments in-app, via digital invoice creation, online payments through your website, and even through shareable checkout links.

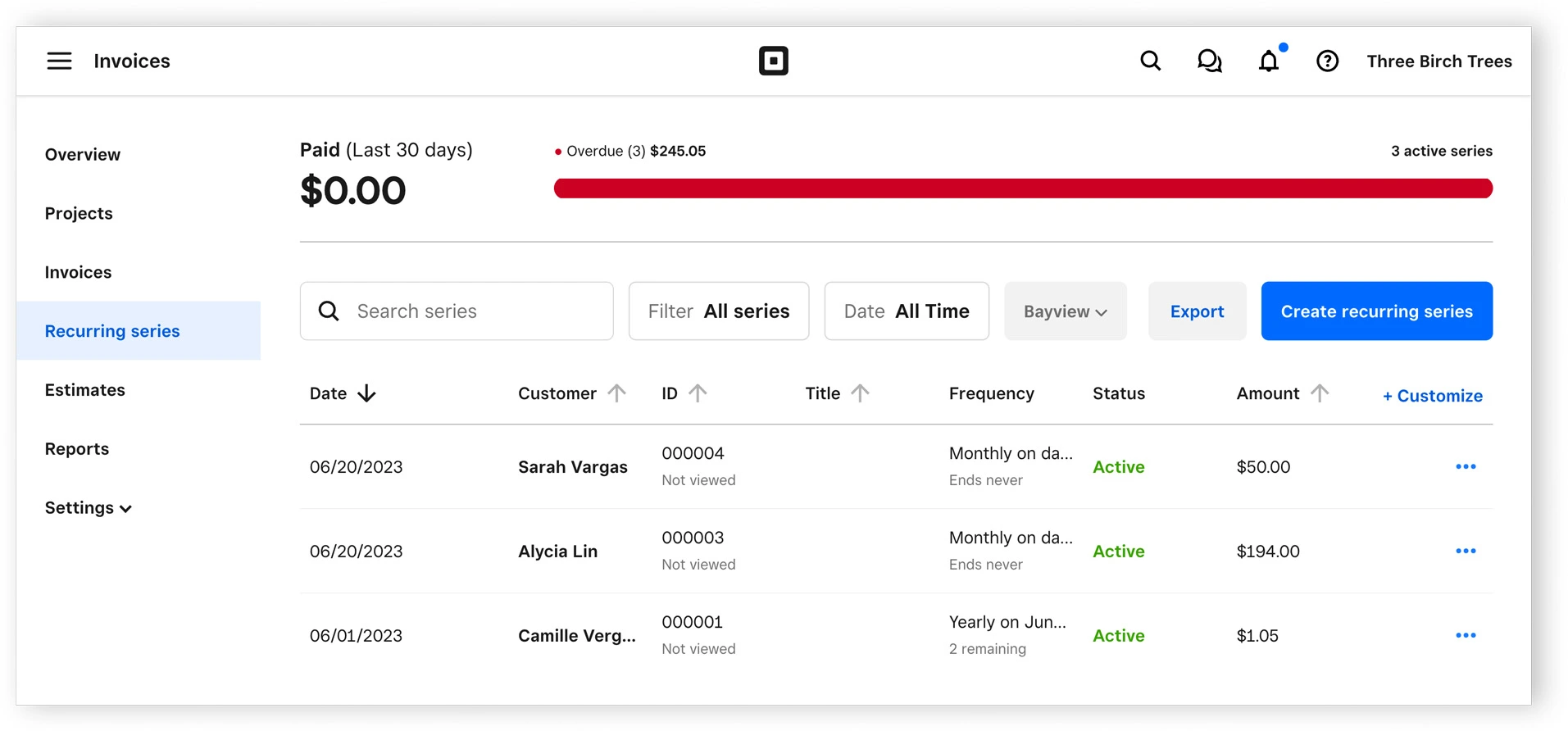

Recurring Invoices

Do you have any regular clients? Perhaps you’re on retainer with a few, providing regular services in exchange for a fixed monthly fee? With Square, you can store your clients’ credit or debit cards and set up automated recurring invoicing. Square automatically charges your client’s card, making it so that neither party needs to remember to pay or get paid.

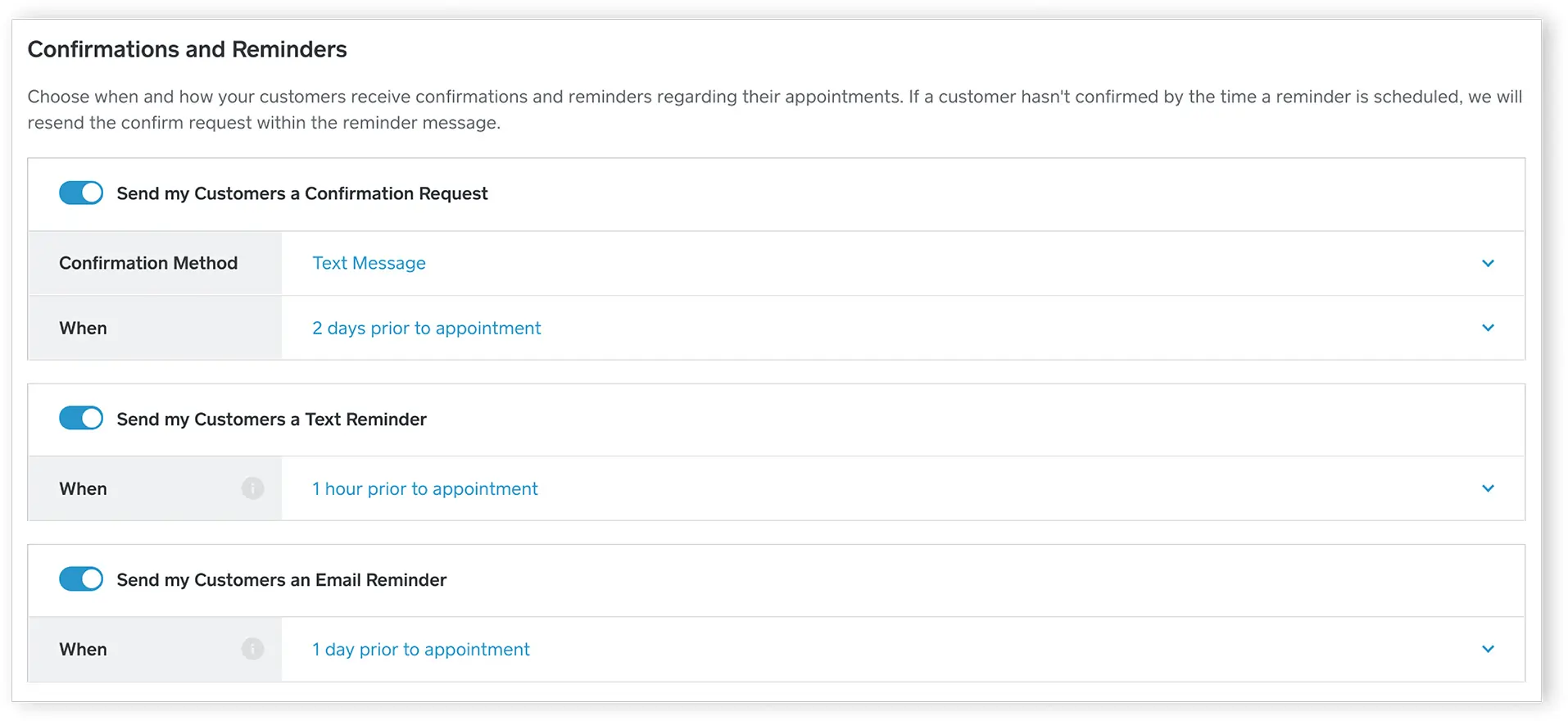

Payment Reminders

Square offers payment reminders as another automation to help you collect on customer accounts and maximize cash flows. When you create an invoice in Square, you can schedule these reminders ahead of time so you can get back to working on more important matters.

Online Payment Solutions for E-Commerce

Square empowers businesses with robust e-commerce payment capabilities through its Online Payment Platforms. Their payment gateway supports secure online payment processing services, enabling merchants to accept payments directly through customizable websites. Virtual card support and electronic check processing make Square’s offerings versatile, while integration with popular e-commerce tools ensures flexibility for modern businesses.

Marketing and Customer Loyalty Programs

Square’s marketing tools help businesses drive customer engagement through personalized email campaigns and promotions. Its loyalty programs allow businesses to reward repeat customers, integrate with payment transactions, and track redemption analytics. These features, built into Square’s Merchant Services software, help businesses create meaningful connections with their customers while enhancing retention rates.

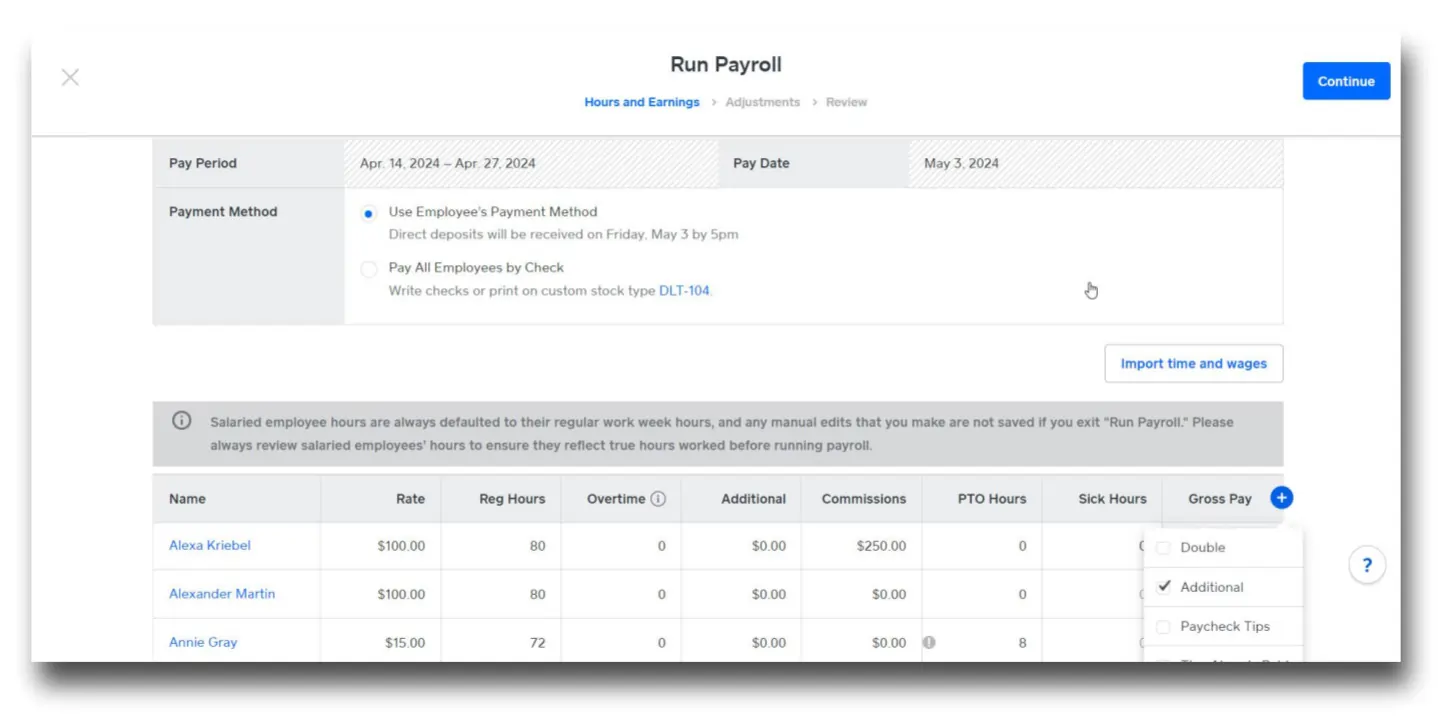

Payroll Services for Businesses

Square simplifies payroll management by offering end-to-end solutions for businesses. With features like automated tax filing, direct deposit, and integration with Square’s POS system, payroll becomes seamless. This solution accommodates all business sizes, offering transparent pricing and efficient employee payment methods.

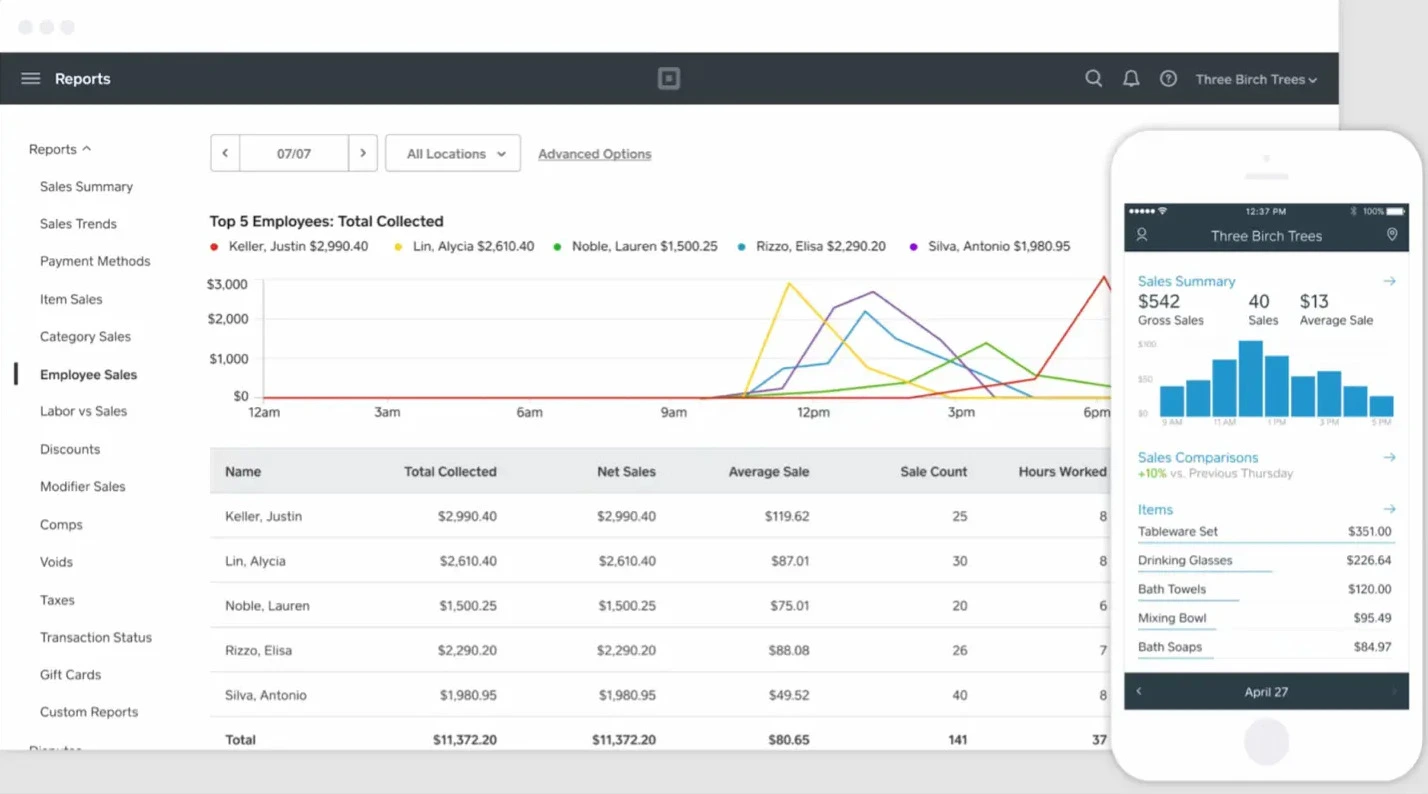

Employee Management and Scheduling Tools

Square includes advanced employee management tools within its software suite, enabling businesses to schedule shifts, track attendance, and manage labor costs. These tools are particularly beneficial for hospitality and retail industries, ensuring optimized staff performance and seamless payroll integration.

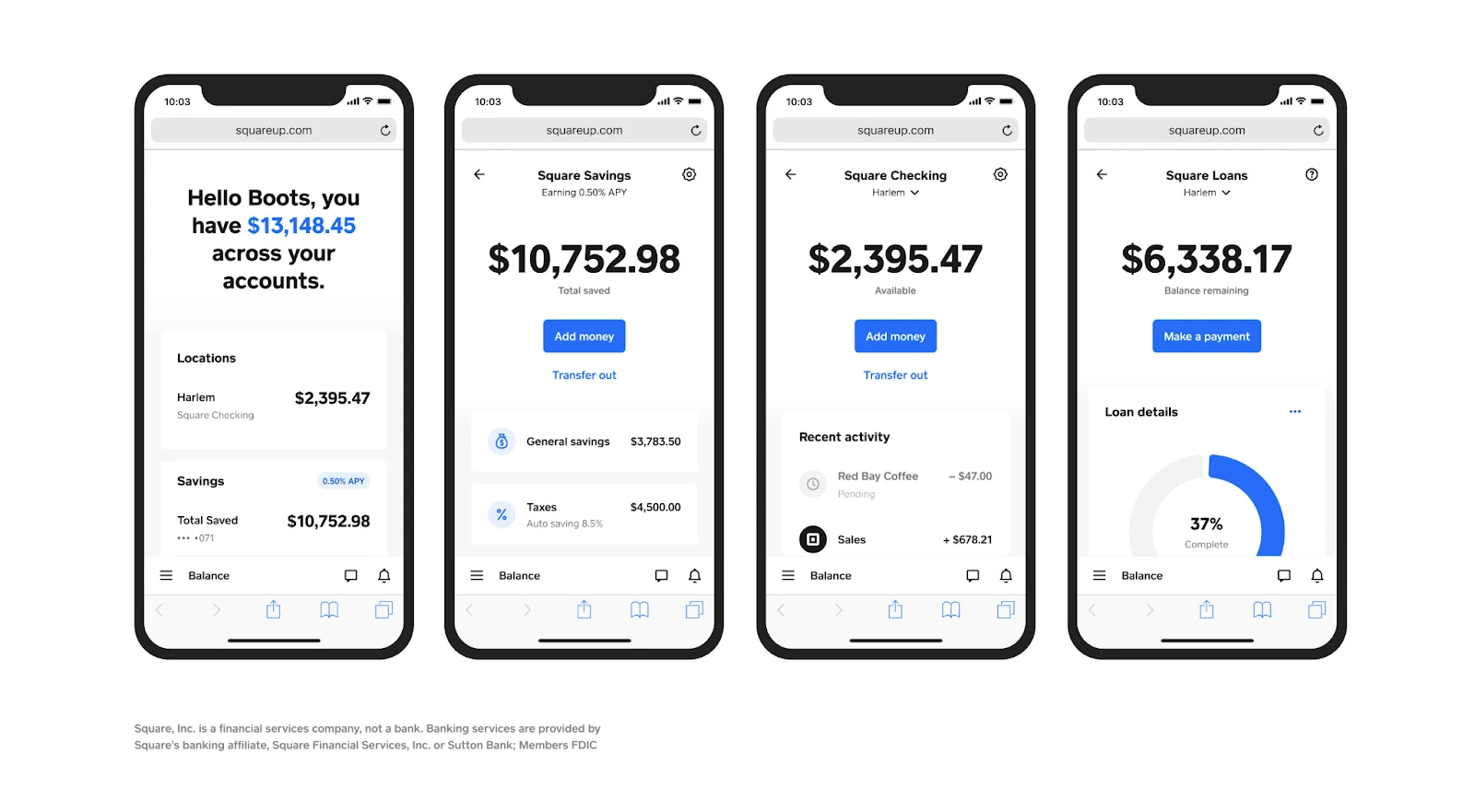

Square Banking with Savings and Checking Options

Square Banking allows businesses to manage their funds efficiently with built-in savings and checking accounts. Transactions are automatically synced with sales data, and the free Square Debit Card ensures immediate access to earnings. This integration of financial services within their Online Merchant Services ecosystem boosts cash flow flexibility for small and medium businesses.

Buy Now, Pay Later Integration for Customers

Square’s Buy Now, Pay Later feature provides customers with flexible financing options, increasing purchase potential and enhancing the overall shopping experience. Integrated with Square’s payment platforms, this solution helps businesses improve conversion rates and customer satisfaction.

Gift Card Solutions for Businesses

Square simplifies gift card management with a comprehensive solution that includes digital and physical options. Gift cards are fully integrated into the payment system, enabling seamless transactions, tracking, and reporting. These tools help businesses drive additional revenue and customer acquisition.

Advanced Analytics and Reporting Tools

Square’s analytics tools provide businesses with actionable insights through intuitive dashboards. Key metrics like sales trends, customer behavior, and inventory performance are easily accessible, enabling data-driven decisions. These tools are part of Square’s Merchant Services software, ensuring businesses can maximize operational efficiency and profitability.

Industry-Specific Tools

Square tailors its solutions to specific industries, offering features like table management for restaurants, inventory tracking for retail, and appointment scheduling for beauty salons. These industry-specific tools are integrated with their online payment processing services, ensuring that businesses can meet their unique operational needs effectively.

Financing

Need some cash for your business to invest in new projects? Square offers merchant cash advances (although they call them loans) through their Square Capital division, so you can exchange a slice of future credit sales for some quick cash.

Square Business Debit Card

Square gives you more control over your business’s income by offering a free business debit card. The moment you make a sale, your debit card becomes loaded with that money. That way, you can quickly and easily spend the money on your business needs.

Alternatively, however, Square lets you transfer funds to your bank account in as little as one business day for free (or instantly for a small fee).

Hardware & Software

Square is compatible with a wide range of Apple and Android devices and devices from several other brands. It also offers plenty of hardware solutions, like POS systems.

Sales Channels

Expand business reach with diverse sales channels.

Ease Of Use:

Square has excellent UI, easy for anyone to learn. Plus, Square has a three-step onboarding sequence to help you set up your business and get familiar with the basics of the product.

Verdict:

Square is an excellent merchant services provider, offering competitive rates, simple UI, and plenty of integrations. Plus, Square provides plenty of other products and services that complement the payment processing well. Overall, it’s excellent for any business that wants no-frills, competitively-priced merchant services — but it’s especially suitable for low-volume companies.

User Review

- high fees are charged to store customer credit cards

- Square e-mails to customers were also less confidential since they mentioned the name of my firm in the message.

- -instant deposit fee is extremely high