Stax Review 2025

Stax Merchant Services Plans & Pricing

Stax Comparison

Expert Review

Pros

Cons

Stax Merchant Services's Offerings

**LIMITED-TIME OFFER**

- For a limited time, try out Stax and get your first month for free*!

- Terms & conditions for Stax apply

Interested customers can schedule a free Stax demo to check out its services before buying. You can choose from several plans if you decide Stax is right for you. They offer a basic Merchant Processing account, as well as three other plans that provide additional features. It looks like you must select one of these plans to accompany your Merchant Processing account, but it’s hard to tell.

No matter which plan you choose, there are no:

- Batch fees

- Cancellation fees

- PCI compliance fees

- Statement fees

So you save plenty on fees

Customer Support

Stax has several customer support options, and each of them is pretty good. If you jump up to a higher-tier plan, you get a dedicated account manager for faster and more personalized service.

Additional support includes:

Blog: Head to Stax’s blog to learn general business tips, industry-specific payment processing topics, and to compare Stax against competitors.

Features & Functionality

General Features

Stax merchant services offer a wide selection of features and tools to optimize your payment abilities, boost sales, and customer retention.

Here’s a quick view:

- Dashboards and analytics

- Customer database management

- Omni Integrated Payments

- E-commerce shopping cart

- Enhanced reporting and analytics suites

- QuickBooks two-way integration

- Integrations with various PoS systems

- API key integration capabilities

- Digital invoicing

- Text2Pay mobile payments

- Hosted payment pages

- Securely stored customer card and bank information

- Accounting reconciliation

- Recurring and scheduled payments

- Automatic updates for stored credit cards

- One-click shopping with catalog management

- Payment links, buttons, and QR codes

- Data exports (transactions, customers)

- Compliant surcharging solutions

- ACH processing

- Terminal protection with unlimited swaps for defects or wear

- Customer branding tools

- Next-day funding (for eligible customers)

- Tailored equipment solutions for in-person payments

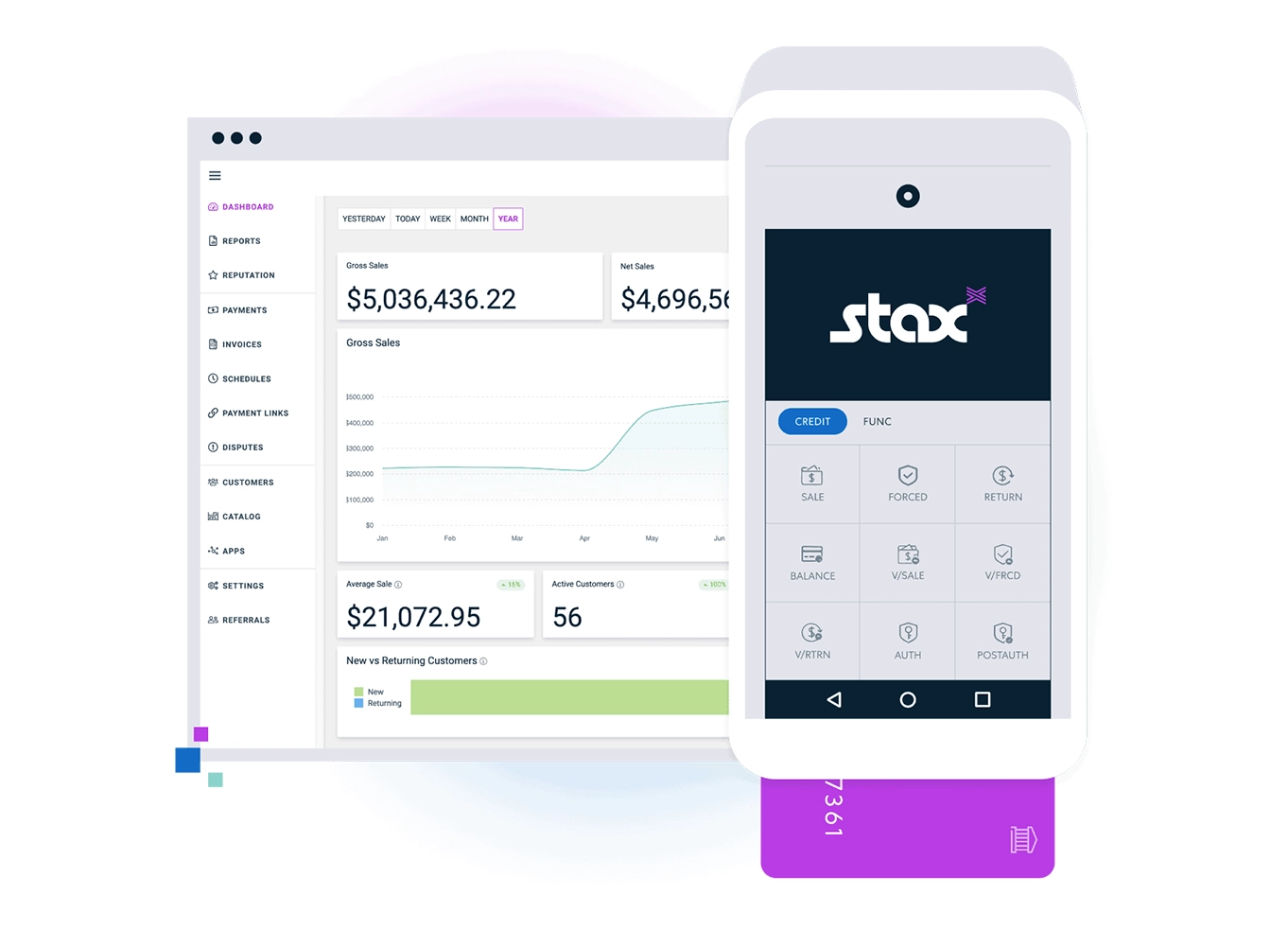

Dashboards and Analytics

Each plan comes with successively better and more useful reporting and analytics suites. Once again, Stax’s Omni Integrated Payments offers reporting and analytics as well. You can check out data on your transactions, sales, item categories, and more.

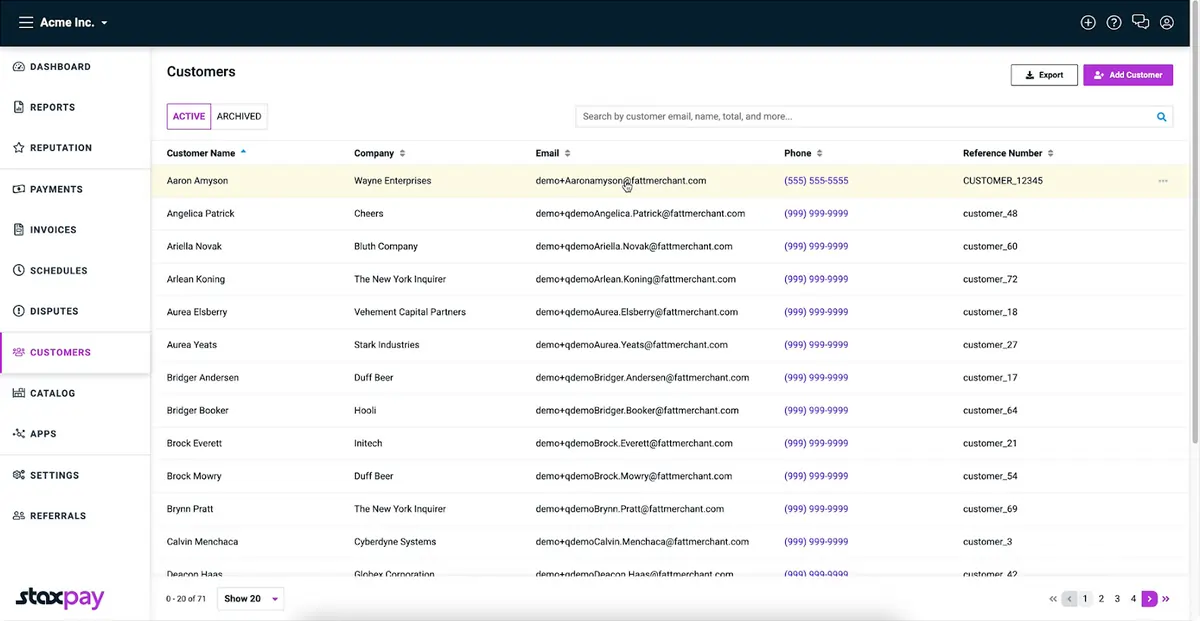

Customer Management

Stax lets you collect data on and manage your customers with their customer database. This database tracks information like payment methods, purchase history, and other matters. With this information, you can find ways to improve your marketing for your products or services.

Omni Integrated Payments

Stax created Omni Integrated Payments to help streamline several aspects of your business. Not only does it collect your transaction data (and all sorts of other data) in one place, but it offers several other features such as business tool integrations and plenty of reports.

E-commerce Shopping Cart

If you upgrade to the Pro plan, you can access a one-click shopping cart to stick on your store. The easier it is to check out, the more revenue you’ll pull in.

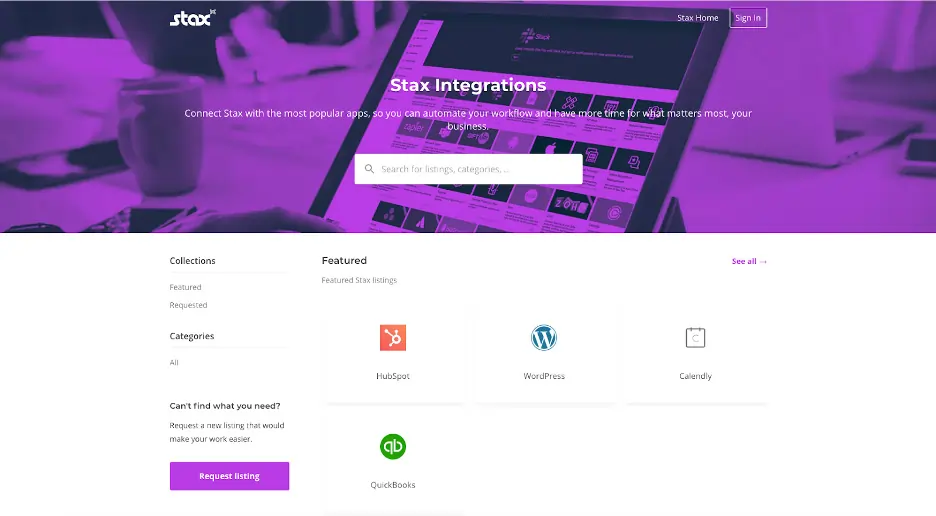

Integrations & Add-Ons

Stax’s two-way Quickbooks integration lets you easily sync your transaction data with your books, streamlining your accounting. Likewise, any relevant changes in Quickbooks will be reflected accordingly in Stax.

Stax also integrates with various PoS systems. However, they don’t make it clear which ones. You may have to contact your PoS provider and find out.

Digital Invoicing

Stax offers a streamlined digital invoicing system, enabling businesses to create and send invoices electronically. This feature simplifies the payment collection process and integrates with other Stax tools for seamless tracking and management.

Text2Pay Mobile Payments

With Stax’s Text2Pay feature, businesses can accept payments directly via SMS. This convenient solution enhances customer experience by allowing secure mobile payments through a simple text message, improving accessibility and speed.

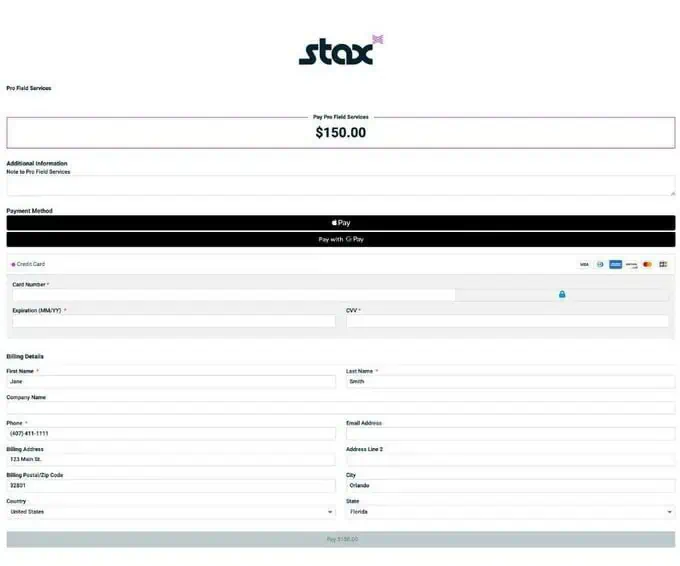

Hosted Payment Pages

Stax provides customizable hosted payment pages for businesses, enabling secure online transactions without the need for extensive technical integration. These pages are ideal for quick implementation and professional branding.

Accounting Reconciliation

Stax simplifies accounting tasks with built-in reconciliation tools. These features align transaction data with accounting systems, ensuring accuracy and reducing the manual effort required for financial management.

Recurring and Scheduled Payments

Stax supports recurring and scheduled payments, allowing businesses to set up automated billing for subscriptions or repeat customers. This feature enhances cash flow consistency and customer satisfaction.

Automatic Updates for Stored Credit Cards

To prevent payment disruptions, Stax provides automatic updates for stored customer credit card information. This feature keeps recurring billing uninterrupted and reduces administrative tasks.

One-Click Shopping with Catalog Management

Stax’s catalog management system facilitates one-click shopping experiences for customers. Businesses can create and manage product listings that enable fast and frictionless purchases.

Payment Links, Buttons, and QR Codes

Stax enables businesses to generate payment links, buttons, and QR codes for various payment scenarios. These tools make transactions easy for customers in both online and offline environments.

Compliant Surcharging Solutions

Stax offers compliant surcharging options, allowing businesses to pass on credit card processing fees to customers where permitted by law. This helps reduce operational costs while remaining customer-friendly.

ACH Processing

Stax supports ACH processing for secure and cost-effective bank transfers. This payment method is ideal for businesses looking to minimize fees while offering diverse payment options.

Terminal Protection with Unlimited Swaps for Defects or Wear

Stax provides terminal protection services, covering unlimited replacements for devices affected by defects, wear, or accidents. This ensures businesses experience minimal downtime.

Customer Branding Tools

With Stax’s branding tools, businesses can customize invoices, receipts, and payment pages to align with their brand identity, enhancing professionalism and trust.

Next-Day Funding (for Eligible Customers)

Stax offers next-day funding for eligible transactions, ensuring businesses receive payments faster to maintain a steady cash flow.

Tailored Equipment Solutions for In-Person Payments

Stax provides customized hardware solutions, including terminals and card readers, to suit specific business needs. These devices integrate seamlessly with Stax’s payment platform for in-person transactions.

Hardware & Software

Stax is cloud-based, so you can use it on Mac or PC from wherever you can connect to the Internet. Additionally, Stax offers iOS and Android apps to handle any payment processing from wherever you may be.

Pricing Options Automations

Simplify billing with automated pricing features.

Sales Channels

Expand business reach with diverse sales channels.

Ease Of Use:

Stax is pretty easy to use. This is especially when you look at the Omni portal. Additionally, Stax offers a tutorial for using the portal.

Verdict:

Stax’s monthly pricing is nice to see, and it’s relatively transparent. Some of the plans go way beyond just payment processing. The Omni Channel Payments provides plenty of features, and all integrations offered sweetened the deal. The pricing might be high for low-volume businesses, so consider Stax only if you’re high volume or on the way there.

User Review

- Error codes are not specific sometimes