Best Free Accounting Software for Small Businesses in 2025

Last updated: September 2025

Free accounting software helps small businesses manage expenses, send invoices, and stay organized without paying monthly fees. If you're a startup or small team that wants to track finances, simplify bookkeeping, and cut costs with easy-to-use tools, there are several free accounting software options designed for your needs.

- Unlimited custom invoices and quotes

- Smart invoicing with automated tracking

- Save an average of $2,100+ per year

- Global business management compliance

- Speeds up the financial closing process

- See metrics in real-time

- All-in-one business management system

- Easily manage your purchasing process

- Generate robust financial reports in seconds

- Award-winning customer service

- Seamless integration & user-friendly

- Save up to $7,000 per year

DISCLAIMER: The “free accounting software” options are recommendations designed to get you off the ground. While these programs are indeed “free” on the most basic levels or for limited times, it’s important to note that once the free trial period concludes, you will be required to pay for continued use. Additionally, if you use “Freemium” accounting software, you must pay for more advanced accounting features and functionality.

Free small business accounting software can help you manage your books without adding to your monthly expenses. Many providers now offer forever-free plans or free trials that include the core tools small teams and freelancers need to stay financially organized.

You may still run into extra costs for things like payroll, advanced reporting, or premium integrations, but for many businesses, a free accounting app is a smart way to handle invoicing, track expenses, and review revenue without paying for a full platform.

- The best free accounting software options on the market today include features like:

- Invoicing and expense tracking

- Automatic syncing with bank transactions

- Built-in financial reports and dashboards

- Optional payroll add-ons

- Free bookkeeping tools and mobile access

These are our top picks for easy accounting software free to try in 2025:

Best free accounting software in 2025

⭐ Zoho Books: Best free accounting software for small businesses

⭐ Odoo Accounting: Best for customizable, open-source accounting

⭐ 1-800Accountant: Best free trial accounting software with expert support

⭐ QuickBooks Online: Best accounting app for freelancers and startups

⭐ FreshBooks: Best for invoicing and expense tracking on a free trial

Quick comparison

| Zoho Books | Odoo Accounting | 1-800Accountant | Quickbooks Online | FreshBooks | |

| Standout feature | Free plan with many automation tools | Modular, open-source accounting | Access to live accountants and guided setup | Easy QuickBooks ecosystem integration | Top-rated invoicing and time tracking |

| Free trial or forever free? | ✅ Free plan available | ✅ Free plan available | Free trial | Free trial | Free trial |

| Best for | Small businesses needing scalable tools | Tech-savvy teams needing customization | Freelancers needing expert guidance | Startups using QuickBooks for bookkeeping | Service-based businesses and solo freelancers |

| Integrates with | Zoho apps, Stripe, PayPal, G Suite | Odoo modules, third-party via API | QuickBooks, FreshBooks, Xero | QuickBooks ecosystem, PayPal, Shopify | Stripe, Gusto, Trello, Zapier |

| Price range | Affordable | Affordable | Expensive | Premium | Premium |

Our top picks

Some platforms offer forever-free plans with essential tools like invoicing, expense tracking, and financial reporting. Others include free trials that unlock premium features such as payroll, real-time bank syncing, and third-party integrations. These are our top picks for free small business accounting software in 2025.

Zoho Books: Best for small businesses

Zoho Books offers one of the best free small business accounting software options for companies earning under $50,000 annually. The forever-free plan includes invoicing, expense tracking, bank reconciliation, and over 25 financial reports. While it lacks features like automatic bank feeds or payroll, it’s an excellent pick for freelancers and startups looking for easy accounting software free of monthly fees.

Key features

- Create and send up to 1,000 invoices per year

- Track business expenses and categorize spending

- Manual bank reconciliation with statement imports

- Access 25+ real-time financial reports

- Client portal for invoice viewing and online payments

- Mobile access through the Zoho accounting app

- Invite one accountant for collaborative bookkeeping

Free plan details

Zoho Books’ free plan is tailored for small businesses and freelancers with annual revenues under $50,000. This forever-free plan allows users to create up to 1,000 invoices annually and manage up to 1,000 expenses per year. It supports one user and one accountant, providing essential features like invoicing, expense tracking, manual bank reconciliation, and access to over 25 financial reports. While it lacks advanced functionalities such as automatic bank feeds, multi-currency support, and third-party payment processor integrations, it offers a solid foundation for businesses seeking a cost-effective accounting solution. Users also benefit from email support during business hours.

Free trial available?

Yes, Zoho Books offers a 14-day free trial that provides access to all features available in the Premium plan. This trial allows you to explore advanced functionalities such as automated workflows, multi-user collaboration, and comprehensive financial reporting. No credit card is required to sign up, and if you need more time, you can extend the trial by an additional 14 days. After the trial period, you can choose to upgrade to a paid plan or switch to the forever-free plan, which includes essential features like invoicing, expense tracking, and manual bank reconciliation, suitable for businesses with annual revenues under $50,000.

Pros and cons

Pros

- Forever-free plan for businesses earning under $50,000 annually

- Includes essential tools like invoicing, expense tracking, and financial reporting

- Seamless integration with other Zoho apps, offering an all-in-one accounting app experience

- User-friendly interface, ideal for those seeking easy accounting software free of charge

- Access to over 25 real-time reports, aiding in comprehensive financial analysis

Cons

- Lacks automatic bank feeds, requiring manual transaction imports

- Limited to one user and one accountant, which may not suit growing teams

- Fewer third-party integrations compared to competitors, potentially limiting flexibility

- Customer support is restricted to email, with no phone or live chat options

- Absence of advanced features like payroll management and multi-currency support in the free plan

Who it’s for

Zoho Books’ free plan is ideal for freelancers, sole proprietors, and small businesses earning under $50,000 per year. It’s best suited for those who need reliable free accounting software for small business tasks like invoicing, expense tracking, and basic reporting—without the need for payroll, advanced automation, or multi-user access.

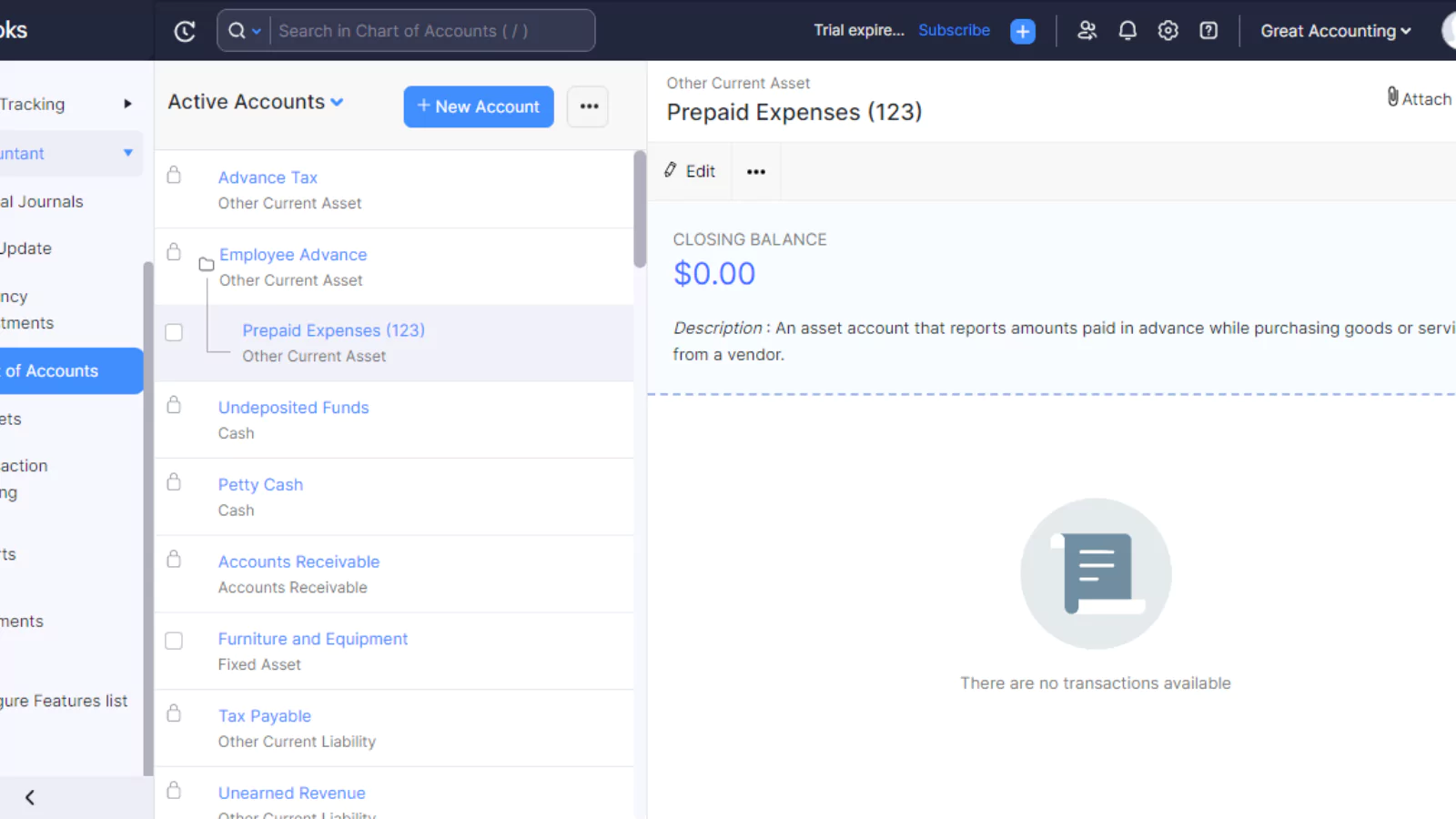

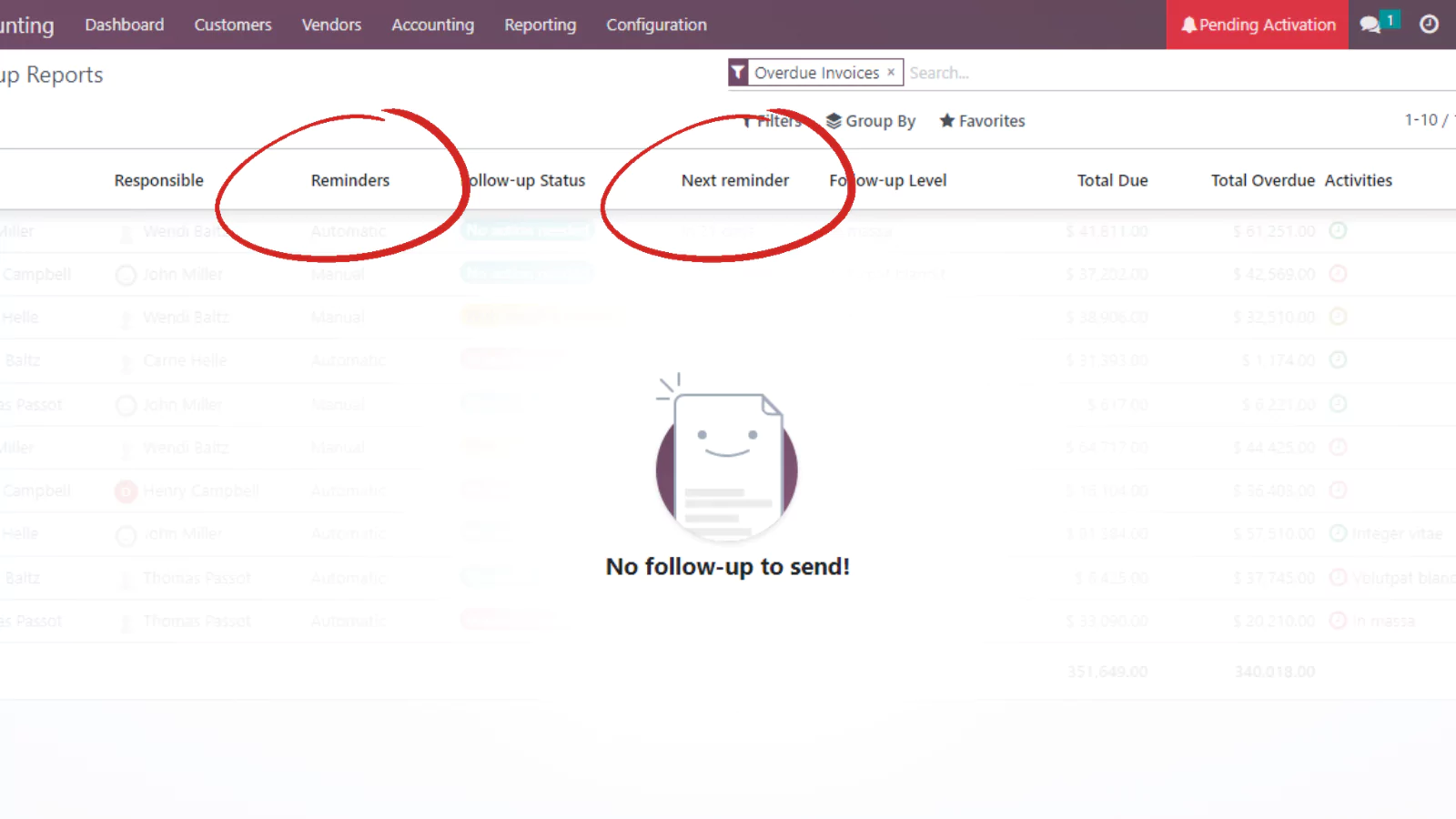

Odoo Accounting: Best for open-source accounting

Odoo Accounting is a flexible, open-source free small business accounting software solution that’s ideal for teams who want control and customization. Its self-hosted version is forever free and includes core features like invoicing, bank reconciliation, and financial reporting. While the cloud version comes with a free trial, Odoo shines for businesses that want an accounting app they can fully tailor to their operations.

Key features

- Invoicing with customizable templates and recurring billing

- Bank reconciliation and real-time cash flow tracking

- Double-entry bookkeeping system with full audit trail

- Financial reports including Profit & Loss, Balance Sheet, and aged receivables

- Multi-currency support for international transactions

- Integrates with Odoo’s CRM, inventory, and sales modules

- Mobile access via the Odoo accounting app

Free plan details

Odoo Accounting offers a flexible free plan through its “One App Free” option, allowing unlimited users to access the Accounting app without cost. This plan includes essential features such as invoicing, bank reconciliation, and financial reporting, making it suitable for small businesses seeking a customizable accounting solution. For those interested in exploring additional functionalities, Odoo provides a 15-day free trial of its full suite, granting access to all apps and features. This trial period enables businesses to assess the platform’s capabilities before committing to a paid plan.

Free trial available?

Yes, Odoo offers a 15-day free trial for its cloud-based platform, providing full access to all features across its suite of business applications, including accounting, CRM, inventory, and more. This trial allows businesses to explore the platform’s capabilities without any financial commitment. Additionally, some Odoo partners may offer extended trial periods, such as 30 days, to give users more time to evaluate the software’s suitability for their needs. After the trial period, users can choose to subscribe to a paid plan or continue with the free “One App” plan, which grants unlimited user access to a single application.

Pros and cons

Pros

- Forever-free plan available through Odoo’s “One App” model

- Highly customizable and open-source—great for tech-savvy users

- Includes core features like invoicing, expense tracking, and financial reports

- Scales easily with optional integration into other Odoo apps (CRM, inventory, etc.)

- Unlimited users on the free plan

Cons

- Steeper learning curve than most easy accounting software free tools

- Setup and customization may require developer support

- No built-in payroll tools on the free plan

- Cloud version only free for 15 days unless limited to one app

Who it’s for

Odoo Accounting is best for small businesses, startups, and freelance teams that want flexible, free small business accounting software they can customize. It’s ideal for users with some technical know-how who want to build out their own system, connect it with other Odoo apps, and scale without being locked into a rigid platform.

1-800Accountant: Best for expert support

1-800Accountant blends free trial accounting software with real human expertise. It’s not just an app—it’s a virtual accounting firm designed for freelancers, startups, and small businesses that want professional help managing their books. During the free trial, you get access to essential tools for invoicing, expense tracking, and financial reporting, plus support from a dedicated accountant to guide you through setup and compliance.

Key features

- Access to a dedicated accountant for personalized, expert support

- ClientBooks software for managing bookkeeping and syncing with tools like QuickBooks and FreshBooks

- Full-service tax prep, planning, and audit defense

- Optional payroll services with automatic calculations and compliance tracking

- Transparent flat-rate pricing with no hourly billing

- Secure client portal for file storage, communication, and reminders

- Financial planning and quarterly business health reviews

Free plan details

1-800Accountant doesn’t offer a forever-free accounting software plan, but they do give you a few solid ways to try things out for free. You get a 30-day free trial of their ClientBooks software to test invoicing, expense tracking, and basic reporting. They also throw in a free consultation with a real accountant, which is helpful if you’re just getting started and want expert advice without the pressure. For new businesses, there’s even a free LLC formation service—you just pay the state filing fees.

Free trial available?

Yes, 1-800Accountant offers a free 30-day trial of its proprietary bookkeeping software, ClientBooks. This trial allows small businesses to explore features like invoicing, expense tracking, and financial reporting, helping them organize their finances effectively. Additionally, 1-800Accountant offers a free initial consultation with a tax expert, providing personalized advice on deductions, compliance, and tax-saving strategies. This consultation is valued at $199 and requires no payment information to schedule. For startups, there’s also a free LLC formation service, which includes assistance with articles of organization and EIN filing, though state fees may apply.

Pros and cons

Pros

- 30-day free trial accounting software access with ClientBooks

- Includes a free consultation with a real accountant

- Offers business formation support and tax guidance

- Flat-rate pricing—no surprise hourly fees

- Integrates with top tools like QuickBooks and FreshBooks

Cons

- No forever-free accounting software plan for ongoing use

- Paid plans are more expensive than most DIY software options

- ClientBooks lacks some automation and features found in top accounting apps

- Best suited for U.S.-based businesses only

Who it’s for

1-800Accountant is best for small business owners, freelancers, or startup founders who want hands-on support from real accountants alongside their bookkeeping software. It’s a good fit if you’re looking for expert guidance, tax help, or LLC formation—not just an app to manage expenses.

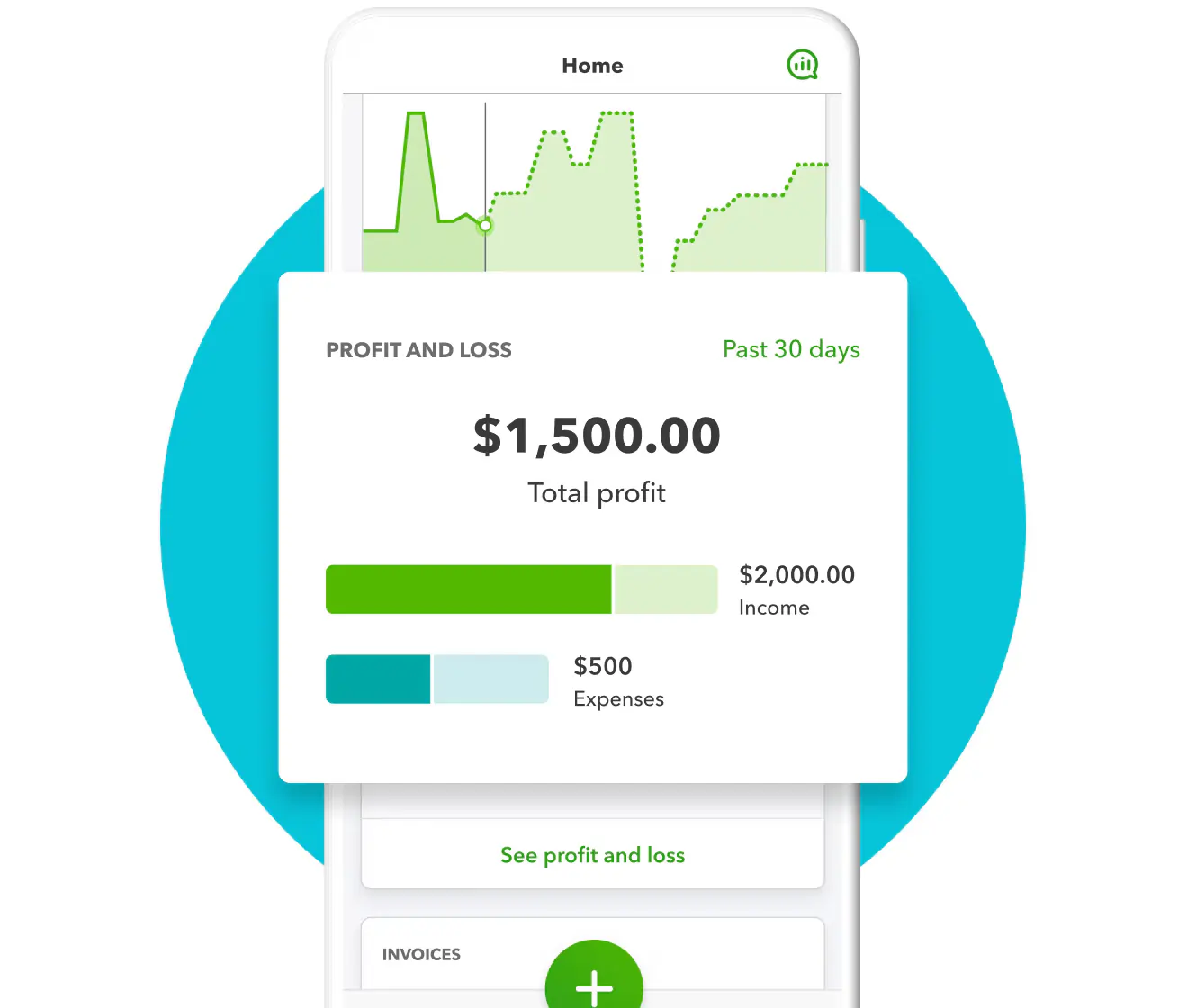

QuickBooks Online: Best for freelancers and startups

QuickBooks Online is a leading free small business accounting software solution that offers a comprehensive 30-day free trial. Designed for small businesses, freelancers, and startups, it provides essential tools like expense tracking, invoicing, and financial reporting. With its user-friendly interface and robust features, QuickBooks Online simplifies the payroll and payment scheduling processes, making it an ideal choice for those seeking easy accounting software free of commitment.

Key features

- Invoicing with templates, automation, and payment tracking

- Expense tracking with receipt capture and categorization

- Bank transaction syncing and reconciliation

- Financial reports including profit & loss, cash flow, and balance sheet

- Payroll add-on with automatic tax filing and payment scheduling

- Time tracking and mileage tracking for freelancers

- Integrations with hundreds of third-party apps (Stripe, Shopify, Gusto, etc.)

Free plan details

QuickBooks doesn’t offer a forever-free version of its software. After the 30-day free trial, you’ll need to sign up for a paid plan to keep using it. The platform is packed with features, but it’s definitely built as a premium product—so if you’re looking for something long-term without any cost, this might not be the right fit.

Free trial available?

Yes, QuickBooks gives you a full 30-day free trial. You can test everything like invoicing, expense tracking, bank syncing, and financial reports, just as you would on a paid plan. It’s a great way to see how it works with your business before you spend anything.

Pros and cons

Pros

- Full-featured platform with strong invoicing, expense tracking, and reporting

- Seamless bank transaction syncing and reconciliation

- Tons of integrations with third-party apps like Stripe, Gusto, and Shopify

- Intuitive, easy-to-use interface ideal for small business owners

- Scales well with plans that support growing teams and add payroll

Cons

- No forever-free plan, subscription required after trial

- Add-ons like payroll and time tracking cost extra

- Can get pricey for small teams on a tight budget

- Some advanced features only available on higher-tier plans

Who it’s for

QuickBooks Online is best for small businesses, startups, and freelancers who want a full-featured, all-in-one accounting solution. It’s a great fit if you need easy tools for invoicing, expense tracking, and financial reporting, and don’t mind paying after the trial for a polished, well-supported platform that can grow with your business.

FreshBooks: Best for invoicing and expense tracking

FreshBooks is a cloud-based accounting app built for freelancers, solo entrepreneurs, and service-based small businesses. While it doesn’t offer a forever-free plan, you can try it free for 30 days and get access to tools like invoicing, expense tracking, time tracking, and client management. Its clean interface and built-in automations make it one of the most easy accounting software free trial options out there, especially for businesses that care about getting paid faster.

Key features

- Customizable invoicing with automatic reminders and late fees

- Expense tracking with receipt uploads and real-time categorization

- Time tracking built-in for billing by the hour

- Financial reports including profit & loss, tax summaries, and balance sheets

- Client portal for online payments and communication

- Mobile access through the FreshBooks accounting app

- Project management tools for tracking billable work and team collaboration

Free plan details

FreshBooks does not offer a forever-free plan. Instead, they provide a 30-day free trial that grants full access to all features of the selected plan, such as invoicing, expense tracking, time tracking, and financial reporting. No credit card is required to start the trial, and you can cancel anytime. After the trial period, you can choose from one of their paid plans to continue using the service.

Free trial available?

Yes, FreshBooks offers a 30-day free trial that provides full access to all features of the selected plan, including invoicing, expense tracking, time tracking, and financial reporting. No credit card is required to start the trial, and you can cancel anytime. After the trial period, you can choose from one of their paid plans to continue using the service.

Pros and cons

Pros

- Clean, intuitive interface that’s easy to learn

- Excellent invoicing and time tracking features

- Includes project and client management tools

- Mobile-friendly with a well-rated accounting app

- 30-day free trial with full feature access

Cons

- No forever-free plan available

- Can get pricey once trial ends, especially for multiple users

- Limited inventory and reporting features compared to some competitors

- Best suited for service-based businesses, not product-heavy companies

Who it’s for

FreshBooks is best for freelancers, solo entrepreneurs, and service-based small businesses that need great invoicing, time tracking, and client management in one place. It’s ideal for users who want an easy-to-use accounting app to stay organized, get paid faster, and handle the basics without feeling overwhelmed.

Is free accounting software right for your business?

Free accounting software can be a smart option for many small businesses, especially those just getting started, watching costs, or managing finances solo. If you’re not ready to invest in a full accounting suite, a free small business accounting software option can give you the essentials without a monthly subscription.

- Free plans and accounting software free trials often include:

- Invoicing and basic client management

- Expense tracking and bank transaction categorization

- Access to core financial reports like profit & loss

- Mobile or cloud-based access via an accounting app

- Options to upgrade with payroll, tax support, or additional users

These tools are usually enough for freelancers, startups, or small teams managing their own books—and they help build solid financial habits early on.

What you should consider with free accounting software

Just because the software is free doesn’t mean it’s always cost-free in the long run. Here are a few things to keep in mind:

Limited features

Most free accounting software for small business comes with some feature caps. You may only be able to send a set number of invoices or connect to one bank account.

No payroll included

If you need built-in payroll, most free or trial options won’t cut it—you’ll need to upgrade or find a separate payroll provider.

Manual processes

Free tools may lack automation, requiring you to manually input bank transactions, sort expenses, or generate reports.

Support and reliability

Some platforms limit customer support on free plans, or offer email-only assistance. If you’re looking for guidance, especially during tax season, this could be a drawback.

Trial expiration

For tools offering a free trial accounting software experience, you’ll need to decide quickly if it’s worth paying to continue.

Business types that benefit most from free accounting software

A free online accounting system works best when you:

- Are a freelancer or solo entrepreneur just getting started

- Run a small business with minimal revenue or transactions

- Want to test software before committing long-term

- Handle your own books and don’t need advanced features

- Need to send invoices, track expenses, and run simple reports

Here are some business types that often thrive using free bookkeeping software:

- Freelancers, consultants, and creative professionals

- Service providers like coaches, stylists, or tutors

- New startups managing cash flow with limited overhead

- Nonprofits or side hustles looking for easy-to-use tools

- Local businesses with basic invoicing and expense needs

If that sounds like you, starting with a free plan lets you take control of your finances while keeping costs low.

Forever-free vs. free trial accounting software: What’s better?

There’s no one-size-fits-all answer here. It depends on how your business runs, how comfortable you are managing finances, and what kind of support you need.

Forever-free accounting software

A forever-free accounting software plan gives you essential tools without monthly fees. It’s a good fit if you only need the basics and want something long-term without any pressure to upgrade.

What to expect:

- Limited access to advanced reports or features

- Manual data entry and fewer automations

- No built-in payroll or tax filing support

- Fewer integrations with tools like CRMs or e-commerce platforms

- Lower priority for customer support

This type of plan is great for small teams and solo operators who just want a reliable, easy accounting software free of monthly charges.

Free trial accounting software

A free trial accounting software setup gives you full access for a limited time—usually 14 to 30 days. This is your chance to explore everything, from detailed financial reports to expense tracking, payment scheduling, and payroll add-ons.

What to expect:

- Full feature access without payment

- Seamless invoicing, reporting, and bank transaction syncing

- Expiration after the trial—payment required to continue

- Better insight into what paid features are worth it

- Ideal for comparing multiple providers before committing

This is best for businesses that plan to grow or need a deeper look at what an advanced platform can offer before buying in.

The bottom line

Free accounting software can be a powerful way for small businesses to handle invoicing, organize expenses, and keep tabs on cash flow without paying for tools they don’t need (yet). Just know what you’re signing up for.

Some plans are truly free forever, but come with limitations. Others give you a 30-day head start before charging a subscription. Either way, the right tool should help you track revenue, simplify your financial processes, and make better business decisions.

Be sure to compare features, read every accounting software review you can find, and choose a platform that works for your budget, your goals, and your workflow.

FAQ

Q: What is the best free accounting software for small businesses?

A: It depends on your needs. Zoho Books and Odoo offer solid forever-free plans, while QuickBooks and FreshBooks provide powerful tools during their free trials. Look for features like invoicing, expense tracking, and financial reporting to get the most value.

Q: Is there any easy accounting software free to use long term?

A: Yes, Zoho Books and Odoo offer long-term free plans with essential tools for small businesses and freelancers. However, most platforms limit features like payroll, integrations, or automation in their free versions.

Q: What features does free small business accounting software usually include?

A: Most free plans include invoicing, expense tracking, basic reports, and sometimes bank transaction imports. Advanced features like payroll, time tracking, or multi-user access typically require a paid upgrade.

Q: Can I run payroll with free accounting software?

A: Not usually. Most free plans don’t include payroll tools. You’ll need to upgrade or use a separate payroll service to handle employee payments, taxes, and filings.

Q: What happens when a free trial accounting software ends?

A: Once the trial ends, you’ll need to choose a paid plan to keep using the software. Some providers lock you out, while others let you view data but disable key features like invoicing or bank syncing.

Q: Is free bookkeeping software secure to use?

A: Yes, as long as you use a reputable provider. Look for accounting apps that offer data encryption, regular updates, and clear privacy policies to keep your financial information safe.