Gusto Payroll Services Review for 2025

Gusto Payroll Services Plans & Pricing

Gusto Comparison

Expert Review

Pros

Cons

Gusto Payroll Services's Offerings

How much is gusto payroll? Gusto Payroll Software offers a range of plans and pricing tailored to meet the needs of businesses of all sizes. Whether you’re a small business looking for basic payroll features or a growing company requiring advanced HR tools, Gusto payroll provides flexible options to streamline payroll, benefits, and workforce management.

Plans and Pricing Breakdown

Simple Plan

The Simple Plan is designed for small businesses needing basic payroll functionality. It is priced at $49/month plus $6 per person and includes essential features like:

- Full-service single-state payroll, including W-2s and 1099s.

- Basic hiring and onboarding tools.

- Employee profiles and self-service.

- Gusto-brokered health insurance administration.

- Payroll and time-off reporting.

- Basic PTO policies and holiday pay.

- Integrations with accounting, time tracking, and expense management tools.

Add-Ons for Simple Plan:

- Time & Attendance Plus: $6/month per person.

- Next-Day Direct Deposit: $15/month + $3/month per person.

Plus Plan

The Plus Plan caters to evolving teams requiring advanced payroll and HR tools. It is priced at $60/month (discounted from $80) plus $9 per person. It includes everything in the Simple Plan, along with:

- Multi-state payroll services, including W-2s and 1099s.

- Next-day direct deposit for faster payroll processing.

- Advanced hiring and onboarding tools.

- PTO (paid time off) management and policies.

- Time tracking and project tracking.

- A Time Kiosk for clocking in and out.

- Scheduling tools for workforce planning.

- Expense and reimbursement tracking.

- Workforce costing and custom reporting.

- Team management tools for HR oversight.

Add-On for Plus Plan:

- Priority Support and HR Resources: $8/month + $6/month per person.

Premium Plan

The Premium Plan is designed for scaling businesses that need comprehensive payroll, benefits, and HR solutions with dedicated support. Priced at $135/month (discounted from $180) plus $16.50 per person, it includes everything in the Plus Plan along with:

- A dedicated Customer Success Manager for personalized support.

- Access to an HR resource center with compliance alerts.

- Certified HR experts for tailored guidance.

- Full-service payroll migration and account setup for easy onboarding.

- Health insurance broker integration.

- R&D tax credit discounts for eligible businesses.

- Priority support for faster issue resolution.

- Special pricing options for qualifying companies.

Key Features Across All Plans

- Gusto offers full-service payroll processing, including tax filings and direct deposit.

- Integrated HR tools to manage hiring, onboarding, and employee profiles.

- Benefits management, including health insurance and financial benefits for employees.

- Time tracking and project management tools to improve operational efficiency.

- Customizable add-ons to enhance functionality based on business needs.

Customer Support

Gusto has phone, chat, and messaging support for non-users, and dedicated support for users within the portal. Their business hours are 7:00 AM – 6:00 PM MST Monday – Friday.

There’s also no shortage of support resources available for business owners at all stages. Their online Help Center is divided into topic categories with search options. Under Resources, you can find the Gusto blog, tax calculators, small business guides, and accountant resources.

Gusto also has a dedicated YouTube Channel.

Gusto Feature Focus

Gusto also Launched Gusto Feature Focus, a dynamic new hub where customers and partners can easily access the latest product updates and improvements. I found this really impressive because it means you can check in every month, and always know how to best use the software and leverage the available features for your business.

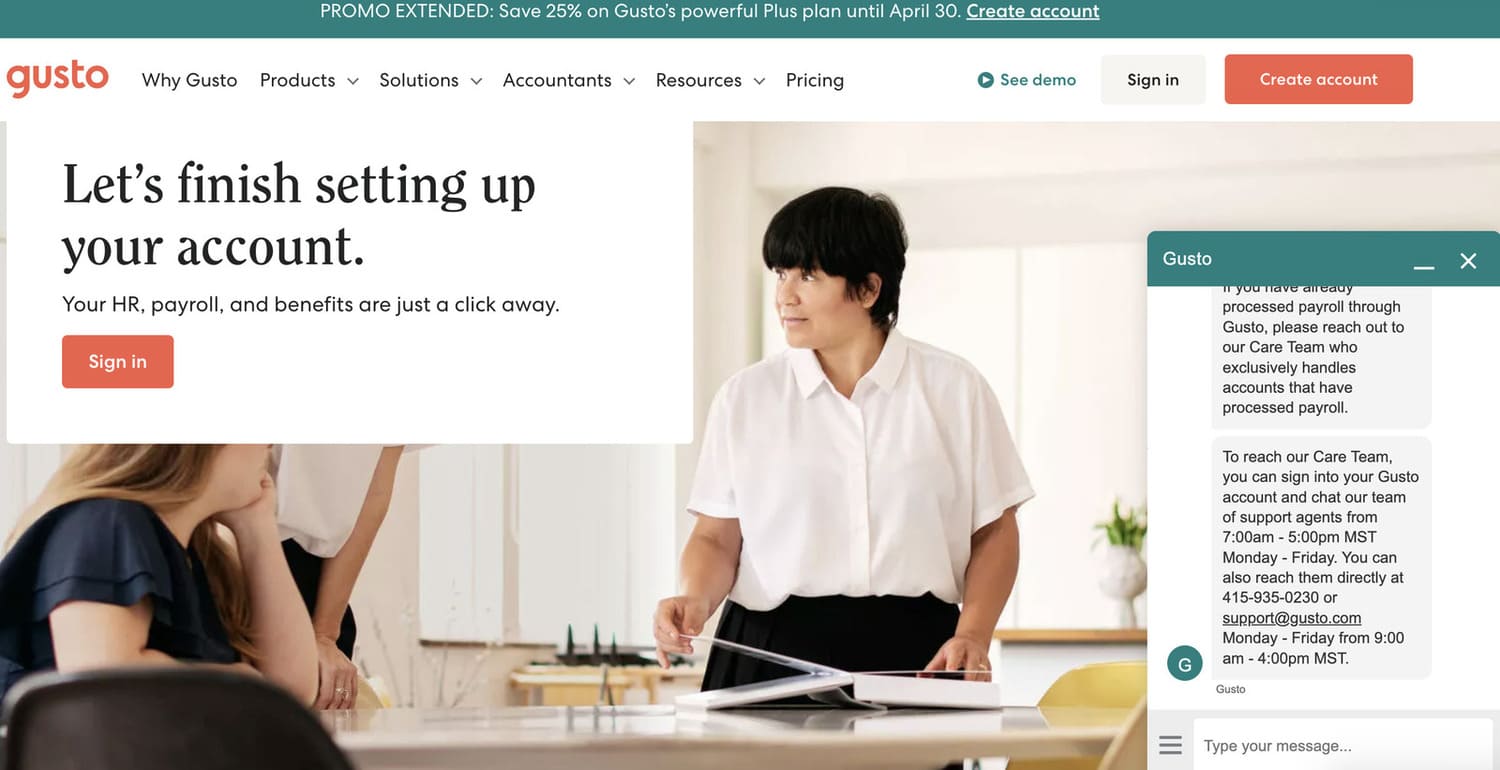

When I explored Gusto’s customer support, I tried out the multiple channels that are available to assist users:

Email Support

For less urgent matters, Gusto provides email support. However, it took me a day to get a response.

Community Forums and Blogs

Gusto maintains a blog and community forums where users can find updates, best practices, and discussions on payroll and HR topics. These platforms offer additional support and insights from both Gusto experts and fellow users.

Online Chatbot

I tried out the live chat feature, which is available during the same hours as phone support.

It is quick to respond and knowledgeable but can only connect with a live agent during business hours.

Contact Submission

The Help Center receives messages via a contact submission form. I sent a short request and received a generic reply within 12 hours. Gusto’s Help Center is a comprehensive resource with articles and guides covering various topics, including payroll processing, benefits, and compliance. When I navigated through the FAQs, I found them detailed and helpful for troubleshooting common issues.

Live Phone Conversation

Although only available during business hours, my phone call was answered on the 3rd ring and the agent was knowledgeable regarding my request for overseas/global payroll processing. There were upsell attempts, but that was to be expected.

Features & Functionality

Payroll Features

When I explored Gusto’s features, I found several tools that enhance payroll and HR management:

- 401k Tracking

- FMLA Tracking

- Generation of pay stubs and reports

- Multi-Country

- Earnings Statements

- Multi-State

- API / Integration Capabilities

- Mobile App For Employees

Payroll Features

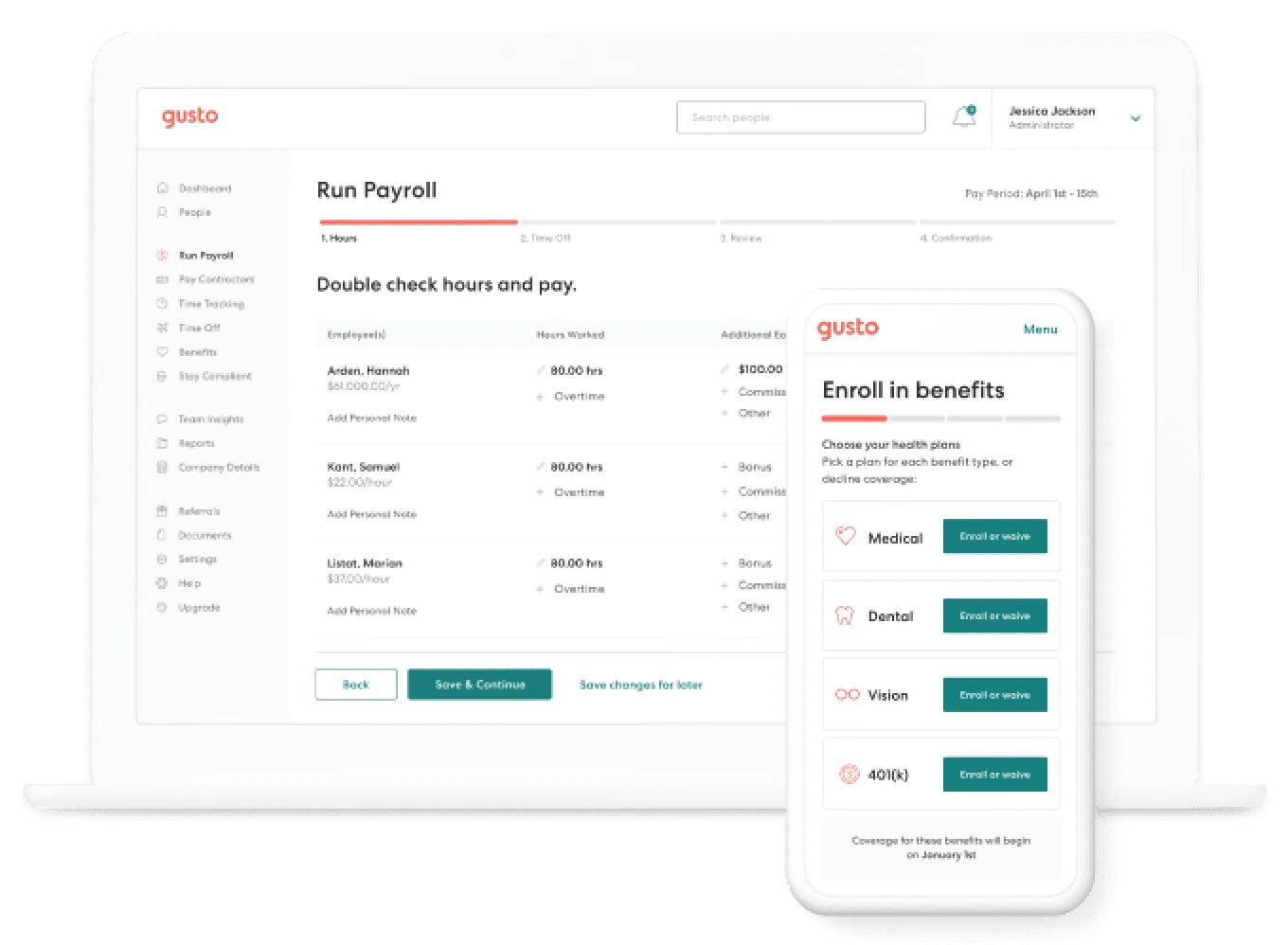

When I tested Gusto’s payroll tools, I found the automation incredibly efficient. Payroll runs automatically, tax filings and payments are handled seamlessly, and employees can access their pay stubs and W-2s through a self-service portal. This simplifies payroll management and reduces manual work, making it a reliable online payment processing service for businesses.

FMLA Tracking

Gusto offers tools to monitor employee leave under the Family and Medical Leave Act (FMLA). This feature helps businesses manage leave balances and maintain compliance with federal regulations.

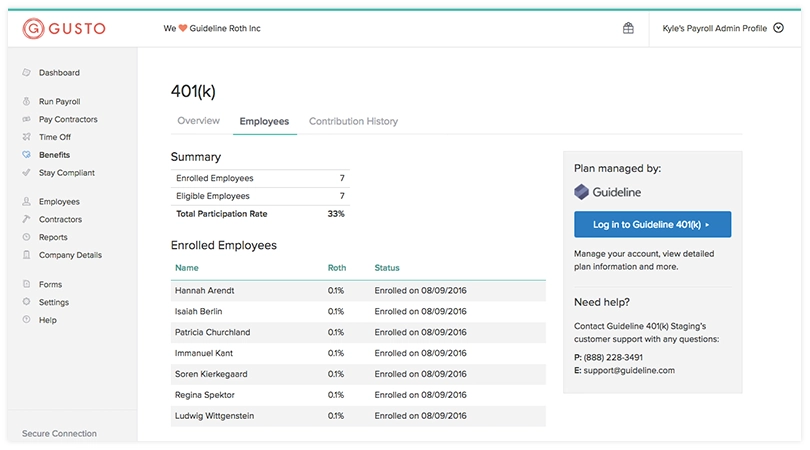

401(k) Tracking

Gusto integrates with various 401(k) providers, allowing automatic deductions and contributions to employee retirement plans. This seamless integration ensures accurate record-keeping and compliance with retirement savings regulations.

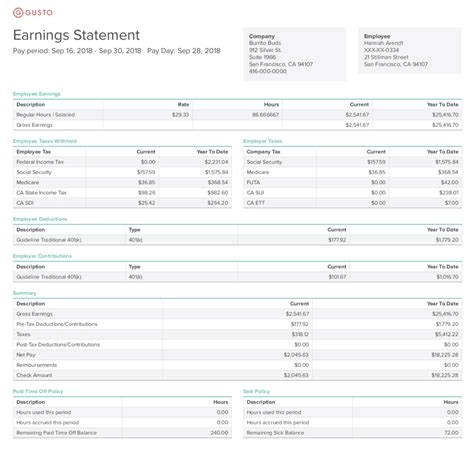

Generation of Pay Stubs and Reports

I found that Gusto automatically generates detailed pay stubs and comprehensive payroll reports. Employees can access their pay information through the self-service portal, reducing administrative tasks for employers.

Multi-State Payroll

Gusto supports payroll processing across multiple states, automatically calculating and filing the necessary state taxes. This is particularly beneficial for businesses with employees in different locations, ensuring compliance with varying state regulations.

Earnings Statements

When I reviewed Gusto’s earnings statements, I found them well-organized and detailed. Employees can easily access digital pay stubs through the self-service portal, which breaks down wages, deductions, and taxes. Employers benefit from automated electronic check processing and clear documentation, ensuring accuracy in online payment processing services while reducing payroll-related inquiries.

API / Integration Capabilities

Gusto offers robust API and integration capabilities, allowing seamless connection with various accounting, time-tracking, and HR software. This integration streamlines data flow and reduces manual entry, enhancing overall efficiency.

Time Tracking

I tested Gusto’s time tracking tools, and they integrate smoothly with payroll. Employees can clock in and out using the mobile app, while overtime calculations are automated. This eliminates manual entry errors and ensures compliance with labor laws. Businesses benefit from real-time tracking that syncs with payroll, making workforce management more efficient.

![]()

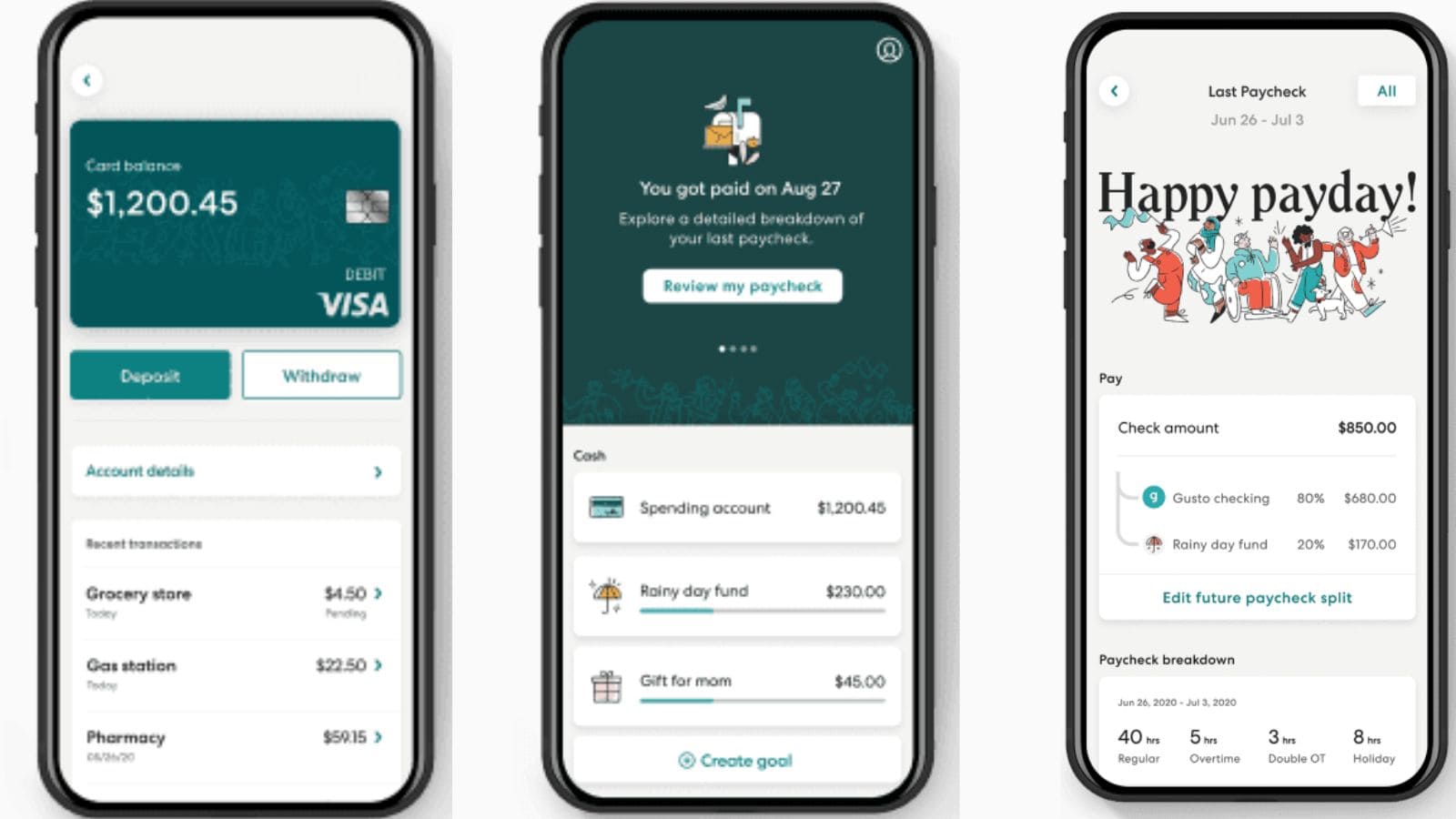

Mobile App & Cash Account

When I used Gusto’s mobile app, I found it convenient for employees to track time, view paychecks, and manage tax documents on the go. The added Cash Account with a Visa Debit Card allows employees to receive direct deposits instantly, making it a great online payment solution for businesses looking to enhance employee financial flexibility.

Automation Features

Automations include automatic payroll calculation, direct deposit, and new hire reporting to state & federal agencies:

- Calculate and pay employee salaries

- Compliance with state and federal tax laws

- Direct Deposit for Employee Paychecks

- Tracking of employee hours and overtime

- Update real-time employee information

Calculate and Pay Employee Salaries

Gusto automates payroll calculations, accounting for various pay structures, including hourly and salaried employees. This ensures accurate and timely payments, reducing manual errors and administrative workload.

Compliance with State and Federal Tax Laws

Gusto automatically calculates, files, and pays all federal, state, and local payroll taxes, ensuring compliance with the latest regulations. This minimizes the risk of penalties and keeps businesses aligned with tax laws.

Direct Deposit for Employee Paychecks

Gusto offers direct deposit, allowing employees to receive their paychecks directly into their bank accounts. This feature enhances convenience for employees and streamlines the payroll process for employers.

Tracking of Employee Hours and Overtime

Gusto integrates with time-tracking tools, enabling accurate recording of employee hours and overtime. This integration ensures precise payroll calculations and compliance with labor laws regarding overtime pay.

Update Real-Time Employee Information

Gusto provides an employee self-service portal where staff can update their personal information in real-time. This feature ensures that records are current and reduces the administrative burden on HR departments.

These features collectively make Gusto a comprehensive solution for businesses seeking efficient payroll and HR management.

HR Features

Some of Gusto’s HR features include an employee database to maintain information, benefits administration that integrates with multiple insurance providers, goal tracking, and new employee onboarding that includes background checks.

Gusto Global

This is Gusto’s newest product. Gusto Global, powered by Remote, enables businesses in the U.S. to hire, onboard, pay, and support their teams across the globe – without cutting compliance corners. It’s an employer of record (EOR) solution designed for SMBs who don’t have the time or resources to manage multiple systems and manual processes, navigate legal and regulatory implications, or stand up a local entity to hire international employees. Gusto Global streamlines hiring, onboarding, payment, and management of international and U.S. workers in a single system

Benefits Management

When I explored Gusto’s benefits management, I found it seamlessly integrates health, dental, vision, and 401(k) plans into payroll. The platform simplifies enrollment, deductions, and compliance, ensuring employees get the coverage they need. Businesses benefit from automated contributions and streamlined online payment solutions, making benefits administration hassle-free and efficient.

Features of Gusto Global

-

Access to talent in more countries – Businesses get easy access to talent around the world without having to open, pay for, or maintain a local entity in that country.

- Built-in compliance management – Through a partnership with Remote, Gusto can ensure compliance with local laws throughout the entire employment lifecycle, from onboarding to offboarding, reducing businesses’ risk and saving them time and money.

- Industry-leading infrastructure – Businesses get access to the most comprehensive global infrastructure in the industry, plus deep expertise on country-specific laws and norms. With a 100% owned entity model, businesses can trust their teams around the globe will get the localized support and expertise they need to thrive.

-

Global payroll – Businesses can easily pay international teams on time, in their local currency, within the same platform they use to pay their US teams.

- Expense Management – Businesses can easily manage expenses for international employees. Employees can submit expenses for admins to review, approve, and report on. Expenses even automatically sync with payroll.

- Time off requests – Businesses can streamline time off request management. Admins can set annual balances for PTO and review time off requests, which automatically sync with payroll.

- Bonuses – Businesses can keep international employees rewarded and motivated with bonuses. Admins can grant commissions, signing bonuses, and recurring reimbursements.

- Integrated reporting – Employers can view international employees in reports or access an in-app view on Gusto of all of their employees.

- Fair pricing and fee transparency – No hidden fees or surprises: businesses will always know how much they’re paying (and when) with our flat, transparent pricing.

-

Trusted partners – Businesses can take advantage of in-house HR, legal, tax, and benefits experts around the world, who become an extension of their teams.

Tax Features

Gusto’s tax software automatically generates W-2 and 1099 forms for employees, calculates and withholds federal, state, and local taxes based on employee information and pay rate, and helps employers stay compliant with payroll tax laws and regulations by providing timely reminders and alerts.

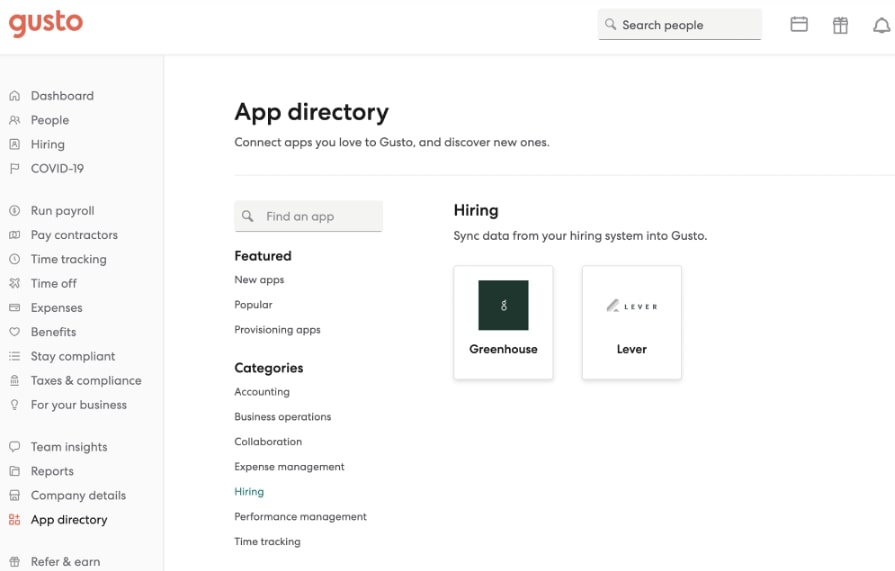

Integrations

Gusto also integrates with almost 200 outside apps and platforms to help run your business. This includes project management tools like Asana, Trello, and more.

Performance:

When I evaluated Gusto’s performance, I focused on its speed, reliability, and feature set to determine its effectiveness as a comprehensive online payment processing service.

Speed

Running payroll with Gusto is efficient. The platform offers next-day direct deposit for Plus and Premium plan users, ensuring employees receive their pay promptly. The automated payroll process minimizes manual input, allowing for quick and accurate pay runs.

Reliability

Gusto is known for its dependable service. The system handles payroll calculations and tax filings with precision, reducing the risk of errors. Its cloud-based infrastructure ensures consistent uptime, so businesses can process payroll without interruptions.

Feature Set

Gusto provides a robust array of features beyond basic payroll processing. These include automated tax filings, benefits administration, time tracking, and compliance support. The platform also offers an employee self-service portal, enabling staff to access pay stubs, tax documents, and personal information, which enhances the overall user experience.

Ease Of Use:

Creating an account was easy and took me less than 5 minutes. I needed my business and tax information handy, and there is a 1-2 business day verification period before being allowed to run the first payroll. I was approved to run payroll within 4 hours of initial setup.

When I navigated Gusto’s platform, I found the dashboard clean and easy to use. Payroll, benefits, and HR features are neatly organized, making it simple to access everything without unnecessary clicks.

Simple Setup Process

Setting up Gusto was straightforward. A step-by-step onboarding wizard guided me through tax details, employee data, and online payment processing services setup. Even for those without payroll experience, the process is seamless and ensures compliance with tax regulations.

Efficient and Time-Saving

With Gusto, payroll takes just a few clicks. Its automation features streamline electronic check processing and payroll taxes, making it one of the most efficient online payment platforms for businesses.

Employee Self-Service Portal

Employees can log in to access pay stubs, tax forms, and benefits without needing HR assistance. This reduces administrative work and enhances the overall e-commerce payment experience.

In this video, you can see how to create an employee/contractor account and it will walk through the steps for running payroll:

Uniqueness:

Gusto stands out with its seamless integration of payroll, HR, and benefits, automated tax filings, and intuitive self-service tools, making it an all-in-one online payment processing service for businesses.

Verdict:

Gusto is feature-heavy and an excellent cloud-based solution for managing your business’s payroll, taxes, and benefits. It is aimed at businesses of all sizes and stages and has pricing tiers based on the number of employees. While it may be pricier than some other options, Gusto’s automation, benefits management, and compliance support makes it a solid investment for businesses looking to streamline their HR processes.

Click the video to see my closing thoughts on Gusto’s platform:

User Review

- customer service was terrible, needs to be improved.

- Customer support is lacking when I need assistance

- -The features are great for small teams

- -Easy to use

- Extremely easy to use

- Not suitable for large firms & companies

- Simple UI, Customization, and the widest range of integrations in it's league.