Cash Register vs POS System: The Truth Every Small Business Should Know

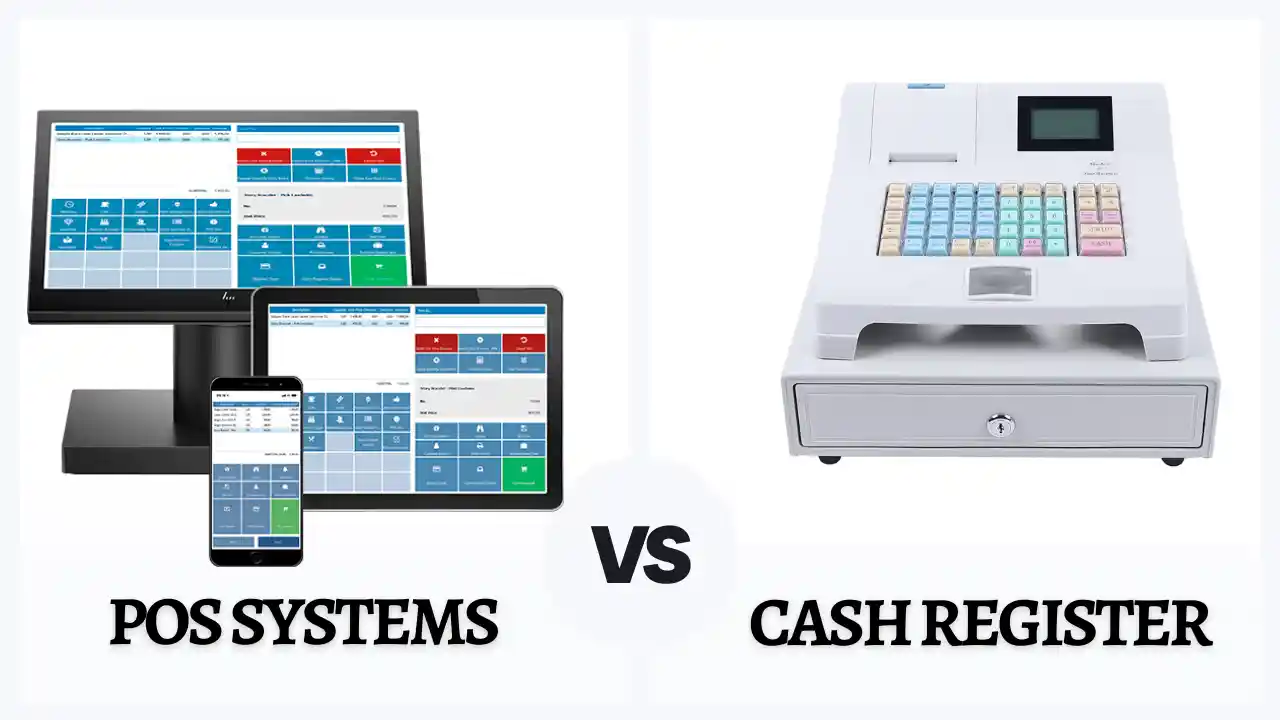

When starting or upgrading a small business, one of the first big decisions you’ll make at the checkout counter is using a traditional cash register or a modern POS (Point of Sale) system. While both are designed to handle sales transactions, they operate very differently – and choosing the right one can have a major impact on how efficiently your business runs.

In this article, we’ll explain the key differences between cash registers and POS systems and help you decide which one is a better fit for your business.

What Is a Cash Register?

A cash register is a mechanical or electronic device that’s used to calculate and record sales, hold cash, and print receipts. A cash register calculates the total sale amount based on the items entered, making it a key part of processing transactions. You’ve probably seen them at local shops, diners, and mom-and-pop stores.

- Traditional cash registers can:

- Add up totals and apply basic taxes

- Open a cash drawer

- Print receipts

- Record daily sales totals

Cash registers are designed for securely storing cash in the cash drawer, helping to prevent theft and ensure accurate reconciliation. They are ideal for handling cash payments and cash transactions in small businesses. Cash registers offer simplicity, durability, and reliability for businesses with basic transaction needs.

The old school cash register is a traditional option, known for its straightforward operation and basic features. In contrast, modern electronic cash registers may include advanced features such as connectivity to payment terminals and integration with point-of-sale systems. Electronic cash registers have evolved from old school models and may include additional features to meet today’s business needs.

Best Point of Sale (POS) System

Advanced inventory management capabilities

Advanced inventory management capabilities  Smarter sales & reporting

Smarter sales & reporting  Start for free

Start for free  Customize your package

Customize your package  Process digital wallets & popular payments

Process digital wallets & popular payments  Personalize marketing to boost loyalty

Personalize marketing to boost loyalty What Is a POS System?

A POS system is a digital setup that does everything a cash register can – and a whole lot more. It typically includes a combination of hardware (like tablets, card readers, and barcode scanners) and software (to manage sales, inventory, customer data, and reporting).

Modern POS systems can:

- Accept multiple types of payments (card, mobile, gift cards, etc.)

- Track inventory in real-time

- Record customer purchase history

- Manage employee hours and sales performance

- Sync with e-commerce platforms

- Generate advanced reports and insights

Many POS systems are cloud-based, allowing you to manage your business from anywhere, support multi location management, and update your system remotely. The best pos systems integrate sales data from various channels and help improve customer satisfaction by reducing wait times, increasing transaction speed, and ensuring accurate order processing. These systems streamline inventory tracking and support growing businesses with multi location management.

Key Differences at a Glance

| Feature | Cash Register | POS System |

| Sales Transactions | Basic | Advanced (multi-channel, faster) |

| Inventory Tracking | Manual | Automatic, real-time |

| Payment Options | Cash, credit | Cash, credit, debit, mobile wallets |

| Customer Data Collection | No | Yes (CRM tools included) |

| Reporting | End-of-day totals | Detailed, real-time reports |

| Integrations | None | E-commerce, accounting, loyalty apps |

| Hardware Cost | Lower upfront | Higher upfront (but scalable) |

| Software Updates | None | Automatic (cloud-based) |

| Remote Access | No | Yes |

| Scalability | Limited | High |

| Barcode Scanner |

Not included | Integrated for fast sales |

| Mobile Payments | Not supported | Supported (contactless, QR, etc.) |

| Credit and Debit Cards | Limited support | Full support |

| Multi Location Management | No | Yes (especially with cloud based pos system) |

| Cloud Based POS System | Not available | Available |

Pros and Cons of Each Option

Cash Register: Pros

- Lower upfront cost

- Easy to use

- Minimal setup required

- Reliable for basic sales

- Ideal for businesses with limited inventory

- A good fit for cash based businesses

Cash Register: Cons

- Limited functionality

- No inventory or customer tracking

- Doesn’t integrate with modern tools

- Difficult to scale with business growth

POS System: Pros

- All-in-one solution for sales, inventory, and reporting

- Automatically records sales data and helps analyze sales trends

- Generates detailed sales reports for better business insights

- Improves operational efficiency and streamlines inventory tracking

- Centralized access to business data for better decision-making

- Accepts more payment types

- Grows with your business

- Offers customer insights and loyalty tracking

- Helps improve customer satisfaction by speeding up transactions and reducing wait times

- Cloud-based access from anywhere

POS System: Cons

- Higher initial investment

- Can be more complex to set up

- Requires internet access for full functionality

- May involve ongoing fees for software subscriptions and support

Implementation and Maintenance: What to Expect

Bringing a new cash register or POS system into your business isn’t just about plugging in a device—it’s about making sure your checkout process runs smoothly from day one. Understanding what’s involved in implementation and ongoing maintenance can help you avoid surprises and keep your business operations on track.

Setting Up a Cash Register: Getting started with a traditional cash register is usually quick and straightforward. Most basic cash registers require minimal assembly—just connect the hardware components, such as the cash drawer and receipt printer, and you’re ready to start processing payments. Training staff is simple, as the functions are limited to ringing up sales, opening the cash drawer, and printing receipts. Ongoing maintenance is minimal, often limited to replacing receipt paper and ensuring the cash drawer operates smoothly.

Implementing a POS System: Setting up a POS system is a more involved process, but it pays off with greater functionality. Installation typically includes assembling hardware like barcode scanners, payment terminals, and receipt printers, as well as configuring the POS software to match your business needs. This might involve setting up inventory management, integrating with accounting software, and customizing sales reporting features. Staff training is essential, as employees will need to learn how to process transactions, manage inventory, and use customer relationship management tools. Most POS providers offer onboarding support and tutorials to streamline this process.

Ongoing Maintenance: Unlike cash registers, POS systems require regular software updates to ensure security and access to the latest features. Many modern POS systems are cloud-based, so updates happen automatically with minimal disruption. Ongoing maintenance may also include troubleshooting hardware issues, managing user accounts, and ensuring data backups. While this means a bit more attention is needed compared to a basic cash register, the result is a more reliable and efficient point of sale system that can adapt as your business grows.

By understanding the implementation and maintenance requirements of both cash registers and POS systems, you can choose the solution that best fits your business’s needs and ensures a smooth transition for your team.

Which One Is Right for Your Business?

The right choice depends on your business’s size, needs, and future plans. For retail stores, it’s important to consider specific requirements such as inventory management, payment options, and customer experience when choosing a register system. The right register system can improve efficiency and enhance the overall customer experience in a retail store.

Selecting a reliable POS provider is also crucial, as they offer ongoing support and ensure smooth integration between your cash register hardware and POS software. This helps retail stores access advanced features and maintain business efficiency.

Choose a cash register if:

- You have a very small or seasonal business

- You primarily accept cash or simple card payments

- You don’t need inventory tracking or detailed reporting

- You want the lowest possible upfront cost

Choose a POS system if:

- You sell across multiple channels (in-store + online)

- You manage inventory or stock

- You want to track customer data and improve loyalty

- You’re growing or plan to scale your business

- You need real-time data to make smarter decisions

Cost Comparison

| Cost Area | Cash Register | POS System |

| Initial Setup | $100 – $500 | $500 – $2,000+ (hardware + setup) |

| Monthly Fees | None | $0 – $200/month (software plans) |

| Maintenance | Minimal | Ongoing (updates, support) |

| Long-term Value | Low (static features) | High (more features, data access) |

While POS systems cost more up front, they often pay for themselves by saving time, reducing errors, and improving your ability to make data-driven decisions.

Final Thoughts

While cash registers are simple and cost-effective for basic transactions, they lack the tools today’s small businesses need to thrive. If your business needs more than just a way to accept payments — such as tracking inventory, generating reports, managing employees, or serving customers across channels – a POS system provides real value.

POS systems offer modern features like real-time data, multi-payment acceptance, and integration with e-commerce and marketing tools. They help you streamline operations and gain insights that drive smarter decisions.

In short, if you’re aiming for growth and efficiency, a POS system isn’t just an upgrade – it’s an essential tool for modern business success.

Related Articles

Cash Register vs. POS System FAQ:

Q1: What’s the difference between a cash register and a POS system?

A cash register processes simple sales and stores money, while a POS system also manages inventory, tracks customer data, and provides real-time reports.

Q2: Which is better for small businesses – a cash register or a POS system?

It depends on your needs. A cash register may be enough if you only need basic transaction handling. But a POS system offers far more value if you want to track sales, inventory, and customers.

Q3: Is it cheaper to use a cash register than a POS system?

Yes, the upfront cost of a cash register is lower. However, a POS system often pays off in the long run by saving time and improving business operations.

Q4: Can a POS system replace a traditional cash register completely?

Yes. A POS system includes all the functionality of a cash register and adds many more tools to help manage and grow your business.

Q5: Do POS systems always need the internet to work?

Most cloud-based POS systems need the internet for full access, but many include offline modes that allow you to continue selling during internet outages.