How To Do Your Own Payroll: A Step-by-Step Guide for Small Businesses

Managing your own payroll might sound like a daunting task, but with the right guidance, it’s absolutely doable and can save you both valuable time and money. Whether you’re running a small business with a handful of employees or just getting started as a solo entrepreneur, learning how to handle payroll is a smart way to take control of your finances and ensure every paycheck is accurate and on time.

Understanding payroll laws is crucial to ensure compliance with various regulations, including taxes and labor laws. A payroll professional can help navigate these laws and maintain organized payroll records to meet legal requirements and prepare for potential audits.

In this guide, we’ll break down the entire payroll process into simple, manageable steps. From calculating wages and taxes to submitting forms, you’ll learn everything you need to confidently manage payroll without relying on expensive third-party services. Plus, we’ll share some free resources and practical tips to help streamline the process, ensuring you adhere to payroll laws and manage payroll accurately with the help of a payroll professional.

Ready to take the first step toward DIY payroll success? Let’s dive in.

Introduction to Payroll

Payroll is a critical component of any business, involving the calculation and payment of employee wages, taxes, and benefits. It’s not just about issuing paychecks; payroll processing encompasses a range of tasks that ensure employees are compensated accurately and on time while complying with various federal, state, and local regulations.

Understanding payroll taxes is essential for accurate calculations and payments. This includes federal income tax, Social Security tax, and Medicare tax, all of which must be withheld from employee wages and paid to the appropriate tax agencies. Additionally, employers must stay compliant with state and local tax requirements, which can vary significantly.

To streamline the payroll process, many businesses turn to payroll software. These solutions can automate calculations, ensure compliance, and reduce the risk of errors. However, it’s crucial to choose the right payroll software that fits your business needs.

For those who find payroll processing too complex or time-consuming, outsourcing payroll to a reputable provider is a viable option. Outsourcing can provide expertise, reduce the risk of errors, and ensure compliance with all regulations, allowing business owners to focus on other critical aspects of their operations.

What is Payroll?

Payroll is more than just issuing paychecks it’s the process of managing and recording employee compensation, including wages, salaries, bonuses, and deductions like taxes and benefits. It also involves staying compliant with local, state, and federal regulations to ensure that both employees and the government are accurately paid. Setting up a payroll bank account is crucial for managing employee payments and maintaining clear financial boundaries.

At its core, payroll ensures your team gets paid for their work while fulfilling your legal obligations as a business owner. It includes tasks like:

- Understanding salary basics, i.e., gross pay and net pay for accurate processing.

- Calculating gross pay based on hours worked or salary.

- Subtracting deductions such as income tax, Social Security, and Medicare.

- Tracking payroll records for tax filing and audits.

For small business owners, handling payroll requires juggling calculations, paperwork, and deadlines. Accurately paying employees is essential to comply with regulations and ensure timely payment, which is crucial for workers. But with a structured approach (and this guide), you can simplify the process and ensure everything runs smoothly.

Setting Up Payroll

Setting up payroll involves several essential steps to ensure smooth and compliant payroll processing. The first step is obtaining an Employer Identification Number (EIN), which is necessary for reporting taxes and other financial documents to the IRS. You can apply for an EIN online through the IRS website.

Next, register with the Electronic Federal Tax Payment System (EFTPS) to handle federal tax payments electronically. This system simplifies the process of making tax payments and helps ensure timely compliance with federal tax obligations.

Another crucial step is gathering employee information. This includes collecting names, addresses, and Social Security numbers, as well as having employees complete necessary forms like the W-4 for federal income tax withholding and the I-9 for employment eligibility verification.

Determining a consistent pay schedule is also essential. Whether you choose a weekly, bi-weekly, semi-monthly, or monthly payroll schedule, it must comply with federal, state, and local regulations. Consistency in the pay schedule helps maintain employee satisfaction and ensures compliance with wage payment laws.

Payroll software can significantly streamline the setup process, ensuring accuracy and compliance. For those who prefer not to handle payroll themselves, outsourcing to a reputable provider can reduce the risk of errors and provide peace of mind.

How to Do Payroll for a Small Business (Step-by-Step Guide)

Handling payroll may seem challenging at first, but by breaking it into clear, actionable steps, the process becomes straightforward and achievable. Here’s how to do your own payroll step-by-step:

Step 1: Get an Employer Identification Number (EIN)

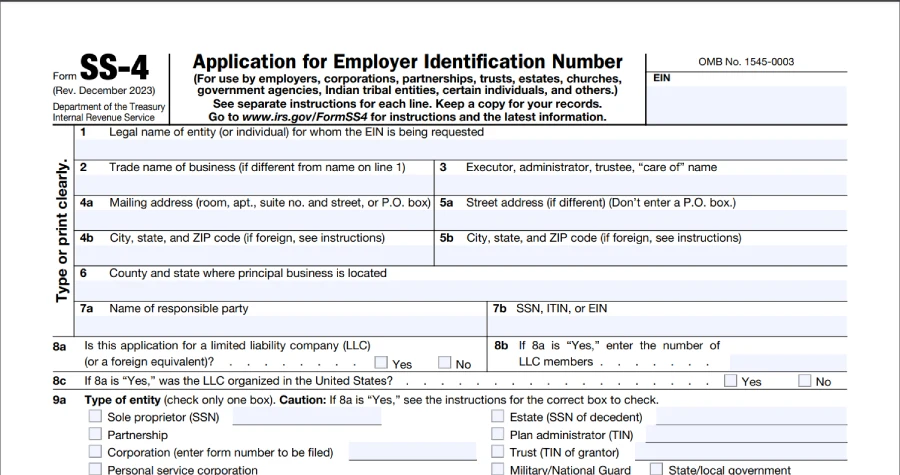

An EIN is required to identify your business with the IRS for tax purposes. The Employer Identification Number (EIN) is a nine-digit number unique to your business, used for reporting taxes and other financial documents. An EIN is also necessary to hire employees and file taxes accurately.

Here’s how to get it:

- Visit the IRS EIN Application page.

- Complete the application online by providing details about your business, including its structure and address.

- Receive your EIN immediately upon submission. Save the confirmation letter for future reference.

Step 2: Register for State and Local Taxes

Most states require employers to register for payroll taxes, including income tax withholding and unemployment insurance. Use the IRS state resource page to find your local tax agency and state requirements. Understanding payroll laws is crucial when registering for state and local taxes to ensure compliance with various regulations.

- For example: In California, you need to register with the Employment Development Department (EDD)

- For New York, register with the Department of Labor

Some cities and counties may require local tax registration — for more information check with your local tax office.

Step 3: Classify Your Workers

Misclassifying workers can lead to penalties, so it’s critical to understand the distinction.

1. Employee vs. Contractor:

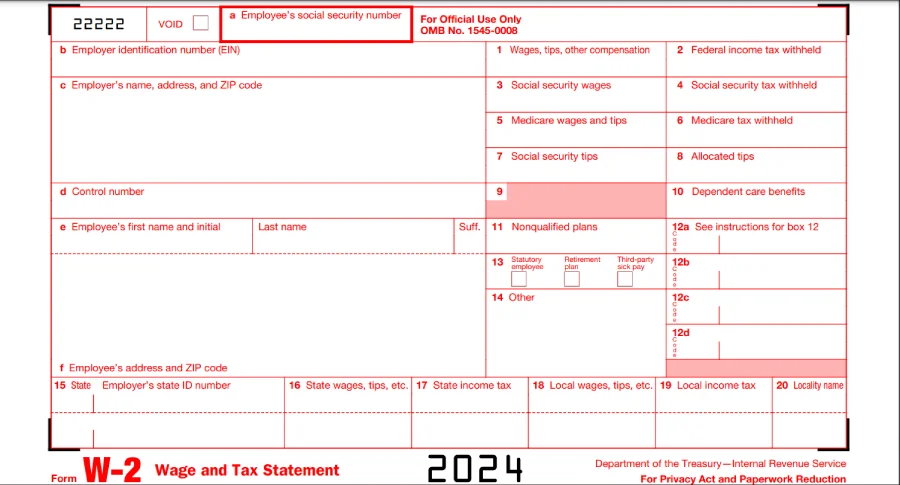

- Employees: Taxes must be withheld; issue Form W-2.

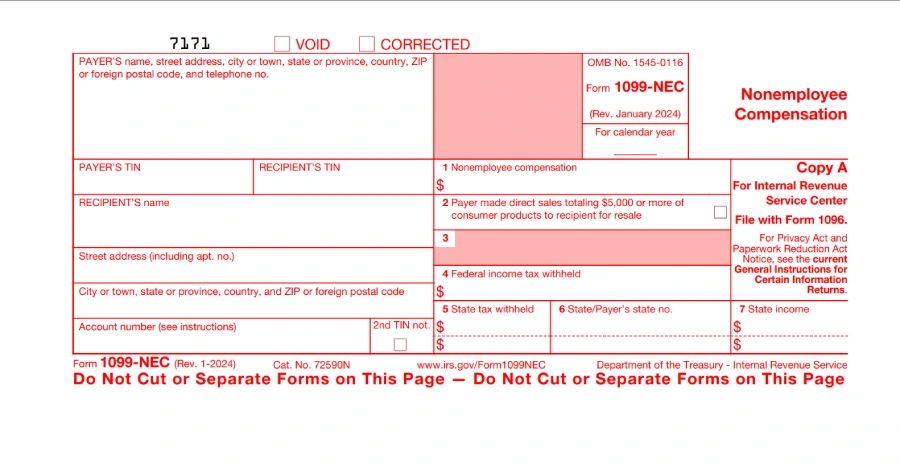

- Contractors: No taxes are withheld; issue Form 1099-NEC.

2. For more information, refer to the IRS Classification Guideline.

Step 4: Collect Employee Information

Before processing payroll, ensure all your employees provide the necessary forms and details.

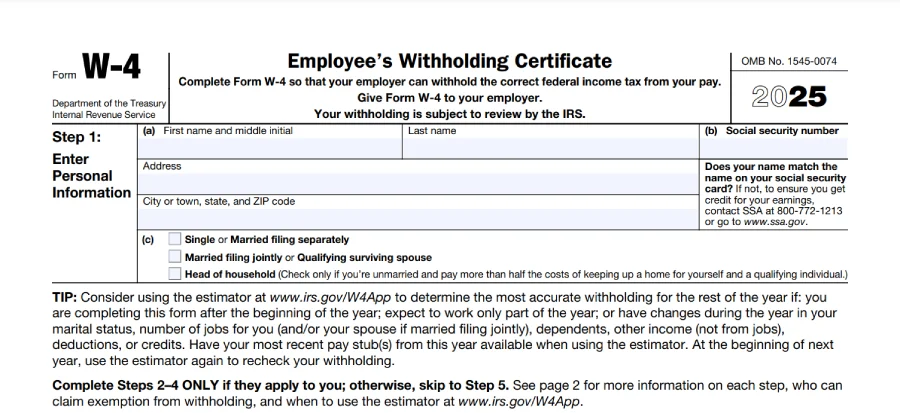

1. Form W-4:

- Employees use Form W-4 to declare federal income tax withholding preferences.

- Example: Employees can choose “married” or “single” and claim additional withholdings if needed.

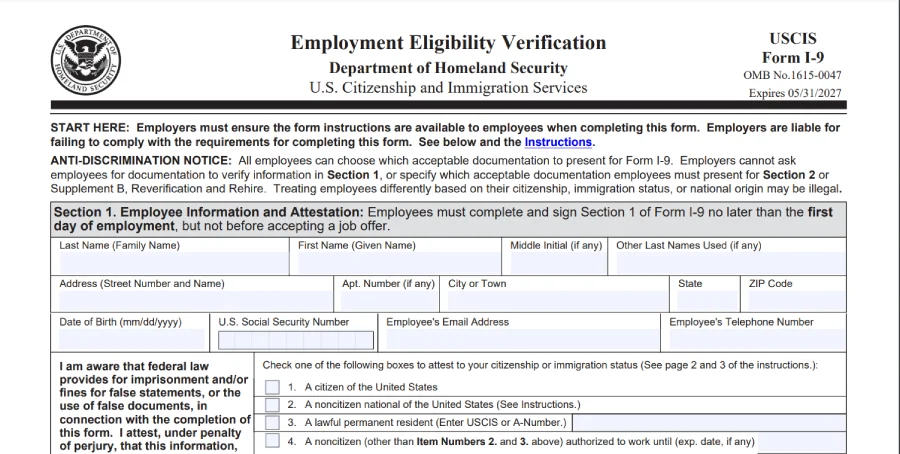

2. Form I-9:

- Form I-9 verifies employment eligibility in the U.S.

- Note: Employers must retain Form I-9 for three years after hire or one year after termination, whichever is later.

3. Direct deposit authorization:

- If paying via direct deposit, use a simple authorization form to collect banking details.

Step 5: Choose a Pay Schedule

Select a pay schedule that works for your business while complying with local & state laws.

1. Options:

- Weekly

- Bi-weekly (every two weeks)

- Semi-monthly (twice a month)

- Monthly

2. Compliance: Check your state’s wage payment laws to ensure your schedule meets requirements.

Step 6: Calculate Gross Pay

Gross pay should be the starting point for payroll calculations. To determine employees’ take-home amounts, it is crucial to calculate net pay by subtracting deductions and withholdings from gross wages.

1. Hourly employees:

- Multiply hours worked by their hourly rate.

- Include overtime (time-and-a-half for hours exceeding 40 per week).

Understanding pre-tax deductions is essential as they can significantly impact employees’ take-home pay and taxable income.

2. Salaried employees:

- Divide their annual salary by the number of pay periods.

Example calculations:

- An hourly worker earning $20/hour for 45 hours: $800 (regular) + $150 (overtime) = $950 gross pay.

- A salaried employee earning $50,000 annually with bi-weekly pay: $50,000 ÷ 26 = $1,923.08 gross pay.

Step 7: Calculate Deductions

Deductions reduce gross pay to net pay. Correctly calculating tax deductions is crucial to ensure compliance with regulations and accurate payroll processing. Here’s what you need to include:

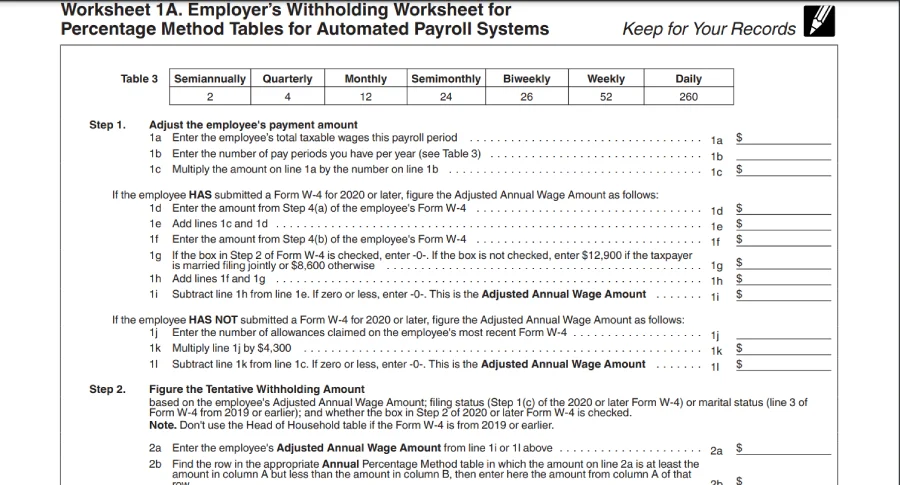

1. Federal income tax:

2. Social Security and Medicare (FICA Taxes):

- Social Security: 6.2% of gross pay (up to $160,200 in wages for 2024).

- Medicare: 1.45% of gross pay.

- Pre-tax deductions can impact the taxable income for state unemployment tax (SUTA) purposes.

3. State and local taxes:

- Vary by state and locality. Refer to your state tax agency for rates.

4. Voluntary deductions:

- Health insurance, retirement contributions (e.g., 401(k)), or other benefits.

- Post-tax deductions are important for understanding how much to deduct from employee paychecks for various benefits contributions.

Step 8: Calculate Employer Contributions

Employers are responsible for matching certain taxes:

1. Social Security and Medicare:

- Match the employee’s contributions (6.2% and 1.45%, respectively).

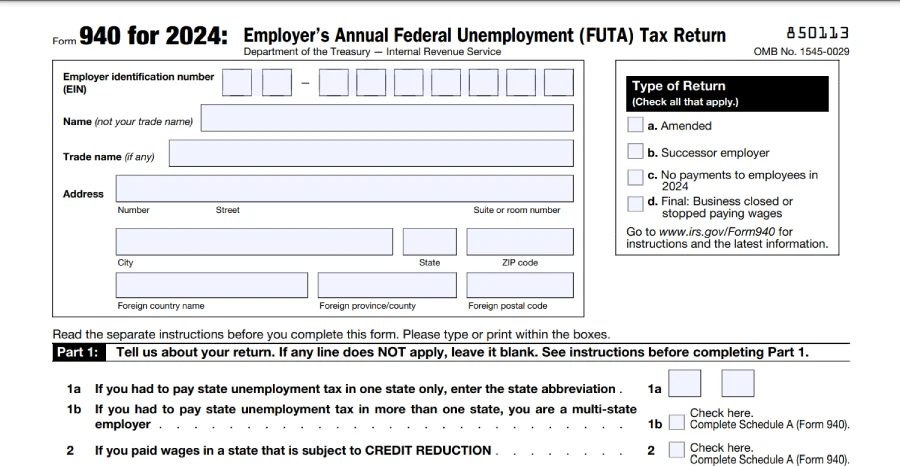

2. Unemployment taxes (FUTA and SUTA):

- FUTA: 6% of the first $7,000 in wages, minus state tax credits. Refer to the IRS guidelines for more details.

Employers can benefit from a tax credit that reduces their FUTA tax rate if they pay their state unemployment insurance on time, thereby emphasizing the financial advantages of timely compliance with tax obligations.

Step 9: File and Pay Taxes

Ensure all taxes are filed and paid on time to avoid penalties. Accurately filing employment taxes is crucial for compliance and avoiding legal issues.

1. Deposit taxes:

- Use the EFTPS system for federal tax payments.

2. Quarterly filings:

- File Form 941 (quarterly federal tax returns)

- Refer to our How to File Form 941 Guide for more details.

- File Form 940 (annual unemployment tax)

- Follow the necessary steps to file taxes, including using specific forms and methods like the Electronic Federal Tax Payment System to report and deposit employment taxes correctly.

Step 10: Distribute Paychecks

Choose a payment method:

- Direct deposit: Set up with your bank or a payroll service.

- Checks: Write physical checks and include detailed pay stubs.

- Digital wallets: Services like PayPal or Venmo can be used in some cases.

Step 11: Maintain Accurate Payroll Records

1. What to keep:

- Gross pay, deductions, and net pay.

- Tax filings and payment confirmations.

- Copies of Forms W-2 and 1099-NEC.

It is crucial to store payroll records securely in compliance with federal and state laws. Proper recordkeeping is essential for tax preparation and audits, maintaining a sound accounting system, and improving overall payroll process efficiency.

2. Retention period: The IRS requires records to be kept for at least four years.

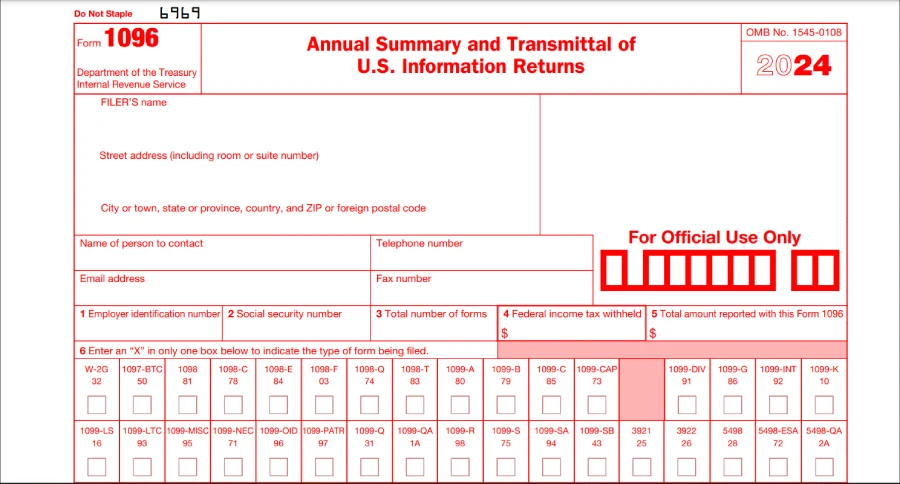

Step 12: Issue Year-End Tax Forms

Issuing year-end tax forms is an essential part of closing out your payroll for the year. Accurately reporting taxes withheld from employee paychecks on these forms is crucial to ensure compliance with federal and local tax regulations. Here’s when each task must be completed to stay compliant:

1. Issue Form W-2 to employees no later than January 31 of the following year.

Deadline for Submission to the Social Security Administration (SSA):

- W-2 forms, along with Form W-3 (a summary of all W-2s), must be submitted to the SSA by January 31 as well.

2. Form 1099-NEC (for contractors)

Deadline for distribution to contractors:

- Provide Form 1099-NEC to independent contractors who earned $600 or more during the year by January 31 of the following year.

Deadline for submission to the IRS:

- File Form 1099-NEC with the IRS by January 31 (can be done electronically or via paper filing).

3. Form 1096 (if filing paper 1099 forms)

Deadline for submission to the IRS:

- If you’re submitting Form 1099-NEC via paper, you must include Form 1096 (a summary of all 1099s) and mail it to the IRS by January 31.

-

Verify tax information before issuing forms

- Cross-check all employee and contractor details (e.g., Social Security Numbers, names, and addresses).

- Ensure all year-end payroll records match the totals reported on W-2s and 1099s.

Who Should Consider DIY Payroll?

DIY payroll can be a smart and straightforward option for many small business owners. If your payroll needs are simple or you’re looking to save money, managing payroll yourself might be the perfect fit. Here’s who could benefit most:

1. Small Businesses

For businesses with a small team or even just one or two employees, payroll is usually pretty easy to manage. With fewer numbers to crunch, handling it yourself can be quick and efficient.

However, utilizing payroll software solutions can further streamline the process, helping small businesses manage payroll efficiently by automating administrative tasks and preventing costly errors.

2. Startups Operating on a Tight Budget

Every penny counts when you’re growing a business. DIY payroll helps you save on costs while ensuring your team gets paid accurately and on time, allowing you to better allocate your valuable funds.

Manual payroll can be a cost-effective solution for startups operating on a tight budget.

3. Owners Who Value Financial Understanding

Taking care of payroll yourself gives you deeper insight into your business’s finances. You’ll better understand cash flow, tax obligations, and how employee compensation impacts your bottom line.

It is crucial to understand the tax obligations for both the employee and employer contributions, as this knowledge helps business owners manage their salary and taxes more effectively compared to regular W-2 employees.

4. Businesses with Straightforward Payroll Needs

If your team members are salaried or there are no complex deductions (like health insurance or retirement plans), DIY payroll is much more manageable.

However, it’s important to consider your time and comfort level with numbers and compliance. If payroll becomes too time-consuming or confusing, exploring alternatives like payroll software like QuickBooks Payroll or professional services might be worth considering. For now, if you’re eager to learn and willing to dedicate time, DIY payroll can be a rewarding choice. Let’s see why it’s worth considering!

Best Practices for Payroll

Implementing best practices for payroll is essential to ensure accurate and timely payment of employee wages, compliance with regulations, and maintenance of detailed payroll records. Here are some key practices to consider:

- Accurate and Timely Payments: Ensure employee wages are correctly calculated and paid on time. This includes accounting for regular hours, overtime, and any bonuses or commissions.

- Compliance with Regulations: Stay up-to-date with federal, state, and local regulations regarding payroll taxes, wage laws, and reporting requirements. This helps avoid costly penalties and ensures legal compliance.

- Detailed Payroll Records: Maintain organized and detailed payroll records, including gross pay, deductions, net pay, and tax filings. Accurate records are essential for audits and year-end tax filings.

- Accurate Deductions and Withholdings: Ensure that payroll deductions and withholdings, such as federal income tax, Social Security, Medicare, and state and local taxes, are accurate and comply with government regulations.

- Regular Audits and Reviews: Conduct regular audits and reviews of payroll processes to identify and correct any errors. This helps maintain accuracy and compliance over time.

Payroll software can help streamline these processes, reducing the risk of errors and ensuring compliance. For added expertise and peace of mind, consider outsourcing payroll to a reputable provider.

Recommended Payroll Software

Paychex: A versatile payroll and HR solution that caters to small and medium-sized businesses, offering features like tax filing, employee benefits integration, and compliance support.

Paycor: A comprehensive platform that streamlines payroll processes with automation, in-depth analytics, and tools to simplify tax filings and employee management.

BambooHR: An intuitive HR and payroll system that combines applicant tracking, employee onboarding, and payroll management for a seamless experience.

Why Do Your Own Payroll?

Managing payroll yourself isn’t just about cutting costs — it’s also an opportunity to streamline processes and gain a deeper understanding of your business operations. Here’s what makes DIY payroll worth considering:

1. It’s easier than you think

Today’s resources — like free tax calculators, payroll templates, and government-provided guides — make payroll easier than ever. With these at your disposal, you can stay on top of deadlines and calculations without feeling overwhelmed.

By taking on payroll yourself, you can save money and build confidence in managing an essential part of your business. Let’s dive into the nuts and bolts of how to do payroll yourself!

2. Cost-Effective Solution

By doing payroll yourself, you can avoid the recurring fees associated with hiring an accountant or subscribing to payroll software. For small businesses, this can make a significant difference in your budget.

3. Hands-On Financial Knowledge

Handling payroll yourself gives you a better grasp of your business’s finances, helping you understand where your money is going and how employee compensation impacts your overall cash flow, allowing you to be a better business owner.

Factors to Consider When Determining How To Do Payroll

- Cost: Compare the costs of payroll software, outsourcing, or hiring an accountant with the time you save. Accuracy and timeliness are crucial when running payroll to avoid potential legal issues and ensure smooth operations.

- Business size: Larger teams may benefit more from automation or outsourcing.

- Complexity: If your payroll involves multiple deductions, benefits, or compliance requirements, external tools or services might be more practical and even save you time and money. It’s essential to avoid costly mistakes in payroll processing by regularly reviewing your processes and seeking expert guidance to mitigate risks and ensure accuracy.

How Can I Do Payroll Myself for Free?

Above, we went over how to do payroll manually, but If you’re asking how can I do payroll myself for free, you’re in the right place. Managing payroll doesn’t always require expensive software or professional services. With a little effort, you can handle payroll for your small business using free tools and resources. Here’s how to do payroll for a small business:

1. Use Government Resources

The federal government provides free tools to help you calculate and file payroll taxes. Accurately completing the W-4 form is crucial as it determines the filing status, which directly affects the amount of taxes withheld from employees’ paychecks.

1. IRS tax tables and withholding calculator

- Use IRS Publication 15-T to calculate federal income tax withholdings

- The IRS Tax Withholding Estimator can help ensure accuracy:

2. Electronic Federal Tax Payment System (EFTPS)

- Pay federal payroll taxes online at no cost:

3. State-specific resources

- Many state tax agencies provide free calculators or guides for state income tax and unemployment insurance. Find your state tax agency here.

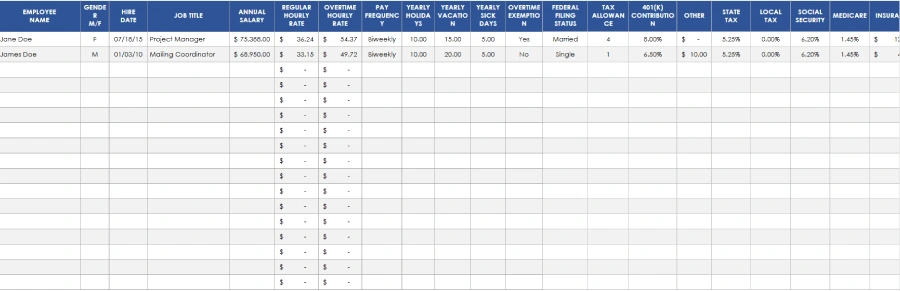

2. Create Your Own Payroll System

If you have basic Excel skills, you can set up a spreadsheet to track and calculate payroll manually. Here’s what to include:

1. Employee information

- Name, Social Security Number (SSN), and pay rate.

2. Columns for payroll calculations

- Hours worked.

- Gross pay calculation (hours × hourly rate or salary ÷ pay periods).

- Deductions for taxes (federal, state, and FICA).

- Voluntary deductions (e.g., health insurance, retirement contributions).

- Net pay (gross pay − total deductions).

3. Template Resources

Even if you aren’t an Excel expert using free templates, you can do payroll with relative ease. Here are some of our favorite free templates:

3. Leverage Free Payroll Calculators

Make use of free online payroll calculators, which can automate many of the calculations. Popular options include:

- Payroll Calculator by ADP – Free, easy-to-use online tool for gross-to-net pay calculations.

- SmartAsset Paycheck Calculator – Includes federal and state tax calculations.

4. File Forms Electronically For Free

- Federal tax forms – Many federal forms, including W-2s and 941 filings, can be submitted electronically for free via the IRS e-file system.

- State tax forms – Check your state tax agency’s website for free filing options.

5. Tap Into Free Educational Resources

If you’re new to payroll, theirs an abundance of online guides and webinars to build your knowledge. Recommended sources include:

Limitations of Free Payroll Tools

While free payroll tools are cost-effective, they may not handle complex needs like managing large teams or multiple deductions. On the other hand, payroll software offers advanced features such as automated tax calculations, compliance updates, and electronic filing, saving time and reducing errors. Payroll expenses can be a significant financial burden for small businesses, making it crucial to manage these costs effectively. As your business grows, these tools scale to support larger teams and streamline operations, keeping you efficient at every stage.

Automating payroll significantly reduces the likelihood of payroll mistakes and saves business time and costs. By utilizing payroll services and online solutions, you can streamline payroll processes, minimize errors, and allow employers to focus on core business activities.

Recommended payroll services:

- Gusto: A user-friendly payroll and HR platform designed for small businesses, offering features like automated tax filing, benefits management, and employee self-service tools.

- Onpay: A straightforward and affordable payroll solution that handles tax calculations, filings, and compliance, with added support for benefits administration and employee management.

- Paychex: A versatile HR and payroll platform for small and medium-sized businesses, providing seamless integration with other HR tools and robust compliance support.

Explore these tools and more to find one that fits your business needs.

Alternatives to DIY Payroll

Handling payroll on your own can save costs, but it often demands time and precision. Alternatives like payroll software, outsourcing, or hiring professional help can simplify tasks, enhance accuracy, and ensure compliance, making them valuable options as your business expands. Using a reliable payroll service provider can further streamline payroll processes, offering robust functionality, seamless integrations, and dedicated support.

- Payroll software – Automates tax calculations, pay stubs, and filings while saving time, reducing errors, and simplifying reporting and compliance processes.

- Outsourcing payroll – Professional providers handle payroll processing, tax filings, and compliance, minimizing administrative workload and ensuring accuracy while freeing up your time to focus on other business priorities.

- Hiring an accountant or bookkeeper – Offers personalized payroll and financial management support, providing expert guidance on complex issues while tailoring solutions to fit your specific business needs.

- Hybrid approach – Combines DIY payroll with external support, using software for routine tasks while outsourcing year-end filings, offering flexibility to balance cost, efficiency, and professional oversight.

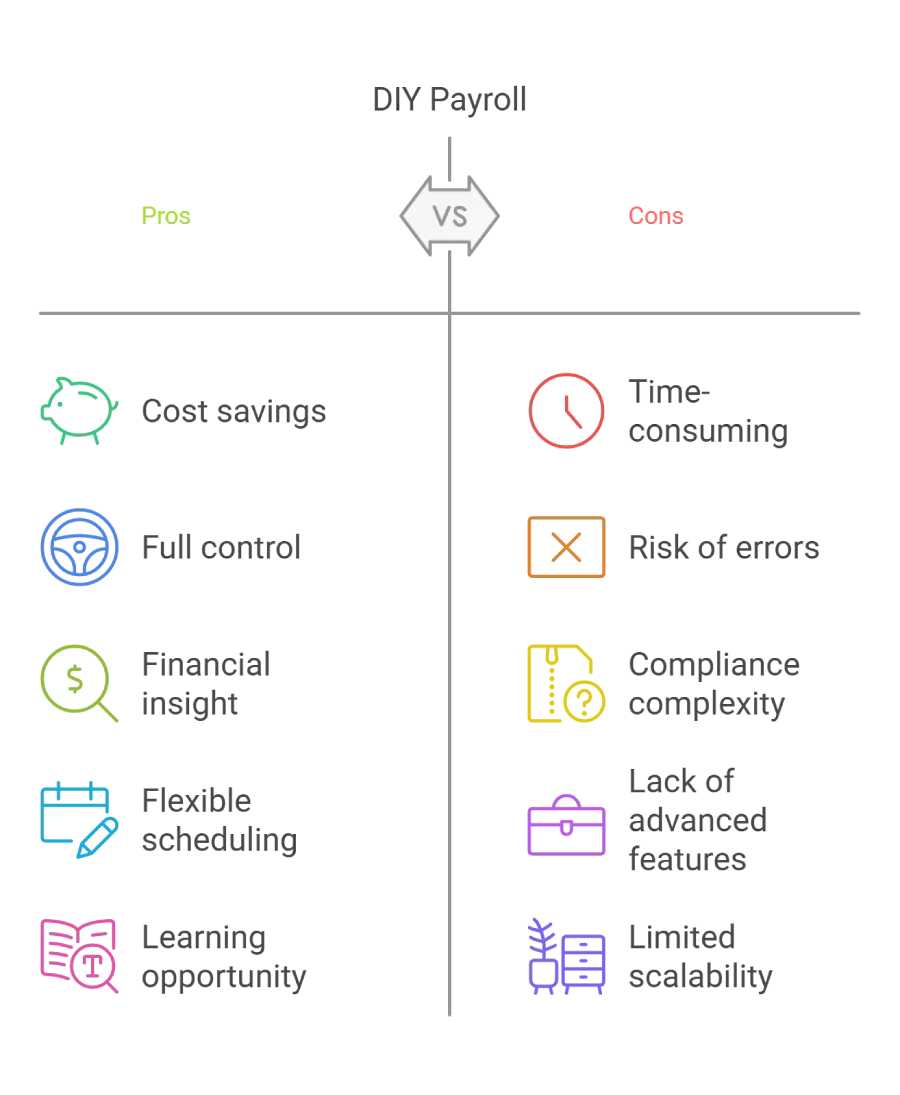

Advantages & Disadvantages of Doing Your Own Payroll

Managing payroll yourself can offer several key benefits, particularly for small business owners who value control and cost savings. Here’s why DIY payroll might be a smart choice:

- Cost savings – Avoid fees for payroll services or accountants, freeing funds for other priorities.

- Full control over payroll – Oversee tax calculations, paycheck issuance, and address issues directly.

- Deeper financial insight – Gain a better understanding of cash flow, wages, and labor costs.

- Flexibility in payroll scheduling – Customize payroll schedules (weekly, bi-weekly, or monthly) to fit your business needs.

- Learning opportunity – Build knowledge of tax laws and compliance for better business decisions.

Managing payroll manually is cost-effective for small businesses with simple needs but demands organization, attention to detail, and compliance. Consider these drawbacks before committing:

- Time-consuming – Managing payroll takes time away from critical business tasks like growth and operations.

- Risk of errors – Mistakes in calculations or tax withholdings can lead to costly penalties and compliance issues.

- Complexity of compliance – Staying updated on changing tax laws and regulations can be challenging and stressful.

- Lack of advanced features – DIY payroll lacks automation for tasks like tax filing, benefits management, and reporting.

- Limited scalability – Managing payroll manually becomes overwhelming as your team grows.

- Administrative burden – Recordkeeping, tax filings, and tracking payments add to your workload.

Successfully managing payroll is an opportunity to gain control over your business’s finances and build confidence in handling essential operations, especially with the right tools and strategies. Whether you manage payroll manually, use free resources, or invest in software, the key is finding a system that works for your business’s size and complexity.

Final Thoughts

Managing payroll effectively is crucial for any business, whether you choose to handle it yourself, use payroll software, or outsource to a professional provider. Each approach has its benefits, and the right choice depends on your business’s size, complexity, and specific needs.

DIY payroll can be cost-effective and provide valuable financial insights, but it requires time and attention to detail. Payroll software offers automation and accuracy, making it easier to manage payroll processes. Outsourcing payroll provides expertise and reduces the administrative burden, ensuring compliance and accuracy.

By understanding the payroll process and exploring the available options, you can make an informed decision that best suits your business. Whether you’re a small business owner or managing a growing team, effective payroll management is key to maintaining employee satisfaction and ensuring compliance with regulations.

FAQ

Q. What Are the Basics of Doing Payroll Myself?

A. To manage payroll on your own, you’ll need to:

- Obtain an EIN (Employer Identification Number).

- Collect employee tax forms like W-4 and I-9.

- Calculate gross pay, deductions, and net pay.

- File and pay federal, state, and local taxes.

- Issue year-end tax forms like W-2s and 1099s.

Q. How Much Time Does DIY Payroll Take?

A. The time required depends on your business size and the complexity of payroll. For small businesses with a few employees, payroll might take a few hours per pay period. Using templates or free calculators can significantly reduce the time involved.

Q. What Happens If I Make a Mistake on Payroll?

A. Payroll errors, such as miscalculations or late tax filings, can result in penalties or fines. If you discover an error:

- Correct it immediately by recalculating wages or taxes.

- Submit an amended tax form if needed (e.g., Form 941-X for federal taxes).

- Communicate with affected employees or contractors.

Q. I’m Learning How To Do My Own Payroll, When Are Payroll Taxes Due?

A. The due dates depend on your payroll frequency:

- Federal Tax Deposits: Semi-weekly or monthly, based on your total tax liability.

- Form 941 (Quarterly Tax Return): Due at the end of the month following the quarter (e.g., April 30 for Q1).

- Form 940 (Annual FUTA Tax): Due by January 31.

Q. What Records Do I Need to Keep for Payroll?

A. The IRS requires employers to maintain payroll records for at least four years, including:

- Employee information (e.g., Social Security Numbers, pay rates).

- Gross pay, deductions, and net pay for each pay period.

- Tax deposits and filings (e.g., Forms 941, 940, W-2).