Gross vs. Net Salary and Why It Matters

Understanding the difference between gross pay and net pay is essential for anyone managing their personal finances, and especially for small business owners handling payroll.

These terms, including annual gross income and gross salary vs net salary, frequently appear on pay stubs, employment contracts, and financial documents, but they can be confusing if you’re not used to them.

In this guide, you’ll learn what gross pay is, what net pay is, and why the difference between gross and net pay matters, with clear examples and practical advice.

By the end, you’ll have the tools to better understand your paycheck, your taxable income, and how to plan smarter financially.

What Is Gross Pay?

Gross pay is the total amount of money an employee earns before any taxes, deductions, or withholdings are taken out.

It includes:

- Regular wages or salary

- Overtime pay

- Bonuses

- Commissions

- Tips

- Other compensation (like holiday pay)

Example:

If your salary is $50,000 a year, that’s your gross pay — not what actually lands in your bank account.

For hourly employees, gross pay is usually:

Formula: Hourly rate × Hours worked + Overtime + Bonuses

Definition of Gross Pay

Gross pay, also known as gross salary, is the full amount of money an employee earns during a specific period. For salaried employees, gross pay is typically calculated based on their annual salary divided by the number of pay periods in a year. This includes both the base salary and any additional earnings such as bonuses, commissions, and overtime pay.

For example, if your annual salary is $50,000 and you earn a $5,000 bonus, your gross pay for the year would be $55,000.

The gross salary means more than just the base figure. It represents the total compensation agreed upon between an employer and an employee before any deductions. These deductions can include taxes, health insurance premiums, retirement contributions, and other withholdings.

Why Gross Pay Matters

✅ Payroll Reference: Gross pay is the baseline for calculating taxes and deductions.

✅ Financial Stability: Lenders often assess loan or credit card applications based on gross earnings.

✅ Job Offer Evaluation: Understanding your gross salary helps when comparing offers, negotiating raises, or assessing benefits.

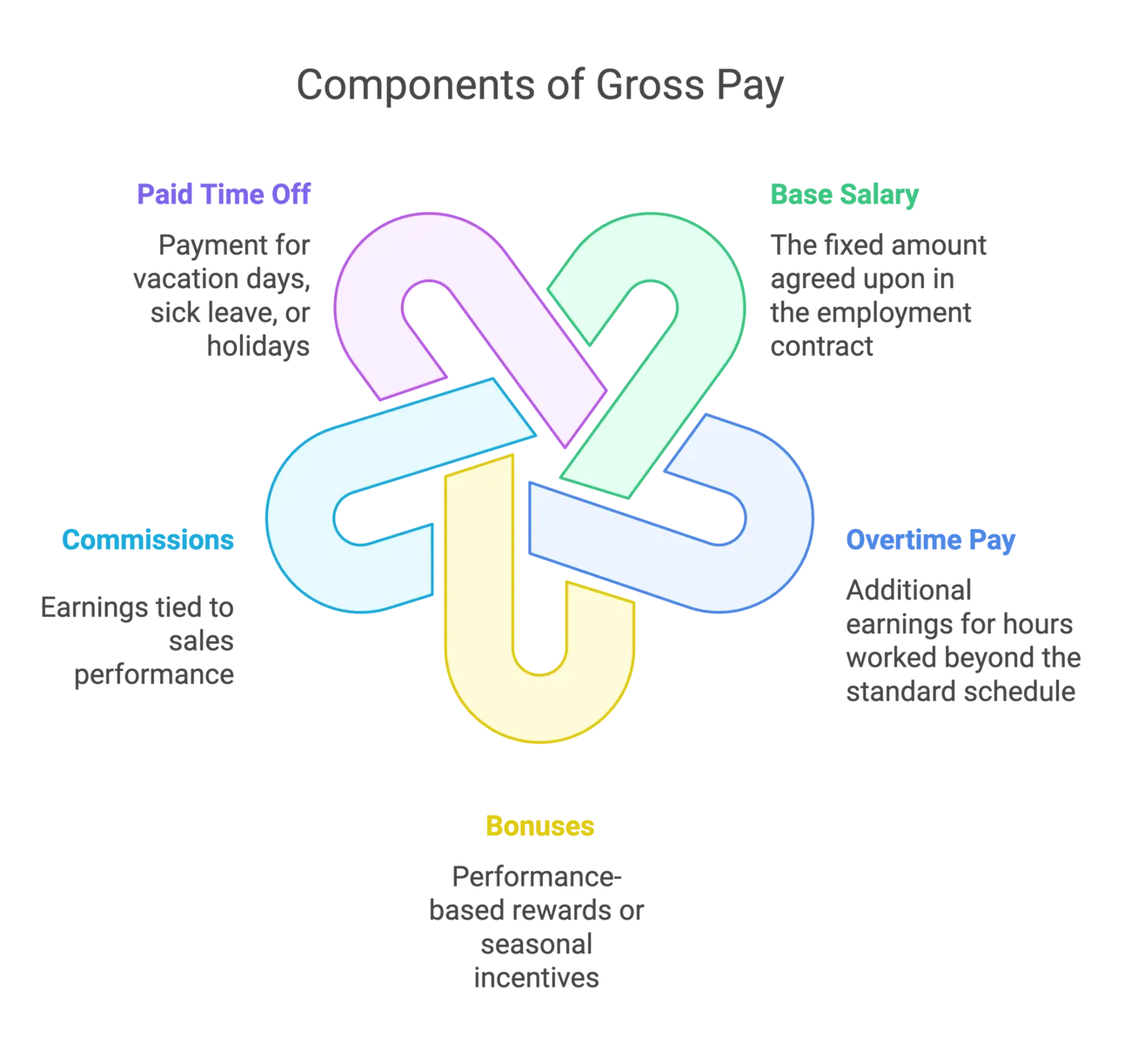

Typical Items Included in Gross Pay

When calculating gross pay for yourself or when preparing payroll for your employees, gross pay will typically include the following components:

- Base salary: The fixed amount agreed upon in your employment contract.

- Overtime pay: Additional earnings for hours worked beyond the standard schedule.

- Bonuses: Performance-based rewards or seasonal incentives.

- Commissions: Earnings tied to sales performance.

- Paid Time Off (PTO): Payment for vacation days, sick leave, or holidays.

💡 Note: Retirement contributions and health insurance premiums are deducted later — they do not reduce gross pay itself.

What Is Net Pay?

Net pay (also known as take-home pay) is the amount an employee actually receives after all deductions are subtracted from gross earnings.

Deductions can include:

- Federal income tax

- State and local taxes

- Social Security and Medicare (FICA taxes)

- Retirement plan contributions (like 401(k))

- Health insurance premiums

- Wage garnishments (if applicable)

Example:

If your gross pay for the month is $4,000, and after taxes, insurance, and retirement contributions, you’re left with $3,000 — that $3,000 is your net pay.

Definition of Net Pay (aka Take-Home Pay)

Net pay is what remains after deductions such as taxes, insurance premiums, and retirement contributions are subtracted from your gross salary. Wage garnishments, which are court-ordered deductions, can also significantly reduce your net pay.

Let’s look at a quick example. If your gross monthly pay is $4,000 and deductions total $1,000, your net pay would be $3,000. You can use this amount for expenses, savings, and investments.

Why Net Pay Is Crucial for Budgeting

✅ Realistic Budgets: Always plan expenses like rent, groceries, and utilities based on net pay, not gross salary.

✅ Tax Planning: Knowing deductions ahead of time helps you manage tax refunds or liabilities.

✅ Financial Goals: Your net income determines how much you can realistically save, invest, or use for debt repayment.

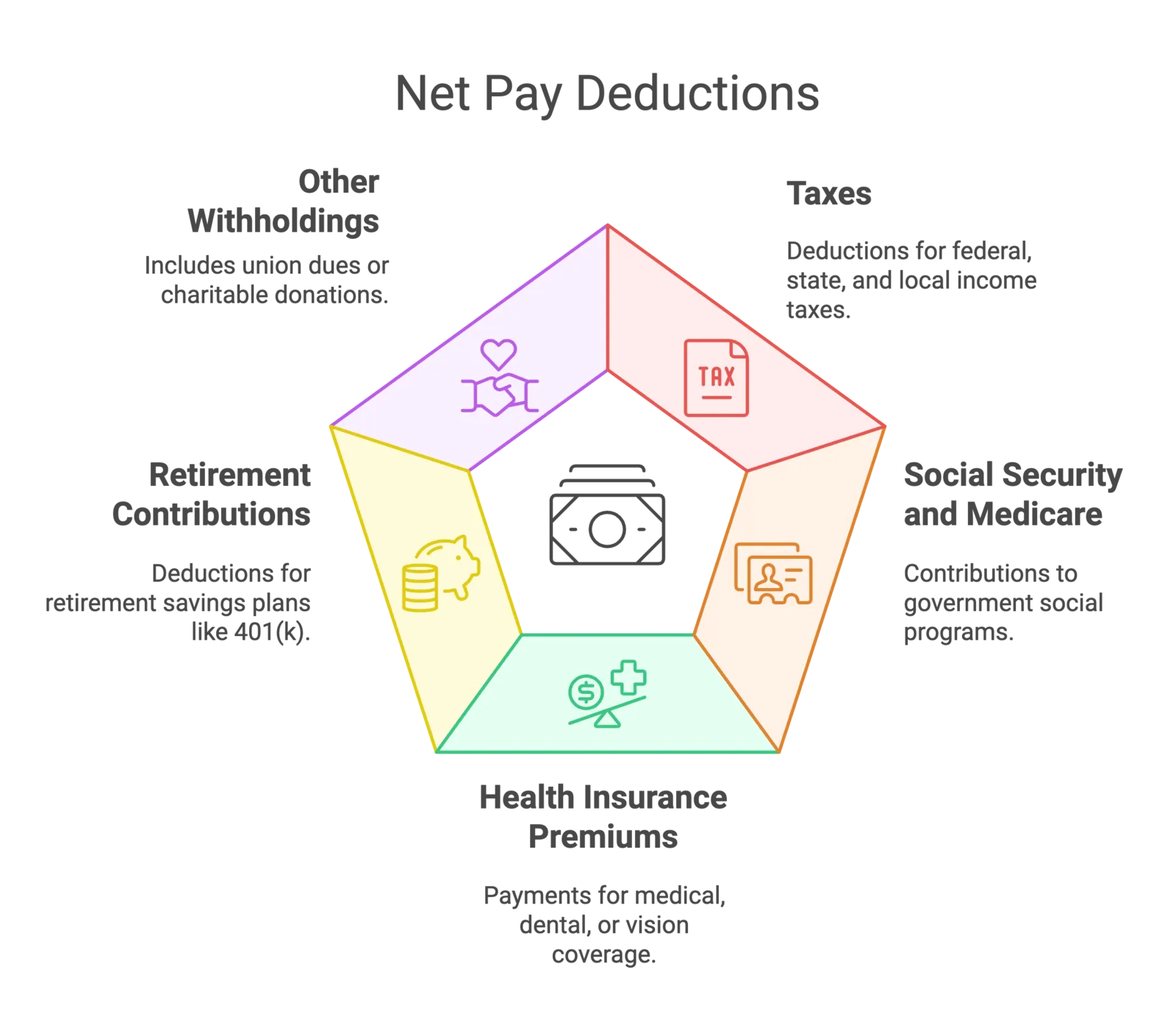

Common Deductions That Reduce Gross Pay to Net Pay

When calculating your income or preparing payroll for your staff, several deductions reduce your gross pay to net pay. These commonly include:

- Taxes: Federal, state, and local income taxes. Payroll taxes, including Social Security and Medicare, are mandatory deductions that reduce your gross pay to net pay.

- Social Security and Medicare: Contributions to government programs.

- Health insurance premiums: Payments for medical, dental, or vision coverage.

- Retirement contributions: Deductions for 401(k) or similar plans.

- Other withholdings: Such as union dues or charitable donations.

Each deduction plays a role in determining the difference between gross pay and net pay. These amounts vary based on factors like location, employment terms, and individual choices. Other factors, such as exchange rates, may also affect your payroll calculations.

Breakdown of Gross Pay vs Net Pay

|

Aspect |

Gross Pay |

Net Pay |

|

Definition |

Total earnings before deductions |

Earnings after deductions |

|

Components |

Includes salary, bonuses, and overtime |

Excludes taxes and other deductions |

|

Used For |

Loan approvals, salary negotiations |

Personal budgeting and spending |

|

Displayed On |

Employment contracts, pay stubs |

Paychecks |

💡 Tip: Always clarify whether a job offer is quoting gross salary or net salary.

Tax Implications of Gross and Net Pay

- Your gross pay is the starting point for calculating taxable income.

- Taxes (federal, state, FICA) are deducted from your gross pay, reducing it to your net pay.

For small businesses, it’s crucial to withhold correctly based on gross wages to avoid payroll tax penalties.

For individuals, understanding gross vs net helps predict tax refunds or amounts owed during tax season.

Why It Matters for SMBs

If you run a small or mid-sized business, gross pay vs net pay impacts:

✅ Payroll Budgeting:

You must budget for gross wages plus employer taxes (like Social Security, Medicare, and sometimes unemployment insurance).

✅ Employee Expectations:

Employees often focus on net pay (“what I actually get”), so clearly explaining their gross vs net during job offers or raises helps avoid confusion.

✅ Compliance and Reporting:

You’re legally responsible for accurately withholding and remitting taxes based on gross pay, not net pay.

✅ Cost Planning:

When planning to hire, remember that your cost to employ someone is always higher than their net pay because you also pay the employer’s share of payroll taxes and benefits.

Why It Matters for Employees

✅ Personal Budgeting:

Knowing your net pay helps you budget realistically — rent, groceries, loans, and savings plans should be based on your after-tax income, not your gross.

✅ Understanding Benefits:

Contributions to things like 401(k) plans, health insurance, and flexible spending accounts lower your taxable income, affecting your net pay now but potentially saving you money long-term.

✅ Negotiating Salaries:

When discussing job offers, always clarify whether the salary quoted is gross or net. It’s usually gross!

✅ Avoiding Surprises:

If you’re a freelancer or contractor, you’re often paid gross, and it’s your job to set aside taxes yourself.

How to Calculate Gross Pay and Net Pay

How to Calculate Gross Pay and Net Pay

To Calculate Gross Pay:

Hourly rate × Hours worked + Overtime + Bonuses = Gross Pay

Or for salaried workers:

Annual salary ÷ Pay periods = Gross pay per period

To Calculate Net Pay:

Gross Pay – Total Deductions = Net Pay

💡 Tip: Online payroll calculators can help you estimate both quickly, factoring in tax brackets and benefits.

Utilizing Payroll Software

If you’re handling payroll for several employees, leveraging payroll services can significantly simplify the process.

- Accuracy in calculations: Payroll services ensure accurate calculation of gross and net pay, helping avoid common errors that can occur when manually determining deductions and taxes. Payroll services often provide exclusive business insights delivered straight to your inbox, helping you stay informed on payroll and HR trends.

- Time efficiency: Automating the payroll process saves time, allowing you to focus more on core business activities rather than the intricacies of payroll management.

- Regulatory compliance: These services keep up-to-date with changes in tax laws and regulations, ensuring that your payroll remains compliant without you needing to track legislative changes.

- Integrated features: Many payroll services offer integrated features such as direct deposit and digital pay stubs, which streamline the entire payroll process from calculation to payment.

- Scalability: As your business grows and you hire more employees, payroll services can easily scale to meet your expanding needs without a corresponding increase in workload or complexity.

Recommended Payroll Software:

- OnPay: OnPay is known for its simplicity and affordability, which is perfect for small businesses seeking an easy payroll solution.

- Gusto: Gusto is favored for its user-friendly design and excellent customer support, which is ideal for startups and small businesses focusing on ease and automation.

- Paychex: Paychex offers robust HR and payroll services, which are ideal for medium to large businesses needing comprehensive support.

Managing Payroll Efficiently with Global HR Shared Services

Managing payroll efficiently is crucial for businesses of all sizes. One effective way to streamline this process is by utilizing global HR shared services. These services offer a comprehensive range of payroll solutions, including payroll processing, tax compliance, and benefits administration.

Global HR shared services can significantly enhance the efficiency of payroll management. By centralizing payroll functions, businesses can ensure consistency and accuracy in payroll calculations. This is particularly beneficial for companies with employees in multiple locations, as it simplifies the complexities of managing different state income tax brackets and local regulations.

Moreover, global HR shared services provide expertise in tax compliance. They stay up-to-date with the latest tax laws and regulations, ensuring that your payroll processes remain compliant. This reduces the risk of errors and penalties, giving you peace of mind.

Another advantage is the integration of additional HR functions. Many global HR shared services offer features such as employee self-service portals, where employees can access their pay stubs, update personal information, and manage benefits. This not only improves the employee experience but also reduces the administrative burden on HR teams.

For businesses looking to scale, global HR shared services offer scalability without increasing complexity. As your business grows and you hire more employees, these services can easily adapt to your expanding needs, providing consistent support and ensuring that your payroll processes remain efficient.

In conclusion, leveraging global HR shared services can transform your payroll management. It ensures accuracy, compliance, and efficiency, allowing you to focus on your core business activities. Whether you are a small business or a large corporation, these services provide the support you need to manage payroll effectively.

Final Thoughts

Understanding the difference between gross and net pay is essential for managing your personal finances. Staying informed with business insights delivered straight to your inbox can help you make better financial decisions. Gross pay represents the total compensation you earn, while net pay reflects what you actually receive after deductions.

By mastering this distinction, you can make informed financial decisions, plan budgets effectively, and evaluate job offers with confidence. Remember, gross income vs net income isn’t just a technicality — it directly impacts your day-to-day life. Use this knowledge to stay on top of your financial game.

FAQ

Q: What is gross pay?

A: Gross pay is the total amount of money you earn before deductions, including your base salary, bonuses, and other earnings.

Q: What is net pay?

A: Net pay is the amount of money you take home after all deductions, such as taxes and insurance premiums, are subtracted from your gross pay.

Q: What is the difference between gross pay and net pay?

A: Gross pay includes all earnings before deductions, while net pay is your take-home pay after deductions.

Q: Why is it important to understand gross pay vs net pay?

A: Understanding the difference helps you manage your budget, plan expenses, and evaluate job offers more effectively.

Q: What is a pay period?

A: A pay period is the frequency with which employees receive their salaries, such as weekly, bi-weekly, or monthly. It influences the calculation of gross income, deductions, and net pay.