Best Payment Gateway Services in 2025

A payment gateway service is what makes online transactions possible. It’s the bridge between your business, customers, and banks, ensuring payments are secure, fast, and hassle-free. Whether you’re running an e-commerce store, a subscription service, or a brick-and-mortar business, having the right payment solution means customers can pay smoothly using credit cards, digital wallets, and other online payment methods—without you having to worry about security or processing issues.

Why You Can Trust the Expertise of Sonary

At Sonary, we are committed to providing accurate and trustworthy information to help you make informed decisions. Our research process is meticulous, transparent, and guided by a dedication to maintaining the highest standards of integrity, ensuring accurate, real-world insights.

Read more

Unlike many other review platforms, we conduct in-depth evaluations of the software and services we feature. Our expert team tests and actively uses the tools we review to understand their features, performance, and value comprehensively. Our assessments are based on real-world use, giving you insights beyond surface-level descriptions. Our research methodology includes analyzing key consumer factors such as pricing, functionality, device usability, scalability, customer support quality, and unique industry-specific features. This hands-on approach and dedication to transparency mean you can trust Sonary to deliver regular, up-to-date content and recommendations that are well-researched and genuinely helpful for your business needs.

Not all payment gateway providers are created equal. Some offer low transaction fees, others prioritize security and fraud prevention, and some focus on seamless integration with e-commerce platforms. The best choice depends on your business size, industry, and how you process payments. In this guide, we’ll compare the best payment processors to help you find the one that’s reliable, cost-effective, and perfectly suited for your business needs.

Best Payment Gateway Services

Features

General Features

Hardware & Software

Pricing Options Automations

Sales Channels

Pros & Cons

Pros

Cons

Features

General Features

Hardware & Software

Sales Channels

Pros & Cons

Pros

Cons

Features

General Features

Hardware & Software

Pricing Options Automations

Sales Channels

Pros & Cons

Pros

Cons

Features

General Features

Hardware & Software

Pricing Options Automations

Sales Channels

Pros & Cons

Pros

Cons

Features

General Features

Hardware & Software

Pricing Options Automations

Sales Channels

Pros & Cons

Pros

Cons

Quick Comparison

| Payment Gateway Service | Key Feature | Best For | Platform | Pricing |

| Merchant One | Fast approval and high-risk processing | Small business and high-risk merchants | Cloud-based and POS | Mid-range, custom rates |

| Paysafe | Global payment solutions with strong security | Businesses needing international payments | Cloud-based | Variable, depends on transaction volume |

| North | Customizable payment integrations | Companies requiring tailored payment solutions | Cloud-based & customizable APIs | Flexible, mid-to-high range |

| Worldpay | Enterprise-level payment processing | Large enterprises with high transaction volumes | Cloud & enterprise-level | Enterprise-level |

| Clover | POS system with integrated payments | Retail and in-person transactions | POS & mobile | Flat-rate & subscription options |

| Payment Cloud | Specializes in high-risk merchant accounts | High-risk businesses | Cloud-based | Custom, varies by risk level |

| Square | Flat-rate pricing and easy setup | Small businesses and startups | Cloud & mobile | Budget-friendly, flat-rate per transaction |

| Lightspeed Retail | Retail-focused payment gateway and POS | Retail stores | POS & e-commerce | Mid-range, subscription and transaction fees |

Our Top Picks

Not all payment gateway providers are created equal, and the right one can make or break your checkout experience. Some are built for small businesses that need quick, hassle-free transactions, while others cater to high-risk industries or large enterprises handling massive payment volumes. We’ve broken down the top payment processors so you can skip the guesswork and find the one that actually fits your business.

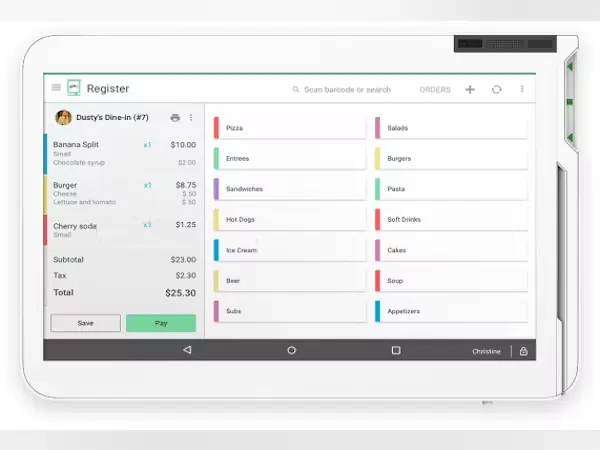

Merchant One: Best for small business credit card processing

98% approval rate & 24/7 customer support

98% approval rate & 24/7 customer support  Flat-rate pricing & no setup fees

Flat-rate pricing & no setup fees Merchant One is built for businesses that need fast payment processing without the red tape. It specializes in quick approvals, next-day funding, and support for high-risk industries, making it a go-to for merchants who don’t want to wait weeks to get set up.

It covers credit card processing, mobile payments, and POS systems, offering a straightforward way to accept payments in-store and online. The focus is on speed and accessibility, giving businesses a no-fuss way to start accepting transactions right away.

Key Features

- Fast approvals. Get approved quickly, even for high-risk industries, with a streamlined application process.

- Next-day funding. Transactions settle fast, ensuring businesses get paid quickly without long wait times.

- Credit card processing. Accept all major credit cards with secure and reliable processing.

- Mobile payments. Process transactions on the go with mobile card readers and contactless payment options.

- POS system integration. Works with various point-of-sale systems to keep payments smooth and efficient.

- Custom pricing plans. Rates are flexible based on business size and industry, making it more accessible for different merchants.

- Fraud prevention tools. Built-in security features help reduce chargebacks and unauthorized transactions.

Pros and Cons

- Pros

- Fast approvals, even for high-risk businesses.

- Next-day funding keeps cash flow moving.

- Works with POS systems and mobile payments.

- Custom pricing based on business needs.

- 24/7 customer support for troubleshooting.

- Cons

- Pricing isn’t fully transparent—requires a quote.

- Contracts may have early termination fees.

- Some businesses report aggressive sales tactics.

Who It’s For

Merchant One is best for small businesses, high-risk merchants, and companies that need quick payment processing approvals. It’s a good fit for those who can’t afford long wait times for setup and funding and want a straightforward way to accept credit cards, mobile payments, and POS transactions. Businesses looking for custom pricing and flexible payment options will also find it useful, though it’s worth checking the fine print on contracts before committing.

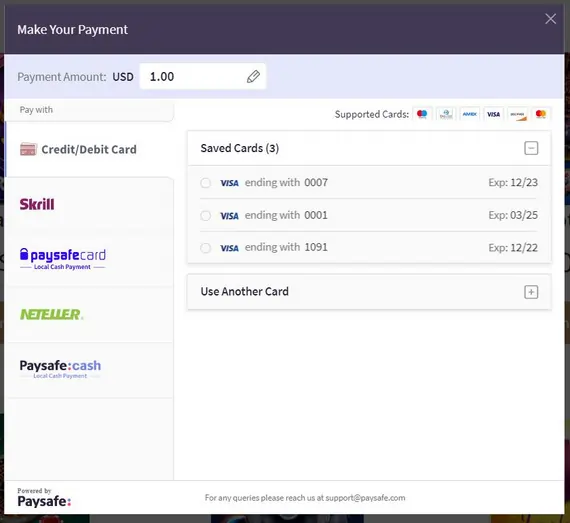

Paysafe: Best for high-risk payment processing

Market-leading risk and fraud protection

Market-leading risk and fraud protection  Seamless, safe and secure payments

Seamless, safe and secure payments Paysafe is a global payment solution that specializes in secure transactions, international payments, and high-risk industries. It’s built for businesses that need flexibility in payment methods, offering support for credit cards, digital wallets, ACH, and even cryptocurrency payments.

With a strong focus on fraud prevention and compliance, Paysafe is designed to handle large-scale transactions and cross-border payments while keeping security a top priority. It’s widely used in e-commerce, gaming, travel, and other industries that require fast, reliable online payment processing.

Key Features

- Global payment processing. Accepts payments in multiple currencies, making it ideal for international transactions.

- Multiple payment methods. Supports credit cards, digital wallets, ACH transfers, and even cryptocurrency.

- High-risk merchant support. Works with industries that struggle to get approval from traditional payment processors.

- Advanced fraud protection. Uses AI-driven security tools to detect and prevent fraudulent transactions.

- Subscription and recurring billing. Automates payments for businesses with membership or subscription models.

- Seamless integrations. Connects with e-commerce platforms, POS systems, and other business tools.

- Compliance and regulatory support. Ensures businesses meet payment security standards like PCI-DSS.

Pros and Cons

- Pros

- Supports multiple payment methods, including crypto.

- Strong fraud protection and compliance tools.

- Works with high-risk industries that need reliable processing.

- Scales well for international businesses with multi-currency support.

- Integrates with e-commerce and POS systems.

- Cons

- Pricing isn’t fully transparent—requires a custom quote.

- Setup and approval process can take longer for some businesses.

- Customer support response times can be inconsistent.

Who It’s For

Paysafe is a great fit for businesses that operate internationally or need diverse payment options beyond just credit cards. It’s ideal for high-risk merchants, e-commerce businesses, and industries that require extra fraud protection. Companies handling subscription billing or cross-border transactions will benefit from its multi-currency support and compliance-focused approach.

North: Best for enterprise payment solutions

User-friendly platform for easy management

User-friendly platform for easy management  Access in-depth analytics and reports

Access in-depth analytics and reports North is a customizable payment solution designed for businesses that need flexible integrations and seamless payment processing. It offers a highly adaptable API, allowing companies to tailor payment systems to fit their operations—whether they’re in e-commerce, retail, or subscription services.

With a focus on security, automation, and multi-channel payment acceptance, North helps businesses streamline transactions while maintaining control over how payments are processed. It’s a strong choice for companies that want a personalized payment gateway without being locked into a one-size-fits-all platform.

Key Features

- Customizable payment integrations. Businesses can tailor payment processing to match their exact needs with a flexible API.

- Omnichannel payment acceptance. Supports online, in-store, mobile, and recurring payments.

- High-level security and fraud protection. Uses advanced encryption and fraud monitoring to secure transactions.

- Automated invoicing and billing. Simplifies subscription-based and recurring payment models.

- Multi-currency support. Processes payments in different currencies, making it ideal for international transactions.

- Seamless e-commerce and POS integrations. Works with major platforms to keep transactions smooth and hassle-free.

- Scalable solutions. Can be used by small businesses or large enterprises looking for custom payment workflows.

Pros and Cons

- Pros

- Highly customizable for businesses with specific payment needs.

- Supports online, in-person, and subscription-based payments.

- Strong security features to prevent fraud.

- Scales well for businesses of all sizes.

- Offers multi-currency and global transaction support.

- Cons

- Setup may require more technical expertise for API integrations.

- Custom pricing means costs vary and may not be budget-friendly for small businesses.

- Not as widely recognized as some larger payment providers.

Who It’s For

North is best for businesses that want a payment solution they can fully customize. It’s ideal for e-commerce brands, subscription services, and companies that need flexible integrations for online and in-store transactions. Businesses with global customers will also benefit from its multi-currency support and fraud prevention tools. While it’s a strong option for those needing control and scalability, companies with simpler payment needs might prefer a plug-and-play solution.

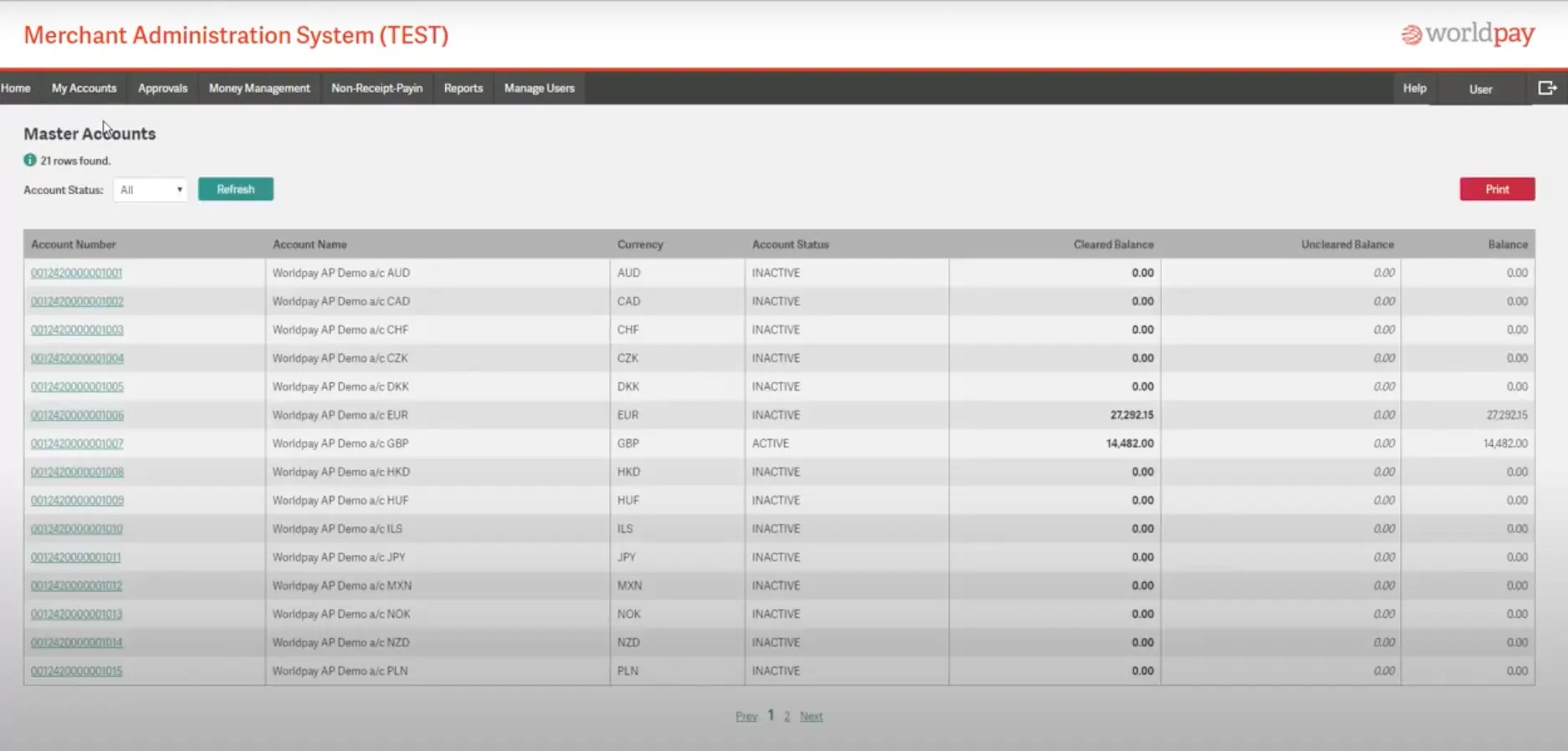

Worldpay: Best for cross-border payment processing

Secure, flexible payment solutions

Secure, flexible payment solutions  Advanced fraud protection for security

Advanced fraud protection for security Worldpay is a global payment processing company known for handling high transaction volumes and enterprise-level businesses. With support for online, in-store, and mobile payments, it provides secure and scalable payment solutions for businesses of all sizes.

Its strength lies in its global reach, making it an excellent choice for companies that operate internationally and need multi-currency support. With fraud prevention tools, recurring billing, and strong e-commerce integrations, Worldpay is a solid option for businesses looking for a reliable and widely accepted payment processor.

Key Features

- Global payment processing. Accepts transactions in multiple currencies and supports international payments.

- Multi-channel payment support. Handles online, in-store, mobile, and contactless payments.

- Fraud detection and security tools. Uses AI-driven monitoring to prevent fraudulent transactions.

- Recurring billing. Automates payments for subscription-based businesses and memberships.

- Custom pricing options. Offers tailored rates based on business type, transaction volume, and industry.

- POS and e-commerce integrations. Works with major e-commerce platforms and in-store payment systems.

- Advanced analytics and reporting. Provides insights into transaction trends and customer payment behaviors.

Pros and Cons

- Pros

- Supports international payments with multi-currency processing.

- Works with both e-commerce and in-store POS systems.

- Advanced fraud prevention features help protect transactions.

- Scalable for small businesses and large enterprises.

- Custom pricing options for businesses with high transaction volumes.

- Cons

- Pricing isn’t transparent and requires a custom quote.

- Some businesses report long contract terms and cancellation fees.

- Customer support can be inconsistent, especially for smaller businesses.

Who It’s For

Worldpay is best suited for large businesses, enterprises, and global companies that need a scalable payment processor with strong security and multi-currency support. It’s a great fit for businesses handling high transaction volumes and those that require a mix of online, mobile, and in-store payment options. While it offers custom pricing and flexibility, smaller businesses may find it less cost-effective compared to flat-rate payment processors.

Clover: Best for customizable POS hardware and software integration

Payments as low as 2.3% +10¢/transaction

Payments as low as 2.3% +10¢/transaction  Fraud protection up to $100,000

Fraud protection up to $100,000 Clover is a point-of-sale (POS) and payment processing system designed for retail stores, restaurants, and service-based businesses. It offers a full suite of hardware and software solutions, making it a great choice for businesses that need an all-in-one payment system for both in-person and online transactions.

With customizable POS features, contactless payments, and built-in business management tools, Clover helps businesses streamline checkout, track sales, and manage inventory efficiently. It’s a popular option for merchants looking for a user-friendly and flexible payment solution.

Key Features

- All-in-one POS system. Combines payment processing with sales tracking, inventory management, and customer analytics.

- Contactless and mobile payments. Accepts credit cards, digital wallets, and tap-to-pay options.

- Customizable hardware. Offers various POS devices, including countertop terminals and mobile card readers.

- E-commerce integration. Syncs with online stores to manage both in-person and digital transactions.

- Built-in business management tools. Includes employee scheduling, loyalty programs, and customer tracking.

- Scalable for different industries. Works for retail, hospitality, and service-based businesses.

- Flat-rate pricing plans. Offers transparent pricing based on business size and transaction volume.

Pros and Cons

- Pros

- All-in-one payment processing and POS system.

- Accepts contactless, mobile, and online payments.

- Easy-to-use hardware with customizable features.

- Integrated business management tools for tracking sales, inventory, and customers.

- Transparent pricing with various plan options.

- Cons

- Hardware costs can add up, especially for larger businesses.

- Requires a contract, which may include termination fees.

- Not as feature-rich for large enterprises needing advanced customization.

Who It’s For

Clover is great for brick-and-mortar businesses that need more than just a payment processor. If you run a retail store, restaurant, or service-based business, Clover gives you a POS system that actually helps you run your business—tracking sales, managing inventory, and handling customer payments all in one place. It’s perfect for businesses that want a simple, all-in-one setup without juggling multiple platforms.

PaymentCloud: Best for high-risk merchant processing

Fast funding with same day deposits

Fast funding with same day deposits  No setup/hidden fees & free terminal

No setup/hidden fees & free terminal PaymentCloud specializes in high-risk merchant accounts, making it a go-to option for businesses that struggle to get approved by traditional payment processors. It works with a wide range of industries, from e-commerce to CBD, firearms, and other high-risk sectors.

Beyond just approvals, PaymentCloud offers customized payment solutions, including credit card processing, ACH payments, mobile payments, and fraud prevention tools. It’s built to help businesses accept payments securely while minimizing risk and chargebacks.

Key Features

- High-risk merchant support. Works with industries that traditional payment processors often reject.

- Custom payment processing solutions. Offers tailored solutions for credit card, ACH, and mobile payments.

- Chargeback protection. Helps businesses reduce the risk of fraudulent transactions and disputes.

- E-commerce and POS integration. Works with Shopify, BigCommerce, WooCommerce, and various POS systems.

- Multi-currency support. Accepts international payments for businesses with global customers.

- Dedicated account managers. Provides hands-on support to help businesses navigate the complexities of high-risk processing.

- Flexible pricing plans. Custom pricing based on industry, risk level, and transaction volume.

Pros and Cons

- Pros

- Approves high-risk businesses that struggle with traditional processors.

- Custom payment solutions based on business needs.

- Strong fraud and chargeback prevention tools.

- Dedicated account managers for hands-on support.

- Integrates with e-commerce platforms and POS systems.

- Cons

- Pricing isn’t transparent and depends on risk assessment.

- Application process can take longer than standard payment providers.

- Not the best option for low-risk businesses needing simple processing.

Who It’s For

PaymentCloud is made for businesses that have a hard time getting approved by traditional payment processors. If you’re in CBD, firearms, adult services, travel, or any other high-risk industry, this service is designed to help you accept payments securely while managing fraud and chargebacks. It’s also a solid option for e-commerce businesses and international merchants that need customized payment solutions without the headache of constant rejections.

Square: Best for in-person and online payment processing

Simple price structures

Simple price structures  Many payment options available

Many payment options available Square is one of the most widely used payment processors, known for its easy setup, transparent pricing, and all-in-one business tools. It’s a great choice for small businesses, retail stores, restaurants, and service providers that want a simple, reliable way to accept payments both online and in-person.

Key Features

- Flat-rate pricing. Simple, transparent pricing with no hidden fees.

- All-in-one POS system. Includes built-in software for sales tracking, inventory management, and customer insights.

- Mobile payments. Accepts payments on smartphones and tablets using Square’s mobile card readers.

- E-commerce integration. Works with platforms like Shopify, WooCommerce, and BigCommerce.

- Next-day funding. Get paid quickly with fast deposit times.

- Contactless and digital wallet payments. Supports Apple Pay, Google Pay, and other tap-to-pay methods.

- No long-term contracts. Businesses can use Square without being locked into a contract.

Pros and Cons

- Pros

- Easy to set up with no monthly fees.

- Works online, in-store, and on mobile devices.

- Transparent flat-rate pricing.

- Includes built-in POS and inventory management.

- Supports digital wallet and contactless payments.

- Cons

- Not ideal for high-risk businesses.

- Higher transaction fees for larger businesses.

- Limited customer support for free accounts.

Who It’s For

Square is best for small businesses, independent retailers, food service businesses, and service providers that need a simple, all-in-one payment solution. It’s a great choice for businesses that don’t want complicated pricing or long contracts and need a system that works both in-person and online.

Lightspeed Retail: Best for retail inventory management

Advanced inventory management capabilities

Advanced inventory management capabilities  Smarter sales & reporting

Smarter sales & reporting Lightspeed Retail is a payment processing and point-of-sale (POS) system designed for retail businesses that need advanced inventory management, analytics, and multi-location support. Unlike basic payment processors, Lightspeed offers a fully integrated solution that helps businesses process transactions, manage stock, and track customer data—all in one place.

Key Features

- All-in-one retail POS system. Combines payment processing with sales, inventory, and employee management tools.

- Omnichannel payment support. Accepts credit cards, contactless payments, and mobile transactions.

- E-commerce integration. Syncs with online stores to manage both digital and in-person sales.

- Advanced inventory management. Tracks stock levels in real-time and automates reordering.

- Built-in analytics and reporting. Provides insights on sales trends, customer behavior, and store performance.

- Multi-location support. Works seamlessly for businesses with multiple retail locations.

- Flexible pricing plans. Offers tiered pricing for small to large retail businesses.

Pros and Cons

- Pros

- Full-featured POS with built-in payment processing.

- Strong inventory management tools for retailers.

- Works for both in-store and e-commerce businesses.

- Multi-location support makes it ideal for expanding retailers.

- Customizable pricing plans based on business size and needs.

- Cons

- More expensive than simpler payment processors.

- Best suited for retail—less flexible for other industries.

- Can have a learning curve for new users.

Who It’s For

Lightspeed Retail is ideal for brick-and-mortar retailers, boutique shops, and multi-location businesses that need more than just payment processing. It’s perfect for businesses that want to integrate inventory tracking, e-commerce, and customer management into one system. If you’re running a growing retail business and need powerful tools to streamline operations, Lightspeed is built for you.

Related Articles

The Importance of Payment Gateway Services

A payment gateway is the backbone of any modern business transaction, allowing customers to pay quickly, securely, and without friction. Whether you operate a small online store, a subscription service, or a large-scale retail operation, having a reliable payment gateway provider ensures that your business can process payments smoothly, avoid fraud risks, and deliver a seamless customer experience.

Without a secure and efficient payment processing company, businesses face slow transactions, increased fraud risk, and potential revenue loss due to cart abandonment or declined payments. Customers today expect fast, flexible, and secure payment options, and businesses that don’t meet these expectations risk losing out to competitors that do. A strong e-commerce payment solution is no longer a luxury—it’s a critical tool for success.

Why a Reliable Payment Gateway is Essential for Your Business

- Security and fraud protection. Payment gateways use encryption and fraud prevention tools to protect both businesses and customers from cyber threats and fraudulent transactions. Secure transactions build trust and prevent chargebacks and financial losses.

- Faster transactions and cash flow. Delayed payments can hurt a business’s bottom line. A good payment solution ensures quick processing and settlements, helping businesses maintain a steady cash flow. Many top payment processors offer next-day or even instant funding to give businesses immediate access to their earnings.

- Multiple payment methods for customer convenience. A strong payment gateway provider lets businesses accept credit cards, debit cards, digital wallets (like Apple Pay and Google Pay), ACH transfers, and even cryptocurrency payments. The more payment methods you offer, the easier it is for customers to complete their purchases.

- Lower cart abandonment rates. Studies show that a slow or frustrating checkout process is one of the top reasons customers abandon their shopping carts. A smooth and optimized payment experience helps reduce friction, increase conversion rates, and maximize sales.

- Global payment support. If your business is expanding internationally, having a payment processor that supports multiple currencies and cross-border transactions is key. Some payment gateway services also handle currency conversion automatically, making it easier for businesses to sell to global customers without hassle.

- Regulatory compliance and data security. Payment processors must comply with strict security standards like PCI-DSS, ensuring that customer data is protected at all times. Businesses that use a compliant payment processing company minimize legal and security risks, avoiding hefty fines and reputational damage.

- Seamless integration with business operations. The best payment gateway providers integrate with e-commerce platforms, accounting software, and customer management tools, making financial tracking and automation effortless. A smooth integration helps businesses manage transactions, refunds, and recurring billing without manual work.

- Scalability and business growth. As your business grows, so do your payment processing needs. The right payment solution will offer scalable features, allowing you to handle higher transaction volumes, multiple sales channels, and new payment methods without switching providers.

A strong, reliable payment gateway is more than just a tool—it’s a core business asset. It reduces risk, enhances customer experience, and provides the flexibility businesses need to keep up with evolving payment trends. Choosing the right payment processor ensures your business remains competitive, secure, and ready for long-term success.

Key Benefits of Payment Gateway Services

The right payment solution helps you streamline transactions, reduce fraud, and improve cash flow, all while providing a smooth checkout experience. Here are the biggest advantages of using a trusted payment gateway provider:

- Secure transactions – Protects customer payment data with encryption, tokenization, and fraud detection tools, reducing chargebacks and unauthorized transactions.

- Multiple payment options – Supports credit cards, debit cards, e-wallets, ACH payments, and even cryptocurrency, making it easier for customers to complete purchases.

- Faster checkout process – Reduces friction at checkout, speeding up transactions and minimizing cart abandonment rates.

- Scalability for business growth – Handles higher transaction volumes, new sales channels, and international expansion as your business grows.

- Seamless integrations – Connects with e-commerce platforms, POS systems, and accounting tools for effortless financial management.

- Improved cash flow – Faster transaction processing means quicker access to funds, helping businesses maintain stable cash flow.

- Compliance with industry regulations – Ensures your business meets PCI-DSS and data security standards, protecting both your revenue and your customers.

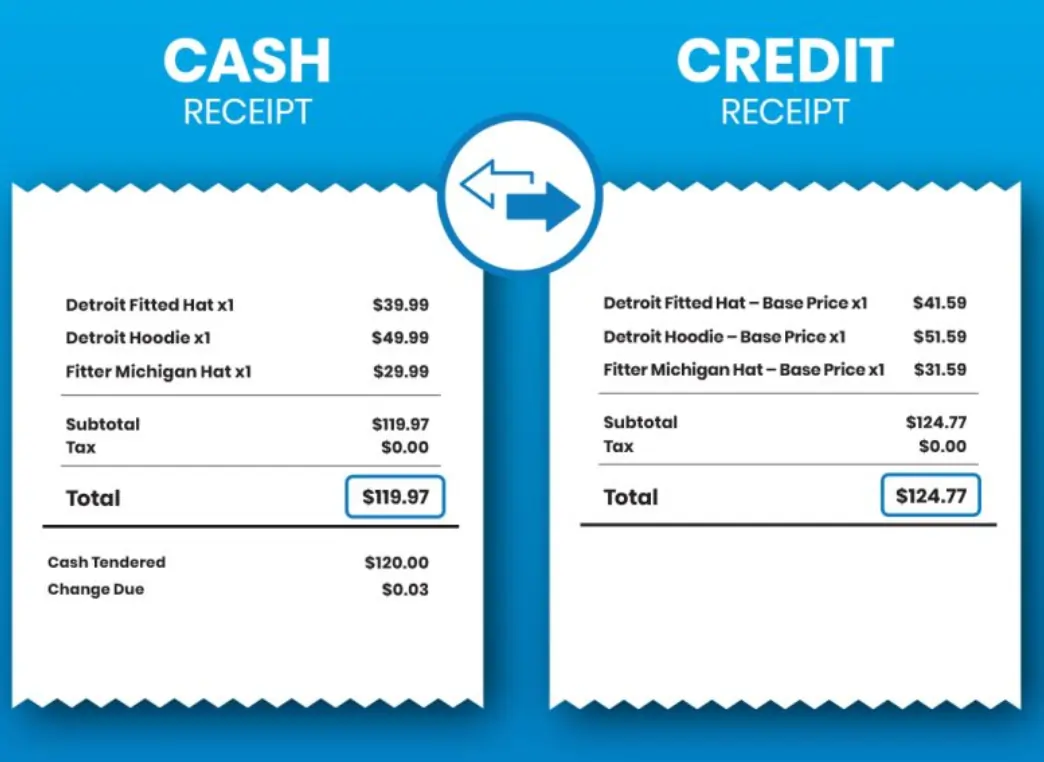

Steps to Choosing the Right Payment Gateway Service

The right payment gateway provider ensures secure, fast, and hassle-free transactions while integrating smoothly with your business operations. With so many options, it’s important to focus on fees, security, payment options, and scalability to find the best fit. Here’s what to consider:

-

Transaction fees and pricing – Compare costs, including per-transaction fees, monthly charges, and hidden costs. Some providers offer flat-rate pricing, while others have tiered or interchange-plus pricing based on volume.

-

Supported payment methods – Ensure the gateway accepts credit/debit cards, digital wallets (Apple Pay, Google Pay), ACH transfers, and cryptocurrency if needed.

-

Security and fraud protection – Look for PCI-DSS compliance, encryption, and AI-driven fraud detection to safeguard transactions and reduce chargebacks.

-

Integration with your business tools – Choose a provider that syncs with e-commerce platforms, POS systems, accounting software, and CRM tools for seamless operations.

-

International payment capabilities – If selling globally, pick a gateway that supports multi-currency transactions and automatic currency conversion.

-

Customer support and reliability – A 24/7 support team, strong uptime, and quick issue resolution are essential for uninterrupted payment processing.

-

Scalability for future growth – Select a payment solution that grows with your business, handling increased transactions and new payment options.

A good payment processor does more than process transactions—it secures your revenue, enhances customer trust, and supports long-term business success.

Final Thoughts

Choosing the right payment gateway is about more than just accepting payments—it’s about security, speed, and a frictionless experience for both you and your customers. Whether you’re selling online, in-store, or across multiple channels, your payment processor should fit seamlessly into your business without extra complications.

Think about what matters most. Are low transaction fees your priority? Do you need multi-currency support for international customers? Maybe strong fraud protection or subscription billing is key to your business. Whatever it is, comparing pricing, features, and integrations will help you find the best fit.

Your payment gateway shouldn’t hold you back—it should support your growth. Take the time to evaluate your options, test out features, and pick a provider that meets both your current needs and future goals. The right choice will make transactions easier, protect your revenue, and help your business scale without limits.

FAQ

Q: What is a payment gateway?

A: A payment gateway is a service that processes and authorizes online and in-person payments, acting as a secure bridge between businesses, banks, and customers.

Q: How does a payment gateway work?

A: It encrypts payment data, sends it to the customer’s bank for approval, and then transfers the funds to the merchant—all within seconds.

Q: What is the best payment gateway for small businesses?

A: The best payment gateway depends on pricing, transaction volume, and payment method support. Square, Stripe, and PayPal are popular for small businesses.

Q: What fees do payment gateways charge?

A: Most payment processors charge transaction fees (2-3%), monthly fees, or additional charges for international payments, refunds, or chargebacks.

Q: Can I accept international payments with a payment gateway?

A: Yes, but you need a payment processor that supports multi-currency transactions, like Worldpay, Stripe, or PayPal.

Q: What is the difference between a payment gateway and a payment processor?

A: A payment gateway collects and encrypts payment info, while a payment processor moves the funds from the customer’s bank to the merchant’s account.

Q: How do I choose the right payment gateway?

A: Compare transaction fees, security features, payment options, and integrations with your business tools before choosing a payment gateway provider.

Q: Do I need a merchant account for a payment gateway?

A: Some payment processors require a merchant account, while others—like Square or PayPal—let you process payments without one.

Q: How do payment gateways prevent fraud?

A: They use encryption, tokenization, AI fraud detection, and chargeback management to protect businesses from fraudulent transactions.

Q: Can I use multiple payment gateways?

A: Yes, businesses can use multiple payment processors to provide backup options, optimize transaction fees, and expand payment choices for customers.