Best Payroll Services for 2026

Last updated: February 2026

Payroll software handles the entire employee payment process, tracking hours, calculating wages and deductions, processing pay runs, and filing taxes. By automating these tasks, great payroll software can help you reduce manual errors and free up time for your business to focus less on paperwork and more on growth.

- Award-Winning SMB Solution

- Over 45 years of excellence

- Easy to pay and manage employees

- Used by over 400,000 SMBs globally

- Automated payroll with tax filing included

- Direct deposit and contractor payments fast

- Advanced features included

- Flexible and customized packages

- Tax filing & payroll automation

- All-in-one HR solution for success

- Used by 2.5M users & 40K+ businesses

- Vast partner network

- 7-day free trial

- Designed for SMBs

- 24/7 customer support for all your needs

- Payroll made easy for as little as $1 per day

- Automated payroll for business efficiency

- US-based customer support

- Award-winning customer service

- Seamless international support

- Dedicated tax support

- Automatic compliance and tax-filing

- Built for all sizes, from small businesses to large

- Sync all your systems with payroll

- Award-winning payroll & HR software

- Variety of packages for your business needs

- Around the clock customer support

Some of the best payroll services for small businesses start as low as $8 per employee per month, while the most robust, all-in-one platforms typically range between $20 and $30 per employee. Whether you’re just hiring your first team member or managing a fast-growing workforce, there’s a payroll solution that fits your budget and business needs.

In this guide, we compare the top payroll services, breaking down pricing, ease of use, features, support, and HR tools so you can confidently choose the best option.

What is payroll software?

Payroll software is a digital solution (most are now cloud-based) that automates and manages all tasks related to employee and contractor payments. This payroll processing program is designed for business owners, office managers, and HR leaders who need to ensure every team member is paid accurately, on time, and in full compliance with all tax laws-without having to be a tax expert themselves.

The primary quick wins are automation and compliance. These payroll systems automatically calculate gross pay, all tax withholdings (federal, state, local, FICA), and any deductions for benefits. More importantly, they handle the payment of those taxes and the filing of all required forms (like Form 941 and W-2s) for you, virtually eliminating the risk of human error and costly penalties from payroll processing companies.

Key Functions of Payroll Software:

✔️ Automated Payroll Processing – Calculates salaries, taxes, and deductions automatically.

✔️ Tax Compliance – Ensures payroll tax filings are accurate and timely.

✔️ Direct Deposits – Sends employee payments electronically.

✔️ Benefits & Deductions Management – Handles health insurance, 401(k), and other employee benefits.

✔️ Employee Self-Service Portals – Allows employees to view pay stubs, W-2s, and tax information.

How does a payroll service work?

A payroll service streamlines the payroll process by automating employee payments, tax deductions, and compliance reporting. Here’s how it typically works:

- Employee Setup – Businesses add employees’ personal, tax, and payment details.

- Time Tracking & Hours Logged – Payroll services integrate with time-tracking software or allow manual entry.

- Salary Calculation – The software calculates gross wages, tax deductions, and benefits.

- Tax Withholding & Filing – Payroll providers automatically deduct and file federal, state, and local taxes.

- Payment Processing – Employees receive payments via direct deposit, check, or payroll card.

- Compliance & Reporting – Payroll services generate reports for tax compliance and auditing.

Compare top payroll services in 2026

| Payroll Service | Best For | Key Features |

| Paychex | Best for Growing Businesses | HR support, tax compliance, scalable payroll options |

| Gusto | Best for Small Businesses | Automated payroll, tax filings, benefits integration |

| OnPay | Best Budget Option | Unlimited payroll runs, benefits integration |

| Paycor | Best for Mid-Sized Companies | Strong HR tools, analytics, and payroll automation |

| BambooHR | Best for HR-Driven Payroll | Integrated HR and payroll solutions |

| SurePayroll | Best for Small Teams | Simple payroll, tax calculations, affordable pricing |

| Paylocity | Best for Large Teams | Cloud-based payroll and workforce management tools |

| Rippling | Best for Automation | Payroll, HR, IT, and finance automation |

| ADP | Best for Enterprises | Scalable payroll and compliance solutions |

Payroll service reviews & comparisons

QuickBooks Payroll – Best for businesses already using QuickBooks Online

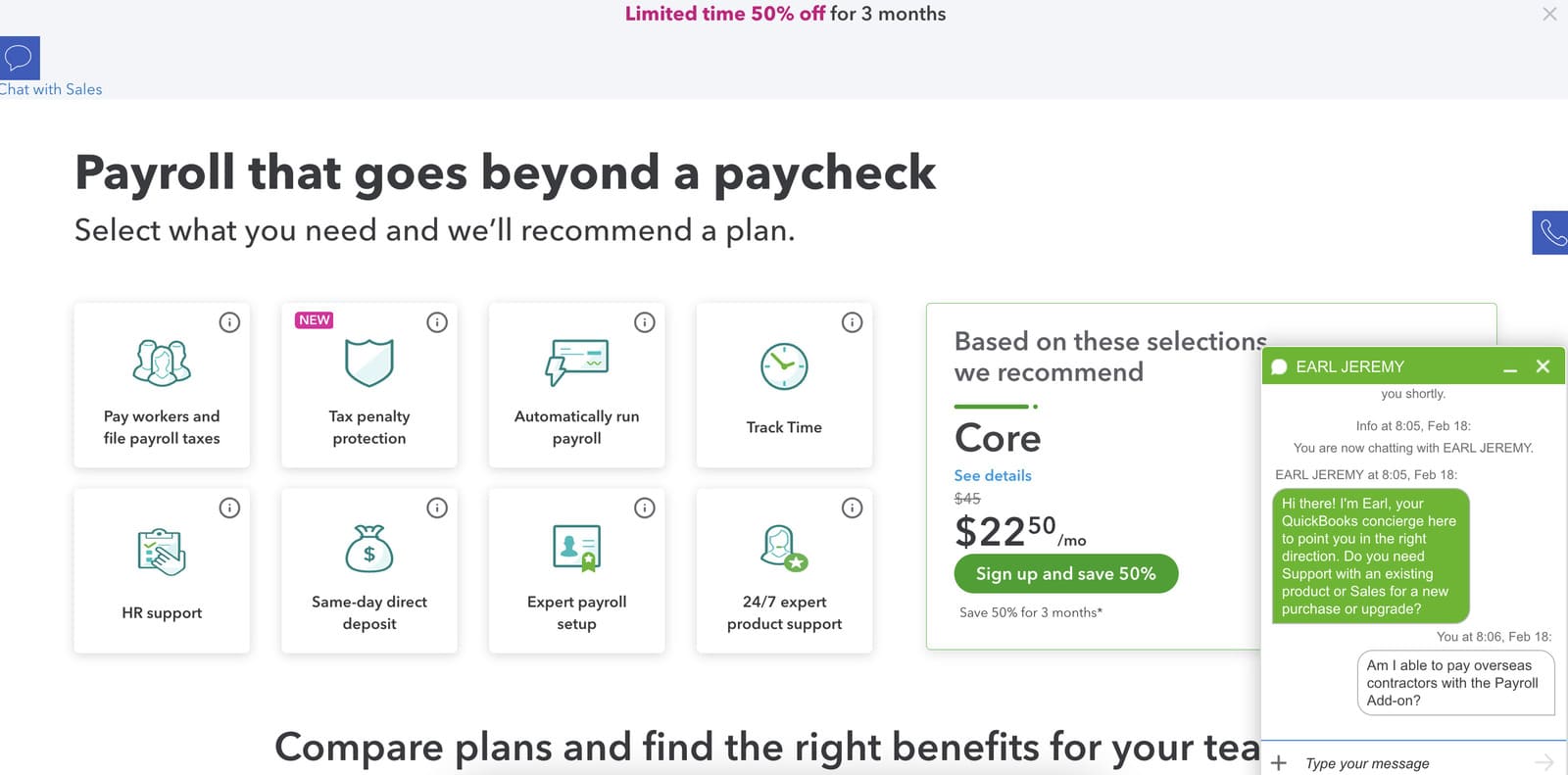

QuickBooks (QB) Payroll is an integrated payroll solution designed to live inside QuickBooks Online, creating a single, unified platform for both accounting and payroll. Its primary philosophy is seamless integration; payroll entries, taxes, and direct deposits automatically update your books, eliminating double entry. It offers three distinct tiers (Core, Premium, and Elite) that scale from basic payroll to a full-service solution with HR support and tax-penalty protection.

All plans include extensive payroll features

All plans include extensive payroll features  Offers third-party HR tools

Offers third-party HR tools - Ease of Use: If you are one of the millions of businesses already using QuickBooks Online, the interface will feel familiar and intuitive. It’s built right in. For new users, there can be a learning curve, as the platform is accounting-first, and payroll setup requires precision.

- Customer Support: This is consistently the most criticized aspect of QuickBooks. While 24/7 support is available on higher tiers, users frequently report very long hold times, inconsistent answers, and difficulty reaching qualified experts, which can be stressful when dealing with time-sensitive payroll or tax issues.

- Verdict: If your business runs on QuickBooks Online, this is the most logical and deeply integrated choice. The convenience is unmatched. However, if you are not tied to the QBO ecosystem, its high price and notoriously poor customer support make standalone providers like OnPay or Gusto more attractive.

| Pros | Cons |

| + Unbeatable integration with QuickBooks Online accounting | – Customer support is widely rated as poor and slow |

| + Automatically syncs payroll and tax data to your books | – One of the more expensive payroll solutions |

| + Includes health benefits & 401(k) in all plans | – Base plan (Core) lacks multi-state payroll & HR tools |

| + Fast direct deposit (next-day or same-day) | – Interface can be less modern than payroll-first competitors |

Key Features:

- Payroll: Full-service payroll, automated federal & state tax filings (multi-state on higher tiers), unlimited pay runs, next-day or same-day direct deposit, contractor payments, expert setup & tax-penalty protection (Elite plan only).

- HR & Onboarding: Employee self-onboarding, HR support center and personal advisor (higher tiers), time tracking (via QuickBooks Time).

- Benefits: Integrated health, dental, vision, and 401(k) plans available on all tiers.

- Integrations: Deep, seamless integration with the QuickBooks Online accounting ecosystem; very limited non-Intuit integrations.

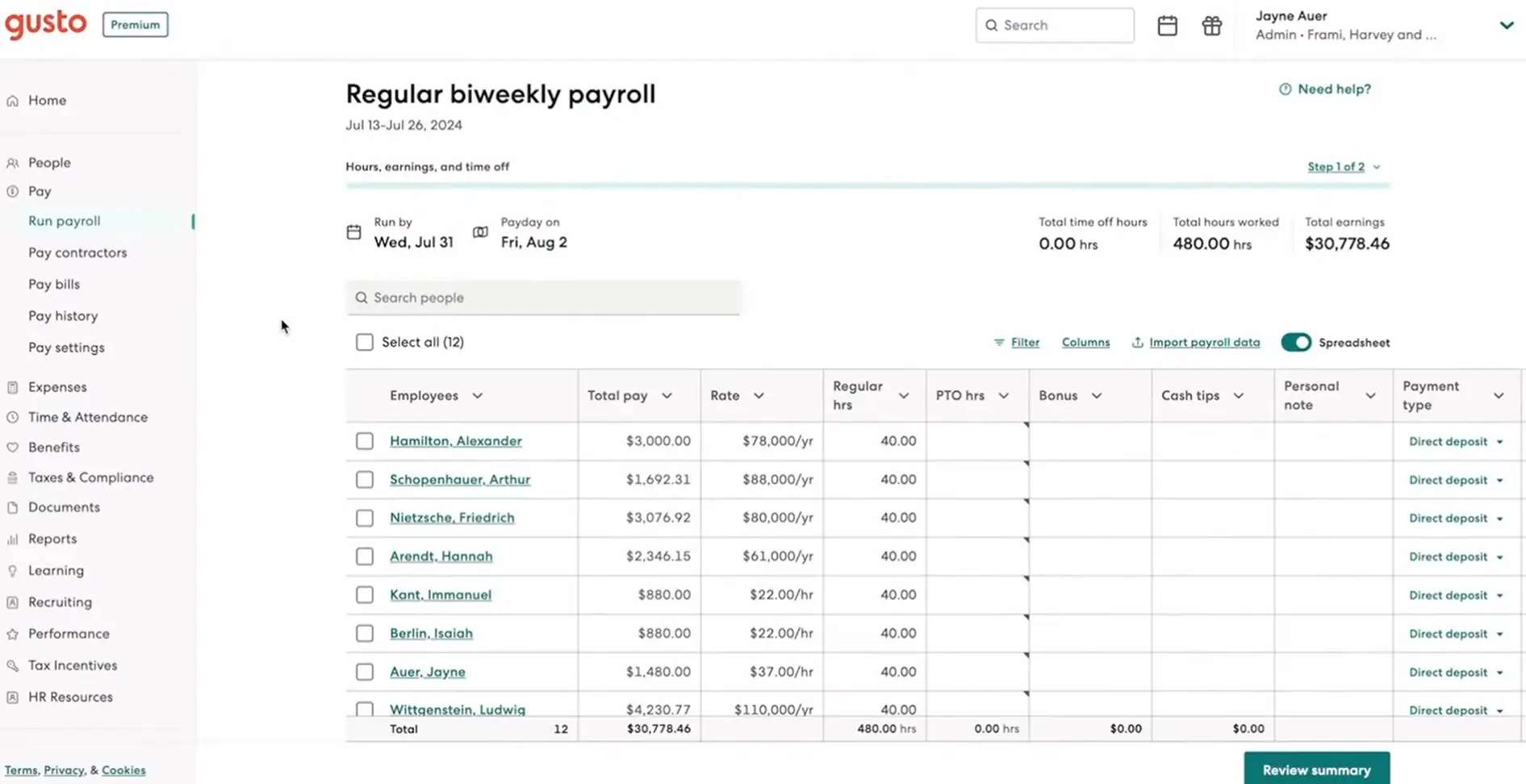

Gusto – Best overall for modern SMBs

Gusto has become the gold standard for small businesses that want a beautiful, easy-to-use platform that also handles complex HR tasks. It was built from the ground up for the modern workforce, easily handling remote employees, multi-state payroll, and contractor payments.

Its real strength is that it’s an all-in-one people platform. You don’t just get payroll; you get high-quality employee onboarding, benefits administration (health, 401(k)), and HR tools in one place.

Used by over 400,000 SMBs globally

Used by over 400,000 SMBs globally  Automated payroll with tax filing included

Automated payroll with tax filing included - Ease of Use: Exceptional. The interface is clean, friendly, and guides you through every step. Running payroll can take just a few clicks.

- Customer Support: Highly rated. Support is available via phone, email, and chat, with a reputation for being helpful and knowledgeable.

- Verdict: If you’re a tech-savvy SMB (or just appreciate good design) and want your payroll, benefits, and HR tools to work together seamlessly, Gusto is the top choice.

| Pros | Cons |

| + Incredibly intuitive and user-friendly | – Higher-tier plans can get expensive |

| + Excellent, fully integrated benefits admin | – Basic plan lacks time tracking & HR tools |

| + Strong onboarding and employee self-service | – Phone support isn’t 24/7 |

Key Features:

- Payroll: Full-service automated payroll, multi-state payroll, contractor payments (1099s), unlimited pay runs, auto-calculated tax filings (federal, state, local).

- HR & Onboarding: Employee self-onboarding, offer letters, document storage, PTO tracking, employee directory.

- Benefits: Fully integrated health, dental, vision, 401(k), and workers’ comp administration.

- Integrations: Connects to 180+ apps, including QuickBooks, Xero, and TSheets.

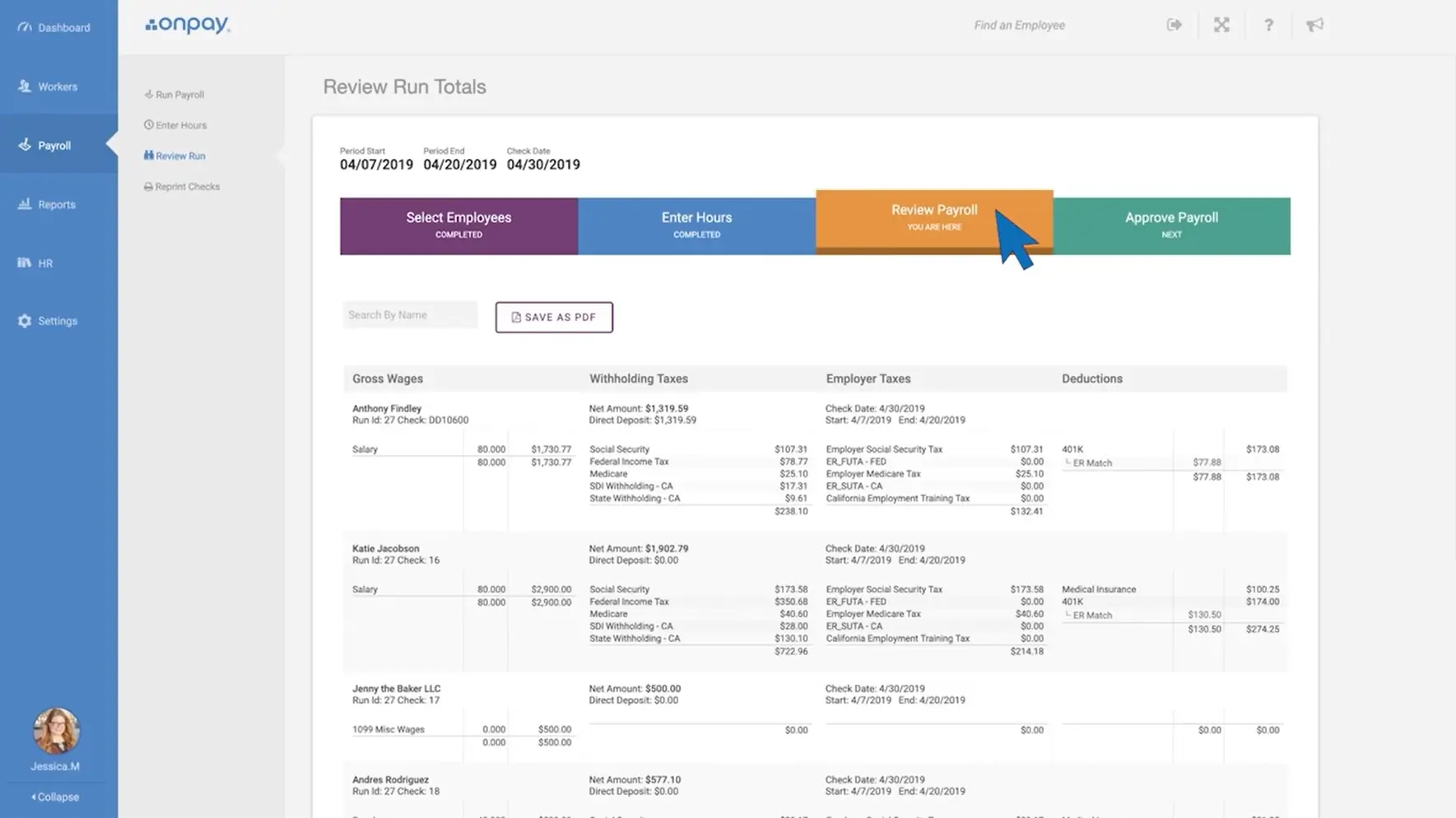

OnPay – Best for simple, all-in-one pricing

OnPay’s philosophy is simple: one plan, one price, every feature. For a flat fee of $40/month + $6 per person, you get everything they offer. This includes full-service payroll in all 50 states, benefits administration, and basic HR tools.

This transparent approach is a breath of fresh air for SMBs who are tired of complex tiers and hidden fees from other payroll service providers. OnPay is also known for its strong support for niche industries, like farms, nonprofits, and churches, which often have unique payroll rules.

Advanced features included

Advanced features included  Flexible and customized packages

Flexible and customized packages - Ease of Use: The platform is straightforward and clean. It’s not as slick as Gusto but is very functional and easy to navigate.

- Customer Support: Consistently receives top marks. Users praise their friendly, expert, US-based support team.

- Verdict: If you want a single, affordable, and predictable price for a full-featured payroll and HR system, OnPay is an outstanding value.

| Pros | Cons |

| + Simple, transparent flat-rate pricing | – Fewer third-party integrations than Gusto |

| + Includes all HR and benefits tools in one plan | – Interface is functional but less modern |

| + Excellent, highly-rated customer support | – Not as scalable for very large or complex teams |

Key Features:

- Payroll: Full-service payroll for all 50 states (no extra fees), multiple pay rates, contractor payments, unlimited pay runs, and automated tax filings.

- HR & Onboarding: Employee self-onboarding, offer letters, document storage, PTO tracking, HR resource library.

- Benefits: Integrated health, dental, vision, 401(k), and workers’ comp.

- Integrations: Connects to QuickBooks, Xero, and some time-tracking apps, but the library is smaller than competitors.

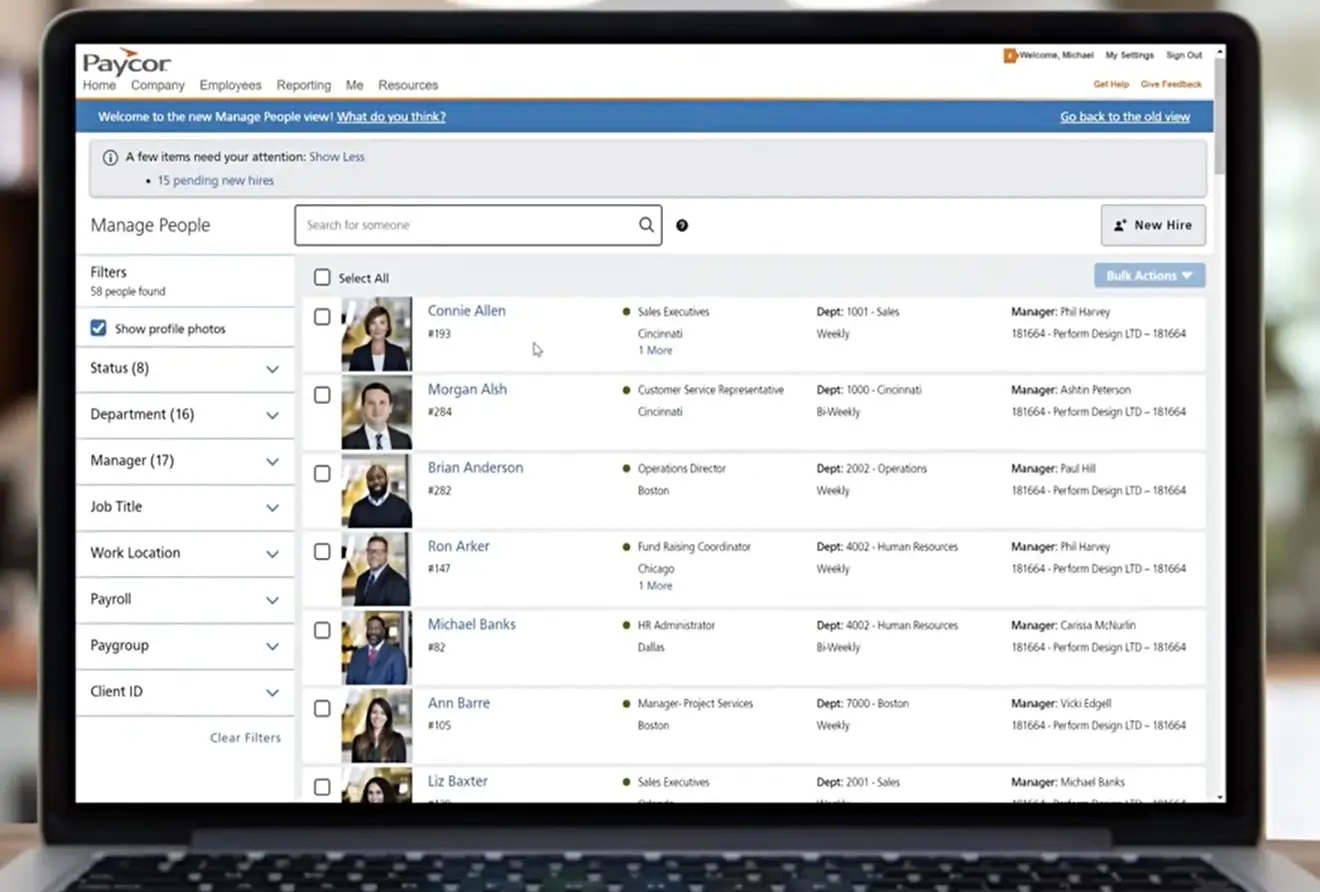

Paycor – Best for growing small to mid-sized businesses

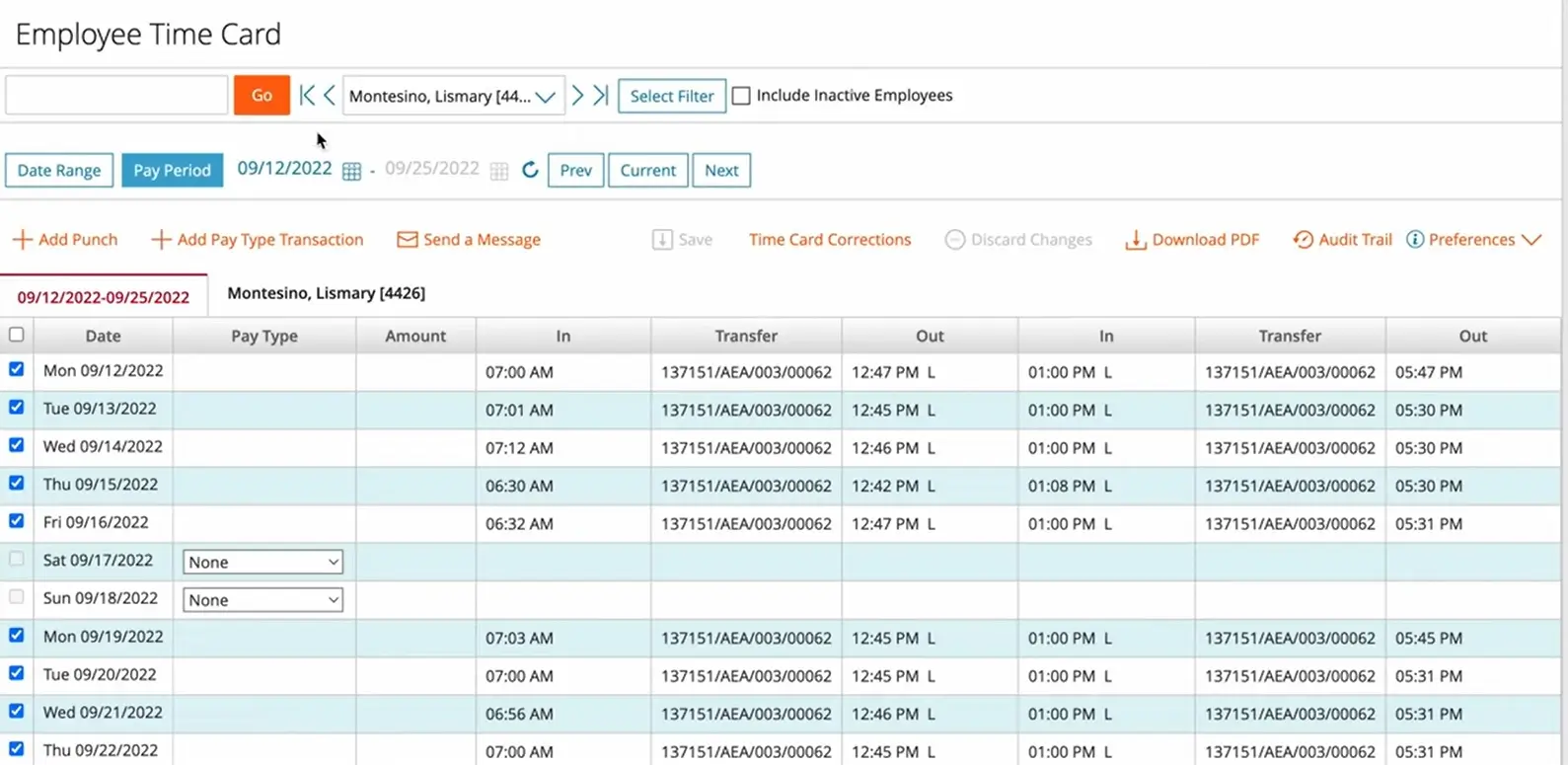

Paycor is a comprehensive Human Capital Management (HCM) solution that unifies payroll, HR, time tracking, and talent management. It’s designed to scale with a growing business, offering robust tools for recruiting, onboarding, and performance management that go beyond basic payroll. It’s particularly strong for businesses with hourly workforces, such as in healthcare, manufacturing, or food service.

All-in-one HR solution for success

All-in-one HR solution for success  Used by 2.5M users & 40K+ businesses

Used by 2.5M users & 40K+ businesses - Ease of Use: Generally considered user-friendly and intuitive. The platform is modern, and the mobile app is functional for both employees and managers. Some users note that switching between different modules can feel a bit disjointed.

- Customer Support: This is the most polarizing aspect of Paycor. Reviews are highly mixed; some users report having a helpful, dedicated support specialist, while many others cite long wait times and difficulty getting issues resolved.

- Verdict: A strong contender if you’re a growing business that wants to manage your entire employee lifecycle, from hiring to retirement, in one system. Its value is less for micro-businesses that just need simple payroll.

| Pros | Cons |

| + Fully integrated HCM suite | – Pricing is not transparent (requires a quote) |

| + Strong talent management & onboarding tools | – Highly inconsistent customer support |

| + Powerful reporting and analytics | – Can be expensive for simple payroll needs |

| + Scales well as your company grows | – Benefits admin & time tracking can be paid add-ons |

Key Features:

- Payroll: Full-service payroll, automated tax calculations and filing (federal, state, local), wage garnishments, on-demand pay, multiple payment options.

- HR & Onboarding: Employee self-service, document storage, applicant tracking (ATS), onboarding, time and attendance, scheduling, compliance tools, performance management.

- Benefits: Benefits administration (often an add-on), ACA reporting.

- Integrations: Connects to 401(k) providers, accounting software, and other HR tools, though its marketplace is smaller than some competitors.

BambooHR – Best for SMBs that prioritize company culture

BambooHR is an HR-first platform (HRIS) that is widely loved for its beautiful, simple, and intuitive design. It excels at centralizing employee records, managing onboarding, tracking time off, and handling performance reviews. Payroll is a paid add-on available only for U.S.-based employees. The philosophy is to make HR tasks easy and engaging for everyone, not just the HR department.

7-day free trial

7-day free trial  Designed for SMBs

Designed for SMBs - Ease of Use: It’s the number one strength. Consistently rated as one of the easiest and most user-friendly platforms on the market for both admins and employees.

- Customer Support: Overwhelmingly positive. Users frequently praise the support team for being friendly, responsive, and genuinely helpful. They offer a dedicated support team for the payroll add-on.

- Verdict: If your primary goal is a modern, easy-to-use system to manage your people, BambooHR is a top-tier choice. Adding its payroll module makes it a full-service (but U.S.-only) solution, though it’s less of a payroll-first system than its competitors.

| Pros | Cons |

| + Market-leading ease of use & clean interface | – Payroll is a paid add-on, not a core feature |

| + Excellent, highly-rated customer support | – Payroll is for U.S.-based employees only |

| + Strong focus on employee experience (onboarding, performance) | – Opaque, quote-based pricing that can get expensive |

| + Great mobile app | – Payroll module integration can be “clunky” at times |

Key Features:

- Payroll: (Add-on) Full-service U.S. payroll, automated federal/state tax filing, direct deposit, W-2/1099 generation. Pulls data from the core HR platform.

- HR & Onboarding: Centralized employee database, employee self-service, applicant tracking system (ATS), new hire onboarding, time-off management, document storage, performance management.

- Benefits: Benefits administration (also a paid add-on) for tracking and open enrollment.

- Integrations: A large marketplace of pre-built integrations with an open API.

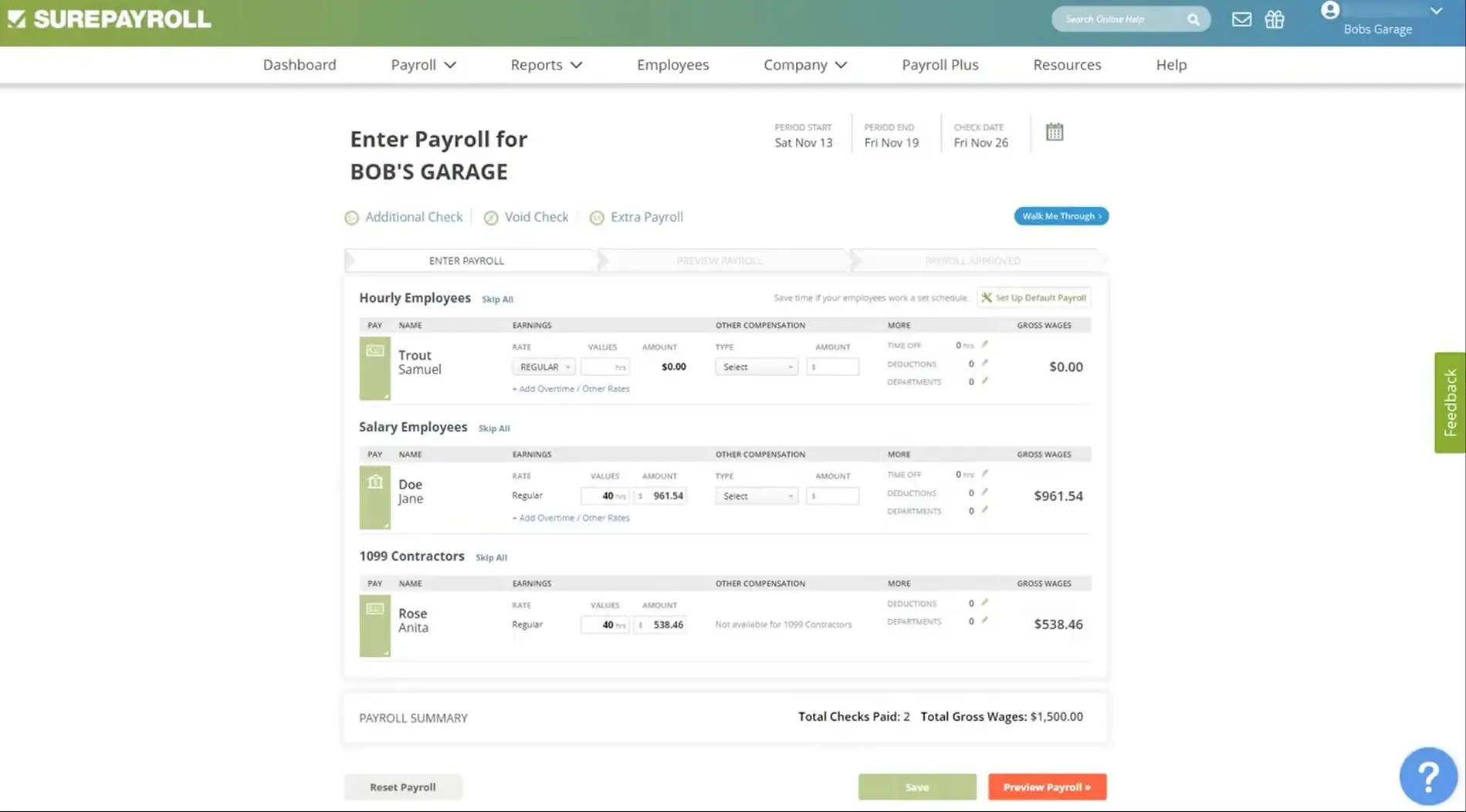

SurePayroll – Best for very small businesses (1-10 employees)

SurePayroll (a Paychex company) is a no-frills, online payroll service built for simplicity and affordability. Its entire focus is on running payroll and filing taxes quickly and correctly. It doesn’t try to be a comprehensive HR suite. It’s a popular choice for micro-businesses, restaurants, and people employing domestic workers who just want the payroll task done.

Payroll made easy for as little as $1 per day

Payroll made easy for as little as $1 per day  Automated payroll for business efficiency

Automated payroll for business efficiency - Ease of Use: Very easy for its core purpose. You can run payroll in just a few clicks online or from the mobile app. The interface is functional but not as modern as others.

- Customer Support: Extremely mixed. While their U.S.-based support is promoted as a key feature, many third-party reviews are highly negative, citing extremely long wait times and an inability to resolve tax or billing issues.

- Verdict: It’s one of the cheapest and most straightforward full-service payroll options available. It’s a great value if you have simple needs, but the gamble on customer support is a significant risk.

| Pros | Cons |

| + Simple, transparent, and affordable pricing | – Extremely mixed (and often poor) customer support reviews |

| + Very easy to use for basic payroll | – Very limited HR features; it’s not an HR suite |

| + Unlimited payroll runs | – Add-on fees for accounting integrations & multi-state filing |

| + Specific plan for household/nanny payroll | – Not scalable for businesses that are growing |

Key Features:

- Payroll: Full-service payroll, automated tax filing (Full Service plan), unlimited pay runs, 2-day direct deposit, contractor payments, mobile app payroll.

- HR & Onboarding: Basic new hire reporting and online paystubs. An HR advisor is available on the Full Service plan.

- Benefits: Can integrate with third-party 401(k) and workers’ comp, but it’s not a benefits admin platform.

- Integrations: Connects to accounting (QuickBooks, Xero) and time-tracking apps, but often for an extra monthly fee.

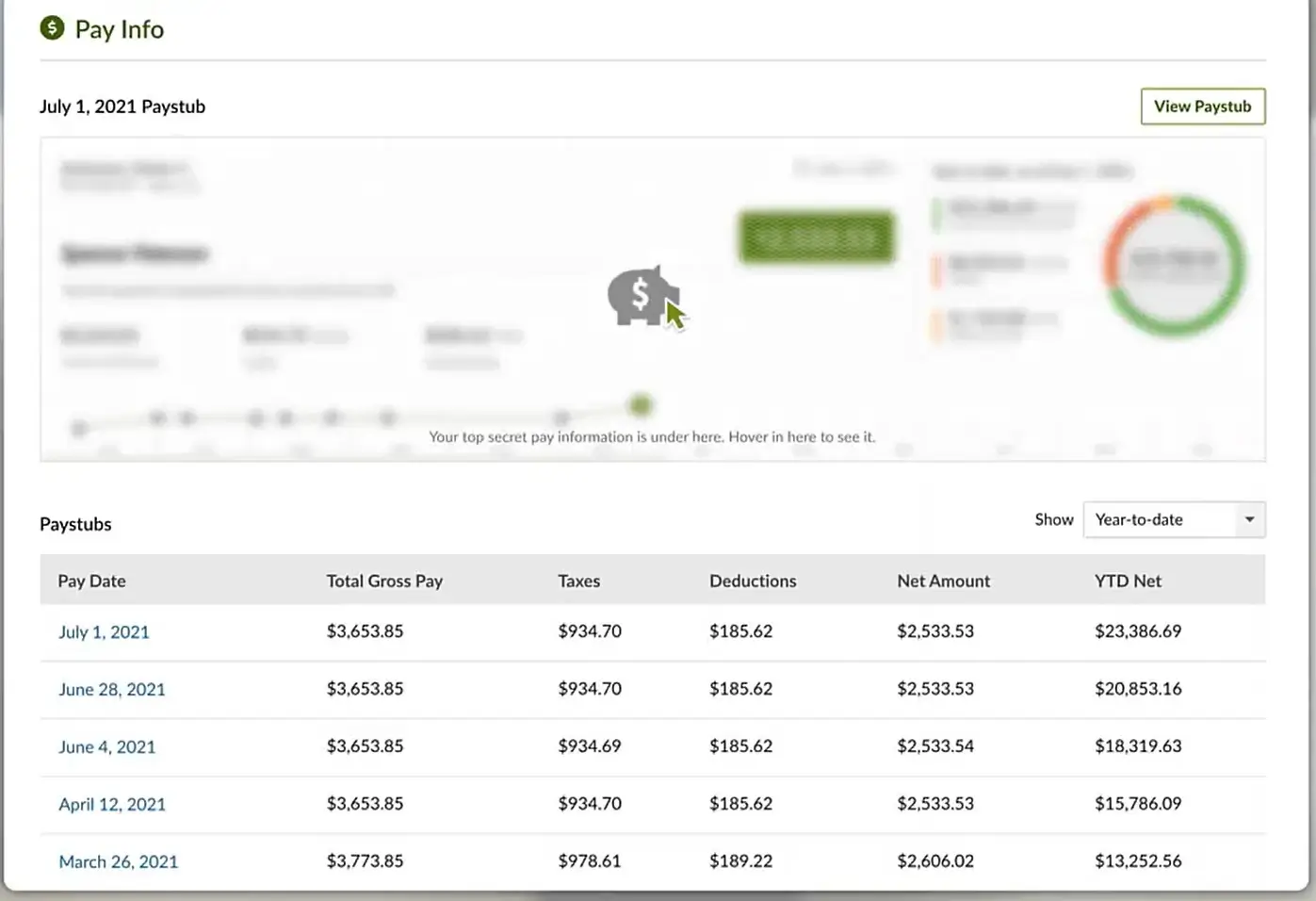

Paylocity – Best for mid-sized companies (50-1,000+ employees)

Paylocity is a direct competitor to Paycor and ADP, offering a robust, unified platform for the entire employee lifecycle. It combines payroll with HR, benefits, time & labor, and a standout talent management suite. A key differentiator is its focus on the employee experience, with built-in tools for peer-to-peer recognition, engagement surveys, and a “Community” social hub.

Award-winning customer service

Award-winning customer service  Seamless international support

Seamless international support - Ease of Use: Widely praised for being user-friendly, especially for such a comprehensive system. The mobile app is a highlight, allowing employees to easily clock in, check pay, and request time off.

- Customer Support: Very mixed, similar to Paycor. Many users love their dedicated support representative, while an equal number of users report inconsistent answers, slow follow-up, and difficulty reaching the right person.

- Verdict: A fantastic choice for a mid-sized company that has outgrown basic payroll and wants a modern, unified system to manage its workforce and build culture. It’s overkill for small businesses.

| Pros | Cons |

| + Fully unified HCM platform | – Opaque, quote-based pricing |

| + Strong employee self-service & mobile app | – Highly inconsistent customer support |

| + Excellent employee engagement & performance tools | – Can be complex to implement (learning curve) |

| + Reliable for complex payroll & tax compliance | – Not for small businesses or global (non-U.S.) payroll |

Key Features:

- Payroll: Full-service payroll and tax filing, on-demand pay, garnishment management, expense management.

- HR & Onboarding: Employee self-service, applicant tracking (ATS), digital onboarding, document storage, time & attendance, scheduling, compliance training (LMS), performance management.

- Benefits: Full benefits administration, including open enrollment and ACA compliance.

- Integrations: A large marketplace with over 300 pre-built integrations, plus an open API for custom connections.

Rippling – Best for scalability and IT integration

Rippling is much more than a payroll company. It’s a “Workforce Management Platform” that unifies Payroll, HR, and even IT. Its modular approach is its superpower. You start with the core platform and payroll, then add on other modules as you need them: benefits, time tracking, recruiting, and even device management (like shipping and setting up a new hire’s laptop).

This makes it incredibly scalable. It’s simple enough for a 10-person startup but powerful enough to manage a 1,000-person global company.

Automatic compliance and tax-filing

Automatic compliance and tax-filing  Built for all sizes, from small businesses to large

Built for all sizes, from small businesses to large - Ease of Use: Modern and powerful, but there’s a steeper learning curve than Gusto due to its sheer number of features.

- Customer Support: Support is generally responsive, but because the platform is so broad, you may be routed to different specialists.

- Verdict: If you are a fast-growing company and want a single platform to manage everything about an employee (from their paycheck to their laptop), Rippling is in a class of its own.

| Pros | Cons |

| + Extremely scalable modular platform (HR + IT + Finance) | – Pricing is quote-only and can be complex |

| + Powerful automation and global payroll capabilities | – Can be overkill for very small businesses |

| + Unifies employee management in one place | – Steeper learning curve than simpler tools |

Key Features:

- Payroll: Full-service global payroll (US & international), automated tax filing, unlimited pay runs, direct deposit.

- HR & Onboarding: Customizable onboarding workflows, document management, PTO tracking, learning management.

- Benefits: Integrated benefits (health, 401(k)) with global support.

- IT Management: App provisioning (auto-setup for Slack, Google Workspace) and device management.

- Integrations: 500+ integrations, making it a central hub for all your business apps.

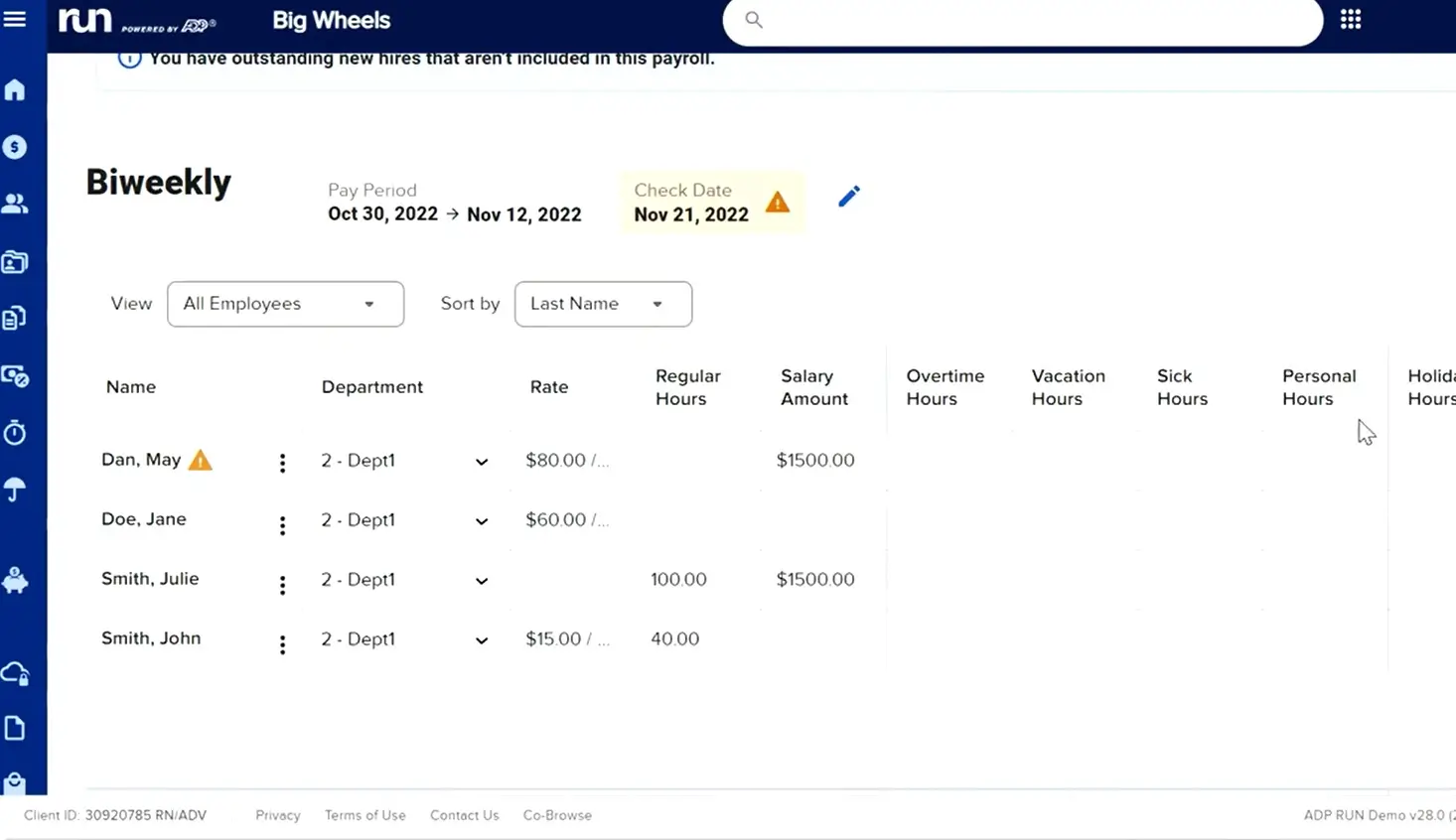

ADP – Best for Enterprises

ADP is one of the oldest and largest names in payroll, and that experience shows. RUN Powered by ADP is their platform built for small businesses (typically under 50 employees). Its biggest strength is its robust tax and compliance engine. They have specialists who understand the weeds of payroll law in every state.

ADP also offers a huge ecosystem of add-ons, including top-tier HR support, retirement plans, and insurance. It’s a traditional, comprehensive solution for businesses that want to ensure payroll is done right, backed by 24/7 support.

Award-winning payroll & HR software

Award-winning payroll & HR software  Variety of packages for your business needs

Variety of packages for your business needs - Ease of Use: The interface is professional and capable, but can feel more “corporate” or dated compared to Gusto.

- Customer Support: A key selling point. They offer 24/7/365 live support, which is critical when you have a payroll emergency.

- Verdict: If your primary concern is compliance, you have complex payroll needs (garnishments, multi-state), or you value the peace of mind of 24/7 expert support, ADP is a rock-solid choice.

Key Features:

- Payroll: Full-service payroll and tax filing, multi-state support, wage garnishment processing, direct deposit, and paper check options.

- HR & Onboarding: New hire reporting, employee handbook wizard, background checks (in higher tiers).

- Benefits: Full-service benefits, workers’ comp, and 401(k) plans.

- Integrations: Large marketplace of integrations with accounting, POS, and time-tracking software.

How much do payroll services cost?

Payroll services vary in pricing based on features and company size. Here’s a general breakdown:

General Pricing:

- Basic Payroll Plans: $20 – $50/month + $4 – $10 per employee.

- Mid-Tier Plans (HR + Payroll Integration): $40 – $100/month + $5 – $15 per employee.

- Enterprise Payroll Solutions: Custom pricing, often exceeding $100/month.

Extra Fees to Watch For:

- Setup Fees – Some providers charge a one-time fee for account setup.

- Tax Filing Fees – Certain plans charge extra for federal and state tax filings.

- Year-End Reporting Fees – Some services charge additional W-2 and 1099 filing fees.

Typical features included in payroll software:

Payroll Processing: Automatically calculate pay based on hours worked, including different rates such as overtime, bonuses, and commissions.

Must-Have Features:

- Full-Service Automated Tax Filing: The payroll system must calculate, pay, and file your federal, state, and local payroll taxes. This is non-negotiable.

- Direct Deposit: Employees expect this. The software should handle it for free or a low cost.

- W-2/1099 Generation: At year-end, it must create and distribute these forms to your team and file them with the IRS/SSA.

- Employee Self-Service Portal: A secure site where employees can see their pay stubs, update their bank info, and get their W-2s. This saves you countless hours.

- Accounting Integration: A native sync with your accounting software.

Nice-to-Have Features:

- New-hire reporting (automates reporting to the state).

- Garnishment processing.

- Tip pooling and reporting (critical for restaurants).

- Job costing (assigning labor hours to specific projects).

- A high-quality mobile app for admin and employees.

Your Buyer Checklist:

Before you demo any product from any payroll service companies, have these answers ready:

- Headcount: How many W-2 employees? How many 1099 contractors?

- Locations: In which states do your employees live and work?

- Pay Schedules: Weekly, bi-weekly, semi-monthly?

- Benefits: What do you offer? (Health, 401(k), HSA, etc.)

- Current Stack: What accounting, time-tracking, or HR tools do you use?

Who uses payroll software?

Payroll software is used by a wide range of entities that need to manage and process employee payments, including:

- Small Businesses: Small business owners often use payroll software to simplify the complexities of paying employees, ensuring taxes and deductions are handled correctly without needing a dedicated payroll department.

- Medium to Large Enterprises: Larger organizations utilize a more robust payroll company to handle a greater volume of payroll processing and to manage additional complexities such as multiple departments, varying employee benefits, and compliance with diverse regulatory requirements.

- Accounting Firms: Many accounting professionals use payroll software on behalf of their clients, providing payroll services as part of a broader suite of accounting and financial management services.

- Non-Profits: Non-profit organizations also benefit from payroll software to manage their often diverse types of compensation structures and to maintain compliance with specific tax exemptions and reporting requirements.

- Government Agencies: Public sector entities use specialized payroll systems to manage their unique needs, such as civil service rules, union contracts, and government-specific payroll regulations.

- Startups: Fast-growing startups use payroll software to handle rapid changes in their workforce, including new hires and changes in compensation structures as the company grows.

Types of top payroll software & services

Many types of payroll software and services are available that cater to different business needs, sizes, and complexities. Here are some of the top types:

- Cloud-Based Payroll Software: These services are hosted on the provider’s servers and can be accessed from anywhere with an internet connection. Examples include Gusto, ADP, and Paychex Payroll. They’re popular due to their flexibility, scalability, and the fact that they often receive automatic updates and enhancements.

- On-Premises Payroll Software: This type of software is installed on a company’s own computers and servers. Examples include Sage Payroll. It gives businesses control over the security and management of their data but requires more in-house IT support.

- Full-Service Payroll Providers: These services handle virtually all aspects of payroll on behalf of the business, including calculating pay, filing taxes, and managing employee data. ADP and Paychex are well-known providers that offer comprehensive payroll services along with HR and compliance support.

- Freelancer and Contractor-Focused Payroll Services: Some platforms are designed specifically for businesses that primarily deal with freelancers and contractors, rather than full-time employees. These include services like Connecteam Payroll, which can handle both types of workers but has features particularly beneficial for managing contract labor.

- Integrated HR and Payroll Systems: These are comprehensive platforms that combine payroll functions with other HR processes like recruitment, onboarding, and benefits management. BambooHR and Zenefits are examples of providers that offer integrated solutions.

- Industry-Specific Payroll Software: Certain industries have unique payroll needs and regulations, and some payroll systems are tailored to meet these requirements. For instance, construction payroll software might include features for handling union reporting and prevailing wage rates.

How often does a typical business run payroll and why?

A business typically runs payroll regularly, such as weekly, bi-weekly, or monthly. The frequency of payroll runs depends on the policies and procedures of the specific business, as well as any legal requirements. Additionally, some businesses are legally required to run payroll at certain intervals to comply with state and federal tax laws.

Payroll software vs. payroll service

| Aspect | Payroll Software | Payroll Service |

| Description | A program purchased and run by businesses on their own systems. | Provided by specialized companies handling all payroll aspects. |

| Control | High control over the payroll process allows customization to fit specific business needs. | Less control as the service handles all aspects of payroll. |

| Operation | Businesses manage payroll tasks internally, including tracking hours, calculating pay, and generating tax forms. | The service provider manages payroll, including calculations, paycheck generation, and tax filings. |

| Cost | Initial purchase costs potentially lower overall long-term costs due to the absence of ongoing service fees. | Recurring service fees, which may be higher over time but offset by reduced internal administrative costs. |

| Compliance Support | Users are responsible for ensuring compliance with tax laws and regulations. | Service providers often have specialized experts to ensure compliance, reducing the risk of errors and penalties. |

| Focus | Allows businesses to tailor the payroll process but requires more internal resources. | Lets businesses focus more on core activities rather than payroll management. |

| Expertise Required | Requires internal expertise to manage and operate effectively. | External expertise provided is beneficial for businesses without in-house payroll expertise. |

| Integration with Other Systems | May require integration with other business systems, which can be technically challenging. | Typically handles integration as part of their services, easing setup and maintenance. |

| Scalability | May require additional licenses or upgrades as business grows. | Service scales with business growth; fees adjusted based on changes in employee numbers. |

| Customer Support | May offer limited support compared to payroll services. | Typically offers comprehensive support as part of their package, beneficial for navigating complex payroll issues. |

Payroll software and payroll services are both options for managing employee pay and taxes, but they have some key differences. Payroll software gives businesses more control over their payroll process, while payroll services take on the responsibility of payroll processing and compliance.

Payroll software is a program that businesses can purchase and run on their own computers. It allows the business to track employee hours, calculate pay and taxes, and generate paychecks and tax forms. The advantage of using payroll software is that the business has complete control over the payroll process and can customize the software to fit their specific needs. Additionally, businesses can save money in the long run by not having to pay for ongoing service fees.

Payroll services are provided by companies that specialize in payroll processing. These companies handle all aspects of payroll, including calculating pay and taxes, generating paychecks and tax forms, and ensuring compliance with federal and state regulations. The advantage of using a payroll service is that the business doesn’t have to worry about handling payroll in-house, and can instead focus on running their business. Additionally, the company that provides the payroll service may have specialized experts that can help you with compliance and tax laws.

Integrations that matter for your payroll management system

A payroll management system that doesn’t talk to your other tools is just a data silo. Integration is how you stop “garbage in, garbage out.”

- Accounting (Essential): A native, API-level sync with your cloud accounting software is the most important. When you run payroll, all the journal entries (wages, taxes) should post to your general ledger automatically.

- HRIS/Time/Point-of-Sale (POS): For restaurants and retail, this is a must. Your payroll system must sync all employee hours and tips directly from your POS or time-tracking tool to avoid hours of manual entry.

- Expense and Benefits: Syncing with expense tools for reimbursements or with your benefits broker ensures deductions are 100% accurate.

Conclusion

Choosing your payroll software is a foundational decision for your business. Moving off spreadsheets and automating your payroll processing, tax filing, and compliance is one of the best investments you can make.

- For all-around ease of use and modern HR features, Gusto is our top pick.

- For unbreakable accounting sync, QuickBooks Payroll is the clear winner for QBO users.

- For ultimate simplicity and transparent pricing, OnPay delivers incredible value.

- For fast-growing, complex, or tech-centric businesses, Rippling is the scalable platform of the future.

- For businesses that demand deep compliance and 24/7 support, ADP and Paychex remain trusted, powerful options.

Selecting the best payroll software is a crucial step in enhancing your company’s efficiency, compliance, and overall payroll management. With so many options available, finding a solution that aligns with your business size, operational needs, and budget can make all the difference. Whether you’re looking to automate tax filings, streamline employee payments, or simplify benefits administration, each payroll provider offers unique advantages tailored to different business requirements.

We hope this comparison has given you clarity and confidence in making an informed decision. The best payroll software doesn’t just ensure timely and accurate employee payments—it also helps you stay compliant with ever-changing payroll regulations, reducing administrative burden and giving you peace of mind.

As your business grows, so do your payroll needs. Investing in a scalable, reliable, and feature-rich payroll solution will ensure smooth operations today and continued success in the future. Choose wisely, and empower your business with a payroll system that works as hard as you do!