Credit Card Processing Fees: What Small and Midsize Businesses Should Know in 2025

Small and midsize business owners know better than anyone – every dollar matters. You watch your margins, negotiate with suppliers, and carefully price your products or services to stay competitive. But there’s one expense that often feels like a quiet thief in the night—credit card processing fees. You see them in your statement, maybe you groan about them, but they’re just “part of doing business,” right? Let’s talk about what they really mean for you, your cash flow, and how you can fight back.

What are Credit Card Processing Fees?

Imagine this: A customer walks into your store, swipes their card for a $100 purchase, and leaves happy. You, however, don’t actually see all $100 hit your bank account. Instead, depending on your processor, you might end up with something like $97.50—or less.

A few bucks may not seem like much, but multiply that by hundreds or thousands of monthly transactions, and suddenly you’re losing thousands of dollars a year in processing fees. That’s rent money. Payroll. Inventory.

The worst part? Many business owners don’t even know exactly how much they’re paying in fees, or why the rates fluctuate. The system is intentionally complicated, and if you don’t pay attention, it’s easy to lose money without even realizing it.

Breaking Down Credit Card Processing Fees (a.k.a. Where Your Money Really Goes)

There are a few hands reaching into your pocket with every credit card swipe:

- Interchange fees—These are the fees charged by the bank that issued the customer’s credit card. Visa, Mastercard, and others set these rates, which usually range from 1.15% to 3.5% per transaction.

- Assessment fees go to the credit card network (Visa, Mastercard, etc.). It’s usually around 0.14%.

- Processor markup – This is what the payment processor (Square, Stripe, PayPal, etc.) charges for handling the transaction. It varies widely depending on your pricing plan.

But those aren’t the only fees you might encounter. You might also run into:

- Transaction fees – A small charge per transaction, either as a percentage of the sale or a flat fee, depending on your processor.

- Monthly fees – Some processors charge a monthly subscription or account fee for access to their payment network and support services.

- Terminal or equipment fees – If you use a physical card reader, POS system, or mobile payment device, you may pay rental or purchase costs.

- Payment gateway fees – If you accept payments online, you may need a payment gateway (like Authorize.net), which comes with additional costs.

- Chargeback fees – When a customer disputes a charge and requests a refund, you’ll often be charged a $15–$25 fee per dispute, even if you win.

- Early termination or cancellation fees – If you break your contract with a payment processor early, you may face a hefty cancellation penalty.

Together, these fees mean that for every $1,000 in sales, you might only take home $970–$985 (between $15 and $30 in fees). And those numbers add up fast.

How Much Do Credit Card Processors Charge Merchants?

Each processor has its quirks, and choosing the right one depends on how your business operates. There are two main pricing models for credit card processing: flat-rate pricing and interchange-plus pricing.

Let’s examine how each model works and which one might be the best fit for your business.

Flat-Rate Processors:

Flat-rate pricing means you pay a fixed percentage plus a small per-transaction fee, regardless of the type of credit card used. Square, PayPal, and Stripe are well-known examples.

Pros:

- Simple, predictable pricing with no surprises

- No need to worry about interchange rates fluctuating

- Easy to set up with no complex contracts or negotiations

Cons:

- Often more expensive for businesses with high sales volume

- No transparency on actual interchange costs—you pay the same whether it’s a debit card or a premium rewards card (which has a lower underlying cost)

- Fees stack up quickly for businesses with large transactions

Who is it best for? Small businesses with lower sales volume, startups, and businesses that value simplicity over the lowest possible cost.

Interchange-Plus Pricing:

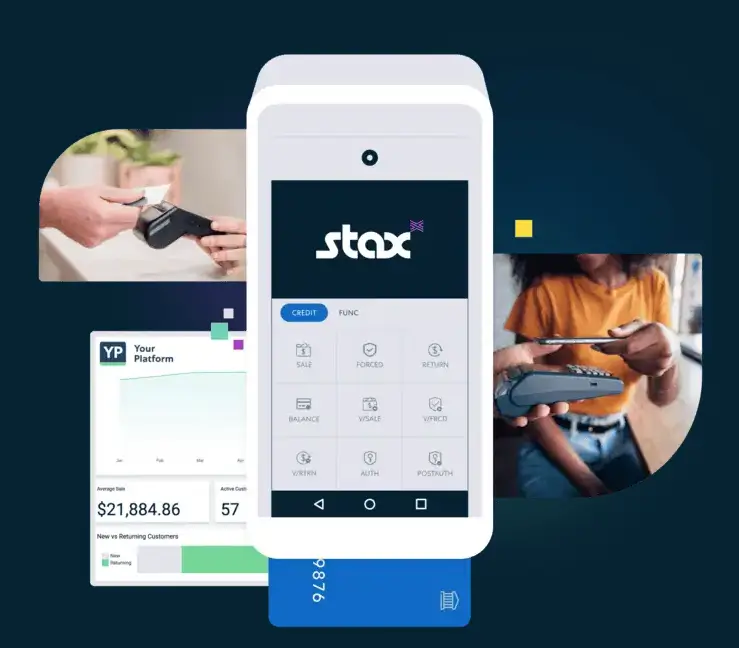

With interchange-plus pricing, you pay the actual interchange fee set by the credit card networks plus a small markup from the processor. Helcim and Stax operate on this model.

Pros:

- More cost-effective for businesses processing high volumes

- Full transparency—you see exactly how much of your fee goes to the bank vs. the processor

- The markup is usually lower than flat-rate pricing

Cons:

- More complex—fees vary based on the type of card and transaction

- Requires monitoring and comparison shopping to ensure you’re getting the best deal

- Some processors have monthly fees (e.g., Stax charges a $99/month subscription fee, which only makes sense if you process high volumes)

Who is it best for? Businesses with high transaction volume, those willing to monitor their statements, and those looking for the most cost-effective option.

Here’s a breakdown to give you a sense of how different payment processors stack up:

|

Payment Processor |

Pricing Structure |

In-Person Fees |

Online Fees |

|

Flat-rate |

2.7% |

2.9% + 30¢ |

|

|

Square |

Flat-rate |

2.7% + 5¢ |

2.9% + 30¢ |

|

Stripe |

Flat-rate |

2.7% + 5¢ |

2.9% + 30¢ |

|

PayPal |

Flat-rate |

2.29% + 9¢ |

2.59%–2.99% + 49¢ |

|

Helcim |

Interchange-plus |

Interchange + 0.50% + 25¢ |

Interchange + 0.50% + 25¢ |

|

Stax |

Subscription + Interchange-Plus |

$99/month + Interchange + 8¢ |

$99/month + Interchange + 15¢ |

Which Processor Should You Choose?

The best pricing model depends on how much you process in credit card transactions and how involved you want to be in managing your fees. Here’s a cost breakdown based on different business scenarios:

If you process less than $10,000/month:

A flat-rate processor like Square or PayPal might be easier and more predictable.

- Example: You own a boutique and process $10,000 per month. With Square at 2.6% + 10¢ per transaction, your fees would be $260 + transaction fees, meaning you take home about $9,740.

- Best for: Small businesses with lower sales volume that prioritize convenience and predictability over cost savings (boutiques, coffee shops, independent artisans).

If you process more than $10,000/month:

Switching to an interchange-plus pricing model like Helcim or Stax can save you money over time.

- Example: You own a busy café that processes $20,000 per month. With Helcim’s interchange + 0.40% + 8¢ per transaction, you might pay around $200–$250 in fees instead of a flat $520 with Square.

- Best for: Growing businesses that want more transparency and lower fees with a little more management effort (restaurants, mid-sized retail stores, service-based businesses like salons).

If you process $50,000+/month:

A subscription-based model like Stax can significantly reduce costs.

- Example: Your consulting firm invoices $50,000+ per month. With Stax, you pay a flat $99/month + interchange fees instead of percentage-based pricing. If your interchange rates are 1.8% on average, your total fees might be around $999, saving you over $500 compared to Square.

- Best for: High-volume businesses that want to minimize per-transaction fees and can handle a monthly subscription (corporate consultants, e-commerce businesses, medical practices).

Not sure where you fall?

Start with a flat-rate processor for simplicity, and switch to interchange-plus once your sales volume justifies the extra effort. Whatever you do, don’t assume you’re getting the best deal—review your statements, shop around, and negotiate when possible.

How to Pay Less in Credit Card Fees

The big question: How do you avoid getting eaten alive by fees? Here are a few strategies that can make a real impact:

1. Negotiate your rates

Not all fees are set in stone. If you process a lot of transactions, you can call your payment processor and negotiate lower rates. Processors want to keep your business, and many are open to adjusting fees if they think you’ll switch to a competitor.

2. Pass fees to customers (the right way)

Some businesses charge a small convenience fee for credit card payments or offer a cash discount. Just make sure you’re following local laws and credit card network rules—Visa and Mastercard have specific guidelines about surcharges.

3. Choose the right processor for your business model

If you have a high transaction volume, interchange-plus pricing is often cheaper than flat-rate models. If you’re a smaller operation with unpredictable sales, a flat-rate processor might be easier to manage, even if it’s slightly more expensive per transaction.

4. Reduce chargebacks

Chargebacks aren’t just a hassle—they come with fees. Avoid disputes by making clear return policies, training employees to verify transactions, and using fraud prevention tools.

5. Encourage alternative payment methods

Encouraging debit card payments, ACH transfers, or even peer-to-peer payments (like Venmo for Business) can help you avoid some of the higher credit card fees.

Related Articles

The Bottom Line on Merchant Credit Card Fees

Credit card processing fees don’t have to be an unavoidable drain on your business. With the right strategy, you can take control, cut unnecessary costs, and put that money back where it belongs—in your business.

Business owners and operators work too hard to let fees quietly eat away at their success. Because in small business, every dollar counts—and those “tiny” fees? They’re bigger than they seem. So next time you see that mystery deduction on your merchant statement, don’t just shrug it off. Ask yourself: How much am I really paying? And how can I keep more of it?

By taking a proactive approach, you can make every transaction work in your favor—boosting profits and strengthening your business for the long run.