Best Credit Card Payment Apps of 2026: Compare Top Brands

Looking for the best credit card payment app for your business? Whether you sell in-store, online, or on the go, the right solution helps you accept payments easily, lower fees, and improve checkout. Compare Square, Clover, Helcim, Stax, Shopify POS, PayPal, Google Pay, and Apple Pay by pricing, features, and business fit.

Accepting credit card payments shouldn’t be complicated or expensive. Whether you’re a retailer, online seller, freelancer, or enterprise business, having the right credit card payment app can help you serve customers better, keep costs predictable, and streamline your operations.

In this page, I break down the top credit card payment apps for 2026, based on pricing, functionality, platform support, and the real-world needs of businesses like yours.

What Is a Credit Card Payment App?

A credit card payment app is software that enables businesses to accept payments via mobile device or tablet, whether using a card reader, tap-to-pay functionality, or an integrated e-commerce checkout. These apps often support in-person sales, contactless payments (NFC), invoicing, and integrations with POS or accounting systems.

What to Look for in a Payment App

Before you choose a provider, evaluate apps based on these key features:

-

Pricing model: Flat-rate vs. interchange-plus vs. subscription

-

Device & platform compatibility: iOS, Android, web access

-

Supported payments: Chip, tap, swipe, Google Pay, Apple Pay, ACH

-

POS and inventory tools: Real-time reporting, customer profiles

-

Integration: Sync with your e-commerce store, CRM, or accounting software

-

Security: PCI-DSS compliance, tokenization, fraud detection

Best Credit Card Processing Apps of 2026

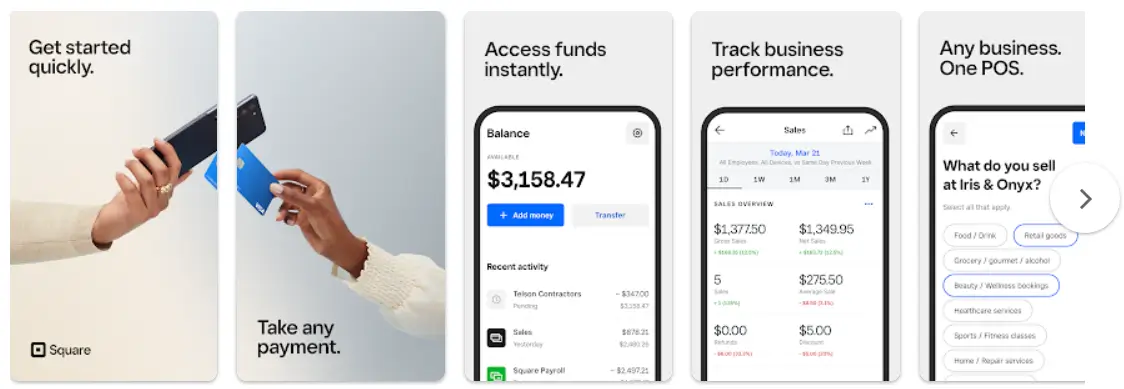

1. Square – Best All-in-One POS for Small Businesses

Square offers a versatile point-of-sale (POS) system that caters to various business types. It supports multiple payment methods, including credit/debit cards, mobile wallets, and contactless payments. Square’s transparent pricing and user-friendly interface make it an excellent choice for small businesses.

Simple price structures

Simple price structures  Many payment options available

Many payment options available Key Features:

-

Supports EMV chip cards, magstripe, and NFC payments.

-

Free POS software with inventory management and sales analytics.

-

Integration with e-commerce platforms and third-party apps.

-

Transparent flat-rate pricing.

Pros:

-

Free POS app

-

Low-cost card readers

-

Great for retail, food trucks, and services

-

Seamless inventory tools

Cons:

-

Flat-rate pricing might get expensive at scale

-

Limited customer support hours

Ideal For: Retailers, food trucks, service providers, and small businesses seeking an integrated POS solution.

2. Clover – Best for Customizable POS Hardware and Software

Clover provides a range of POS hardware options and a customizable software platform suitable for various business sizes. Its cloud-based system allows for real-time data access and management.

Payments as low as 2.3% +10¢/transaction

Payments as low as 2.3% +10¢/transaction  Fraud protection up to $100,000

Fraud protection up to $100,000 Key Features:

-

Multiple hardware options, including handheld and countertop devices.

-

Customizable POS software with app marketplace for additional features.

-

Supports EMV, NFC, and mobile wallet payments.

-

Robust reporting and inventory management tools.

Pros:

-

Multiple hardware options

-

Customizable POS apps

-

Ideal for restaurants and retail stores

Cons:

-

Higher upfront hardware costs

-

Tied to specific merchant service providers

Ideal For: Businesses requiring tailored POS solutions with scalable hardware and software options.

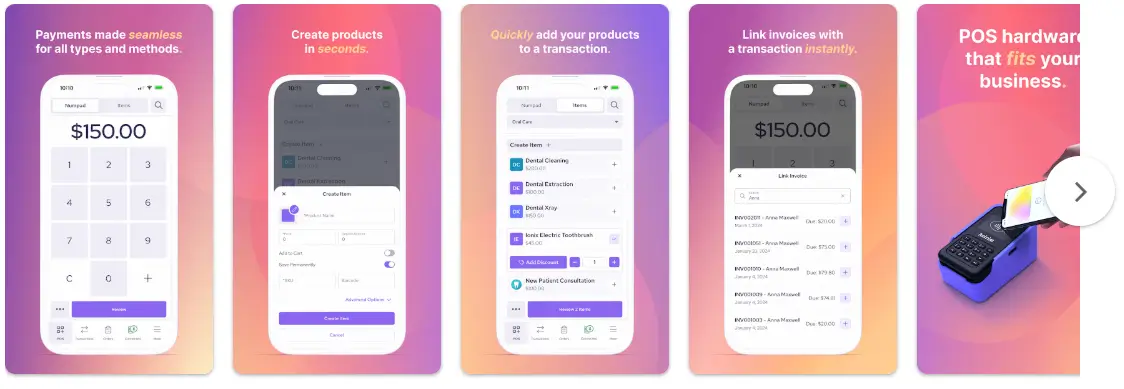

3. Helcim – Best for Transparent Pricing and High-Volume Merchants

Helcim offers transparent interchange-plus pricing with no monthly fees, making it cost-effective for businesses with higher transaction volumes. It provides comprehensive tools for both in-person and online payments.

No contracts. No monthly fees.

No contracts. No monthly fees.  Comprehensive customer management system

Comprehensive customer management system Key Features:

-

Interchange-plus pricing model with volume-based discounts.

-

Integrated POS system with inventory management and customer profiles.

-

Supports EMV, NFC, ACH, and mobile wallet payments.

-

Virtual terminal and invoicing capabilities.

Pros:

-

Transparent pricing (no monthly fees)

-

Built-in POS and invoicing

-

Excellent for scaling operations

Cons:

-

Approval process can take time

-

Card reader is more expensive

Ideal For: Established businesses and high-volume merchants seeking transparent fees and comprehensive payment solutions.

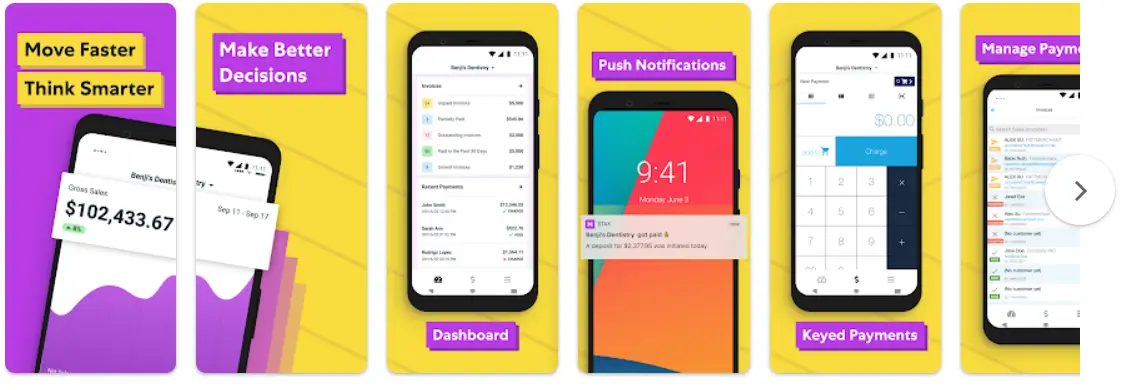

4. Stax – Best for Subscription-Based Pricing and Large Businesses

Stax provides a subscription-based pricing model with zero markup on interchange fees, benefiting businesses with substantial monthly sales. It offers advanced reporting and integration capabilities.

0% markup payment processing with flat fees

0% markup payment processing with flat fees  Savings of up to 40% monthly

Savings of up to 40% monthly Key Features:

-

Flat monthly fee with no per-transaction markup.

-

Advanced analytics and reporting tools.

-

Integration with various business software, including accounting and CRM systems.

-

Supports EMV, NFC, ACH, and mobile wallet payments.

Pros:

-

Predictable, flat-rate pricing

-

Detailed analytics and integrations

-

Great for growing or enterprise-level businesses

Cons:

-

Not cost-effective for low-volume businesses

-

Setup can be more technical

Ideal For: Large businesses and enterprises with high transaction volumes seeking predictable costs.

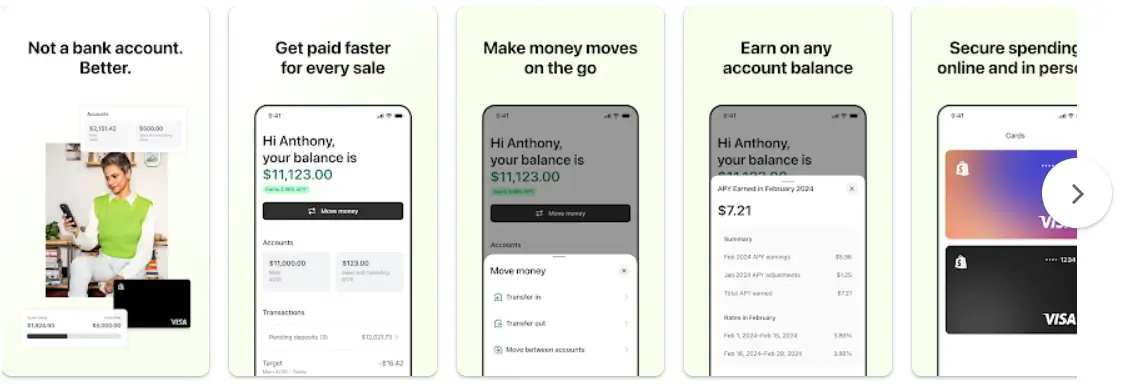

5. Shopify – Best for E-Commerce and Retail Integration

Shopify offers a unified platform for online and in-person sales, making it ideal for businesses operating both e-commerce stores and physical locations. Its POS system integrates seamlessly with its online store platform.

Process digital wallets & popular payments

Process digital wallets & popular payments  Personalize marketing to boost loyalty

Personalize marketing to boost loyalty Key Features:

-

Integrated e-commerce and POS system.

-

Supports various payment methods, including credit/debit cards and mobile wallets.

-

Inventory and customer management across online and offline channels.

-

Customizable checkout experiences and third-party app integrations.

Pros:

-

Seamless online + offline sync

-

Great mobile app experience

-

Integrates with Shopify Payments

Cons:

-

Monthly fee required

-

Some hardware is proprietary

Ideal For: Retailers and businesses with both online and brick-and-mortar operations seeking a cohesive sales platform.

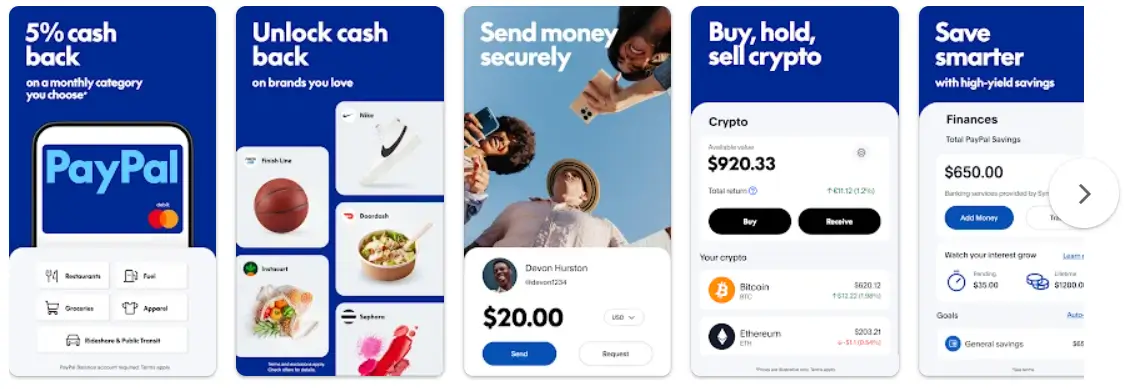

6. PayPal – Best for Online Payments and Global Reach

PayPal is a widely recognized payment platform offering solutions for online transactions, invoicing, and mobile payments. Its global presence makes it suitable for businesses targeting international customers.

Key Features:

-

Easy integration with e-commerce platforms and websites.

-

Supports multiple currencies and international transactions.

-

Offers PayPal Here for in-person payments with mobile card readers.

-

Provides buyer and seller protection programs.

Pros:

-

Instant payouts with PayPal Balance

-

Invoicing and ecommerce tools

-

Great for international transactions

Cons:

-

Higher per-transaction fees

-

Limited customer support for disputes

Ideal For: Online businesses and merchants seeking a trusted global payment solution.

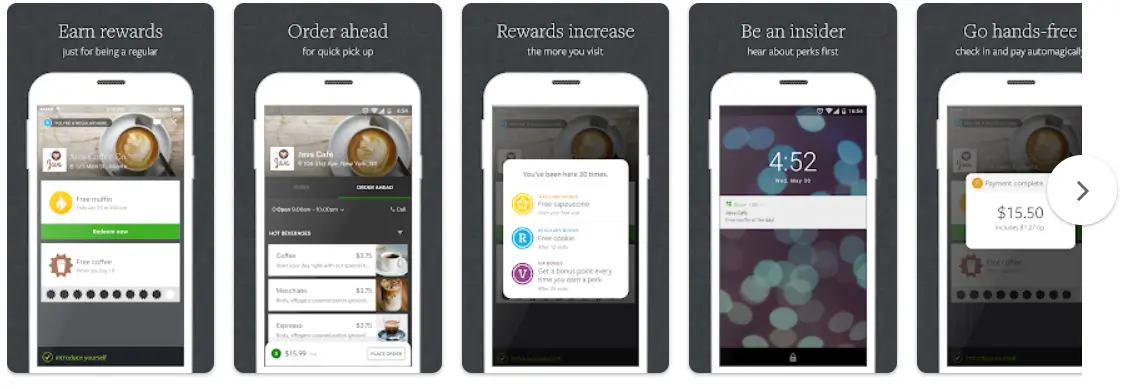

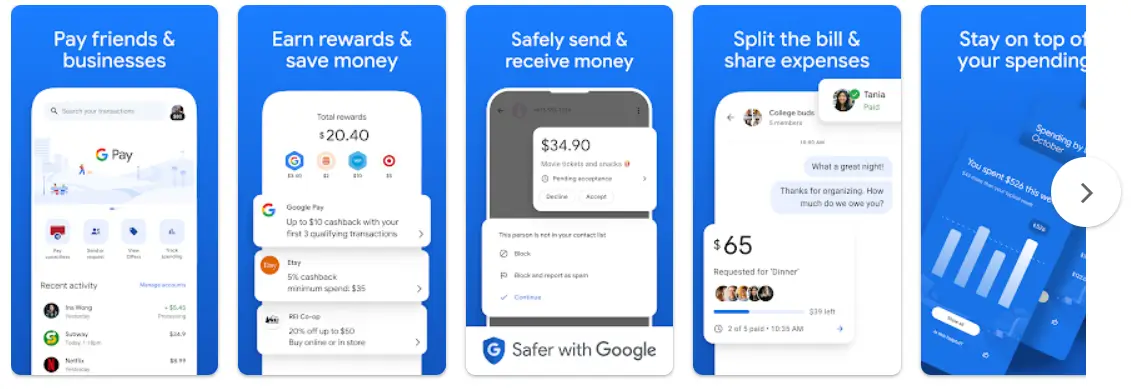

7. Google Pay – Best for Android Users and Contactless Payments

Google Pay enables users to make secure, contactless payments using their Android devices. It’s a convenient option for businesses looking to cater to Android users.

Key Features:

-

Supports NFC-based contactless payments.

-

Integrates with loyalty programs and offers.

-

Allows storage of multiple payment methods.

-

Enhanced security with tokenization and biometric authentication.

Pros:

-

No additional fees to accept payments

-

Fast, secure checkout experience

-

Loyalty program integration

Cons:

-

Limited control over backend

-

Only available on Android devices

Ideal For: Businesses aiming to provide seamless payment options for Android users.

8. Apple Pay – Best for iOS Users and Secure Transactions

Apple Pay offers a secure and private way to make payments using Apple devices. Its integration with the Apple ecosystem provides a smooth user experience.

Key Features:

-

Facilitates contactless payments via NFC technology.

-

Supports in-app and online purchases.

-

Utilizes Face ID, Touch ID, and passcode for authentication.

-

Offers Apple Card integration with cashback rewards.

Pros:

-

High security with biometrics

-

Great for in-app or browser-based purchases

-

No fees from Apple

Cons:

-

Only available to iOS users

-

Requires NFC-compatible terminal

Ideal For: Businesses targeting customers within the Apple ecosystem seeking secure payment options.

Quick Comparison Summary

A full-featured comparison table for all eight providers is available above in the spreadsheet for side-by-side evaluation.

| Provider | Best For | Monthly Fee | Transaction Fee | Card Reader | Platform Support |

| Square | All-in-one POS for small businesses | $0–$165 | 2.6% + $0.10 | $0–$59 | iOS, Android |

| Clover | Customizable POS hardware/software | $14.95–$69.95 | 2.3% + $0.10 | $49–$1,349 | iOS, Android |

| Helcim | Transparent pricing & high-volume merchants | $0 | Interchange + 0.40% + $0.08 | $99 | iOS, Android |

| Stax | Subscription-based pricing & large businesses | $99–$199 | Interchange + 0% | $99+ | iOS, Android |

| Shopify | Ecommerce & retail integration | $39+ | ~2.7% | $49 | iOS, Android |

| PayPal | Online payments & global reach | $0 | 2.9% + $0.30 | $29–$79 | iOS, Android |

| Google Pay | Android users & contactless payments | $0 | Set by processor | Mobile NFC | Android only |

| Apple Pay | iOS users & secure transactions | $0 | Set by processor | Mobile NFC | iOS only |

Best App by Use Case

| Use Case | Recommended App |

| All-in-one POS system | Square |

| Custom hardware & app combos | Clover |

| Transparent, low fees | Helcim |

| High transaction volume | Stax |

| Online + offline selling | Shopify POS |

| Freelancers & international | PayPal |

| Android tap-to-pay | Google Pay |

| iOS tap-to-pay | Apple Pay |

How We Evaluated These Payment Apps

To help you choose the right credit card reader app or mobile point-of-sale system, we ranked providers using the following data-backed criteria:

- POS App Features – 30%

Includes inventory tools, invoicing, recurring billing, tap-to-pay, and EMV chip reader support. - Pricing & Transaction Fees – 20%

Transparent pricing models, flat-rate vs. interchange-plus, and hardware cost. - Customer Support & Reliability – 20%

24/7 availability, technical stability, fraud prevention, and account protection. - Ease of Use & Mobile UX – 15%

Speed of setup, UI/UX design, and user onboarding flow. - User Reviews & App Store Ratings – 15%

Final Thoughts

There’s no one-size-fits-all answer when it comes to choosing a credit card payment app—but there is a best fit for your current needs and growth path.

-

If you’re starting out, Square gives you a free, intuitive setup with room to grow.

-

For custom POS setups, Clover offers unmatched hardware flexibility.

-

If you process high volumes and want full cost control, Stax or Helcim will save you money over time.

-

Need omnichannel sales? Go with Shopify.

-

Want to keep things simple with a digital wallet option? Enable Google Pay and Apple Pay at checkout.

Whichever route you choose, make sure it integrates smoothly with your operations, supports your sales model, and doesn’t eat into your margins.