Best Payroll For Startups for 2025

Managing payroll is a necessary but challenging task for startups. Ensuring employees are paid accurately and compliant with tax regulations can be time-consuming and stressful. The right payroll software for startups simplifies these processes, saves time, and grows your business.

In this guide, we’ll explore the best payroll software for startups, comparing features, benefits, and solutions from the top payroll companies to help you choose the right fit for your needs.

Comparison of Best Payroll Software for Startups

|

Payroll Service |

Top Features |

Ideal For |

|

Gusto |

Full-service payroll, benefits management, automated tax filing, employee self-service |

Startups seeking an all-in-one payroll and HR solution |

|

OnPay |

Simplified payroll, benefits administration, contractor payments, unlimited pay runs |

Small startups needing flexibility and affordability |

|

Paychex |

Scalable payroll solutions, compliance support, employee retirement plans |

Growing startups requiring robust compliance tools |

|

TriNet |

Comprehensive HR and payroll outsourcing, benefits administration, risk management |

Startups looking to outsource HR and payroll entirely |

|

Paycor |

Customizable payroll, analytics, workforce management |

Startups wanting detailed workforce insights |

|

QuickBooks |

Integration with QuickBooks, automated tax filing, same-day direct deposit |

Startups already using QuickBooks for accounting |

|

SurePayroll |

Affordable payroll, tax filing, mobile app for payroll on-the-go |

Budget-conscious startups needing a simple solution |

Why You Can Trust the Expertise of Sonary

At Sonary, we are committed to providing accurate and trustworthy information to help you make informed decisions. Our research process is meticulous, transparent, and guided by a dedication to maintaining the highest standards of integrity, ensuring accurate, real-world insights.

Read more here

Unlike many other review platforms, we conduct in-depth evaluations of the software and services we feature. Our expert team tests and actively uses the tools we review to understand their features, performance, and value comprehensively. Our assessments are based on real-world use, giving you insights beyond surface-level descriptions. Our research methodology includes analyzing key consumer factors such as pricing, functionality, device usability, scalability, customer support quality, and unique industry-specific features. This hands-on approach and dedication to transparency mean you can trust Sonary to deliver regular, up-to-date content and recommendations that are well-researched and genuinely helpful for your business needs.Top 7 Payroll For Startups

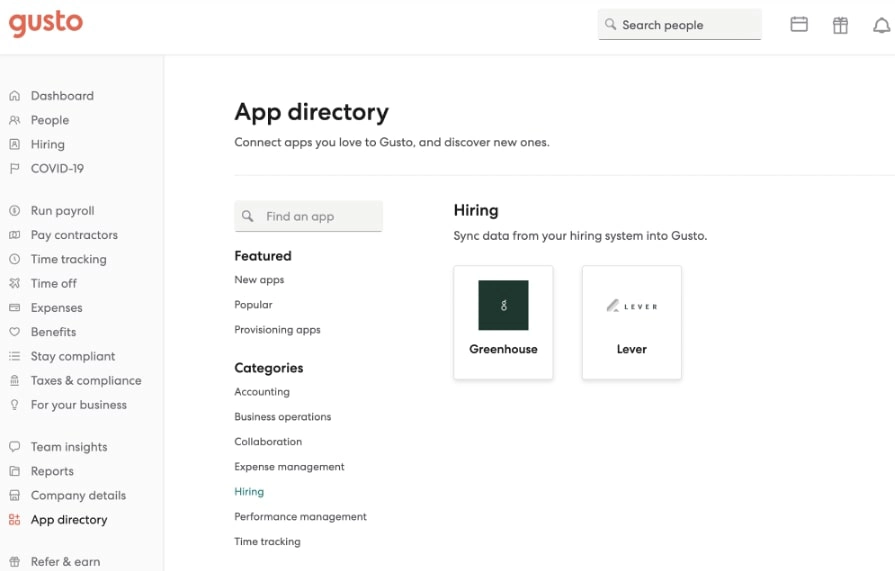

1. Gusto

Gusto is an ideal choice for payroll startups, offering an all-in-one platform that simplifies payroll, benefits, and HR management. Known for its user-friendly design, Gusto automates complex tasks like payroll processing, tax compliance, and employee onboarding, making it one of the best payroll software for startups. Its scalability and robust features make it ideal for startups looking for efficiency and growth.

Used by over 400,000 SMBs globally

Used by over 400,000 SMBs globally  Automated payroll with tax filing included

Automated payroll with tax filing included Key features

- Full-service payroll: Automates payroll processing, including direct deposits, tax calculations, and filings for federal, state, and local taxes.

- Employee benefits management: Seamlessly integrates benefits like health insurance, retirement plans (401(k)), and commuter perks into payroll.

- Employee self-service portal: Allows employees to access pay stubs, W-2s, and update their information, reducing administrative work.

- Time tracking integration: Syncs with time-tracking tools to ensure accurate payroll calculations for hourly workers and contractors.

- Compliance support: Keeps your business compliant with changing labor laws and tax regulations, helping startups avoid costly errors.

- Onboarding tools: Streamlines new employee onboarding with digital offer letters, tax forms, and benefits enrollment tools.

Pros

- Intuitive interface, perfect for startups with limited HR resources.

- Combines payroll, benefits, and HR into one cohesive system.

- Scalable pricing plans that grow with your business.

- Automated processes save time and reduce human error.

- Offers detailed compliance support and robust reporting features.

Cons

- Higher-tier plans may not fit the budget of tiny startups.

- Limited international payroll support for startups with global employees.

Ideal for

Startups searching for scalable, all-in-one startup payroll software that combines payroll and HR features with automation and compliance tools.

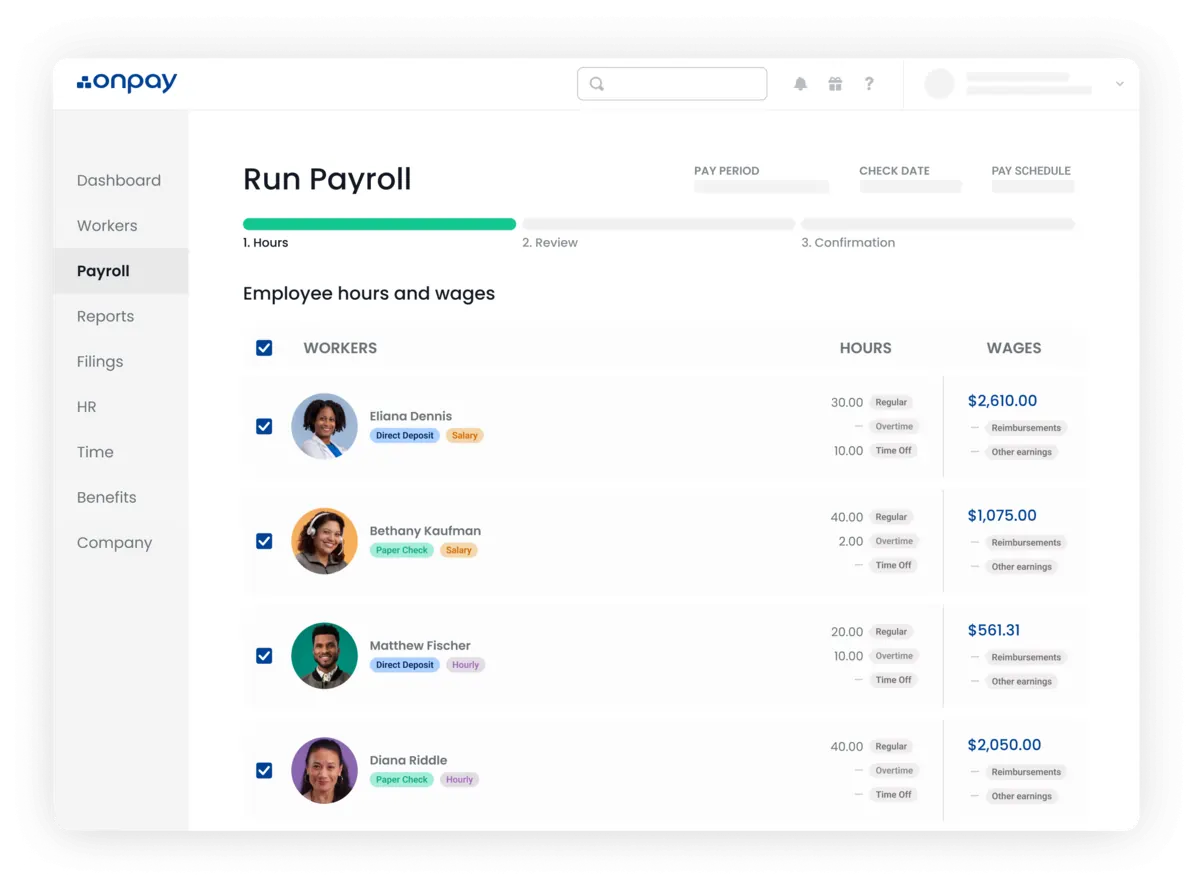

2. OnPay

Overview

OnPay is a reliable and affordable startup payroll software designed to simplify payroll and benefits administration. Known for its transparency and flexibility, OnPay supports small teams and scales as your business grows. With features like unlimited payroll runs, automated tax filings, and contractor payment support, it’s one of the best payroll software for startups looking for flexibility and affordability.

Advanced features included

Advanced features included  Flexible and customized packages

Flexible and customized packages Key features

- Unlimited payroll runs: Process payroll as often as needed without additional fees, enabling startups to stay flexible during periods of growth or irregular cash flow.

- Automated tax filing and compliance: Automatically handles federal, state, and local tax filings, ensuring compliance with evolving regulations without needing dedicated tax expertise.

- Seamless contractor payments: Pay employees and contractors in the same system, perfect for startups with hybrid teams or freelancers supporting dynamic business needs.

- Integrated benefits management: Simplify offering health insurance, 401(k) plans, and workers’ compensation to attract and retain top talent in competitive environments.

- Customizable payroll workflows: Adapt payroll processes to fit your startup’s structure, such as offering flexible schedules for part-time, full-time, and contractor team members.

- Accounting software integration: Connect seamlessly with QuickBooks and Xero, providing startups with efficient bookkeeping tools to monitor cash flow and control costs.

Pros

- Transparent and affordable pricing with no hidden fees.

- Supports payroll for both salaried employees and contractors.

- Easy-to-use interface designed for startups with limited resources.

- Strong integration capabilities with accounting and benefits platforms.

- Includes compliance support for tax filings and payments.

Cons

- Lacks some advanced HR features compared to larger platforms.

- Limited customization for reports and analytics.

Ideal for

Small startups needing flexible, budget-friendly startup payroll services with strong contractor support and tax compliance features.

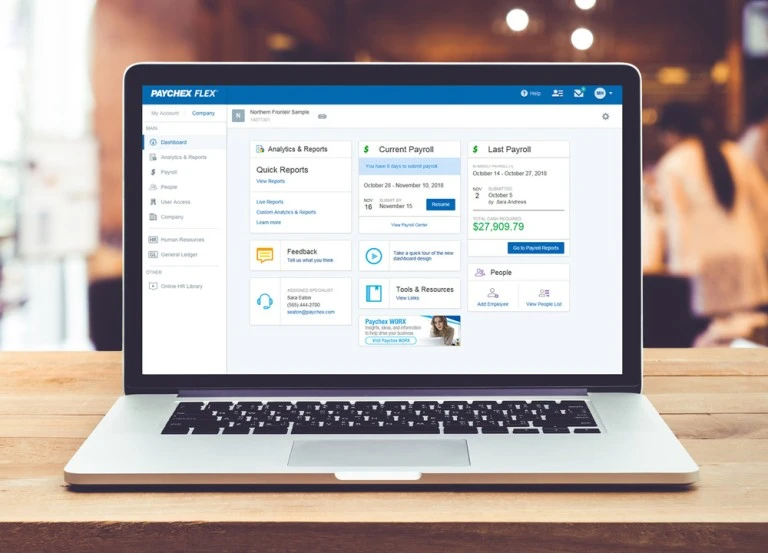

3. Paychex

Overview

Paychex is a robust and scalable startup payroll software designed to meet the needs of growing businesses. With features like automated payroll, tax filing, and comprehensive compliance tools, Paychex provides startups with peace of mind. It also offers retirement plans and HR features, making it one of the best payroll services for startups that anticipate growth and require advanced capabilities.

Award-Winning SMB Solution

Award-Winning SMB Solution  Over 45 years of excellence

Over 45 years of excellence Key features

- Automated payroll: Streamlines payroll processing with automatic calculations, direct deposit, and tax filing at all levels.

- Compliance tools: Provides robust support for tax compliance, labor law adherence, and record-keeping to avoid penalties.

- Employee benefits management: Supports retirement plans, health insurance, and wellness programs for your team.

- Mobile app: Allows employers and employees to manage payroll and benefits on the go.

- Scalable solutions: Offers customized plans to fit the needs of startups as they grow.

- HR services: Includes onboarding tools, employee handbooks, and performance management features.

Pros

- Scalable and customizable solutions for businesses of all sizes.

- Comprehensive compliance support to keep startups up-to-date with regulations.

- Wide range of employee benefits options, including retirement plans.

- 24/7 customer support and dedicated specialists for payroll assistance.

- Mobile app for added convenience and flexibility.

Cons

- Can be expensive for small startups.

- Some features, like advanced HR tools, are available only in higher-tier plans.

Ideal for

Growing startups that need scalable payroll software for startups with advanced compliance tools and benefits administration.

4. TriNet

Overview

TriNet is a professional employer organization (PEO) that provides comprehensive startup payroll services by outsourcing payroll, HR, and compliance management. This solution is ideal for startups that want to focus on core business operations while leaving administrative tasks to experts. With robust tools for benefits administration, risk management, and compliance, TriNet is a leading option for startups looking to outsource these critical functions.

SMBs most trusted advisor

SMBs most trusted advisor  Winners of 2 Gold Stevie awards

Winners of 2 Gold Stevie awards Key features

- Comprehensive payroll services: Handles payroll processing, direct deposit, and automated tax filings.

- PEO services: Offers full-service HR outsourcing, covering payroll, compliance, and benefits.

- Risk management: Provides tools and guidance to ensure workplace safety and compliance with labor laws.

- Employee benefits administration: Offers access to health insurance, retirement plans, and other perks through large-group rates.

- Customizable reporting: Generates detailed reports for payroll, benefits, and compliance metrics, giving startups valuable insights.

- Expert HR support: Includes dedicated specialists to assist with complex HR and payroll challenges.

Pros

- Fully outsourced HR and payroll services for convenience.

- Access to high-quality employee benefits at competitive rates.

- Strong compliance tools, particularly for startups navigating complex regulations.

- Customizable solutions for startups of various sizes and industries.

- Dedicated customer support and expert guidance.

Cons

- Higher costs compared to standalone payroll software.

- Less control over day-to-day HR operations due to outsourcing.

Ideal for

Startups seeking to outsource payroll and HR entirely, particularly those needing access to high-quality employee benefits and compliance tools.

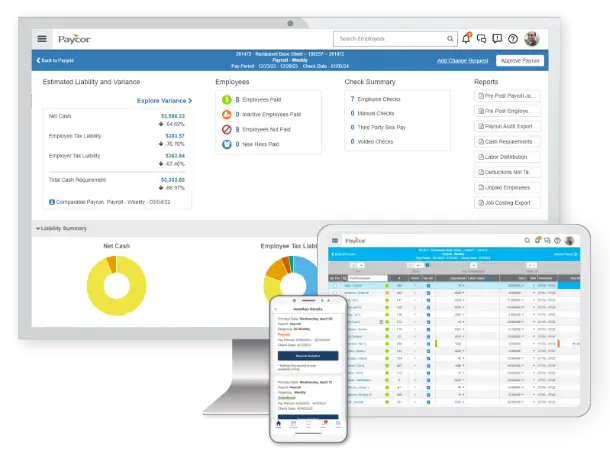

5. Paycor

Overview

Paycor is a flexible and scalable payroll software for startups that combines payroll, HR, and workforce management into one platform. With tools that simplify payroll processing and deliver actionable workforce analytics, Paycor helps startups streamline administrative tasks while managing team growth effectively. Its customizable features make it one of the best payroll services for startups.

All-in-one HR solution for success

All-in-one HR solution for success  Used by 2.5M users & 40K+ businesses

Used by 2.5M users & 40K+ businesses Key features

- Customizable payroll solutions: Tailored workflows for salaried employees, hourly workers, and contractors.

- Workforce analytics: Detailed insights into employee performance and payroll costs, enabling startups to make data-driven decisions.

- Automated tax compliance: Handles federal, state, and local tax filings, ensuring your startup meets all regulatory requirements.

- Onboarding features: Streamlines new employee onboarding with digital forms, offer letters, and compliance tracking.

- Employee benefits administration: Offers support for health insurance, retirement plans, and other benefits, integrated with payroll.

- Mobile-friendly tools: Manage payroll, benefits, and HR processes on the go with Paycor’s intuitive mobile app.

Pros

- Robust workforce analytics to improve team management.

- Customizable payroll workflows tailored to startup needs.

- Scales well as startups grow and expand their teams.

- Strong compliance tools for tax filing and reporting.

- Integrated onboarding and employee management features.

Cons

- Advanced features like detailed reporting require premium plans.

- Slight learning curve for first-time users.

Ideal for

Startups that need customizable payroll services with detailed workforce insights and tools for managing HR and compliance seamlessly.

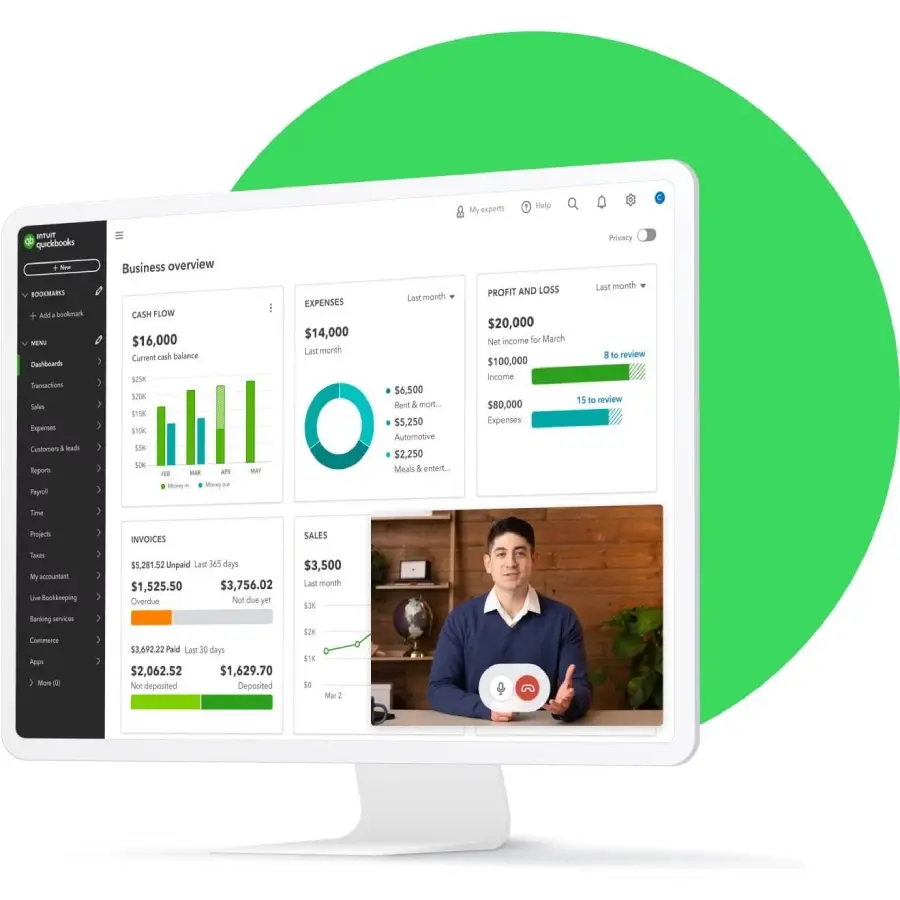

6. QuickBooks Payroll

Overview

QuickBooks Payroll is a seamless solution for startups that are already using QuickBooks for accounting. It simplifies payroll with automated tax filings, same-day direct deposits, and easy integration with existing QuickBooks software. This startup payroll software is designed to provide efficiency and accuracy while maintaining a straightforward interface that’s easy to navigate.

All plans include extensive payroll features

All plans include extensive payroll features  Offers third-party HR tools

Offers third-party HR tools Key features

- Same-day direct deposit: Ensure employees and contractors are paid quickly with same-day payroll options.

- Automated tax filings: Handles federal, state, and local tax filings, as well as year-end forms, to keep your startup compliant.

- Integration with QuickBooks: Sync payroll seamlessly with QuickBooks for simplified accounting and financial management.

- Time tracking integration: Links with time-tracking tools like QuickBooks Time to ensure accurate wage calculations.

- Employee self-service portal: Allows employees to view pay stubs, update information, and access W-2s independently.

- Customizable payroll schedules: Supports flexible pay schedules for hourly workers, salaried employees, and contractors.

Pros

- Perfect integration for businesses already using QuickBooks for accounting.

- User-friendly setup with robust automation for tax filings and payroll processing.

- Competitive pricing with strong features for startups.

- Same-day direct deposit ensures timely employee payments.

- Scalable to meet the needs of growing businesses.

Cons

- Limited HR tools compared to more comprehensive platforms.

- Not ideal for startups not already using QuickBooks.

Ideal for

Startups that rely on QuickBooks for accounting and need a payroll solution that integrates seamlessly with their existing systems.

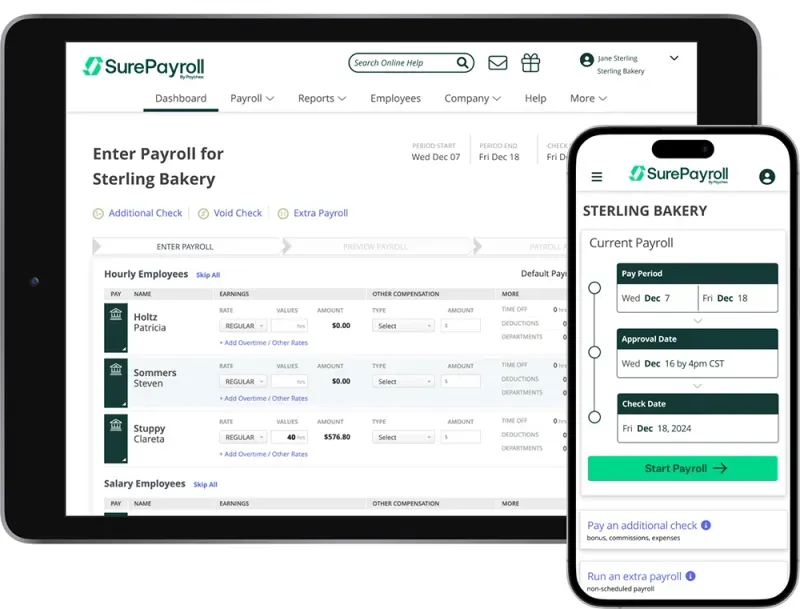

7. SurePayroll

Overview

SurePayroll is an affordable and straightforward payroll service for startups designed to simplify payroll processes. With its easy-to-use platform and mobile app, SurePayroll ensures that startups can manage payroll anytime, anywhere. Its automated tax filings and employee self-service options make it one of the most accessible solutions for small and budget-conscious teams.

Payroll made easy for as little as $1 per day

Payroll made easy for as little as $1 per day  Automated payroll for business efficiency

Automated payroll for business efficiency Key features

- Automated payroll and tax filing: Processes payroll with automatic tax calculations and filings, including federal, state, and local taxes.

- Mobile app: Manage payroll on the go with a user-friendly mobile platform that allows employers to approve and process payroll from anywhere.

- Employee self-service: Provides employees with access to pay stubs, tax forms, and account updates without requiring admin intervention.

- Contractor payments: Supports payroll for contractors alongside employees, making it ideal for startups with mixed teams.

- Affordable pricing: Offers competitive pricing plans tailored to small businesses and startups.

- Compliance support: Keeps your startup compliant with tax regulations and filing deadlines.

Pros

- Simple and intuitive platform, perfect for startups with limited payroll experience.

- Mobile app ensures payroll can be managed flexibly.

- Affordable pricing for startups on a tight budget.

- Strong tax compliance tools to avoid errors and penalties.

- Excellent customer support with live chat and phone assistance.

Cons

- Limited scalability for larger teams or growing businesses.

- Fewer advanced HR features compared to comprehensive platforms.

Ideal for

Budget-conscious startups needing easy-to-use payroll software for startups with mobile accessibility and strong tax compliance tools.

How to Choose the Best Payroll Software for Startups

Selecting the right payroll software for startups is essential for ensuring smooth operations while staying within budget. Here’s a detailed breakdown of key factors to consider when evaluating the best payroll services for startups:

1. Budget

Startups often operate with tight budgets, so it’s crucial to choose a payroll service with pricing plans tailored to small teams. Avoid paying for advanced features or enterprise-level tools that you don’t need. Many providers offer tiered pricing, allowing you to start small and scale as your business grows.

Tip: Compare pricing structures to identify services that provide essential features at an affordable cost.

2. Ease of Use

Startup Payroll software should simplify payroll management, not complicate it. Choose a platform with an intuitive interface that streamlines tasks like running payroll, setting up direct deposits, and generating tax forms. A user-friendly platform ensures that payroll processing is quick and error-free, even for first-time users.

Tip: Opt for software with a clean design, clear navigation, and a simple onboarding process.

3. Compliance Support

Tax compliance is a critical component of payroll management. Your payroll software should automatically calculate, withhold, and file federal, state, and local taxes. Compliance support reduces the risk of errors, penalties, and legal issues while saving you time.

Tip: Ensure the software keeps up with changing tax laws and provides automatic updates to maintain compliance.

4. Scalability

While your startup might begin with a small team, your payroll needs will likely grow over time. Choose a solution that allows you to add employees, integrate with other tools, and expand features like benefits management as your business scales. This ensures you won’t need to switch software as your needs evolve.

Tip: Review the provider’s pricing for adding employees and additional features to ensure cost-effective scalability.

5. Customer Support

Effective customer support is essential, particularly for startups new to payroll management. Choose a payroll service that offers accessible support channels, such as live chat, phone assistance, or a knowledge base. Quick and reliable support ensures smooth payroll operations and timely resolution of any issues.

Tip: Look for platforms with consistently high ratings for customer service and fast response times.

Final Thoughts

Managing payroll is a critical yet often challenging task for startups. Choosing the right payroll software for startups can simplify payroll processing, ensure compliance, and save valuable time. The solutions outlined in this guide cater to various needs, from budget-conscious startups to those looking for comprehensive HR and payroll integration.

By evaluating factors like budget, ease of use, compliance support, scalability, and customer service, you can confidently select the best payroll service for startups to suit your business needs. The right payroll solution will streamline operations and help set the foundation for your business to grow efficiently.

FAQ

Q. How do I choose a payroll service?

A. Identify your needs, such as budget, team size, and required features. Look for ease of use, compliance tools, scalability, and strong customer support.

Q. Is it better to outsource payroll?

A. Outsourcing payroll can save time and reduce errors, especially for startups without dedicated HR staff. However, it may be costlier than in-house solutions.

Q. Can I run my own payroll?

A. Yes, but it requires time, knowledge of tax regulations, and attention to detail. Payroll software simplifies the process and minimizes compliance risks.

Q. What is the difference between payroll software and HR software

A. Payroll software focuses on employee payments, tax filings, and compliance, while HR software includes broader functions like hiring, training, and performance management.

Q. Do I need payroll software for my startup?

A. Yes, if you want to save time, ensure compliance, and automate payroll tasks. It’s particularly valuable as your team grows.