Best Payroll Services for 2025

Last updated: September 2025

Payroll software handles the entire employee payment process, tracking hours, calculating wages and deductions, processing pay runs, and filing taxes. By automating these tasks, great payroll software can help you reduce manual errors and free up time for your business to focus less on paperwork and more on growth.

- Award-Winning SMB Solution

- Over 45 years of excellence

- Easy to pay and manage employees

- Used by over 400,000 SMBs globally

- Automated payroll with tax filing included

- Direct deposit and contractor payments fast

- Advanced features included

- Flexible and customized packages

- Tax filing & payroll automation

- All-in-one HR solution for success

- Used by 2.5M users & 40K+ businesses

- Vast partner network

- 7-day free trial

- Designed for SMBs

- 24/7 customer support for all your needs

- Payroll made easy for as little as $1 per day

- Automated payroll for business efficiency

- US-based customer support

- Award-winning customer service

- Seamless international support

- Dedicated tax support

- Automatic compliance and tax-filing

- Built for all sizes, from small businesses to large

- Sync all your systems with payroll

- Award-winning payroll & HR software

- Variety of packages for your business needs

- Around the clock customer support

Some of the best payroll services for small businesses start as low as $8 per employee per month, while the most robust, all-in-one platforms typically range between $20 and $30 per employee. Whether you’re just hiring your first team member or managing a fast-growing workforce, there’s a payroll solution that fits your budget and business needs.

In this guide, we compare the top payroll services, breaking down pricing, ease of use, features, support, and HR tools so you can confidently choose the best option.

What is payroll software?

Payroll software automates the process of paying employees by calculating wages, deducting taxes, and ensuring compliance with federal and state labor laws. It simplifies payroll management by reducing manual errors, saving time, and ensuring that payments are processed on time.

Key Functions of Payroll Software:

✔️ Automated Payroll Processing – Calculates salaries, taxes, and deductions automatically.

✔️ Tax Compliance – Ensures payroll tax filings are accurate and timely.

✔️ Direct Deposits – Sends employee payments electronically.

✔️ Benefits & Deductions Management – Handles health insurance, 401(k), and other employee benefits.

✔️ Employee Self-Service Portals – Allows employees to view pay stubs, W-2s, and tax information.

How Does a Payroll Service Work?

A payroll service streamlines the payroll process by automating employee payments, tax deductions, and compliance reporting. Here’s how it typically works:

- Employee Setup – Businesses add employees’ personal, tax, and payment details.

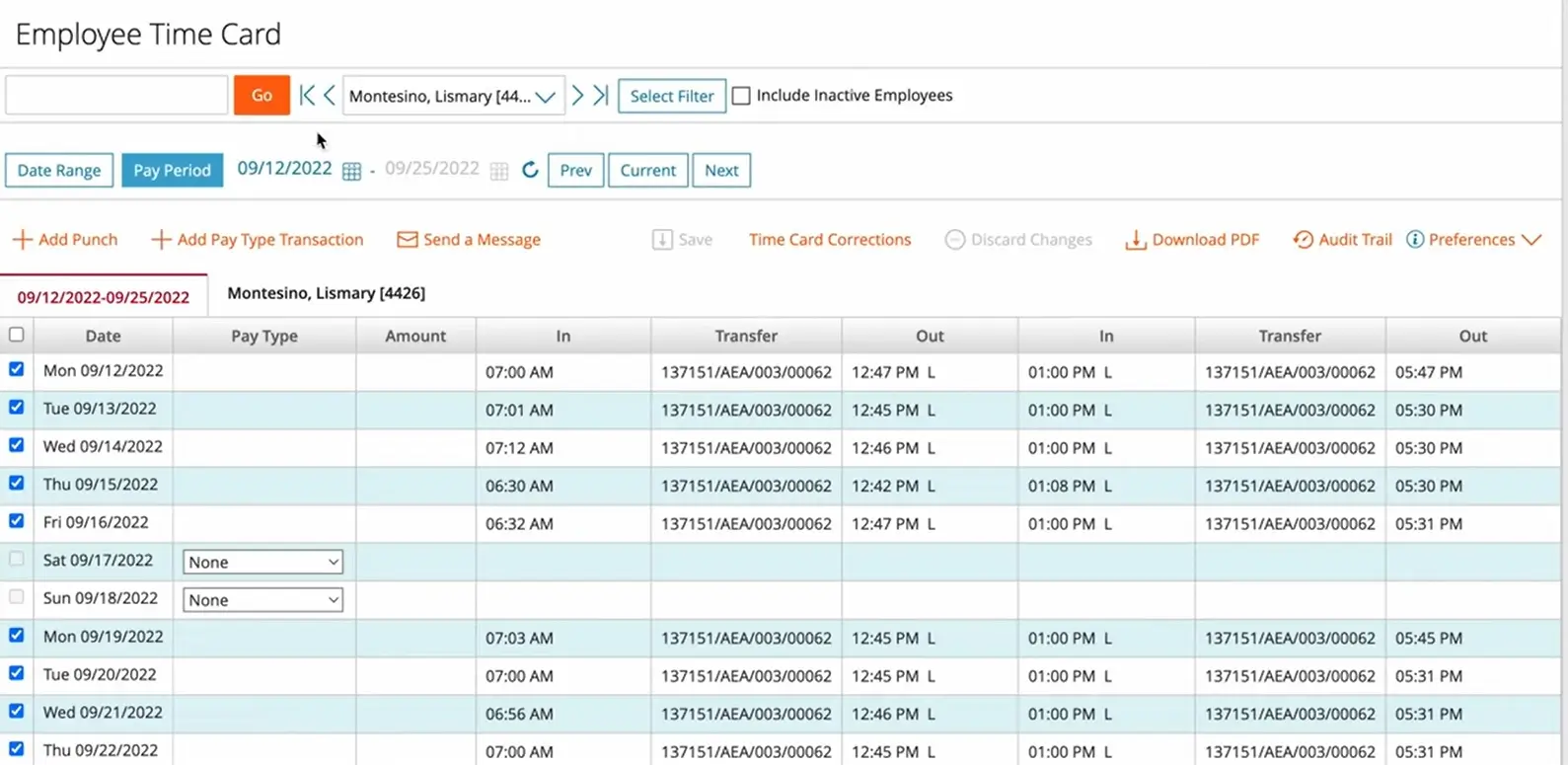

- Time Tracking & Hours Logged – Payroll services integrate with time-tracking software or allow manual entry.

- Salary Calculation – The software calculates gross wages, tax deductions, and benefits.

- Tax Withholding & Filing – Payroll providers automatically deduct and file federal, state, and local taxes.

- Payment Processing – Employees receive payments via direct deposit, check, or payroll card.

- Compliance & Reporting – Payroll services generate reports for tax compliance and auditing.

Compare Top Payroll Services in 2025

| Payroll Service | Best For | Key Features |

| Paychex | Best for Growing Businesses | HR support, tax compliance, scalable payroll options |

| Gusto | Best for Small Businesses | Automated payroll, tax filings, benefits integration |

| OnPay | Best Budget Option | Unlimited payroll runs, benefits integration |

| Paycor | Best for Mid-Sized Companies | Strong HR tools, analytics, and payroll automation |

| BambooHR | Best for HR-Driven Payroll | Integrated HR and payroll solutions |

| SurePayroll | Best for Small Teams | Simple payroll, tax calculations, affordable pricing |

| Paylocity | Best for Large Teams | Cloud-based payroll and workforce management tools |

| Rippling | Best for Automation | Payroll, HR, IT, and finance automation |

| ADP | Best for Enterprises | Scalable payroll and compliance solutions |

Payroll Service Reviews & Comparisons

Paychex – Best for Growing Businesses

Paychex is a well-established payroll provider known for scalability and compliance support. It’s an excellent choice for businesses that need customizable payroll solutions with integrated HR tools.

Award-Winning SMB Solution

Award-Winning SMB Solution  Over 45 years of excellence

Over 45 years of excellence Key Features:

✔️ Full-service payroll with automatic tax calculations.

✔️ Compliance management and labor law updates.

✔️ Employee benefits integration, including 401(k) and health insurance.

✔️ Time tracking and workforce analytics.

✔️ Mobile payroll processing for on-the-go management.

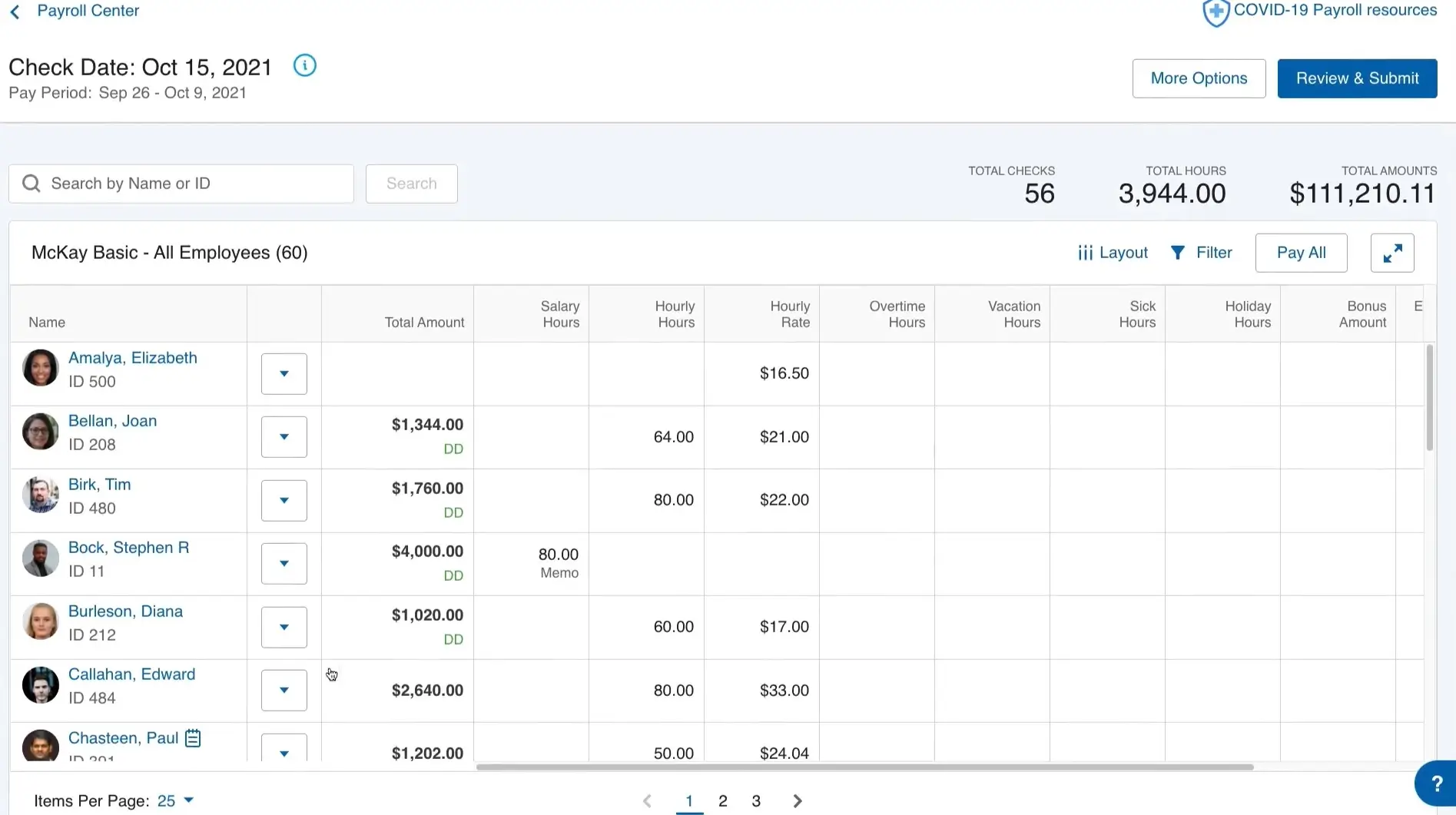

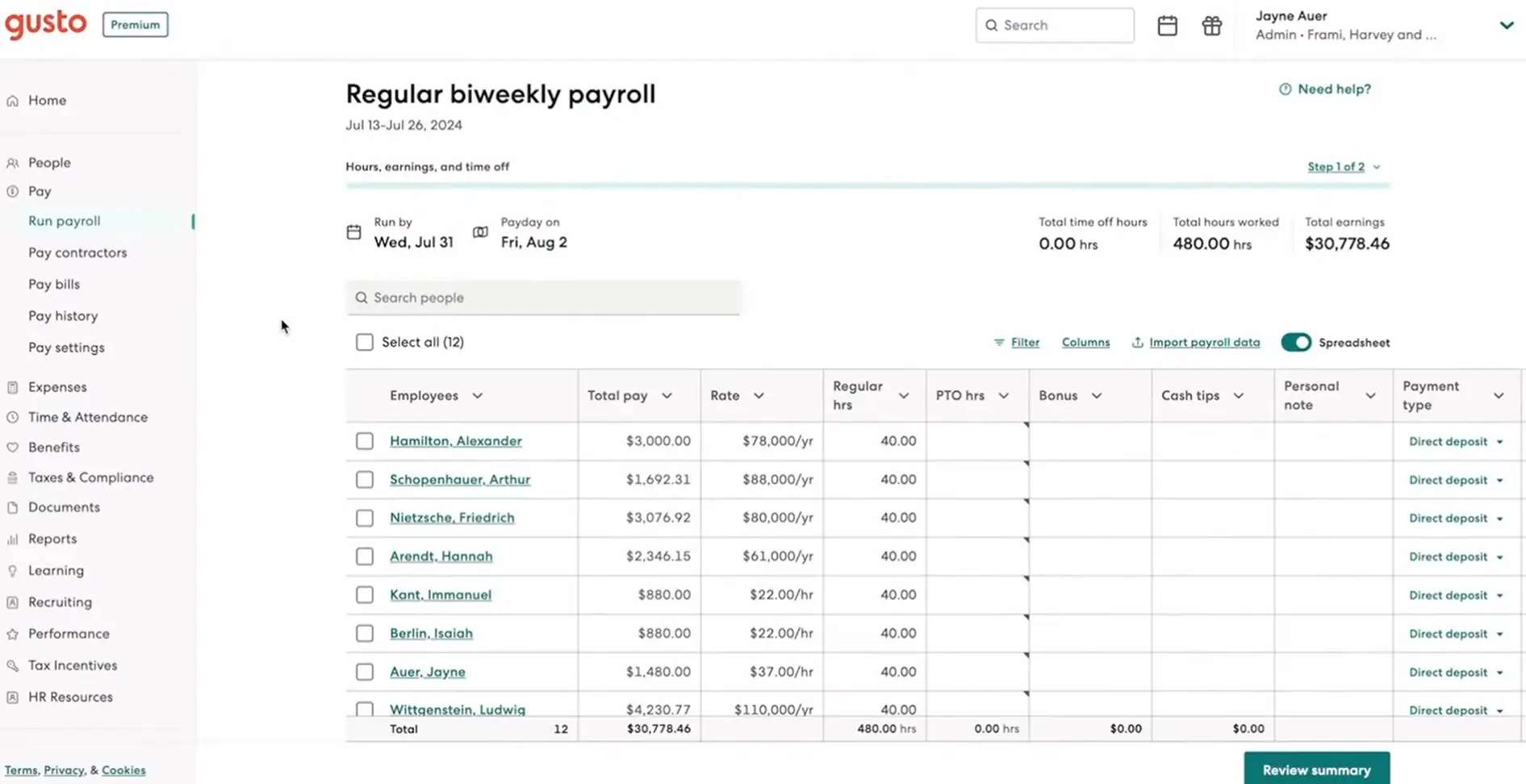

Gusto – Best for Small Businesses

Gusto provides an intuitive, modern payroll system that’s perfect for small businesses. It automates payroll, taxes, and employee benefits with an easy-to-use dashboard.

Used by over 400,000 SMBs globally

Used by over 400,000 SMBs globally  Automated payroll with tax filing included

Automated payroll with tax filing included Key Features:

✔️ Automated payroll processing, tax filings, and direct deposits.

✔️ Built-in HR tools, including onboarding and benefits management.

✔️ Contractor payments with no extra fees.

✔️ Transparent pricing with no hidden costs.

✔️ Employee self-service portal for pay stubs and W-2s.

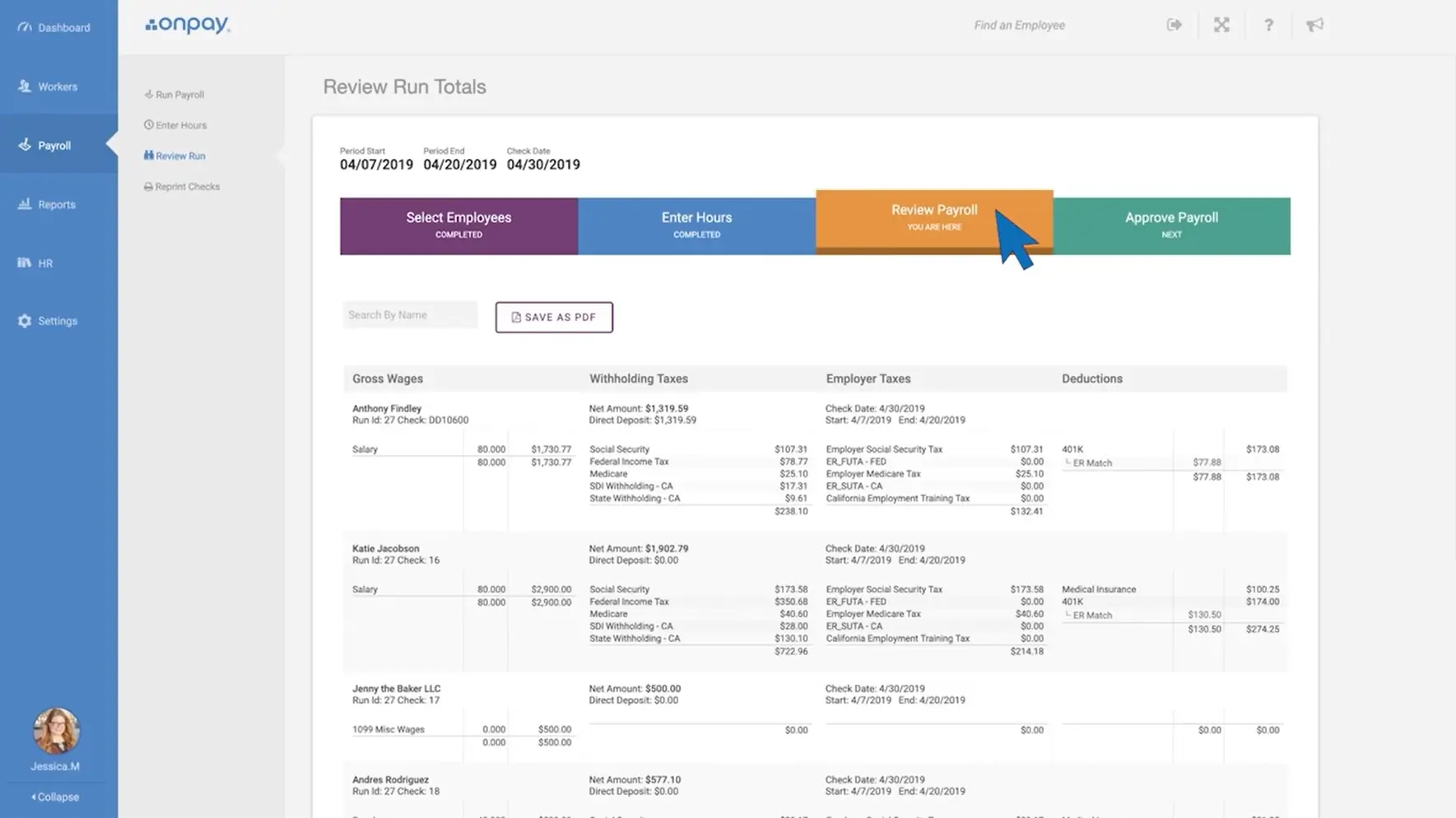

OnPay – Best Budget Option

OnPay is an affordable payroll service that offers unlimited payroll runs for a flat fee, making it ideal for small businesses looking to save money without sacrificing features.

Advanced features included

Advanced features included  Flexible and customized packages

Flexible and customized packages Key Features:

✔️ Flat-rate pricing with unlimited payroll runs.

✔️ Benefits management, including health insurance and retirement plans.

✔️ Supports both W-2 employees and 1099 contractors.

✔️ Tax calculations and compliance assistance.

✔️ Easy-to-use dashboard with mobile access.

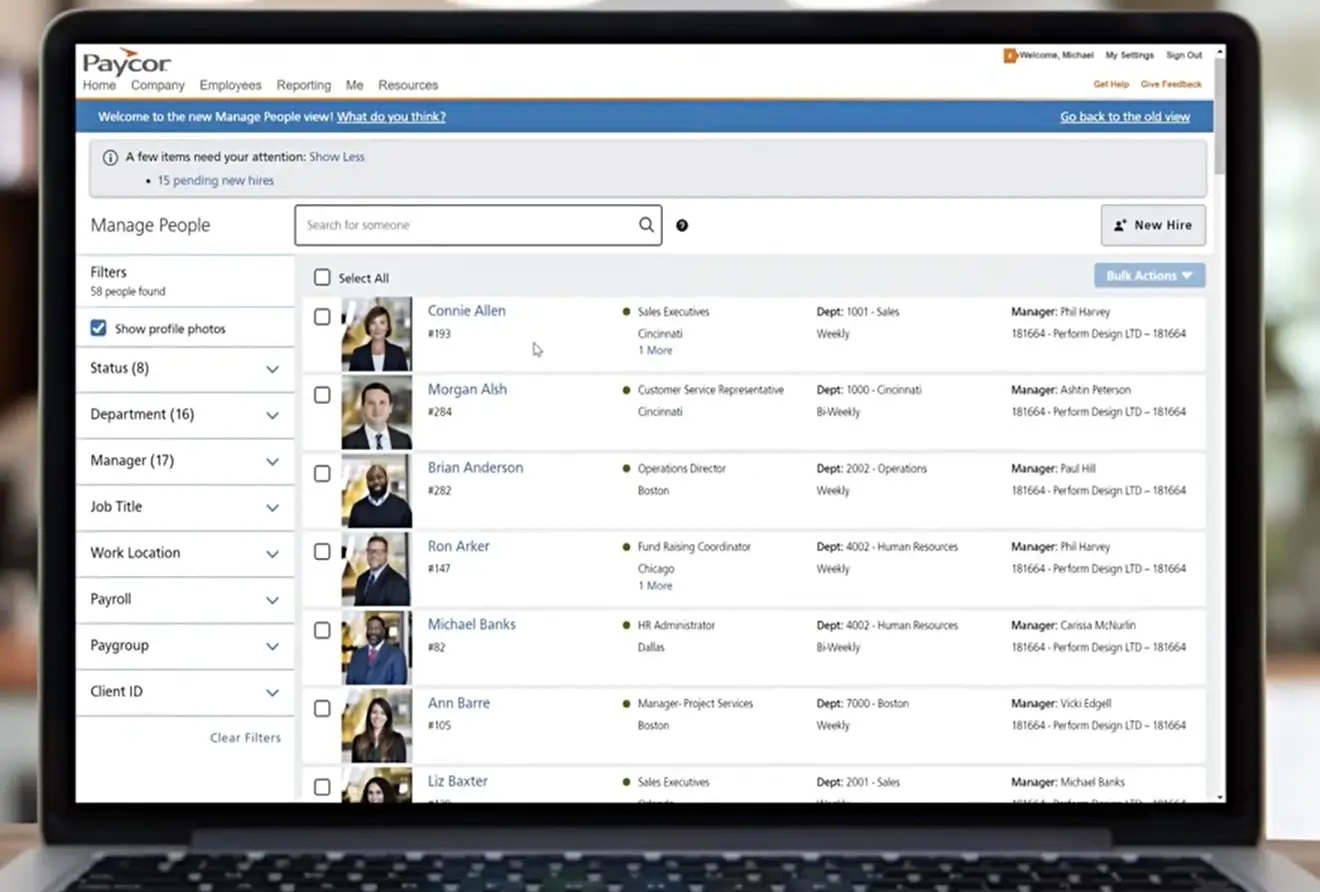

Paycor – Best for Mid-Sized Companies

Paycor is a feature-rich payroll and HR platform designed for mid-sized businesses that need advanced workforce management tools.

All-in-one HR solution for success

All-in-one HR solution for success  Used by 2.5M users & 40K+ businesses

Used by 2.5M users & 40K+ businesses Key Features:

✔️ Payroll automation and tax compliance.

✔️ Advanced HR tools, including employee scheduling and performance tracking.

✔️ Customizable reporting and workforce analytics.

✔️ Strong customer support and training resources.

✔️ Scalable pricing for businesses of different sizes.

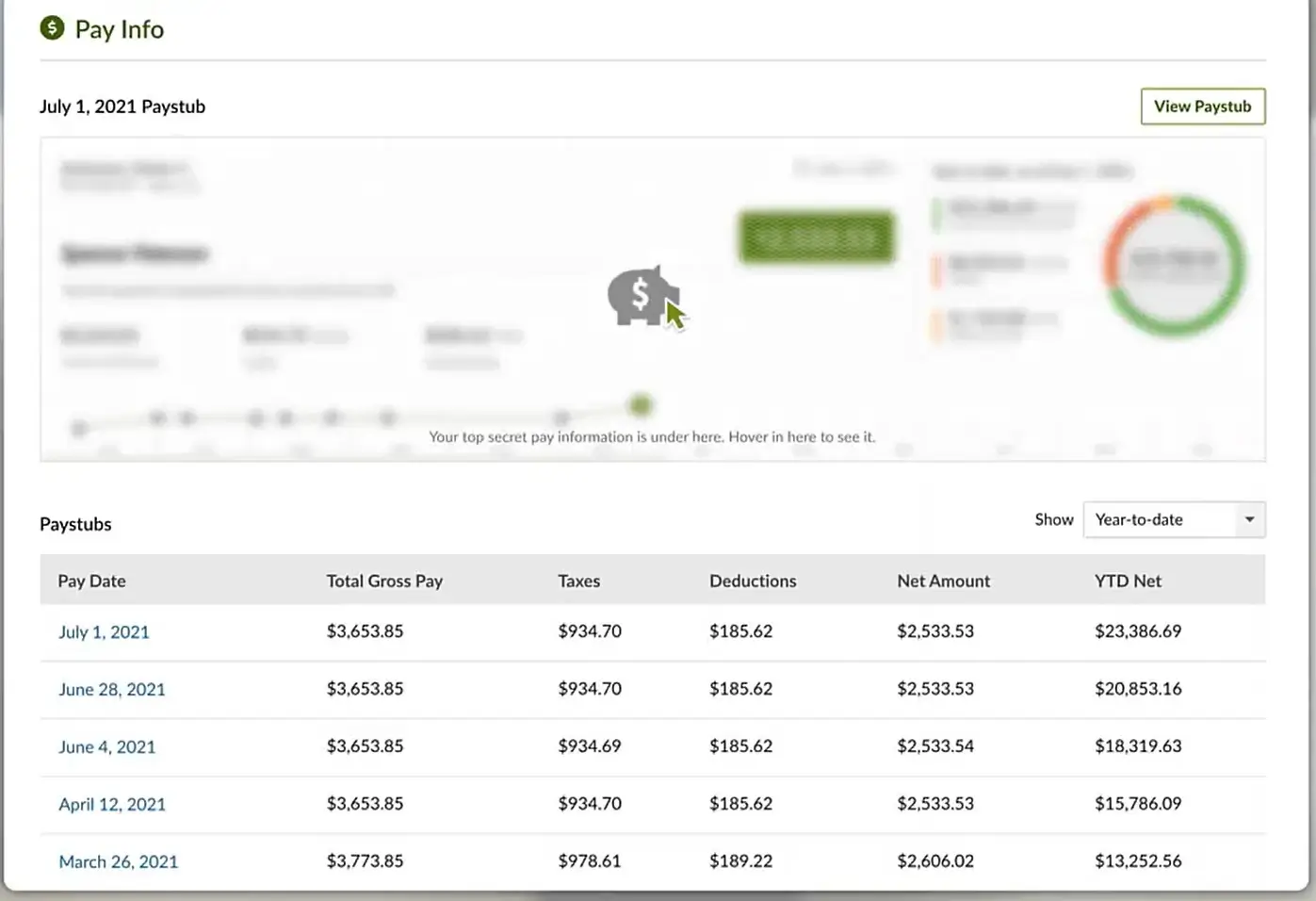

BambooHR – Best for HR-Driven Payroll

BambooHR combines HR and payroll functionalities in one seamless platform, making it a great option for businesses prioritizing employee experience and HR automation.

7-day free trial

7-day free trial  Designed for SMBs

Designed for SMBs Key Features:

✔️ Full-service payroll integrated with BambooHR’s HR suite.

✔️ Employee self-service for pay stubs and tax forms.

✔️ Time tracking and leave management.

✔️ Mobile-friendly interface for payroll processing on the go.

✔️ Customizable reports and workforce analytics.

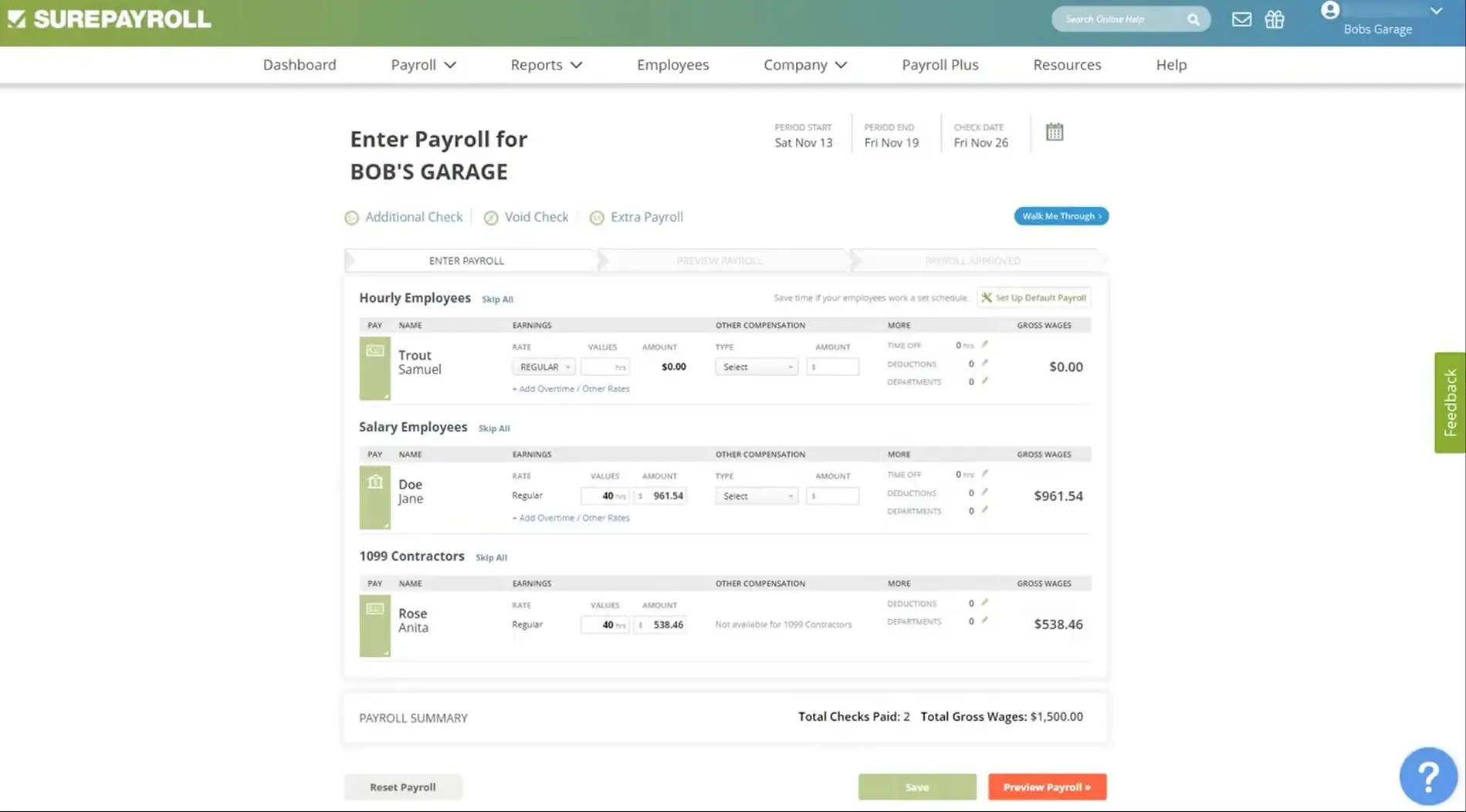

SurePayroll – Best for Small Teams

SurePayroll is an affordable, easy-to-use payroll service designed for very small businesses, startups, and self-employed individuals who need simple payroll processing.

Payroll made easy for as little as $1 per day

Payroll made easy for as little as $1 per day  Automated payroll for business efficiency

Automated payroll for business efficiency Key Features:

✔️ Low-cost pricing with transparent fees.

✔️ Automated payroll and tax filing services.

✔️ Support for both W-2 and 1099 workers.

✔️ Mobile payroll app for convenience.

✔️ Strong customer support with live chat and phone assistance.

Paylocity – Best for Large Teams

Paylocity is a cloud-based payroll and workforce management solution that caters to larger businesses looking for enterprise-level features.

Award-winning customer service

Award-winning customer service  Seamless international support

Seamless international support Key Features:

✔️ Full-service payroll with tax compliance and direct deposit.

✔️ Employee benefits and HR management tools.

✔️ Advanced reporting and workforce analytics.

✔️ Mobile access and self-service options for employees.

✔️ Integration with third-party accounting and HR software.

Rippling – Best for Automation

Rippling is a powerful all-in-one platform that automates payroll, HR, IT, and finance—great for tech-savvy businesses looking for complete automation.

Automatic compliance and tax-filing

Automatic compliance and tax-filing  Built for all sizes, from small businesses to large

Built for all sizes, from small businesses to large Key Features:

✔️ Fully automated payroll with global payments support.

✔️ Seamless integration with IT and HR tools.

✔️ Employee onboarding with device management capabilities.

✔️ Tax compliance and benefits management.

✔️ AI-powered analytics and workflow automation.

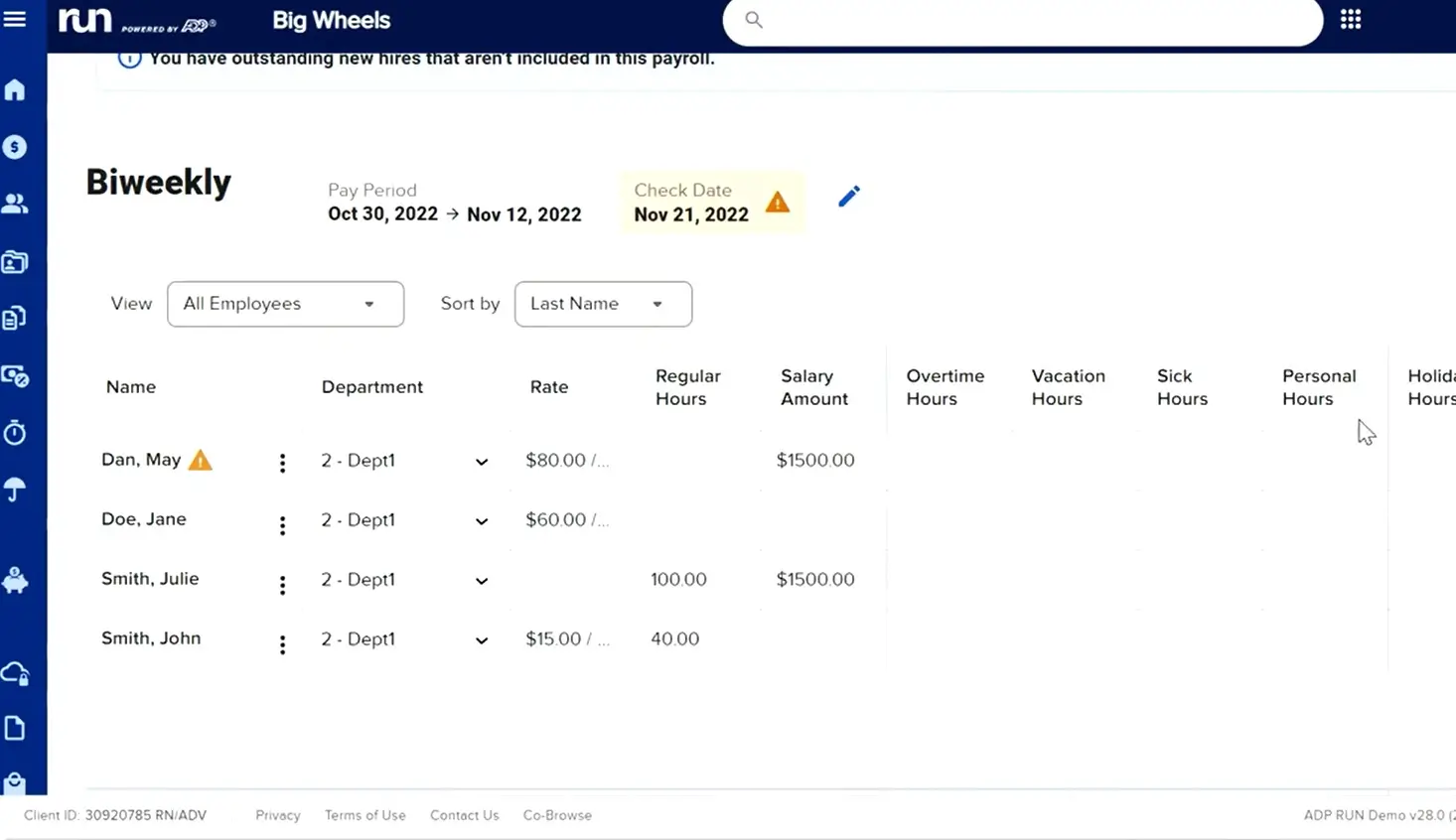

ADP – Best for Enterprises

ADP is one of the most established payroll providers, known for scalability and enterprise-level HR solutions.

Award-winning payroll & HR software

Award-winning payroll & HR software  Variety of packages for your business needs

Variety of packages for your business needs Key Features:

✔️ Payroll processing for businesses of all sizes.

✔️ Compliance management and legal assistance.

✔️ Employee benefits, retirement plans, and insurance integration.

✔️ Custom pricing with dedicated customer support.

✔️ Advanced workforce analytics and reporting.

How Much Do Payroll Services Cost?

Payroll services vary in pricing based on features and company size. Here’s a general breakdown:

General Pricing:

- Basic Payroll Plans: $20 – $50/month + $4 – $10 per employee.

- Mid-Tier Plans (HR + Payroll Integration): $40 – $100/month + $5 – $15 per employee.

- Enterprise Payroll Solutions: Custom pricing, often exceeding $100/month.

Extra Fees to Watch For:

- Setup Fees – Some providers charge a one-time fee for account setup.

- Tax Filing Fees – Certain plans charge extra for federal and state tax filings.

- Year-End Reporting Fees – Some services charge additional W-2 and 1099 filing fees.

Typical Features Included in Payroll Software:

Payroll Processing: Automatically calculate pay based on hours worked, including different rates such as overtime, bonuses, and commissions.

- Tax Filing and Compliance: Automated solutions for payroll taxes, including deductions, withholdings, and year-end forms like W-2s and 1099s.

- Direct Deposit and Pay Options: Ability to pay employees via direct deposit, paper checks, or pay cards.

- Employee Self-Service Portal: Employees can access their pay stubs and tax forms and update their personal details through the portal.

- Integration Capabilities: The ability to integrate with existing HR, accounting, or time-tracking software.

- Reporting: Generate reports on payroll expenses, tax deductions, and more.

Who uses payroll software?

Payroll software is used by a wide range of entities that need to manage and process employee payments, including:

- Small Businesses: Small business owners often use payroll software to simplify the complexities of paying employees, ensuring taxes and deductions are handled correctly without needing a dedicated payroll department.

- Medium to Large Enterprises: Larger organizations utilize a more robust payroll company to handle a greater volume of payroll processing and to manage additional complexities such as multiple departments, varying employee benefits, and compliance with diverse regulatory requirements.

- Accounting Firms: Many accounting professionals use payroll software on behalf of their clients, providing payroll services as part of a broader suite of accounting and financial management services.

- Non-Profits: Non-profit organizations also benefit from payroll software to manage their often diverse types of compensation structures and to maintain compliance with specific tax exemptions and reporting requirements.

- Government Agencies: Public sector entities use specialized payroll systems to manage their unique needs, such as civil service rules, union contracts, and government-specific payroll regulations.

- Startups: Fast-growing startups use payroll software to handle rapid changes in their workforce, including new hires and changes in compensation structures as the company grows.

Types of Top Payroll Software & Services

Many types of payroll software and services are available that cater to different business needs, sizes, and complexities. Here are some of the top types:

- Cloud-Based Payroll Software: These services are hosted on the provider’s servers and can be accessed from anywhere with an internet connection. Examples include Gusto, ADP, and Paychex Payroll. They’re popular due to their flexibility, scalability, and the fact that they often receive automatic updates and enhancements.

- On-Premises Payroll Software: This type of software is installed on a company’s own computers and servers. Examples include Sage Payroll. It gives businesses control over the security and management of their data but requires more in-house IT support.

- Full-Service Payroll Providers: These services handle virtually all aspects of payroll on behalf of the business, including calculating pay, filing taxes, and managing employee data. ADP and Paychex are well-known providers that offer comprehensive payroll services along with HR and compliance support.

- Freelancer and Contractor-Focused Payroll Services: Some platforms are designed specifically for businesses that primarily deal with freelancers and contractors, rather than full-time employees. These include services like Connecteam Payroll, which can handle both types of workers but has features particularly beneficial for managing contract labor.

- Integrated HR and Payroll Systems: These are comprehensive platforms that combine payroll functions with other HR processes like recruitment, onboarding, and benefits management. BambooHR and Zenefits are examples of providers that offer integrated solutions.

- Industry-Specific Payroll Software: Certain industries have unique payroll needs and regulations, and some payroll systems are tailored to meet these requirements. For instance, construction payroll software might include features for handling union reporting and prevailing wage rates.

How Often Does a Typical Business Run Payroll and Why?

A business typically runs payroll regularly, such as weekly, bi-weekly, or monthly. The frequency of payroll runs depends on the policies and procedures of the specific business, as well as any legal requirements. Additionally, some businesses are legally required to run payroll at certain intervals to comply with state and federal tax laws.

Payroll Software vs. Payroll service

| Aspect | Payroll Software | Payroll Service |

| Description | A program purchased and run by businesses on their own systems. | Provided by specialized companies handling all payroll aspects. |

| Control | High control over the payroll process allows customization to fit specific business needs. | Less control as the service handles all aspects of payroll. |

| Operation | Businesses manage payroll tasks internally, including tracking hours, calculating pay, and generating tax forms. | The service provider manages payroll, including calculations, paycheck generation, and tax filings. |

| Cost | Initial purchase costs potentially lower overall long-term costs due to the absence of ongoing service fees. | Recurring service fees, which may be higher over time but offset by reduced internal administrative costs. |

| Compliance Support | Users are responsible for ensuring compliance with tax laws and regulations. | Service providers often have specialized experts to ensure compliance, reducing the risk of errors and penalties. |

| Focus | Allows businesses to tailor the payroll process but requires more internal resources. | Lets businesses focus more on core activities rather than payroll management. |

| Expertise Required | Requires internal expertise to manage and operate effectively. | External expertise provided is beneficial for businesses without in-house payroll expertise. |

| Integration with Other Systems | May require integration with other business systems, which can be technically challenging. | Typically handles integration as part of their services, easing setup and maintenance. |

| Scalability | May require additional licenses or upgrades as business grows. | Service scales with business growth; fees adjusted based on changes in employee numbers. |

| Customer Support | May offer limited support compared to payroll services. | Typically offers comprehensive support as part of their package, beneficial for navigating complex payroll issues. |

Payroll software and payroll services are both options for managing employee pay and taxes, but they have some key differences. Payroll software gives businesses more control over their payroll process, while payroll services take on the responsibility of payroll processing and compliance.

Payroll software is a program that businesses can purchase and run on their own computers. It allows the business to track employee hours, calculate pay and taxes, and generate paychecks and tax forms. The advantage of using payroll software is that the business has complete control over the payroll process and can customize the software to fit their specific needs. Additionally, businesses can save money in the long run by not having to pay for ongoing service fees.

Payroll services are provided by companies that specialize in payroll processing. These companies handle all aspects of payroll, including calculating pay and taxes, generating paychecks and tax forms, and ensuring compliance with federal and state regulations. The advantage of using a payroll service is that the business doesn’t have to worry about handling payroll in-house, and can instead focus on running their business. Additionally, the company that provides the payroll service may have specialized experts that can help you with compliance and tax laws.

What Software is Related to Payroll Software?

While payroll software is specifically designed to automate the payroll process and help businesses stay compliant with state and federal regulations, there are also other types of software that can be related to payroll software. These include:

- Human Resources Software: Human resources software can be used to manage employee information, such as personal and contact details, and to track employee attendance, benefits, employee onboarding, and other HR-related tasks. This can be integrated with payroll software to streamline the payroll process and ensure compliance with state and federal regulations.

- Professional Employer Organization: A professional employer organization (PEO) is a third-party provider that partners with businesses to provide a range of human resources and employee benefits services. PEOs also allow for cost-effective access to group health insurance and other benefits typically available only to large companies.

- Learning Management System: A Learning Management System (LMS) is a software application for the administration, documentation, tracking, reporting, and delivery of educational courses, training programs, or learning and development programs. Some LMSs may have an integrated time and attendance tracking feature, which can be used to record and track the hours that employees have worked. This data can then be used to calculate payroll and generate paychecks

- Accounting Software: Accounting software can be used in conjunction with payroll software to manage financial transactions, such as paying bills and tracking expenses. Some accounting software also includes payroll functionality, making it a one-stop solution for businesses.

- Time and Attendance Software: Time and attendance software can be used to track employee hours and overtime, and Paid time off (PTO).

Benefits Administration Software: This software can help businesses manage employee benefits such as health insurance, retirement plans, and paid time off.

Conclusion

Each payroll service offers unique strengths. Here’s a quick guide to selecting the best one for your business:

✔️ Need affordability? OnPay is a great budget option.

✔️ Looking for HR integration? BambooHR or Paycor are top picks.

✔️ Scaling a business? Paychex and ADP provide growth-friendly options.

✔️ Automating everything? Rippling is a powerful choice.

✔️ Managing a large team? Paylocity is the best fit.

Selecting the right payroll software is a critical step toward improving your company’s efficiency, compliance, and overall payroll management. With so many options available, finding a solution that aligns with your business size, operational needs, and budget can make all the difference. Whether you’re looking to automate tax filings, streamline employee payments, or simplify benefits administration, each payroll provider offers unique advantages tailored to different business requirements.

We hope this comparison has given you clarity and confidence in making an informed decision. The best payroll software doesn’t just ensure timely and accurate employee payments—it also helps you stay compliant with ever-changing payroll regulations, reducing administrative burden and giving you peace of mind.

As your business grows, so do your payroll needs. Investing in a scalable, reliable, and feature-rich payroll solution will ensure smooth operations today and continued success in the future. Choose wisely, and empower your business with a payroll system that works as hard as you do!